Professional Documents

Culture Documents

REVENUE REGULATIONS NO. 12-2012 Issued On October 12, 2012 Prescribes The Rules On

Uploaded by

Sherily Cua0 ratings0% found this document useful (0 votes)

10 views1 pagerr

Original Title

65716RR 12-2012

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentrr

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageREVENUE REGULATIONS NO. 12-2012 Issued On October 12, 2012 Prescribes The Rules On

Uploaded by

Sherily Cuarr

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

REVENUE REGULATIONS NO.

12-2012 issued on October 12, 2012 prescribes the rules on

the deductibility of depreciation expenses as it relates to purchase of vehicles and other expenses

related thereto, and input taxes allowed therefor, to wit:

a. No deduction from gross income for depreciation shall be allowed unless the taxpayer

substantiates the purchase with sufficient evidence, such as official receipts or other

adequate records which contain the following, among others:

i. Specific Motor Vehicle Identification Number, Chassis Number or other

registrable identification numbers of the vehicle;

ii. The total price of the specific vehicle subject to depreciation; and

iii. The direct connection or relation of the vehicle to the development, management,

operation and/or conduct of the trade or business or profession of the taxpayers.

b. Only one vehicle for land transport is allowed for the use of an official or employee,

the value of which should not exceed Two Million Four Hundred Thousand Pesos

(Php 2,400,000.00);

c. No depreciation shall be allowed for yachts, helicopters, airplanes and/or aircrafts and

land vehicles which exceed the above threshold amount, unless the taxpayers main

line of business is transport operations or lease of transportation equipment and the

vehicles purchased are used in said operations;

d. All maintenance expenses on account of non-depreciable vehicles for taxation

purposes are disallowed in its entirety;

e. The input taxes on the purchase of non-depreciable vehicles and all input taxes on

maintenance expenses incurred thereon are likewise disallowed for taxation purposes.

You might also like

- Answers - Mock 1st PBDocument1 pageAnswers - Mock 1st PBkellyshaye08No ratings yet

- Audit of ReceivablesDocument7 pagesAudit of Receivableskellyshaye08No ratings yet

- Audit of Cash and Cash EquivalentsDocument7 pagesAudit of Cash and Cash Equivalentskellyshaye08No ratings yet

- REPORTDocument1 pageREPORTkellyshaye08No ratings yet

- ACCTG4Document3 pagesACCTG4kellyshaye08No ratings yet

- Quiz On Cost of Credit - Without AnswersDocument2 pagesQuiz On Cost of Credit - Without Answerskellyshaye08No ratings yet

- LTD LawDocument6 pagesLTD Lawkellyshaye08No ratings yet

- Working Capital Review Case 2014 With AnswersDocument4 pagesWorking Capital Review Case 2014 With Answerskellyshaye08No ratings yet

- Articles of IncorporationDocument5 pagesArticles of Incorporationkellyshaye08No ratings yet

- Mas IiiDocument2 pagesMas Iiikellyshaye08No ratings yet

- Kelly Shaye C. Bayno MWF 4:00-5:00pm Bsa - 4Document1 pageKelly Shaye C. Bayno MWF 4:00-5:00pm Bsa - 4kellyshaye08No ratings yet

- Relevance, Timeliness, Accuracy, Completeness, and SummarizationDocument1 pageRelevance, Timeliness, Accuracy, Completeness, and Summarizationkellyshaye08No ratings yet

- MAS - Group 6Document3 pagesMAS - Group 6kellyshaye08No ratings yet

- Auditing TheoryDocument7 pagesAuditing TheoryMichael TejanoNo ratings yet

- Case DigestDocument2 pagesCase Digestkellyshaye08No ratings yet

- ChordsDocument4 pagesChordskellyshaye08No ratings yet

- SocioDocument1 pageSociokellyshaye08No ratings yet

- Tax Final OutputDocument10 pagesTax Final Outputkellyshaye08No ratings yet

- Amendment to University Service AgreementDocument6 pagesAmendment to University Service Agreementkellyshaye08No ratings yet

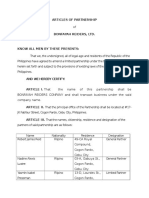

- Articles of Partnership For General PartnershipsDocument4 pagesArticles of Partnership For General Partnershipskellyshaye08No ratings yet

- Ang Tax Bai'. We've Got To Assess The Effects of Personal, Investment, and BusinessDocument1 pageAng Tax Bai'. We've Got To Assess The Effects of Personal, Investment, and Businesskellyshaye08No ratings yet

- Earth Moon Sun RelationshipDocument17 pagesEarth Moon Sun Relationshipkellyshaye08No ratings yet

- At MidtermDocument9 pagesAt Midtermkellyshaye08No ratings yet

- BIR Revenue Regulation No. 25-2002Document2 pagesBIR Revenue Regulation No. 25-2002joelbabe4No ratings yet

- EditedDocument13 pagesEditedkellyshaye08No ratings yet

- Acctg 5Document2 pagesAcctg 5kellyshaye08No ratings yet

- Introduction: This Memorandum Sets Out Our Proposed Strategy For Auditing The Karnataka State Khadi and Village Industries Board (KVIB) For The Year Ended 31 March 2006Document3 pagesIntroduction: This Memorandum Sets Out Our Proposed Strategy For Auditing The Karnataka State Khadi and Village Industries Board (KVIB) For The Year Ended 31 March 2006Rachyl SacramedNo ratings yet

- Amendment to University Service AgreementDocument6 pagesAmendment to University Service Agreementkellyshaye08No ratings yet

- Auditng TheoryDocument3 pagesAuditng Theorykellyshaye08No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)