Professional Documents

Culture Documents

Study of Distribution Channels of Kara

Uploaded by

Paul SaabOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Study of Distribution Channels of Kara

Uploaded by

Paul SaabCopyright:

Available Formats

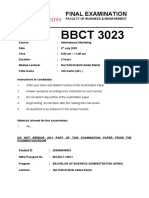

Study of Alternate Channels to Promote Kara Wipes in

Lucknow Market

Summer Training Project Report submitted in partial

fulfillment of the requirements for the

Diploma of

Post Graduate Diploma in Management

At

Jaipuria Institute of Management, Lucknow

By

Feroz Ahmad

Enroll No. : JIML-11-057

Batch: 2011-13

Project Mentor: Prof. Hyma Apparaju

Abstract

2

The purpose of my study was to find out different channels that can be used in

promoting and maximizing the sales of Kara in major markets of Lucknow. As

any study is incomplete without the interaction with its main stakeholders, I also

interacted with many commuters of different cosmetics, general stores and

medical stores covering various major markets of Lucknow such as Aminabad,

Hazratganj, Charbagh, Patrakarpuram, Bhoothnath, Hussainganj etc.

Further interaction was with the second most important stakeholder who plays a

significant role in sale of a product i.e. retailer. It helped in gauging the

expectations of retailers as well as the expectations of customers through

retailers to reduce the gap between expectations and realistic presence of the

product.

I sampled Kara in major markets of Lucknow to increase the awareness of Kara

because the concepts of using wet facial wipes is very new in India unlike other

western countries where people spend their major portion salary in disposable

products.

Executive Summary

3

In last few years, the growth and development story of India has seen different

stages. From the time of independence to 1991, the time of liberalization in India

and then to the twenty first century, the markets have shown tremendous

changes. Today consumers have got the power and the income to spend on

products. Different firms entered in the market and lost but many succeeded and

make their mark. All the markets starts with nascent stage and later grow to its

maturity, same with the wipes market which is in its nascent stage in India now

but the potential is high if explored.

Kara is a brand name of Wet wipes from the house of Grasim Industries, Aditya

Birla Group. Among its different variants, Refreshing facial wipes are the most

selling wipes in the consumer market.

My project title was study of alternate channels to promote Kara in Luknow

market in Grasim Industries, Aditya Birla Group. Objective of the project was to

find out the ways to promote Kara and create new potential areas for the

product. It also involves the work to find out the measures to keep the product

ahead of its competitors such Johnson & Johnson, Bilt, Good Look, Freshia,

Mistique and last but the least the Chinese wipes products.

For brand promotion and widening the horizon for the new products launched

by the company I sampled Kara in almost all major markets and malls of

Lucknow such as Aminabad, Hazratganj, Hussainganj, Bhootnath,

Patrakarpuram, Thakurganj, Saharaganj mall, Spencer, Shalimar mall etc. which

also resulted into generating the awareness of the brand and it provided a

chance to the people to use Kara at free of cost first time. Once they are fond of

the product, they will voluntarily buy the product and will become its regular

user.

In my later stage of training, I was assigned to understand the operations of the

company by visiting almost all markets in Lucknow. For the purpose, I visited

more than 140 shops and took orders from retailers of the company and was

4

also responsible in placing the product onto new stores by convincing the

retailers to keep the product.

Without collection of statistical data and its analysis any project is incomplete,

thus, I surveyed 156 people by way of questionnaire and collected some

secondary data from internet to understand and analyze the exact situation of

the market. Analysis part has been done through interviews and surveys with the

people visiting the retail stores in different major markets and malls of Lucknow.

Result showed that the concept of using wet facial wipe is not as new as it was a

couple of years ago in the Indian market and now people are partially aware of it.

Middle class people can be targeted and educated about this new concept

through extensive promotional activities. One of the finding was that people

consider wet wipes as an extravagant article rather than essential product which

is positioned by the company and do not want to spend a lot on such a product.

Acknowledgement

The training program was designed in such a way that it provided a full learning

opportunity throughout the training program. I would like to express my

5

gratitude towards all the people who guided me throughout the program and

their direct or indirect help was priceless for me, without their guidance and

support this project would not have been completed successfully.

I express my sincere gratitude to Mr. Divyankar Goel, Regional Sales Manager,

North Division, Grasim Industries & Birla Cellulose, for his belief in me and giving

a chance to do market research for the company.

It has been an honor to do my summer training under Mr. Surya Prakash Singh,

Area Sales Manager, North Division, Grasim Industries & Birla Cellulose, a

composed and talented person who not only guided but also supported and

rectified me where I was going wrong. Therefore, I would specially thank Mr.

Surya Prakash Singh for his continuous guidance and assistance throughout the

training.

There was a great learning from my team at Grasim Industries, who not only

behave in a co-operative manner but also provide constant help in the

completion of the project, thus, I thank to my each team member in the training

program.

Last but surely not the least, I am very much thankful to my faculty guide, Prof.

Hyma Apparaju, core faculty at Jaipuria Institute of Management Lucknow, for

her continuous guidance and support from the proceeding of the project to its

completion. I can not think of the accomplishment of the project without her

assistance and guidance.

TABLE OF CONTENTS

Page No.

CHAPTER - 1

1

6

INTRODUCTION

2

SCOPE OF THE STUDY

..3

OBJECTIVE OF THE STUDY

3

RELEVANCE OF THE

STUDE.4

TEAM CONSTITUTION

..4

ACHIEVEMENT AND RECOGNITION

..5

CHAPTER - 2

...6

SUMMER INTERNSHIP PROFILE

........7

STUDY OF ALTERNATE CHANNELS TO PROMOTE KARA

WIPES7

USE OF SOCIAL MEDIA TO PROMOTE KARA

WIPES........9

INDTRODUCTION ABOUT ADITYA BIRLA

GROUP...11

HINDALCO

INDUSTRIES...22

7

IDEA CELLULAR

25

ULTRATECH

.....27

GRASIM INDUSTRIES

..31

BIRLA

CELLULOSE....37

ANALYSIS OF INDIAN WIPES

MARKET......60

COMPETITION ANALYSIS OF KARA WIPES

........65

MICHAEL PORTERS FIVE FORCES MODEL

.......67

SWOT ANALYSIS

.69

CHAPTER 3

.72

RESEARCH METHODOLOGY

...73

CHAPTER 4

.79

DATA ANALYSIS

.80

8

CHAPTER 5

.99

RECOMMENDATIONS AND SUGGESTIONS

.100

CHAPTER 6

...104

CONCLUSION

..105

CHAPTER 7

....106

ANNEXURE

...107

BIBLIOGRAPHY

..109

MY LEARNING FROM SUMMER INTERNSHIP

....110

LIST OF FIGURES

Page No.

FIG 1: USE OF WET WIPES

80

9

FIG 2: MARKET SHARE OF WET FACIAL WIPES

.....81

FIG 3: FREQUENCY OF USE OF WET WIPES

..82

FIG 4: PREFERRED PLACE TO BUY SKIN CARE

PRODUCTS.83

FIG 5: RESPONSE ABOUT IDEAL PACK.

...84

FIG 6: RESPONSE ABOUT IDEAL PRICE FOR A MEDIUM SIZE PACK.

...85

FIG 7: PURPOSE OF USE OF WIPES...

....86

FIG 8: PERCEPTION OF CUSTOMER TOWARDS THE CONCEPT OF

WIPES.............87

FIG 9: AWARENESS OF KARA WIPES

..88

FIG 10: MEDIUM MADE AWARE ABOUT KARA

WIPES.89

FIG 11: SATISFACTION LEVEL TOWARDS KARA

WIPES....90

FIG 12: INFLUENCIAL ATTRIBUTES OF KARA WIPES

.91

FIG 13: ATTRIBUTES LEAD TO DISLIKE KARA WIPES

...92

10

FIG 14: ATTRIBUTES THAT DIFFERENTIATE KARA FROM OTHER BRANDS

.93

FIG 15: WOULD KARA BE RECOMMENDED BY CUSTOMERS

....94

FIG 16: GENDER DISTRIBUTION OF CUSTOMERS..

.95

FIG 17: AGE DISTRIBUTION

...96

FIG 18: SHARE OF INCOME CLASS.

...97

FIG 19: PROFESSION DISTRIBUTION.. ...98

11

CHAPTER-1

INTRODUCTION

12

Aditya Birla Group is India's first truly multinational corporation. Global

in vision, rooted in values, the Group is driven by a performance ethic

pegged on value creation for its multiple stakeholders. The group has an

annual turnover of US$ 24 billion, market capitalization of US$ 23 billion,

and has over 100,000 employees belonging to over 25 different

nationalities on its rolls. The group has diversified business interests and

is dominant player in all the sectors in which it operates such as viscose

staple fibre, metals, cement, viscose filament yarn, branded apparel,

carbon black, chemicals, fertilizers, insulators, financial, service, telecom,

BPO and IT services.

Its subsidiary company Grasim is the largest exporter of Viscose Rayon

Fiber in the country, with exports to over 50 countries.

Grasim Industries is mainly focusing on increasing more awareness about

its newly launched Kara wet wipes. Being a new concept in India, it is very

difficult for the company to divert Indian customers to substitute

traditional handkerchief by Kara wet wipes. They are position the same

through their continuous and effective marketing communication. They

have an edge over their competitors because of its backward integration

and the raw material for Kara wet wipes is being provided from Birla

cellulose division.

I sampled in different markets of Lucknow to create awareness about the

product and give the commuters opportunity to use Kara wet wipes free

of cost for the first time approach. A field work has also been done to

know the response of the customers towards the brand of company,

brand of the competitors, their perception about using wet wipes etc.

through a formal questionnaire.

I was fortunate enough to get this opportunity to work with such a

multinational incorporation. As the group quotes its tageline, Taking

India to the world, it provided a lot of learning experiences those will

surely help in long run in my transformation towards corporate world.

13

Scope of the study

The data collected gives the clear picture of the product in the markets of

Lucknow, the study of this research, gives the company an indication about

whether it is feasible to move on with the persisting movements and marketing

strategies, and if no, then how to go about it and make it worthwhile for the

brand as well as the company. And conclude on what should be the most favored

deal.

The main purpose to conduct this marketing research is to find out the

perception of the consumer towards the new concept of the skin care wet wipes

whether they are not hesitant to accept this new concept of the wet wipes or

they still believes in the traditional method of using the formulized based

products. And even to study how much awareness of this product is there in the

market and the brand image of it.

Another main aim to conduct this study was to understand the retailers reactions

and expectation towards the KARA and to reduce the gap between the

expectations of retailers and in actual.

The study of consumers responses helps firms and organizations improve their

marketing strategies.

Purpose of the study

The objective of project was To take measures for maximizing sales

opportunities and promote Kara in Lucknow market. Thus, approaching to

general public and introducing our products to them and reminding them until

they give a formal response was our priority task. However, along with it, a

primary research work was also done to supplement the field work.

14

Context of Study

Free samples were given to people along with a small briefing about the product

who showed good level of interest in Kara. The questionnaire was pre-designed

and during conversation, the questions were disguisedly asked.

Relevance of Study

The research work gives us an idea as to what difficulties Kara is facing in spite

of being a very good quality product. It gives a scope of improvement to rethink

on some marketing aspects like better discount slabs, refining target customers

etc. Since the TV advertisement campaign for Kara is gaining momentum,

aggressive selling can be practiced to offer Kara in major market of Lucknow.

Reporting: I reported to Mr. Surya Singh, Area Sales Manager who acted as the

delivery head for this particular project.

Team Constitution: The core team was made up of six members in trade

management area covering Lucknow. The one management trainee, one Sales

Officer and Area Sales Manager were involved in Trade Management. We all

together sampled people covering a particular market for a particular day.

I applied my learning at JIML

During the project my learning in classroom (case studies, freewheeling

discussions) proved to be very useful. At times I referred to my marketing book

for brand promotion & distribution channel of KARA. Basically all the marketing

communication tools for brand promotion and different distribution channel for

placing the KARA to retailers are applied in the field came from my marketing

knowledge. This comparison pushed me to revisit the plans/ strategy thought

out by me. This was of immense help in improving the quality of my inputs.

15

Achievements/Recognition:

Post the sampling activity, I was assigned to visit retailers along with one

salesman to take orders from retailers keeping Kara and place the product onto

new counters for the increment of sales as well as awareness. I got appreciation

from Area Sales Manager for high worth of order in a day and continuous

placement of the product onto new counters.

16

Chapter-2

Detailed Introduction of about the Topic

17

Summer Internship Profile

1) Modern Trade Management

Modern trade management deals with malls and shopping complex where

thousands of customers come daily to buy household items. Kara is available at

almost every mall in Lucknow however internees under this profile have to

check inventory levels of product, placing of the product as compared to

competitor products, visibility, customers reaction on seeing the product etc.

2) General Trade Management

In this profile, all the small retail shops are focused where I had to see if Kara is

already available with them, are the retailers happy about the response of the

product, sufficient inventory levels are maintained etc. Also there were many

retail shops which didnt have any wet wipes and were apprehensive about

keeping the product. I had to market the product to such retailers and clarify any

doubts which retailer has about the product.

3) Marketing Research

This profile is a pure marketing research based where I have to ask respondents

to fill up a pre-designed questionnaire thus fulfilling the given objective. I chose

places like malls and major markets where I had to intercept respondents and

request them to take part in the research. Sample size was 156 which includes

both online and offline.

STUDY OF ALTERNATE CHANNELS TO PROMOTE KARA

WET WIPES IN LUCKNOW MARKET

Marketing communications are the means by which firms attempt to inform,

persuade, and remind consumers, directly or indirectly about the products and

brands they sell. In a sense, marketing communications represent the voice of

18

the company and its brands and are a means by which it can establish a dialogue

and build relationships with consumers. Marketing communications also

perform many functions for consumers. They can tell or show consumers how

and why a product is used, by what kind of person, and where and when.

Consumers can learn about who makes the product and what the company and

brand stand for; and they can get an incentive or reward for trial or usage.

Marketing communications allow companies to link their brands to other people,

places events, brands, experiences, feelings, and things. They can contribute to

brand equity by establishing the brand in memory and creating a brand image as

well as drive sales and even affect shareholder value.

Although marketing communications can play a number of crucial roles, they

must do so in an increasingly tough communication environment. Technology

and other factors have profoundly changed the way consumer process

communications, and even whether they choose to process them at all. The rapid

diffusion of powerful broadband internet connections, ad skipping digital video

recorders, multipurpose cell phones, and portable music and video players have

forced marketers to rethink a number of their traditional practices. These

dramatic changes have eroded the effectiveness of the mass media.

Sales promotion tools

19

Using Social Media Channels to Promote Kara

The main challenge in this era is to stand out from the crowd, and use of any non-

traditional channel of promotion can differentiate us from our competitors and

we can attract the potential customers.

One of every nine people on earth log on to social media channels every day and

spend 700 billion minutes a day sharing content on social media. Kara needs a

social media component, or may potentially lose the attention of over 750 million

social media users. Here are five fun ways to promote the product on social

media channels.

Facebook Offers

Facebook recently rolled out the new Facebook offers for fan pages, which is a

free service for Facebook page administrative. The Facebook offers feature is as

easy as posting a status update, and is an easy, fun way to promote the brand. We

can create a catchy, strong headline remember, the offer will be competing with

lots of other status updates, photos and links in your fans news feeds. Next, add

an image that is recognizable in thumbnail form and represents our offer at a

glance. As a final step, add fine print or terms and conditions to avoid

misconceptions if our customers have. Fans redeem Facebook offers via their

smartphone or from an email thats mailed to them after they get the offer.

20

Pin it to win it

One of the hottest new social media channels over the past twelve months is

pinterest, a social bookmarking site that acts as a virtual pin board, visually

saving and sharing recipes, favorite products, stunning images, beauty tips and

much more.

The company can take full advantage of the excitement surrounding pinterst by

creating pin it to win contests. Where it can share some beauty tips and at the

same time it can educate how regular use of wet wipes can keep our skin healthy.

These contests encourage users to pin products from the company website to

their own personal pin boards the more pins or repins the product receives,

the better chance the customers have to win. This is a great way to drum up

excitement for a new variant or change in existing variant of Kara. The more

visually striking our product, the more successful our pinterest contest will be.

Reviews on Blogs

There are more than 164 million blogs on the internet and more than 133 million

blog readers. If we search long enough, we will find well written, popular blogs

covering almost any topic under the sun.

Many bloggers are interested in reviewing products and working with brands,

especially when free products are involved. Giving a blogger with a loyal

following a sample or complimentary product is a great way to get exposure for

Kara wet wipes. Readers trust their favorite bloggers opinions on products, and

a great product review can go a long way in building our brand. We can consider

offering a second product or exclusive discount for the blogger to give away to

their readers. Blogger reviews promoting our product will give us lots of

exposure.

21

Aditya Birla Group is India's first truly multinational corporation. Global in

vision, rooted in values, the Group is driven by a performance ethic pegged on

value creation for its multiple stakeholders. The group has an annual turnover of

US$ 24 billion, market capitalization of US$ 23 billion, and has over 100,000

employees belonging to over 25 different nationalities on its rolls. The group has

diversified business interests and is dominant player in all the sectors in which it

operates such as viscose staple fibre, metals, cement, viscose filament yarn,

branded apparel, carbon black, chemicals, fertilizers, insulators, financial,

service, telecom, BPO and IT services. The origins of Aditya Birla Group can be

traced back to the 19th century when Seth Shiv Narayan Birla started trading in

cotton in the town of Pilani, Rajasthan. In the early part of the 20th century,

Group's founding father, Ghanshyamdas Birla, expanded the group and set up

industries in critical sectors such as textiles and fibre, aluminium, cement and

chemicals. In 1969, Aditya Birla, the then Chairman of the Group, put the group

on the global map. He set up 19 companies outside India, in Thailand, Malaysia,

Indonesia, the Philippines and Egypt.

Under Aditya Birla's leadership, the group attained new heights and it became

world's largest producer of viscose staple fibre, the largest refiner of palm oil, the

third largest producer of insulators and the sixth largest producer of carbon

black. After Aditya Birla's demise his son Kumar Mangalam Birla took over the

charge of the group and under his leadership the group has sustained the

significant position in the sectors in which it operates. The Group operates in 25

countries India, UK, Germany, Hungary, Brazil, Italy, France, Luxembourg,

22

Switzerland, Australia, USA, Canada, Egypt, China, Thailand, Laos, Indonesia,

Philippines, Dubai, Singapore, Myanmar, Bangladesh, Vietnam, Malaysia and

Korea.

A US $29.2 billion corporation, the Aditya Birla Group is in the league of Fortune

500. It is anchored by an extraordinary force of 130,000 employees, belonging to

30 different nationalities. In India, the Group has been adjudged "The Best

Employer in India and among the top 20 in Asia" by the Hewitt-Economic Times

and Wall Street Journal Study 2007. Over 50 per cent of its revenues flow from

its overseas operations.

Globally the group has proved its mettle:

A metals powerhouse, among the world's most cost-efficient aluminium

and copper producers. Hindalco-Novelis is the largest aluminium rolling

company. It is one of the three biggest producers of primary aluminium in

Asia, with the largest single location copper smelter

No.1 in viscose staple fibre

The fourth largest producer of insulators

The fourth largest producer of carbon black

The eleventh largest cement producer globally and the second largest in

India

Among the best energy efficient fertiliser plants

Among the world's top 15 and India's top four BPO companies

In India, the Group holds a frontrunner position as:

A premier branded garments player

The second largest player in viscose filament yarn

The second largest in the core alkali sector

23

Among the top five mobile telephony players

A leading player in life insurance and asset management

Among the top three supermarket chains in the retail business

Global Presence of the group

Aditya Birla Group has many subsidiary companies across the world. It has its

presence not only in Asian countries but also in European and African countries.

Thailand

o Thai Rayon

o Indo Thai Synthetics

o Thai Acrylic Fibre

o Thai Carbon Black

o Aditya Birla Chemicals (Thailand) Ltd.

o Thai Peroxide

Philippines

o Indo Phil Textile Mills

o Indo Phil Cotton Mills

o Indo Phil Acrylic Mfg. Corp.

Indonesia

o PT Indo Bharat Rayon

o PT Elegant Textile Industry

o PT Sunrise Bumi Textiles

o PT Indo Liberty Textiles

24

o PT Indo Raya Kimia

Egypt

o Alexandria Carbon Black Company S.A.E

o Alexandria Fiber Company

China

o Liaoning Birla Carbon Canada

o AV Cell Inc.

o AV Nackawic Inc.

Australia

o Aditya Birla Minerals Ltd. Laos

o Birla Laos Pulp and Paper Plantation Company Ltd.

Rock solid in fundamentals, the Aditya Birla Group nurtures a culture where

success does not come in the way of the need to keep learning afresh, to keep

experimenting.

Diversified Businesses

Aditya Birla is organized into various subsidiaries that operate across different

sectors. Among these are viscose staple fibre, non-ferrous metals, cement,

viscose filament yarn, branded apparel, carbon black, chemicals, Modern retail

(under the 'More' brand of Supermarkets, and also under the Trinethra, and

Fabmall brands until recently), fertilizers, sponge iron, insulators, financial

25

services, telecom, BPO and IT services. The Group consists of four main

companies, which operate in various industry sectors through subsidiaries, joint

ventures etc. These are Hindalco, Grasim, Aditya Birla Nuvo, and UltraTech

Cement.

Non Ferrous Metals

The groups non-ferrous metals are under Hindalco. It is a dominant player in

aluminum and copper. Its manufacturing locations are primarily in India, and it

owns mines in Australia. On February 11, 2007, the company entered into an

agreement to acquire the Canadian company Novelis for U$6 billion, making the

combined entity the world's largest rolled-aluminium producer. On May 15,

2007, the acquisition was completed with Novelis shareholders receiving $44.93

per outstanding share of common stock.

Hindalco has also recently acquired Alcan's stake in the Utkal Alumina Project

Joint venture in Orissa,India. Hindalco is a Fortune500 company, it makes

alumina chemicals, primary aluminum, rolled products, alloy wheels, roofing

sheets, wire rods, Cast copper rods, copper cathodes and several other products.

But the project has faced massive protests from locals. On 16 Dec 2001 three

tribal people were shot dead because they were opposed to the project.

Cement

The Group has two subsidiary companies in cement sector named as Grasim and

UltraTech cement. Together the two companies under the group account for a

substantial share of the cement market in India. UltraTech cement comprises the

erstwhile cement business of L&T which was acquired by the group. UltraTech

announced an increase in sales by 18% and Profit after Tax by 42% for the

quarter ending March 31, 2012.

26

Carbon Black

The Group is the fourth largest manufacturer of Carbon Black worldwide. It

operates out of facilities in Egypt, Thailand, India and China. It is a major supplier

to several major automobile tyre manufacturers worldwide.

Textile Business

The Aditya Birla Group is the world's largest player in the Viscose Staple Fiber

industry. It operates out of India also such as in Laos, Thailand, Malaysia and

China. It owns the Birla Cellulose brand. Apart from viscose staple fiber, the

group also owns acrylic fiber businesses in Egypt and Thailand, viscose filament

yarn businesses and spinning mills at several locations all over India and South

East Asia.

The group has pulp and plantation interests in Canada and has recently invested

in plantations in Laos the Aditya Birla group is also a major player in the branded

garments market in India. Its subsidiary, Madura Garments, is a major producer

of textile fabric as well as the brand licensee of Louis Phillip, Van Heusen and

Allen Solly in India. It operates company owned retail outlets in several cities in

India and now planning to go to Pakistan as well.

Telecom Services

Aditya Birla Group holds a 98.3% stake in Idea Cellular, a leading telecom

operator in India. Idea Cellular started off as a joint venture with the group,

AT&T and the Tata Group. However the stakes of the remaining partners was

eventually acquired by the group. After an Initial Public Offering on the Indian

Stock Markets, Idea Cellular now accounts for a third of the group's market

capitalization.

27

Other Business

Apart from the above businesses, the group is a major player in sectors like

Insulators, Fertilizers, IT (It owns PSI Data Systems Limited -

http://www.psidata.com), ITeS (It owns Trans-works and recently acquired the

Canadian BPO Firm Minacs), Chemicals, Mining, Sponge Iron, Financial Services

(A joint venture with Sunlife) and more recently, Retail.

Beyond Business

Transcending business for over 50 years now, the Group has been and continues

to be involved in meaningful welfare-driven initiatives that distinctly impact the

quality of life of the weaker sections of society in India, South-East Asia and

Egypt.

In India, the Group's social projects span 3,000 villages. It reaches out to seven

million people annually through the Aditya Birla Centre for Community

Initiatives and Rural Development, spearheaded by Mrs. Rajashree Birla. Its

focus is healthcare, education, sustainable livelihood, infrastructure and

espousing social causes.

The Group runs 42 schools, which provide quality education to over 45,000

children in India's interiors. Of these, over 18,000 children receive free

education. An additional 8,000 students receive merit scholarships. Likewise at

its 18 hospitals in India, more than a million patients are given extremely

subsidised medical care. To embed corporate social responsibility as a way of life

in organisations, the Group has set up the FICCI Aditya Birla CSR Centre for

Excellence, in Delhi.

28

The Group transcends the conventional barriers of business and reaches out to

the marginalised because of its conviction of bringing in a more equitable society

and send out a message that "We care.

MAJOR COMPANIES

The major companies of the Group are among India's leading corporate. These

include:

Grasim: Viscose staple fibre, rayon grade pulp, cement, chemicals, textiles

UltraTech Cement Ltd: Ordinary Portland cement, Portland blast furnace

slag cement, Portland pozzolana cement and grey Portland cement

Samruddhi Cement: Cement

Hindalco: Aluminum, copper

Aditya Birla Nuvo: Garments, viscose filament yarn, carbon black,

textiles, insulators

Idea Cellular Ltd.: Telecom

Birla Sun Life Insurance Co. Ltd.: Life insurance

Birla Sun Life Asset Management Company Ltd.: Mutual fund

Aditya Birla Money Mart Limited: Mutual fund distribution

Aditya Birla Capital Advisors Private Limited (ABCAP): Private equity

advisory and investment management, for Indian and offshore investors

Aditya Birla Money Limited: Leading player in broking space

Aditya Birla Minacs IT Services Ltd.: Application development,

maintenance and enhancement solutions

Aditya Birla Minacs Worldwide Limited: Customer relations

management (CRM), integrated marketing services, knowledge process

outsourcing

Aditya Birla Finance Limited: Asset-based finance, corporate finance

and investment banking, capital market and treasury

29

Birla Insurance Advisory & Broking Services Ltd: Non-life insurance

advisory and broking services

Non-life insurance advisory and broking services: Apparel retail

Peter England Fashions and Retail Ltd: Apparel retail

Madura Garments Exports Limited: Apparel export

Aditya Birla Retail Limited: Multi-format stores

Tanfac Industries Ltd.: Fluorine chemicals

Essel Mining & Industries Ltd.: Iron and manganese ore mining, noble

ferro alloys

REWARDS & RECOGNITION

2002

KHARACH unit won Chairman's Gold Award for manufacturing excellence.

2003

Birla Cellulose's HARIHAR (India) unit bagged "TERI Corporate

Environmental Award" for cleaner production, while keeping waste

generation at its lowest.

Birla Cellulose's KHARACH (India) unit was awarded "Green-tech Gold

Award" for environmental excellence, in recognition for its continuous

efforts in the field of sustainable development and environmental

preservation.

2004

Birla Cellulose's NAGADA (India) unit was awarded the coveted

"Stockholm Industry Water Award", a first time achievement in Asia.

30

Grasilene division HARIHAR won Green-tech Environment Excellence

Gold Award.

HARIHAR unit won Golden Peacock Environment Management Award.

2005

KHARACH unit won PSU- Quality Circle competition for South Gujarat

Industries

2007

HARIHAR Poly fibers wins 2007 IMC Ramakrishna Bajaj award

2008

The President of India, Mrs. Pratibha Patil confers the much coveted

Rotary International Polio Eradication Champion Award on Mrs.

Rajashree Birla

2009

Grasim's pulp and fibre division wins the highly prestigious Asian CSR

Award.

Idea Cellular wins the Economic Times' "Emerging Company of the Year

Award for 2009".

2010

Hindalco ranked ninth across industries on Forbes Asia's Fab 50

companies list of Asia's 50 most valued companies.

Hindalco and Birla White declared winners in the Golden Peacock Awards

for Corporate Social Responsibility

The Rajiv Gandhi Environment Award for Clean Technology for the year

2009-2010 is awarded to Vikram Cement Works.

31

2011

Business Todays Best Companies to work for in Indias survey, the Aditya

Birla Group was on the top of the league in their rankings of most loved

companies.

The Aditya Birla Group is ranked No. 4 in the list of global top companies

for leaders and No.1 in Asia Pacific for 2011, in a study conducted by Aon

Hewitt, Fortune Magazine.

32

An industry leader in aluminium and copper, Hindalco Industries Limited, the

metals flagship company of the Aditya Birla Group is the world's largest

aluminium rolling company and one of the biggest producers of primary

aluminium in Asia. Its copper smelter is the worlds largest custom smelter at a

single location.

Established in 1958, we commissioned our aluminium facility at Renukoot in

eastern Uttar Pradesh, India in 1962. Later acquisitions and mergers, with Indal,

Birla Copper and the Nifty and Mt. Gordon copper mines in Australia,

strengthened our position in value-added alumina, aluminium and copper

products. The acquisition of Novelis Inc. in 2007 positioned us among the top

five aluminium majors worldwide and the largest vertically integrated

aluminium company in India. Today we are a metals powerhouse with high-end

rolling capabilities and a global footprint in 13 countries. Our consolidated

turnover of USD 15.85 billion (Rs. 72,078 crore) places us in the Fortune 500

league.

Hindalco's businesses creating superior value

Hindalco is one of the leading producers of aluminium and copper. Our

aluminium units across the globe encompass the entire gamut of operations,

from bauxite mining, alumina refining and aluminium smelting to downstream

rolling, extrusions, foils, along with captive power plants and coal mines. Our

copper unit, Birla Copper, produces copper cathodes, continuous cast copper

33

rods and other by-products, such as gold, silver and DAP fertilisers.

Our units are ISO 9001:2000, ISO 14001:2004 and OHSAS 18001 certified.

Several units have gone a step further with an integrated management system

(IMS), combining ISO 9001, ISO 14001 and OHSAS 18001 into one business

excellence model. We have been accorded the Star Trading House status in India.

Hindalco's aluminium metal is accepted for delivery under the High Grade

Aluminium Contract on the London Metal Exchange (LME). Our copper quality

standards are also internationally recognised and registered on the LME with

Grade A accreditation.

Aluminium

Hindalco's major products include standard and

speciality grade aluminas and hydrates, aluminium

ingots, billets, wire rods, flat rolled products,

extrusions and foil. The integrated facility at

Renukoot houses an alumina refinery and an aluminium smelter, along with

facilities for the production of semi-fabricated products, namely, redraw rods,

flat rolled products and extrusions. The plant is backed by a co-generation power

unit and a 742 MW captive power plant at Renusagar to ensure the continuous

supply of power for smelter and other operations.

A strong presence across the value chain and synergies between operations has

given us a dominant share in the value-added products market. As a step

towards expanding the market for value-added products and services, we have

launched various brands in recent years Everlast roofing sheets, Freshwrapp

kitchen foil and Freshpakk semi-rigid containers.

34

Copper

Birla Copper, Hindalcos copper unit, is located in

Gujarat. The unit has the unique distinction of

being the largest single-location copper smelter in

the world. The smelter uses state-of-the-art

technology and has a capacity of 500,000 tpa.

Birla Copper also produces precious metals, fertilisers and sulphuric and

phosphoric acid. The unit has captive power plants for continuous power

generation and a captive jetty to facilitate logistics and transportation.

Birla Copper upholds its longstanding reputation for quality copper cathodes and

continuous cast copper rods by assuring its management processes meet the

highest standards. It has acquired certifications such as ISO-9001:2000 (Quality

Management Systems), ISO-14001:2004 (Environmental Management System)

and OHSAS-18001:2007 (Occupational Health and Safety Management Systems).

Mines

Hindalco acquired two Australian copper mines, Nifty and Mt. Gordon, in 2003.

The Birla Nifty copper mine consists of an underground mine, heap leach pads

and a solvent extraction and electrowinning (SXEW) processing plant, which

produces copper cathode.

The Mt. Gordon copper operation consists of an

underground mine and a copper concentrate

plant. Until recently, the operation produced

copper cathode through the ferric leach process.

In 2004, a copper concentrator was commissioned

to provide concentrate for use at Hindalco's operations in Dahej.

Both Nifty and Mt. Gordon have a long-term life of mine off-take agreement with

Hindalco for supply of copper concentrate to the copper smelter at Dahej.

35

Idea Cellular Limited was incorporated in 1995, and now ranks third in terms of

all-India wireless revenue market share at 13.6 per cent. Idea ranks second with

23.6 per cent revenue market share in nine service areas where it holds 900 MHz

spectrum and which derive about 41 per cent of the industrys all-India

revenues. The market positioning of Idea reflects the strength of its brand

considering the fact that Idea added 11 out of its total 22 service areas in the past

four years. Today, it is a pan-India player with commercial 2G operations in 22

service areas, and 3G in nine of these circles. Its subscriber base has grown

multifold, from 7.37 million in March 2006 to 89.5 million in March 2011.

Idea holds 16 per cent stake in Indus Towers, a joint venture with other telecom

majors Bharti Airtel and Vodafone. Indus Towers is the world's largest tower

company with over one lakh towers.

Idea enjoys a market leadership position in many of its operational areas. It

offers GPRS on all its operating networks for all categories of subscribers, and

was the first company in India to commercially launch the next generation EDGE

technology in Delhi in 2003. As a pioneer in technology deployment, it has been

at the forefront through the adoption of bio fuels to power its base stations, and

by employing satellite connectivity to reach inaccessible rural areas in Madhya

Pradesh.

Idea has been a leader in the introduction of value-added services, and there are

many firsts to its credit, including a voice portal 'Say Idea', Idea TV, voice chat

and instant messenger. Tariff plans have been customer-friendly, catering to the

unique needs of different customer segments, for instance the 'Women's Card'

36

caters to the special needs of women on the move, and 'Youth Card' covers the

emerging youth segment. Idea has a network of over 70,000 cell sites covering

the entire length and breadth of the country. The company has over 3,000

service centres servicing Idea subscribers across the country. Ideas service

delivery platform is ISO 9001:2008 certified, making it the only operator in the

country to have this standard certification for all 22 service areas and the

corporate office.

Achievements

Idea has won numerous awards and is the only Indian GSM operator to win the

prestigious GSM Association Award consecutively in the best mobile technology

category for the Best Billing and Customer Care Solution both in 2006 and in

2007, even in the face of international competition.

Idea was adjudged the Emerging Company of the Year by The Economic

Times. Brand Idea has won many accolades for its innovative communication.

The What an Idea, Sirji ads have won four Effies from 2008-2010, making it

one of the Buzziest brands in the country.

In 2011 Brand Idea moved to the No. 4 position amongst all service brands in

the 'Most Trusted Brands Survey' conducted by Economic Times publication.

Idea's biggest campaigns "Break the Language Barrier" and "No idea Get

Idea" were ranked globally as the best brand campaigns 2011 at MMA Global

Awards and World Communication Awards, London.

In radio, Idea won six awards at the Golden Mikes Awards 2011 and was

adjudged the Advertiser of the Year. Besides, Idea has also won a series of

Digital Awards, the biggest being the Yahoo Big Chair where it won Gold.

IDEA Cellular has been recognized as the 'Most Customer Responsive

Company' in the Telecom sector, at the prestigious Avaya Global Connect

Customer Responsiveness Awards 2010.

Idea's subscriber base as at the end of August 2011 according to the statistics,

is totalling to 98,441,714.

37

UltraTech Cement Limited is India's biggest cement company

and Indias largest

exporter of cement clinker based in Mumbai, India. The company is division

of Grasim Industries. It has an annual capacity of 52 million tonnes. UltraTech is

India's largest exporter of cement clinker. The company's production facilities

are spread across eleven integrated plants, one white cement plant, and one

clinkerisation plant in UAE, fifteen grinding units, and five terminals.

UltraTech's success is attributed to its diverse product offerings. Different

products are handled by different product groups, which are also known as

profiles. Product groups decentralise control and encourage innovation. They

also ensure better customer segmentation, which in turn leads to better

customization of product offerings and guarantees cent percent customer

satisfaction. UltraTech Cement, Birla White, UltraTech Concrete, UltraTech

Building Products and UltraTech Solutions are the different profiles of UltraTech,

each catering to varied needs. This versatility has been a key competitive

advantage for UltraTech over the years.

UltraTech is the 10th largest cement manufacturer in the world making it a

significant global player. It has grinding units, jetties, bulk terminals and

integrated plants all across the world. UltraTech Cement is the country's largest

cement clinker exporter, catering to export markets in countries across the

Indian Ocean, Africa, Europe and the Middle East. Such diverse presence across

countries has helped UltraTech leverage economies of scale and enabled it to

become a name to reckon with in the international market.

38

UltraTechs journey began almost three decades ago and throughout this

journey, the focus has always been on providing customers with the best

products and services. The resulting success has only reaffirmed UltraTechs

desire to be a complete end-to-end building solutions provider. Each milestone

in this journey is a cherished memory: becoming the largest cement

manufacturer in India, winning the SUPERBRAND and 'POWERBRAND'

accolades and being recognised as a truly global organization, are a few that

stand out.

UltraTechs inception can be traced back to the mid-1980s with the

establishment of Grasims first cement plant at Jawad in Madhya Pradesh. In

2001, with the objective of increasing its reach, Grasim acquired a stake in L&T

Cement Ltd. The stake was further increased to a majority stake in 2003 thereby

giving Grasim a pan-India presence and an increased market share. In 2004, the

demerger of L&Ts cement business was completed and Grasim acquired a

controlling stake in L&T Cement Ltd and the name was subsequently changed to

UltraTech cement. The cement business of Grasim was demerged and vested in

Samruddhi Cement Limited in May 2010, with Samruddhi Cement Limited

consequently being amalgamated with UltraTech Cement Limited in July 2010. In

September 2010, UltraTech Cement Middle East Investments Limited, a wholly

owned subsidiary of UltraTech Cement acquired management control of ETA

Star Cement Company, along with its operations in the UAE, Bahrain and

Bangladesh, thereby putting UltraTech on the global map.

Today, UltraTech Cement is the tenth largest producer of cement globally. It has

a diverse presence across the globe. The company has eleven integrated plants,

one white cement plant and one clinkerisation plant, which is based in the UAE.

Furthermore, UltraTech has 15 grinding units across the world: 11 in India, 2 in

UAE and 1 each in Bahrain and Bangladesh. It also has 2 rail bulk terminals in

India, 3 coastal terminals, out of which 2 are located in India and one in Sri

Lanka.

39

UltraTech Cement is the largest selling single brand cement in India and the

largest cement clinker exporter. UltraTech's products include Ordinary Portland

Cement, Portland Pozzolana Cement and Portland Blast Furnace Slag cement.

UltraTech is the most trusted and preferred brand of Engineers, builders,

contractors and individual house builders. Today, UltraTech is used in vital

structures like dams, bridges, flyovers, airports, metro railways apart from

residential and commercial structures.

Ready mix concretes of UltraTech operate under the mother brand of UltraTech

Concrete. UltraTech Concrete sub-brands are christened 'Fibrecon', 'Free Flow',

'Colourcon', 'Stainless', 'Thermocon', 'Hypercon', 'Pervious' and 'Dcor', each of

which offer a unique value proposition and cater mainly to specific requirements

of large infrastructural projects.

UltraTech Building Products manufactures and markets technologically

reengineered products including dry mix mortars and blocks for the construction

and infrastructure industry. The sub brands of UltraTech Building Products are

'Seal & Dry', 'Super Stucco', 'Readiplast', 'Fixoblock', 'Xtralite' and 'Powergrout'.

40

UltraTech Building Solutions (UBS) is a novel concept in the Indian Construction

Industry. It is a one stop shop designed on the "plan, build and support"

philosophy, which offers home building solutions right from planning to

completion. UBS is based on a franchise model that caters to the building and

construction needs of individual home builders as well as the entire building and

construction fraternity. Collaboration is the key to UBS which houses renowned

brands of building materials apart from its own cement, namely paint,

construction chemicals, steel, pipes and fittings. A basket of services like

technical advisory, vaastu services, House Layouts and Construction Cost

Calculator, also form a significant part of the offerings at UBS.

The UltraTech brand houses its white cement products under the umbrella of

'Birla White'. Birla White's range comprises of Birla White Cement and other

finishing products, widely used for interiors and exteriors including flooring,

walls and ceilings. The sub brands of Birla White are 'Wallcare', 'Textura',

'Levelplast' and 'GRC'.

Star Cement is a leading manufacturer of cement in the Middle East. Its

operations are spread across UAE, Bahrain and Bangladesh with an installed

capacity of 3 million metric tons per annum.

41

Grasim Industries Limited, a flagship company of the Aditya Birla Group, ranks

among India's largest private sector companies, with consolidated net revenue of

Rs.202 billion and a consolidated net profit (before extraordinary items) of

Rs.27.6 billion (FY2010).

Starting as a textiles manufacturer in 1948, today Grasim's businesses comprise

viscose staple fibre (VSF), cement, chemicals and textiles. Its core businesses are

VSF and cement, which contribute to over 90 per cent of its revenues and

operating profits. The Aditya Birla Group is the worlds largest producer of VSF,

commanding a 21 per cent global market share. Grasim, with an aggregate

capacity of 333,975 tpa has a global market share of 10 per cent. It is also the

second largest producer of caustic soda (which is used in the production of VSF)

in India. Grasim is the largest exporter of Viscose Rayon Fiber in the country,

with exports to over 50 countries. This, along with Aditya Birla Nuvo can be

considered as the flagship companies of the AV Birla Group.

Grasim is India's pioneer in Viscose Staple Fibre (VSF), a man-made,

biodegradable fibre with characteristics akin to cotton. As an extremely versatile

and easily blendable fibre, VSF is widely used in apparels, home textiles, dress

material, knitted wear and non-woven applications.

Grasim's VSF plants are located at Nagda in Madhya Pradesh, Kharach in Gujarat

and Harihar in Karnataka, with an aggregate capacity of 333,975 tpa.

Nagda

Nagda is its largest unit producing a wide range of VSF to suit customer

42

requirements in terms of length, denier and colour and also second and third

generation fibres like Modal, Excel and Solvent Spun fibres, respectively. Nagda

is also the largest producer of spun-dyed specialty fibre in the world.

Harihar

The Harihar unit houses facility for manufacture of both VSF and rayon grade

pulp, the basic raw material for VSF. The company's Rayon Grade plant was the

first in India to use totally indigenous wood resources with in-house technology

for producing rayon pulp with an innovative oxygen bleaching process to reduce

the use of chlorine.

Kharach

The VSF plant at Kharach, set up in 1996, employs the most modern technology

giving it a competitive edge in the export market.

Joint Ventures (JV)

Thai Rayon Promoted in 1974 by the Aditya Birla Group, Thai Rayon is the sole

manufacturer of Viscose Rayon Staple Fibre (VSF) in Thailand. More than 50 per

cent of Thai Rayon's VSF throughput is directly exported to more than 20

countries worldwide. The VSF meets the stringent quality expectations of

customers in USA, Mexico, Europe, Turkey, Canada, Israel, Australia, South Korea,

Philippines, Indonesia, Pakistan, Bangladesh and Sri Lanka.

PT Indo Bharat Rayon Marketed under the brand name of 'Birla Cellulose', the

company produces a wide range of VSF in engineered specifications for textiles

and non-woven applications. The company's strong focus on environmental

protection is reflected through its investments in a sophisticated state-of-the-art

waste-water treatment plant and scientific waste disposal systems.

43

Grasim has joint venture with the following overseas companies:

AV Cell and AV Nackawic in Canada

AV Cell and AV Nackawic supply dissolving grade pulp to the Groups VSF

units in India, Thailand and Indonesia.

Birla Lao Pulp & Plantation Limited in Laos

To further strengthen the backward integration in pulp, Birla Lao has

been formed as a JV with other associate companies for raising captive

plantations at Laos. This will provide a low cost source for wood to meet

future requirements of a green field pulp plant in due course of time.

Birla Jingwei Fibres Company Limited in China

The JV with Hubei Jingwei Chemical Fibre Company Ltd. was formed in

2006 for manufacturing VSF. Currently, this plant has a capacity to

produce VSF of 35,000 tpa.

This spread and scale of operations make the Group's VSF operations very cost

competitive. Moreover, vertical integration into plantation, manufacturing of rayon

grade pulp and horizontal integration into production of principal raw material

required for VSF production, namely, caustic soda, intermediate inputs namely CS2,

sulphuric acid along with captive power and steam generation facilities, further

enhance its competitive edge.

Research & Development

Grasim has established a very strong R&D base covering different stages of the

value chain such as:

Grasim Forest Research Institute, Harihar is involved in R&D of forestry. Birla

Research Institute for Applied Sciences (BRI), Nagda is involved in the

development of different generations of cellulosic fibres. Textile Research

Application Development Centre (TRADC) at Kharach, a NABL accredited Lab, is

44

involved in addressing research and development related to downstream textile

value chain comprising various fibres, yarns, processing, garments, etc.

With the capability to offer the entire range of cellulosic fibre under the umbrella

brand of Birla Cellulose, Grasim has positioned itself as a dependable supplier

of cellulosic fibres for Feel, Comfort & Fashion across global markets. To

penetrate into niche market segments and to grow further, the division has

ventured into the production of high performance viscose fibres aptly named

Viscose Plus, High Wet Modulus Fibres (Modal) and new generation Solvent

Spun Fibres and Birla Excel. Grasim is also the largest producer of Sodium

Sulphate, a byproduct of VSF manufacture. This chemical is widely used in the

paper and pulp, detergent, glass and textile industries.

Cement

Grasim has grown to become a leading cement player in India. Grasim ventured

into cement production in the mid 1980s, setting up its first cement plant at

Jawad in Madhya Pradesh and since then it has grown to become a leading

cement player in India.

Grasims cement operations today span the length and breadth of India, with 11

composite plants, 11 split grinding units, four bulk terminals and 64 ready-mix

concrete plants as on 30 June 2009.

All the plants are located close to sizeable limestone mines and are fully

automated to ensure consistent quality. All units use state-of-the-art equipment

and technology and are certified with ISO 9001 for quality systems and ISO

14001 for environment management systems.

45

Chemicals

Grasim has India's second largest caustic soda unit. Rayon grade caustic soda is

an important raw material in VSF production. To achieve a reliable and

economical supply of this chemical, Grasim set up a rayon grade caustic soda unit

at Nagda in 1972, with an initial capacity of 33,000 tpa. This has since grown to

258,000 tpa, making it the country's second largest caustic soda unit.

Textiles

Grasim has strong nation-wide retail network and also caters to international

fashion houses in USA and UK. Grasim has a strong presence in fabrics and

synthetic yarns through its subsidiary, Grasim Bhiwani Textiles Limited, and is

well known for its branded suitings, Grasim and Graviera, mainly in the polyester

- cellulosic branded menswear.

Grasim's strong nationwide retail network includes 50 exclusive showrooms as

well as 200 wholesalers and 25,000 multi-brand outlets through which it reaches

its customers. Grasim caters to international fashion houses in the USA and UK

supplying fabric to them for manufacturing of garments, which are available in

some of the largest retail chain stores.

Sources of competitive advantage

Cost: Grasim is the lowest cost producer of VSF in the world. It is the most

integrated fibre producer with the chain stretching right from Forest to Pulp to

Fibre to Yarn. All most all the intermediate inputs are captive. Besides, their in-

house engineering division enables us to grow in a most cost effective way.

Technology: On technology front, they produce all the three generations of man-

made cellulosic fibres from an in-house developed capability through research

and development. Their research and development efforts are not limited to

46

fibre stage alone but extend to entire textile value chain. While the plantation

and related activity is carried out at Grasim Research Institute (GFRI, Harihar,

India), the Product innovations are carried out at Birla Research Institute (BRI,

Nagda, India). For value chain related activities, a state of art Textiles Research

& Application Development Centre has been established at Kharach, Gujarat-

India to entire textile value chain from yarn to fabric to garments.

Markets: On marketing front, their reach extends to the entire globe, through

marketing offices. On a global level, their major strength is in spun-dyed fibres

and now other specialties such as Non-woven, Modal and Excel have started

penetrating in global markets. Their brand Birla Cellulose is firmly entrenched

in the market. Their value added marketing services comprising of technical,

logistical, financial, marketing and informational support have enabled us to

emerge as the most preferred supplier of VSF in world. Our offerings whether

from India, Thailand, Indonesia or China are all marketed under the mother

brand Birla Cellulose and sub brands Birla Viscose, Birla Modal & Birla Excel.

An umbrella brand has enabled us to create a common identity for our product

across the globe irrespective of its production origin and creating of awareness

of the brand.

Consumer Products Division of Grasim Industries

Grasim Industries, an Aditya Birla Group Enterprise has started its Consumer

Product Division with various personal care & home care dry & wet wipes

products. This marks the companys foray into the Indian FMCG market. The

Indian FMCG market is of US$13.1 billion and is the fourth largest sector in the

economy. FMCG Sector is expected to grow by over 60% by 2015. That will

translate into an annual growth of 10% over a 5-year period.

47

In 2008 the company launched Kara skin care wipes and Prim Home Care wipes.

Kara Skincare wipes is positioned as an essential skincare accessory.

In 2009, Grasim entered the baby care segment with the launch of Puretta.

Puretta is targeted at today's mother, who opts for a contemporary and

convenient lifestyle. Introduced for the first time in India, the Puretta product

portfolio includes Complete Cleaning Wipes, Germ Shield Wipes and Skin

Nourishing Wipes.

Birla Cellulose is the Aditya Birla Group's umbrella brand for its range of

cellulosic fibres. It comprises versatile sub-brands; Birla Viscose, Birla Viscose

Plus, Birla Modal, and Birla Excel. These brands offer a wide range of functional

benefits such as soft feel, high moisture absorbency, bio degradability and

comfort to the wearer. These fibres have multiple applications including apparel,

home textiles, dress material, knitwear, non-woven etc.

Fibre is one of the oldest businesses of the Aditya Birla Group that commenced in

1954. Birla Cellulose is a world leader in viscose staple fibre (VSF). Its

production is spread across six countries, viz. Canada, Thailand, India, Indonesia,

China and Laos. The Group independently fulfils India's entire VSF requirements.

With a strong focus on Research and Development (R&D), the Group's R&D

initiatives span the entire value chain.

Grasim Forest Research Institute pulp to plantation research

Birla Research Institute for Applied Sciences pulp to fibre research

48

Textile Research & Application Development Centre (TRADC) value

chain from fibre to garments / made ups

"Nature is the genesis of all that surrounds us; therefore, what other than nature

could be the origin of Birla Cellulose.. Nature is the source of Birla Cellulose and

herein the inspiration of our logo lies.

'Fibers from Nature' is our theme and our message: Leaves fall and grow all over

again; they are a renewable resource of nature. Birla Cellulose is much like these

leaves and is made from the same trees. The floating leaves symbolise the key

characteristics of Birla Cellulose which are "comfort and lightness". The vibrant

green indicates that Birla Cellulose can take on vibrant colours. The circle

signifies the cycle of nature and sustainability.

Nature remains the underlying theme for all our brands:

Viscose is symbolised by the fresh green of summer

Modal is symbolised by the burnt orange of autumn

Excel is symbolised by the deep pink of spring.

An integrated outlook

Birla Cellulose is growing by leaps and bounds through both organic and

inorganic route. The efforts towards integration and self-sufficiency are as

follows:

Backward integration into pulp and plantation.

Captive power plant at all locations.

In house manufacturing of all major chemicals and auxiliaries used in VSF

manufacturing.

49

Attributes of Birla Cellulose

Natural: Soothing, comforting and elevating, Birla cellulose exhibits all qualities

of its source nature.

Stylish: The drape and fall of Birla Cellulose with its natural inheritance is a

fashion statement.

Timeless: Just like nature, Birla Cellulose, is timeless and shall always remain in

vogue.

A fashion catalyst: A hint of Birla Cellulose in your wardrobe brings in the

glamour that differentiates between mundane and fashionable.

Versatile: Birla Cellulose combines the best properties of all fibres. It is

extremely bendable hence enhancing the realms of possibilities in clothing.

Birla Cellulose - Fibres from nature contributing to a green world

Preserving our environment has always been the inspiration behind Birla

Cellulose. It has successfully achieved this goal through the following initiatives:

Nurturing and building the green cover

Over a million plantlets are being produced from identified superior

clones for development of clonal orchards and plantations.

Land conservation

Efforts are on to encourage tree-farming practice on marginal, sub-

marginal and fallow lands to the best advantage of the country. The yield

of Viscose is seven times that of cotton for the same land area. Thus

significantly contributing to conservation of land, and reaping maximum

results from this limited resource.

50

Water conservation

Birla Cellulose Viscose is highly environment friendly. Every kilogram of

viscose produced saves 200 buckets of water when compared to cotton.

Thus it preserves one of the most valuable natural resources.

Process friendliness

The process being followed for production is environment friendly and

green due to the following advantages:

Non toxic effluent as a result of replacement of zinc by alum

Less solid waste generation due to reduced lime consumption

Reduced risk of fouling biological microorganism in reactor

Spun Shades

This variant is environment friendly and results in conservation of water

throughout the value chain. It is Okeo Tex certified, i.e. it meets the

ecological requirements set for baby articles.

Birla Cellulose: The perfect blend

Birla Cellulose fibres are the perfect blend with all types of fibres. The benefits of

using Birla Cellulose as a blend are as below:

Birla Cellulose blends Benefits of blending with Birla Cellulose

Birla Cellulose-cotton

Makes cotton soft and supple

Improves fabric uniformity

Imparts sheen and colour brilliance

Birla Cellulose-wool

Improves wear properties

51

Imparts softness

Enhances skin friendliness

Adds shine and luster

Birla Cellulose-silk

Maintains sheen of silk

Improves comfort

Economical and fashionable

Birla Cellulose-

synthetics

Improves comfort, breathability, lustre and skin

friendliness

Birla Cellulose-elastane

Offers excellent sheen, comfort and stretch

Birla Cellulose-elastane

Offers excellent sheen, comfort and stretch

PRODUCTS OF BIRLA CELLULOSE

Aditya Birla group announced its foray into the baby care segment in India by

launching PURETTA 100 per cent natural and biodegradable baby care wipes in

2009. Product portfolio includes Complete Cleansing Wipes, Germ Shield Wipes

and Skin Nourishing Wipes. These wipes are safe for the babys delicate skin as

they are alcohol free, hygienic, hypoallergenic and dermatologically tested. Since

Puretta (meaning pure and diminutive) is made from Birla Cellulose, soothes the

babys tender skin with its soft and nature-friendly properties.

While the usage of baby wipes is growing in India, there is limited access to

quality products at the right price points. Most of the products available today

52

are imported, and are primarily regular wet wipes that do not serve the specific

needs of baby care. Puretta fills this gap with its three distinct variants, aiming to

satisfy the need of Smart Moms.

Most of the other wet wipes in the market today are made from Polyester-

Viscose blended non- woven fabric or paper. Polyester is not skin friendly and its

repeated use on the skin is not advisable. Paper tissues tear off when rubbed

over skin and leave lint on face in a way that can often embarrass the user. While

Puretta is made up of non-woven fabric which absorbs sweat, extra oils from the

skin without scrubbing it. It doesnt wither when rubbed hard and doesnt leave

lint on facial skin or stubble.

Characteristics of Puretta Baby Wipes

Safe for babys skin.

Hygienic.

Hypoallergenic

Dermatologically tested.

Alcohol free.

With mild fragrance.

Convenient- hassle free cleaning and application of lotions without using

towel or cotton balls.

Portable.

With optimized efficacy.

For complete baby care.

53

Variants of Puretta

Complete Cleansing Wipes

Complete cleansing baby wipes are enriched with chamomile extracts these

wipes are gentle and soothing to the babys skin ensuring complete cleansing

while retaining the pH balance of the skin. It is a smart way to clean the baby

completely anytime & anywhere.

It is basically used on babys nappy area and can be used on complete body of a

0-3 years of babies. It is used for following:

Every nappy or diaper change.

For cleansing in the absence of regular bath while travelling or in

winters.

Wipe entire body to keep baby clean and fresh at all times, day or night.

Provide soothing relief.

Most of the other wet wipes in the market today are made from Polyester-

Viscose blended non- woven fabric or paper. Polyester is not skin friendly and its

repeated use on the skin is not advisable.

Paper tissues tear off when rubbed over skin and leave lint on face in a way that

can often embarrass the user. While Puretta is made up of non-woven fabric

which absorbs sweat, extra oils from the skin without scrubbing it. It doesnt

wither when rubbed hard and doesnt leave lint on facial skin or stubble.

54

Skin Nourishing Wipes

Skin Nourishing Baby Wipes keeps the babys skin soft and nourished always,

after a bath or even during the dry season. Enhanced with Mineral oil and Pear

extracts, it leaves a protective layer of moisture on the babys delicate skin. A

smarter way to keep the babys skin nourished anytime, anywhere.

It is used on babys complete body especially hands, feet, face, neck and back

area. It is a good add-on or occasional substitute for baby oil massage. It is

basically for babies of age 0-3 years but can also be used for older children with

sensitive skin. And it is used for following:

Essential to keep babys skin soft and nourished always.

After bath and during dry season.

While travelling or exposure to air-conditioning at home

Germ Shield Wipes

Germ Shield Baby Wipes contains antiseptic properties to protect the babies

from germs always. Enriched with Lavender extracts, it leaves the babys skin

refreshed. A smart multipurpose option for not only sanitizing babys hands and

mouth but also utensils, tethers and toys, anytime and anywhere.

55

It is basically for 0-5 year old babies but can also be used by older children while

travelling and also advisable for adults handling the babies. And it is used for

protecting the babies from germs throughout the day with natural antiseptic

properties.

Essential to clean baby as he/she gains mobility and crawls on surface

that may be contaminated.

After play time, before food and especially while travelling.

To sanitize babys utensils, tethers and toys.

PRIM

Home & Kitchen Care Wipes

PRIM is basically dry wipes used in Kitchen and various multipurpose household

works. It can be used to wipe the utensils and cutleries. One wipe can be used for

at least a month in the kitchen. There is no product in the market in this category

but Scrotch brite is there which is seen as the substitute of the product. Usually

cloth is used as the substitute in most of the families but if the promotion is done

properly to make the consumers aware of this product it will do very good in the

market because of very less competition in this category. There are two packs

available in the market one is three wipes pack and the other one in five wipes

pack.

56

HANDYS - Hand sanitizing wipes

Handys hand sanitizing wipes have been shown to clean and sanitize hands more

effectively than rub-in gels. These sanitizing wipes are extra tough on germs,

killing 99.9% of germs. Though there are few companies who manufacture

sanitizing wipes, but all of them are alcohol based. Handys is the only sanitizing

wipe which is Triclosan based and as sufficient as alcohol in killing germs.

Triclosan is one of the antibacterial and antifungal and even toothpaste. Grasim

Industries outsource Triclosan from vivimed Labs based in Hyderabad. The

wipes contain 0.1% Triclosan which is sufficient to give required anti bacterial

properties.

Rub-in gel sanitizers can not remove stain marks or dirt but sanitizing wipes are

very efficient in cleaning hands. It is gentle on hands, containing moisturizers,

aloe vera and silicones. Clinically tested, our hand sanitizing wipes provide

convenient protection anywhere, anytime when soap and water are not

available. It is an excellent product for anybody seeking hygiene and prevention

from infections.

KARA Skin Care Wipes

Grasim Industries has started its Consumer Product Division with various FMCG

products which includes personal care & home care dry & wet wipes products.

The main product of our concern for the research is Kara Skincare wipes.

57

It is not easy to look beautiful all the time and it gets even harder when you are

out of home with pollution, dust and heat. Introducing for the first time in India,

Kara a complete range of skincare wipes.

In India, the market for wet wipes was gradually picking up with changing

lifestyles and the fast pace of life among the young and upwardly mobile

population with higher disposable income.

''Kara skincare wipes fill up the lacuna in this segment as there is lack of

availability of quality products at appropriate price in the Indian market.''

Kara Skincare wipes is a new product to hit the Indian market. The brand is now

running heavy print campaign announcing the launch. Kara Skincare wipes can

be called as India's first branded skincare wipe product. Skincare wipes are

popular in the west but in India the category is a new one. Although Indian

consumers are familiar with the products which are imported, its the first time

that an Indian company enters this segment Kara means care. The brand also

marks Aditya Birla Group's foray into the Indian FMCG market.

The brand aims to create a new category of wipes in India. Hence the challenge is

to educate the target audience about the usefulness of this product. This task is

cut out for Kara since the customer is already exposed to such products. The only

task is to inculcate the habit of buying and using the wipes. The product is

relevant in the Indian market for two reasons.

One is the climate which necessitates such a product and

Second is the growing number of lady professionals.

The brand has the tagline At your best always this clearly communicates the

core brand positioning. The brand is being promoted as the anytime solution to

look good.

58

Also Kara is loaded with lotions for different application like deep pore cleansing,

moisturizing, toning, sunscreen and make up remover.

Rejuvenating the skin is a natural property of mint oil and cucumber coupled with

aloe Vera for skin nourishing in refreshing wipes.

Jojoba and Avocado unclogs pres, detoxes and exfoliates dead skin in Deep Pore

Cleansing wipes.

Rose and Thyme are well known to have toning properties used in Toning Wipes.

Honey and Almond are age old products for removing dryness of skin and

moisturizing present in moisturizing wipes

Aloe Vera and plum have natural sunscreen properties Kara Sunscreen wipes.

Lavender cleaning and relaxing properties while Seaweed has nourishing effect on

skin both used for makeup removal wipes.

Kara has a good potential to create and own a new category. The brand already

has the first mover advantage. But the category does not have much entry

barriers. It can face stiff competition from cheap imports. But Kara has the

financial backing of Birla group and the investment in building this brand will

pave the way for another successful marketing story.

59

Kara is readily available pan India at superstores, cosmetic and chemist outlets

and modern retail. The ease of usability of a convenient and high value product

at an affordable cost in India for a young and mobile population is a huge