Professional Documents

Culture Documents

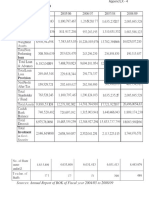

Budget at A Glance: Revenue and Foreign Grants

Uploaded by

Ashraf HossainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget at A Glance: Revenue and Foreign Grants

Uploaded by

Ashraf HossainCopyright:

Available Formats

1

BUDGET AT A GLANCE

(Taka in Crore)

Budget

Description

Revised

Budget

Actual

2013-14

2012-13

2014-15

2013-14

1,82,954

1,56,671

1,67,459

1,28,128

1,55,292

1,30,178

1,41,219

1,07,452

1,49,720

1,25,000

1,36,090

1,03,332

5,572

5,178

5,129

4,120

27,662

26,493

26,240

20,676

6,206

5,956

6,670

6,879

Total :

1,89,160

1,62,627

1,74,129

1,35,007

Total - Financing Including BPCs Liability :

1,89,160

1,62,627

1,74,129

1,35,007

1,54,241

1,34,907

1,34,449

1,04,318

1,28,231

1,15,998

1,13,471

99,376

29,305

24,854

26,003

22,322

1,738

1,686

1,740

1,593

26,010

18,909

20,978

309

188

263

Loans & Advances (Net)/3 (Statement VIA)

9,611

15,982

15,504

16,959

Development Expenditure

86,345

65,145

72,275

53,172

1,068

893

1,934

597

Non-ADP Project (Statement VIA)

3,469

3,058

3,014

1,802

Annual Development Programm/5 (Statement IX)

80,315

60,000

65,870

49,474

Non-ADP FFW and Transfer/6 (Statement X)

1,493

1,194

1,457

1,299

Total - Expenditure :

2,50,506

2,16,222

2,22,491

1,74,013

Overall Deficit (Including Grants) :

- 61,346

(In percent of GDP) :

- 4.5

Overall Deficit (Excluding Grants) :

- 67,552

(In percent of GDP) :

- 5.0

- 5.0

- 4.6

- 4.4

Total - Financing Including BPCs Liability :

2,50,506

2,16,222

2,22,491

1,74,013

18,069

12,613

14,398

5,812

26,519

21,058

23,729

13,301

Amortization (Statement IX)

- 8,450

- 8,445

- 9,331

Domestic Borrowing (Statement VIB)

43,277

40,982

33,964

33,193

31,221

29,982

25,993

27,464

Revenue and Foreign Grants

Revenues (Statement I)

Tax Revenue

NBR Tax Revenue

Non-NBR Tax Revenue

Non-Tax Revenue

Foreign Grants/1 (Statement V)

Expenditure

Non-Development Expenditure

Non-Development Revenue Expenditure (Statement III)

of which

Domestic Interest

Foreign Interest

Non-Development Capital Expenditure/2 (Statement IV)

Net Outlay for Food Account Operation (Statement VIII)

Development Programmes Financed from Revenue Budget/4

(Statement IV)

53,595

- 4.5

-

59,551

48,362

4,943

-

39,006

- 4.0

-

55,032

437

- 3.8

-

45,885

Financing

Foreign Borrowing-Net

Foreign Borrowing (Statement V)

Borrowing from Banking System (Net)

7,489

BUDGET AT A GLANCE

Description

(Taka in Crore)

Budget

Revised

Budget

Actual

2014-15

2013-14

2013-14

2012-13

Long-Term Debt (Net)

19,824

16,955

14,355

22,746

Short-Term Debt (Net)

11,397

13,027

11,638

4,718

Non-Bank Borrowing (Net)

12,056

11,000

7,971

5,729

National Savings Schemes (Net)

9,056

8,000

4,971

824

Others/7 (Statement VII)

3,000

3,000

3,000

4,905

Total - Financing :

61,346

53,595

48,362

39,005

Total - Financing Including BPCs Liability :

61,346

53,595

48,362

39,005

11,88,800

10,37,987

Memorandum Item :

GDP

13,39,500

11,81,000

Capital Market:

Capital Market has remained stable during FY2014: DSEX index has increased by 11.7%;

total trade value by 9.4% and market capitalization by 16.3%. Proposal for tax exemption

facilities for demutualised stock exchanges for over 5 years in graduated rate would help to

build confidence on the bourses to potential international institutional strategic partners

Retail investors will get some relief because of rise in tax exempted dividend income from

Tk.10,000 from Tk.15,000 65CPD (2014)Remaining works of demutualization should be

completed on time.

You might also like

- Finance Alberta Health Budget Estimates 2013Document1 pageFinance Alberta Health Budget Estimates 2013TeamWildroseNo ratings yet

- Ashok Leyland Annual Report 2012 2013Document108 pagesAshok Leyland Annual Report 2012 2013Rajaram Iyengar0% (1)

- Balance Sheet and Financial Ratios of Parabhu BankDocument7 pagesBalance Sheet and Financial Ratios of Parabhu BankSocialist GopalNo ratings yet

- Gov1. SecuritvDocument2 pagesGov1. SecuritvrahulNo ratings yet

- Financially Distressed State of The Company: Flow-Based Financial DistressDocument5 pagesFinancially Distressed State of The Company: Flow-Based Financial DistressMd Shakawat HossainNo ratings yet

- BUS 635 Project On BD LampsDocument24 pagesBUS 635 Project On BD LampsNazmus Sakib PlabonNo ratings yet

- Balance SheetDocument6 pagesBalance SheetMohammad Abid MiahNo ratings yet

- Premier BankDocument14 pagesPremier Bankanower.hosen61No ratings yet

- Statement of Financial Position and Comprehensive Income SummaryDocument6 pagesStatement of Financial Position and Comprehensive Income SummaryPratikBhowmickNo ratings yet

- RelianceDocument22 pagesReliance122jasbirkaur2003No ratings yet

- Group 2 RSRMDocument13 pagesGroup 2 RSRMAbid Hasan RomanNo ratings yet

- Quice Foods Industries Ltd profit and loss analysisDocument4 pagesQuice Foods Industries Ltd profit and loss analysisOsama RiazNo ratings yet

- Itr - 1Q13Document75 pagesItr - 1Q13Usiminas_RINo ratings yet

- Accounting Presentation (Beximco Pharma)Document18 pagesAccounting Presentation (Beximco Pharma)asifonikNo ratings yet

- LBP 2013 executive summaryDocument3 pagesLBP 2013 executive summaryDenise Angel SonNo ratings yet

- Hindustan Uniliver - FMDocument9 pagesHindustan Uniliver - FMrachitaNo ratings yet

- RBSMI Achieves Over P1 Billion in Total Assets in 2021Document14 pagesRBSMI Achieves Over P1 Billion in Total Assets in 2021Vicxie Fae CupatanNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisMohammad Abid MiahNo ratings yet

- Asset Liability Management at HDFC BankDocument31 pagesAsset Liability Management at HDFC BankwebstdsnrNo ratings yet

- Black Hole Futsal & Café Projected Balance SheetDocument9 pagesBlack Hole Futsal & Café Projected Balance Sheetkalpana BaralNo ratings yet

- Cash Flow Statement Comparison 2015-2018Document4 pagesCash Flow Statement Comparison 2015-2018holtreng lolNo ratings yet

- Group 2 - VNM - Ver1Document11 pagesGroup 2 - VNM - Ver1Ánh Lê QuỳnhNo ratings yet

- FY 2012 Audited Financial StatementsDocument0 pagesFY 2012 Audited Financial StatementsmontalvoartsNo ratings yet

- BDlampDocument59 pagesBDlampSohel RanaNo ratings yet

- Data Analysis Penna Cement 1 NEWDocument22 pagesData Analysis Penna Cement 1 NEWShanmuka SreenivasNo ratings yet

- Project Report Ca SignDocument9 pagesProject Report Ca SignRavindra JondhaleNo ratings yet

- BHP Group PLCDocument20 pagesBHP Group PLCKishor JhaNo ratings yet

- Dandot CementDocument154 pagesDandot CementKamran ShabbirNo ratings yet

- Bindoy Executive Summary 2013Document11 pagesBindoy Executive Summary 2013fenty girlNo ratings yet

- Accounting ProjectDocument16 pagesAccounting Projectnawal jamshaidNo ratings yet

- Teuer Furniture A Case Solution PPT (Group-04)Document13 pagesTeuer Furniture A Case Solution PPT (Group-04)sachin100% (4)

- For The Year Ended 30 June 2018: Chapter No. 4 Financial AnalysisDocument37 pagesFor The Year Ended 30 June 2018: Chapter No. 4 Financial AnalysisAbdul MajeedNo ratings yet

- Pratik Project Report (Bank OD)Document6 pagesPratik Project Report (Bank OD)Raghu RangrejNo ratings yet

- Altavas Executive Summary 2015 PDFDocument6 pagesAltavas Executive Summary 2015 PDFThe ApprenticeNo ratings yet

- Project Report PDFDocument13 pagesProject Report PDFMan KumaNo ratings yet

- Ashok LeylandDocument124 pagesAshok LeylandananndNo ratings yet

- Financial: Six Years Review at A GlanceDocument4 pagesFinancial: Six Years Review at A GlanceMisha SaeedNo ratings yet

- ANNEXURESDocument6 pagesANNEXURESneymarjr.facebooklockedNo ratings yet

- Executive Summary Highlights Manaoag Municipality's FinancialsDocument8 pagesExecutive Summary Highlights Manaoag Municipality's FinancialsJasha Alexi FuentesNo ratings yet

- 2013 Proposed BudgetDocument339 pages2013 Proposed BudgetMichael PurvisNo ratings yet

- Student Number (UWL Registration Number) : 21452742 Assignment Name: Consolidation and Analysis On The MusicalDocument19 pagesStudent Number (UWL Registration Number) : 21452742 Assignment Name: Consolidation and Analysis On The MusicalSavithri NandadasaNo ratings yet

- Dutch Lady Company - Construct A Cash Budget (Task Group) - Kba2431a - Fin420Document12 pagesDutch Lady Company - Construct A Cash Budget (Task Group) - Kba2431a - Fin420MOHAMAD IZZANI OTHMANNo ratings yet

- UNCG ReportDocument117 pagesUNCG ReportthemudcatNo ratings yet

- Grand Plaza Hotel CorporationDocument2 pagesGrand Plaza Hotel CorporationDarell TorresNo ratings yet

- FINM 7044 Group Assignment 终Document4 pagesFINM 7044 Group Assignment 终jimmmmNo ratings yet

- Department of Public Works and Highways Executive Summary 2022Document14 pagesDepartment of Public Works and Highways Executive Summary 2022Stacy VeuNo ratings yet

- 2019 Proposed BudgetDocument91 pages2019 Proposed Budgetcharmaine vegaNo ratings yet

- Financial AccountingDocument18 pagesFinancial AccountingBhargavi RathodNo ratings yet

- Fu-wang ceramic industries ltd. financial analysisDocument23 pagesFu-wang ceramic industries ltd. financial analysisযুবরাজ মহিউদ্দিনNo ratings yet

- Enterprise Valuation of BEACON PharmaceuticalsDocument35 pagesEnterprise Valuation of BEACON PharmaceuticalsMD.Thariqul Islam 1411347630No ratings yet

- Investment ExcelDocument78 pagesInvestment ExcelByezid LimonNo ratings yet

- Budget at A GlanceDocument2 pagesBudget at A Glancefaysal_duNo ratings yet

- Project Report On: Saraswati Vidya Mandiram-NarpalaDocument24 pagesProject Report On: Saraswati Vidya Mandiram-NarpalaUsmankhan KhanNo ratings yet

- BSBFIM601 Manage FinancesDocument34 pagesBSBFIM601 Manage Financesneha0% (1)

- FIN506 Business Finance Weekly Assignment 2 Due Sep 04Document2 pagesFIN506 Business Finance Weekly Assignment 2 Due Sep 04Areeba QureshiNo ratings yet

- Balance Sheet As On 31st March, 2018: Coastal Bank - 2018Document2 pagesBalance Sheet As On 31st March, 2018: Coastal Bank - 2018Ranjan Roy JacobNo ratings yet

- South Metro Fire Rescue Authority Proposed 2014 BudgetDocument124 pagesSouth Metro Fire Rescue Authority Proposed 2014 BudgetRonda ScholtingNo ratings yet

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanFrom EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- ADB Annual Report 2013: Promoting Environmentally Sustainable Growth in Asia and the PacificFrom EverandADB Annual Report 2013: Promoting Environmentally Sustainable Growth in Asia and the PacificNo ratings yet

- Labour LawDocument6 pagesLabour LawAshraf HossainNo ratings yet

- Dishonour of ChequeDocument11 pagesDishonour of ChequeAshraf HossainNo ratings yet

- Document Checklist: Permanent Residence - Federal Skilled Worker ClassDocument7 pagesDocument Checklist: Permanent Residence - Federal Skilled Worker Classmohd0032No ratings yet

- Paper JonaDocument13 pagesPaper JonaAshraf HossainNo ratings yet

- 9935 36575 1 PBDocument18 pages9935 36575 1 PBAshraf HossainNo ratings yet

- Questionnaire On Human Resource ManagementDocument2 pagesQuestionnaire On Human Resource ManagementAshraf HossainNo ratings yet

- Report 2Document8 pagesReport 2Ashraf HossainNo ratings yet

- Final Garments Study ReportDocument20 pagesFinal Garments Study ReportAshraf HossainNo ratings yet

- Effective HRM Practise in Banking Sector of BangladeshDocument20 pagesEffective HRM Practise in Banking Sector of BangladeshNyeem Al Ahad0% (1)

- Central Tendency & DispersionDocument11 pagesCentral Tendency & DispersionAshraf HossainNo ratings yet

- HRM ReportDocument22 pagesHRM ReportAshraf HossainNo ratings yet

- Dhaka BankDocument40 pagesDhaka BankAshraf HossainNo ratings yet

- AssignmentDocument13 pagesAssignmentAshraf HossainNo ratings yet

- Case On EthicsDocument8 pagesCase On EthicsAshraf HossainNo ratings yet

- Assignment 1Document18 pagesAssignment 1Ashraf HossainNo ratings yet