Professional Documents

Culture Documents

LTA Claim Form - Period 1.jan.2006 To 31.dec.2009

Uploaded by

Paymaster ServicesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LTA Claim Form - Period 1.jan.2006 To 31.dec.2009

Uploaded by

Paymaster ServicesCopyright:

Available Formats

Company:_______________________________________

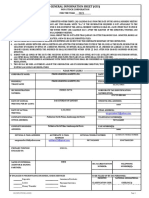

LEAVE TRAVEL ASSISTANCE CLAIM FORM

To

The Payroll Department Employee's Payroll Code

(As shown on the Payslip)

Dear Sir,

I, declare having spent by way of travel fare Rs.

for proceeding on leave within India, during the dates _______________ to _________________.

I have obtained from a recognised travel agent the 'Exempted Fare' amount as per the requirements

of the Income Tax Authourity, detailed in the notes below. The said 'Exempted Fare' amounts to

Rs. .

Notes:

1. Where journey is performed by air -- The amount of exemption cannot exceed air economy fare of the National

Carrier by the shortest route or the amount spent, whichever is less.

2. Where journey is performed by rail -- The amount of exemption cannot exceed air-conditioned first class rail fare

by the shortest route or amount spent, whichever is less.

3. Where journey is performed by a recognised public transport system -- The amount of exemption cannot exceed

First class or deluxe class fare by the shortest route or the amount spent, whichever is less.

4. Exemption is available only pertaining to fare. No other charges are to be included.

5. Please refer Sec.10 (5) of The Indian Income Tax Act for further details.

I certify the above information is true and correct.

Yours faithfully, Please list persons who have accompanied you on leave (if any)

and their relationship, certifying that they are dependent on you.

Name Relationship

1. 1.

2. 2.

3. 3.

Signature of Employee 4. 4.

5. 5.

Dated: 6. 6.

Cyrus Paymaster

Digitally signed by Cyrus Paymaster

DN: cn=Cyrus Paymaster, o=Paymaster services, ou,

email=callcyrus@gmail.com, c=IN

Date: 2009.11.20 17:06:25 +05'30'

LTA_claim LTA Claimant 14/11/2009

You might also like

- LTC TA GPF Medical Forms For Central Govt EmployeesDocument27 pagesLTC TA GPF Medical Forms For Central Govt Employeesrkthbd5845No ratings yet

- 2.1 Trivelio Travel Allowance Booking Mobile GuideDocument7 pages2.1 Trivelio Travel Allowance Booking Mobile GuideChristian Natalius NaibahoNo ratings yet

- Gratuity Affidavit FormatDocument3 pagesGratuity Affidavit FormatSAI ASSOCIATE100% (1)

- LTC Claim FormsDocument7 pagesLTC Claim FormsfatgembitNo ratings yet

- LTC, TA, GPF, Medical Forms For Central Govt EmployeesDocument27 pagesLTC, TA, GPF, Medical Forms For Central Govt Employeesprinceej100% (5)

- Ilfbl 1: Salary Savings Scheme Authorisation LetterDocument2 pagesIlfbl 1: Salary Savings Scheme Authorisation LetterOffice of the Principal Accountant General G&SSA67% (3)

- Es Direct Debit MandateDocument4 pagesEs Direct Debit Mandatecatherinecastillo914No ratings yet

- LTA Declaration Form Form 12BBDocument3 pagesLTA Declaration Form Form 12BBAmitomSudarshanNo ratings yet

- GST letter waiver show cause noticeDocument3 pagesGST letter waiver show cause noticevishnuprakash1990No ratings yet

- Enroll in Auto-Debit Arrangement for Bills PaymentDocument1 pageEnroll in Auto-Debit Arrangement for Bills PaymentDiana Sia VillamorNo ratings yet

- Ada Form DownloadDocument1 pageAda Form DownloadDona DolorzoNo ratings yet

- Prof Tax JanDocument2 pagesProf Tax JanSai Krishna Health Center BanakalNo ratings yet

- US Internal Revenue Service: f8404 - 2003Document2 pagesUS Internal Revenue Service: f8404 - 2003IRSNo ratings yet

- Ertificat E of D FN Resident For Indone T Withh F R - DGT 2: C O Micile O ON SIA AX Oldin G O M)Document2 pagesErtificat E of D FN Resident For Indone T Withh F R - DGT 2: C O Micile O ON SIA AX Oldin G O M)Reviansyah Machfudin YusufNo ratings yet

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Document17 pagesRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Moysés Isper NetoNo ratings yet

- Ir 1241Document1 pageIr 1241Kit ChuNo ratings yet

- LOAN FORM AND PN 2021Document2 pagesLOAN FORM AND PN 2021tom10carandangNo ratings yet

- Insured Instruction Letter - KurniaDocument1 pageInsured Instruction Letter - KurniaishamNo ratings yet

- Auto Debit Arrangement - 20190804 - 020707 PDFDocument4 pagesAuto Debit Arrangement - 20190804 - 020707 PDFKim Josashiwa BergulaNo ratings yet

- Application Form EMPLOYEES CAR LOAN SCHEME (New/Reconditioned Car)Document4 pagesApplication Form EMPLOYEES CAR LOAN SCHEME (New/Reconditioned Car)assadNo ratings yet

- Renewal Ecs Latest Form - 8.9.2017Document1 pageRenewal Ecs Latest Form - 8.9.2017Priya SelvarajNo ratings yet

- BESALA Loan Application-EVELYN BULATAODocument1 pageBESALA Loan Application-EVELYN BULATAOYul BackNo ratings yet

- India Statutory Form TemplateDocument11 pagesIndia Statutory Form TemplateMadhusudan MadhuNo ratings yet

- Mechelec Credit Application2Document3 pagesMechelec Credit Application2Nithin M NambiarNo ratings yet

- GTC Application ProcessDocument6 pagesGTC Application ProcessWerewolfman 186No ratings yet

- KRA Annex ADocument5 pagesKRA Annex AkavitajijagtapNo ratings yet

- 01.latest New FORM 19-InfocommDocument3 pages01.latest New FORM 19-InfocommABHISHEK JURIANI100% (1)

- Motor Insurance Amendment Form - Updated May 2023Document1 pageMotor Insurance Amendment Form - Updated May 2023bibi138913No ratings yet

- Due Date For Payment of Service Tax & IntDocument3 pagesDue Date For Payment of Service Tax & IntKaran KhatriNo ratings yet

- Cleartrip AgentBox Agreement ReDocument4 pagesCleartrip AgentBox Agreement ReTarush GoelNo ratings yet

- Registration FormDocument1 pageRegistration FormNidhi RanaNo ratings yet

- Spenmo SPADocument17 pagesSpenmo SPANicole VelasquezNo ratings yet

- 1010 Form62Document2 pages1010 Form62Viral ShahNo ratings yet

- Kuldeep Offer LetterDocument4 pagesKuldeep Offer LetterKuldeep TiwariNo ratings yet

- Credit Note and Debit Note Under GST - Masters IndiaDocument5 pagesCredit Note and Debit Note Under GST - Masters Indiaarun alwaysNo ratings yet

- Form 6af PDFDocument5 pagesForm 6af PDFRAJESH KUMARNo ratings yet

- Leave Travel Concession Bill 20201012123051Document4 pagesLeave Travel Concession Bill 20201012123051Kiran AlluriNo ratings yet

- Appointment Letter: Teamlease Services Limited., Cin No. U74140Mh2000Ptc124003Document3 pagesAppointment Letter: Teamlease Services Limited., Cin No. U74140Mh2000Ptc124003BATTLE GAMING ZONENo ratings yet

- Canara Rebecco Page 2Document1 pageCanara Rebecco Page 2nirajthacker93620No ratings yet

- Declaration for Remittance under Specified ListDocument1 pageDeclaration for Remittance under Specified ListSonu YadavNo ratings yet

- 003 - Confidentiality AgmtDocument1 page003 - Confidentiality Agmtmike mNo ratings yet

- Help Kit D.P.T-3Document9 pagesHelp Kit D.P.T-3Harmeet SinghNo ratings yet

- ZTP Application FormDocument4 pagesZTP Application Formuchennaoluebube22No ratings yet

- 103120000000007839Document3 pages103120000000007839ShilpaMurthyNo ratings yet

- 2023 Winter Storm Penalty WaiverDocument2 pages2023 Winter Storm Penalty WaiverFOX54 News HuntsvilleNo ratings yet

- Demo Service AgreementDocument9 pagesDemo Service Agreementgudirohit90No ratings yet

- Franchisee Application FormDocument4 pagesFranchisee Application FormMuzammil HawaNo ratings yet

- Form No. 16A (See Rule31 (L) (B) )Document4 pagesForm No. 16A (See Rule31 (L) (B) )Nirmal MalooNo ratings yet

- Non-Profit School GIS Form GuideDocument6 pagesNon-Profit School GIS Form GuideEl Comedor BenedictNo ratings yet

- Surrender Form SummaryDocument3 pagesSurrender Form SummaryDevendra RawoolNo ratings yet

- Registration Form-NewDocument5 pagesRegistration Form-NewswarajNo ratings yet

- Form 3 - DKMDocument4 pagesForm 3 - DKMJATIN KAPADIANo ratings yet

- Reactivation of Client Trading Account Securites - 220718 - 141307Document7 pagesReactivation of Client Trading Account Securites - 220718 - 141307Nirmal GeorgeNo ratings yet

- Instructions For Form 940: Future DevelopmentsDocument16 pagesInstructions For Form 940: Future DevelopmentsHotfootballmomNo ratings yet

- EREG Advisory 05152019Document60 pagesEREG Advisory 05152019Joy Dela RosaNo ratings yet

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Everthing You Need To Know To Start An Auto DealershipFrom EverandEverthing You Need To Know To Start An Auto DealershipRating: 5 out of 5 stars5/5 (1)

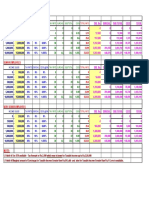

- New - Cost Inflation IndexDocument1 pageNew - Cost Inflation IndexPaymaster ServicesNo ratings yet

- Detailed Tax Slabs - FY 2017-18Document1 pageDetailed Tax Slabs - FY 2017-18Paymaster ServicesNo ratings yet

- Key Highlights of The Finance Budget - 2017Document1 pageKey Highlights of The Finance Budget - 2017Paymaster ServicesNo ratings yet

- Cost Inflation IndexDocument1 pageCost Inflation IndexPaymaster ServicesNo ratings yet

- Proof of Investment - Y.E. 31.03.2011Document5 pagesProof of Investment - Y.E. 31.03.2011Paymaster ServicesNo ratings yet

- Profession Tax Challan - MaharashtraDocument1 pageProfession Tax Challan - MaharashtraPaymaster ServicesNo ratings yet

- LTA Claim Form - Period 1.jan.2006 To 31.dec.2009Document1 pageLTA Claim Form - Period 1.jan.2006 To 31.dec.2009Paymaster Services100% (1)

- Only Tax Slabs - Fy 2017-18Document2 pagesOnly Tax Slabs - Fy 2017-18Paymaster ServicesNo ratings yet

- Marginal Relief To Income Tax - Fy 2016-17Document2,489 pagesMarginal Relief To Income Tax - Fy 2016-17Paymaster ServicesNo ratings yet

- Tax Proof Summary Form For Tax Relief - Ye 31.03.2017Document1 pageTax Proof Summary Form For Tax Relief - Ye 31.03.2017Paymaster ServicesNo ratings yet

- Form 16 & Form 12ba Details - F.Y. Ending 31.03.2017Document3 pagesForm 16 & Form 12ba Details - F.Y. Ending 31.03.2017Paymaster ServicesNo ratings yet

- Tax Declaration Form For Tax Relief - Ye 31.03.2017Document1 pageTax Declaration Form For Tax Relief - Ye 31.03.2017Paymaster ServicesNo ratings yet

- Perquisite Details - Y.E. 2017Document4 pagesPerquisite Details - Y.E. 2017Paymaster ServicesNo ratings yet

- Gratuity Types & Tax ExemptionsDocument1 pageGratuity Types & Tax ExemptionsPaymaster Services100% (1)

- LTA DeclarationDocument1 pageLTA DeclarationPaymaster ServicesNo ratings yet

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Document1 pageTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesNo ratings yet

- Proof of Investment - Y.E. 31.03.2011Document5 pagesProof of Investment - Y.E. 31.03.2011Paymaster ServicesNo ratings yet

- Tax Declaration Form - Ye. 31.03.2014 - AllDocument1 pageTax Declaration Form - Ye. 31.03.2014 - AllPaymaster ServicesNo ratings yet

- ITR-3 For Assessment Year 2011-12, Financial Year 2010-11Document7 pagesITR-3 For Assessment Year 2011-12, Financial Year 2010-11Paymaster ServicesNo ratings yet

- Key Features of Finance Budget For Financial Year - 2012-13Document18 pagesKey Features of Finance Budget For Financial Year - 2012-13Paymaster ServicesNo ratings yet

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Document1 pageTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesNo ratings yet

- ITR 1 Sahaj For Assesment Year 2011-12, Financial Year 2010-11Document6 pagesITR 1 Sahaj For Assesment Year 2011-12, Financial Year 2010-11Paymaster ServicesNo ratings yet

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Document1 pageTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesNo ratings yet

- Key Features of Indian Union Budget FY - 2011-12Document23 pagesKey Features of Indian Union Budget FY - 2011-12Paymaster ServicesNo ratings yet

- Budget Speech by Finance Minister On 28 February, 2011Document35 pagesBudget Speech by Finance Minister On 28 February, 2011Paymaster ServicesNo ratings yet

- ITR - 2 For Assessment Year 2011-12, Financial Year 2010-11Document8 pagesITR - 2 For Assessment Year 2011-12, Financial Year 2010-11Paymaster ServicesNo ratings yet

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Document1 pageTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesNo ratings yet

- Employee State Insurance - ESICDocument3 pagesEmployee State Insurance - ESICPaymaster ServicesNo ratings yet

- Taxability of GiftsDocument6 pagesTaxability of GiftsPaymaster ServicesNo ratings yet

- 2013 P T D 1420Document6 pages2013 P T D 1420haseeb AhsanNo ratings yet

- Fast Services Payroll SlipDocument1 pageFast Services Payroll SlipLeidegay AnicoyNo ratings yet

- Sales ProcessesDocument16 pagesSales ProcessespraveerNo ratings yet

- Core Savings Account - IDBIDocument2 pagesCore Savings Account - IDBIprasanNo ratings yet

- Statement: Select AccountDocument22 pagesStatement: Select Accountmike brienNo ratings yet

- Quiz 001 - Attempt Review 1Document6 pagesQuiz 001 - Attempt Review 1christoper laurenteNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherPriyanka DevghareNo ratings yet

- Comparison of Post Office Savings SchemesDocument1 pageComparison of Post Office Savings SchemeskabitabalaNo ratings yet

- Jurisdiction DetailsDocument7 pagesJurisdiction DetailstvsshindeNo ratings yet

- DELSA account statementDocument1 pageDELSA account statementraymon generNo ratings yet

- TransNum Nov 18 223225Document1 pageTransNum Nov 18 223225alpha_numericNo ratings yet

- BarksDocument45 pagesBarksKaye Alyssa EnriquezNo ratings yet

- Calculating Deferred Tax for Permai BhdDocument3 pagesCalculating Deferred Tax for Permai Bhddini sofiaNo ratings yet

- Fair Price Gold CalculatorDocument8 pagesFair Price Gold CalculatorSacred MindNo ratings yet

- Sargodha Spices Accounts DetailDocument3 pagesSargodha Spices Accounts Detailwasim khanNo ratings yet

- Kashato Practice Set - 2020-10thedDocument84 pagesKashato Practice Set - 2020-10thedMary Jhiezael Pascual83% (12)

- TRAIN Law Overview and OutlookDocument4 pagesTRAIN Law Overview and OutlookAdam Ross Toledo BrionesNo ratings yet

- Ajio 1706695254075Document1 pageAjio 1706695254075shaelkmr550No ratings yet

- Suffolk County Democratic Committee - 11-Day Pre-GeneralDocument47 pagesSuffolk County Democratic Committee - 11-Day Pre-GeneralRiverheadLOCALNo ratings yet

- Payslip TemplateDocument1 pagePayslip Templatejoshua galuraNo ratings yet

- A Private Limited Company Advantages and Disadvantages Compared With Retaining Sole Trader Status Extends Beyond Purely Tax AdvantagesDocument4 pagesA Private Limited Company Advantages and Disadvantages Compared With Retaining Sole Trader Status Extends Beyond Purely Tax AdvantagesRoget WilliamsNo ratings yet

- Tax Invoice: Mcconnell DowellDocument1 pageTax Invoice: Mcconnell DowellAndy HeaterNo ratings yet

- Bank Reconciliation StatementDocument6 pagesBank Reconciliation StatementHarshitaNo ratings yet

- Sample of Contract With Direct Sellers PDFDocument2 pagesSample of Contract With Direct Sellers PDFPankaj PandeyNo ratings yet

- REVOKING REVENUE REGULATIONS REINSTATING PRIOR PROVISIONSDocument2 pagesREVOKING REVENUE REGULATIONS REINSTATING PRIOR PROVISIONSAndrew Benedict PardilloNo ratings yet

- Telephone September BillDocument1 pageTelephone September BillMeghana ManjunathNo ratings yet

- Order Invoice Details ViewDocument2 pagesOrder Invoice Details ViewanilpkNo ratings yet

- Passenger Detail: Rajasthan State Road Transport CorporationDocument2 pagesPassenger Detail: Rajasthan State Road Transport CorporationDheeraj Jha0% (1)

- Internet JuneDocument1 pageInternet JuneUgesh ReddyNo ratings yet

- In GMSDocument1 pageIn GMStarun.kushNo ratings yet