Professional Documents

Culture Documents

Anx 8

Uploaded by

mdsarwaralamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anx 8

Uploaded by

mdsarwaralamCopyright:

Available Formats

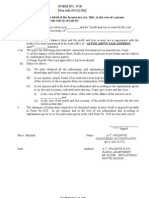

Annexure 8

Original

Duplicate

Triplicate

Personal Ledger Account

For the month of200.

Commissionerate:

Division:

Range:

Name of the factory

With address and

Registration

EC Code No.

Date

and

SL.No.

of

entry

Particulars of

credit/debit

Document

--------------

Description of

documents

with name of

treasury where

necessary

No.

Date

Central

excise

Tariff

Sub-

headin

g

number

EC

code

of the

buyer

Basic

--------

Credit

Excise

--------

Debit

Duty

-------

Balance

--------

Credit

-------

Debit

---------

Balanc

e

Cess on Commodities] Miscellaneous

Credit Debit Balanc

e

Credit Debit Balanc

e

Credit Debit Balanc

e

Credit Debit Balanc

e

Signature of

he Assessee

or his agent

12

Notes: 1. This account should be prepared in triplicate using indelible pencil and double sided carbon. The original and

duplicate copies should be detached and sent to the Central Excise Officer- Incharge alongwith the R.T. 12

Return.

2. Columns 7 to 9 of the Form have been left blank to be used for showing the appropriate type of duty and the

duty credited and debited there against.

3.. No. and date of invoice against which debit is raised in this account should be shown in Col. 3.

4. Where single invoice covers goods falling under different sub-heading, separate entries shall be made for each

of such sub-heading.

5. Where consolidated debit entry is permitted to be made at the end of the day, separate entries shall be made

for each sub-heading.

6. Assessee may exclude from their Accounts those of the Columns 7 to 11 which are inapplicable.

7.The closing balance in the last months PLA should be brought and shown in the column for credit against the

entry balance BF. Which should be verified by the C.A.O. with the closing balance in the last months PLA.

You might also like

- CPWA Cash Book FormsDocument168 pagesCPWA Cash Book Formsovishalz100% (1)

- Central Public Works Account CODE FORMSDocument243 pagesCentral Public Works Account CODE FORMSbharanivldv978% (23)

- South Pars Gas Field Development Phases 15&16 InvoicingDocument34 pagesSouth Pars Gas Field Development Phases 15&16 Invoicingpeter2mNo ratings yet

- Personal Ledger AccountDocument2 pagesPersonal Ledger Accountvishnu0072009No ratings yet

- Book of Forms CPWADocument168 pagesBook of Forms CPWAkhan_sadi0% (2)

- Journal Entry Voucher (Jev) : Liquidation Report (LR)Document4 pagesJournal Entry Voucher (Jev) : Liquidation Report (LR)Mariechi BinuyaNo ratings yet

- Factory cash drill procedureDocument37 pagesFactory cash drill procedureSaloni GautamNo ratings yet

- Imprest Cash Account FormDocument5 pagesImprest Cash Account FormrkthbdNo ratings yet

- GL Instructions for Accounting TransactionsDocument1 pageGL Instructions for Accounting TransactionsPayie PerezNo ratings yet

- Saral: ITS-2D Form No. 2DDocument2 pagesSaral: ITS-2D Form No. 2DPrasanta KarmakarNo ratings yet

- Cash Book RulesDocument33 pagesCash Book RulesNarasimha Murthy InampudiNo ratings yet

- Manual of Standing Orders: (Accounts & Entitlements) Volume-IDocument18 pagesManual of Standing Orders: (Accounts & Entitlements) Volume-IAtul SushantNo ratings yet

- RCD Report InstructionsDocument2 pagesRCD Report Instructionsthessa_starNo ratings yet

- 3CD Ready ReckonerDocument39 pages3CD Ready ReckonerTaxation TaxNo ratings yet

- Sales Manual PartII PDFDocument100 pagesSales Manual PartII PDFRohit VermaNo ratings yet

- Check Disbursement Journal InstructionsDocument1 pageCheck Disbursement Journal Instructionsabbey89No ratings yet

- FIU-IND CTR ReportDocument3 pagesFIU-IND CTR ReportRamprasad AkshantulaNo ratings yet

- Cpwa CodeDocument4 pagesCpwa CodeVIVEKNo ratings yet

- Law Society of Saskatchewan: Form Ta-5R Accountant'S Report (Random)Document8 pagesLaw Society of Saskatchewan: Form Ta-5R Accountant'S Report (Random)dsffsdfsdfNo ratings yet

- 215f3 Index of Statements DocumentsDocument6 pages215f3 Index of Statements DocumentsIngole j pNo ratings yet

- Individual or HUF TMemDocument14 pagesIndividual or HUF TMemVasoya ManojNo ratings yet

- "Third Schedule Form A-Annual Return of Company Having Share CapitalDocument3 pages"Third Schedule Form A-Annual Return of Company Having Share CapitalWaseem Raza NumNo ratings yet

- Appendix 3 - Instructions - CDJDocument1 pageAppendix 3 - Instructions - CDJPayie PerezNo ratings yet

- Procedure For Lodgment of Claims Under para 1-4 (A) and 1-4 (D) of Textile Division's Notification Duty Drawback Taxes Order 2017-18Document8 pagesProcedure For Lodgment of Claims Under para 1-4 (A) and 1-4 (D) of Textile Division's Notification Duty Drawback Taxes Order 2017-18Saad UllahNo ratings yet

- D1 Explanatory NotesDocument11 pagesD1 Explanatory NotesnagallanraoNo ratings yet

- GSRG 405 PT 1Document17 pagesGSRG 405 PT 1LaLa BanksNo ratings yet

- S.No Particulars: Client Name: Period EndedDocument19 pagesS.No Particulars: Client Name: Period EndedNeelam GoelNo ratings yet

- Appendix 10.1 Certificate of Inward Remittance (Cir) of Foreign Exchange No. Ccyy-Nnnnnn-BbbbbbbbbbbDocument4 pagesAppendix 10.1 Certificate of Inward Remittance (Cir) of Foreign Exchange No. Ccyy-Nnnnnn-BbbbbbbbbbbRalph AcobaNo ratings yet

- Fondo de Energia Social - Foes-Usuarios de Zonas Especiales: Fondo - Solidaridad@minminas - Gov.coDocument7 pagesFondo de Energia Social - Foes-Usuarios de Zonas Especiales: Fondo - Solidaridad@minminas - Gov.coPatrick Zevallos RodriguezNo ratings yet

- Guidelines Stock Audit - Drawing PowerDocument4 pagesGuidelines Stock Audit - Drawing PowerHimanshu Aggarwal50% (4)

- Sales Tax Special Procedure (Withholding) Rules, PDFDocument6 pagesSales Tax Special Procedure (Withholding) Rules, PDFAli MinhasNo ratings yet

- Bill FORM Blank Page No. 1Document2 pagesBill FORM Blank Page No. 1gagajain67% (6)

- Monthly Statement ConsultantDocument2 pagesMonthly Statement ConsultantPRBFRMP DWRINo ratings yet

- Monthly Statement of Consultant Inputs and Payment ClaimDocument2 pagesMonthly Statement of Consultant Inputs and Payment ClaimCliantha AimeeNo ratings yet

- Lddap AdaDocument1 pageLddap AdasedanzamNo ratings yet

- Form 3cb ExcelDocument4 pagesForm 3cb ExcelRashmeet Kaur BangaNo ratings yet

- Advice To Debit Account Disbursements Journal (Adadj) : InstructionsDocument2 pagesAdvice To Debit Account Disbursements Journal (Adadj) : Instructionsabbey89No ratings yet

- Tax Audit - Sec.44abDocument82 pagesTax Audit - Sec.44absathya300No ratings yet

- Guidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesDocument2 pagesGuidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesKarlNo ratings yet

- Form No. 3Cb (See Rule 6G (1) (B) )Document12 pagesForm No. 3Cb (See Rule 6G (1) (B) )Jay MogradiaNo ratings yet

- Closing Guidelines 2023-24 (1)Document68 pagesClosing Guidelines 2023-24 (1)Nikhil Kharat NiCkNo ratings yet

- Manage Cash Receipts Journal with CRJ InstructionsDocument1 pageManage Cash Receipts Journal with CRJ InstructionsPayie PerezNo ratings yet

- AY 2005-06 Saral Form 2DDocument2 pagesAY 2005-06 Saral Form 2DVinod VarmaNo ratings yet

- How to file Form 20B annual returnDocument7 pagesHow to file Form 20B annual returnmanish dhakarNo ratings yet

- Aptc Form 56Document3 pagesAptc Form 56mrraee472960% (5)

- Neral LedgerDocument2 pagesNeral Ledgerrhuejanem21No ratings yet

- BADVAC3X MOD 5 Financial StatementsDocument9 pagesBADVAC3X MOD 5 Financial StatementsEouj Oliver DonatoNo ratings yet

- Multiple Bank Account MandateDocument2 pagesMultiple Bank Account Mandateanaga1982No ratings yet

- SOP Accounts ReceivablesDocument5 pagesSOP Accounts ReceivablesOsmanMehmoodNo ratings yet

- Pay utility bills for power, gas and water onlineDocument13 pagesPay utility bills for power, gas and water onlineshahid2opuNo ratings yet

- Income-Tax Rules, 1962: Form No.29BDocument5 pagesIncome-Tax Rules, 1962: Form No.29Bjack sonNo ratings yet

- 04 Accounting For Service BusinessDocument64 pages04 Accounting For Service BusinessJean RomarNo ratings yet

- ReconcilationDocument19 pagesReconcilationEssImranNo ratings yet

- Tax Audit Plan and ProgrammeDocument39 pagesTax Audit Plan and Programmepradhan13No ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- 2 Service TaxDocument10 pages2 Service TaxArchana ThirunagariNo ratings yet

- 14 Journal Entry Guide 330491326886752Document178 pages14 Journal Entry Guide 330491326886752Sandeep SinghNo ratings yet

- ACA CMA MaCpping RevisedDocument3 pagesACA CMA MaCpping RevisedDebashis1982No ratings yet

- Cost ElementsDocument30 pagesCost ElementsDebashis1982No ratings yet

- Express Entry System: Information For Skilled Foreign WorkersDocument16 pagesExpress Entry System: Information For Skilled Foreign WorkersTitoFernandezNo ratings yet

- T I C A I: HE Nstitute of Hartered Ccountants of NdiaDocument5 pagesT I C A I: HE Nstitute of Hartered Ccountants of NdiaAnkit SahaNo ratings yet

- 8364-1 Lesson 03 PDFDocument30 pages8364-1 Lesson 03 PDFdb_chakrabartyNo ratings yet

- Cost CenterDocument6 pagesCost CenterDebashis1982No ratings yet

- Final Accounts ProblemDocument21 pagesFinal Accounts Problemkramit1680% (10)

- AdjustmentsDocument23 pagesAdjustmentsRahul KhandelwalNo ratings yet

- Accounts Payable JournalDocument16 pagesAccounts Payable JournalDebashis1982No ratings yet

- Accounting For Standard and Extended WarrantiesDocument3 pagesAccounting For Standard and Extended WarrantiesDebashis1982No ratings yet

- ASAP PhasesDocument26 pagesASAP PhasesDebashis1982No ratings yet