Professional Documents

Culture Documents

For Immediate Release November 12, 2009

Uploaded by

api-25887578Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

For Immediate Release November 12, 2009

Uploaded by

api-25887578Copyright:

Available Formats

For Immediate Release CONTACT: Office of Financing

November 12, 2009 202-504-3550

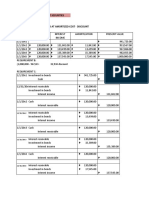

TREASURY AUCTION RESULTS

Term and Type of Security 30-Year Bond

CUSIP Number 912810QD3

Series Bonds of November 2039

Interest Rate 4-3/8%

High Yield1 4.469%

Allotted at High 18.01%

Price 98.454984

Accrued Interest per $1,000 $0.12086

Median Yield2 4.388%

Low Yield3 4.284%

Issue Date November 16, 2009

Maturity Date November 15, 2039

Original Issue Date November 16, 2009

Dated Date November 15, 2009

Tendered Accepted

Competitive $36,122,450,000 $15,972,237,100

Noncompetitive $27,765,700 $27,765,700

FIMA (Noncompetitive) $0 $0

Subtotal4 $36,150,215,700 $16,000,002,8005

SOMA $1,989,301,300 $1,989,301,300

Total $38,139,517,000 $17,989,304,100

Tendered Accepted

Primary Dealer6 $24,912,350,000 $7,009,957,000

Direct Bidder7 $2,475,000,000 $1,932,180,100

Indirect Bidder8 $8,735,100,000 $7,030,100,000

Total Competitive $36,122,450,000 $15,972,237,100

1 5

All tenders at lower yields were accepted in full. Awards to combined Treasury Direct systems = $6,709,100.

2 6

50% of the amount of accepted competitive tenders was tendered at or below Primary dealers as submitters bidding for their own house accounts.

that yield. 7

Non-Primary dealer submitters bidding for their own house accounts.

3 8

5% of the amount of accepted competitive tenders was tendered at or below Customers placing competitive bids through a direct submitter, including

that yield. Foreign and International Monetary Authorities placing bids through the

4 Federal Reserve Bank of New York.

Bid-to-Cover Ratio: $36,150,215,700/$16,000,002,800 = 2.26

You might also like

- For Immediate Release January 14, 2010Document1 pageFor Immediate Release January 14, 2010api-25887578No ratings yet

- For Immediate Release October 08, 2009Document1 pageFor Immediate Release October 08, 2009api-25887578No ratings yet

- 10 YrDocument1 page10 Yrapi-25887578No ratings yet

- For Immediate Release February 10, 2010Document1 pageFor Immediate Release February 10, 2010qtipxNo ratings yet

- 10 YrDocument1 page10 Yrapi-25887578No ratings yet

- For Immediate Release September 23, 2009Document1 pageFor Immediate Release September 23, 2009api-25887578No ratings yet

- For Immediate Release December 28, 2009Document1 pageFor Immediate Release December 28, 2009api-25887578No ratings yet

- 5 YrDocument1 page5 Yrapi-25887578No ratings yet

- For Immediate Release September 22, 2009Document1 pageFor Immediate Release September 22, 2009api-25887578No ratings yet

- 10 YrDocument1 page10 Yrapi-25887578No ratings yet

- 2 YrDocument1 page2 Yrapi-25887578No ratings yet

- 2 YrDocument1 page2 Yrapi-25887578100% (2)

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered AcceptedJose Campos100% (1)

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered AcceptedJose CamposNo ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered AcceptedJose CamposNo ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Public Debt NewsDocument1 pagePublic Debt NewsTimNo ratings yet

- Yields and ReturnsDocument1 pageYields and ReturnsVISHAL PATILNo ratings yet

- Prelim Exam-Boticario D. (AST)Document4 pagesPrelim Exam-Boticario D. (AST)Dominic E. BoticarioNo ratings yet

- Caso 2 Modelo RentabilidadDocument8 pagesCaso 2 Modelo RentabilidadCamilaNo ratings yet

- Nzombo, Mambo & Pima Partners: Trading Profit and Loss Apprpriation AccountsDocument4 pagesNzombo, Mambo & Pima Partners: Trading Profit and Loss Apprpriation Accountskjoel.ngugiNo ratings yet

- ACCT336 Solved Exercises - Chapters 14 and 15Document5 pagesACCT336 Solved Exercises - Chapters 14 and 15kareemrawwadNo ratings yet

- Latihan Soal Asis Akm Ii - Sekuritas DiplutifDocument6 pagesLatihan Soal Asis Akm Ii - Sekuritas DiplutifRADEN DIPONEGORONo ratings yet

- Lease Option Offers - V1Document8 pagesLease Option Offers - V1John TurnerNo ratings yet

- AccountingDocument13 pagesAccountingkjoel.ngugiNo ratings yet

- ADF Managerial Project - ReviewDocument4 pagesADF Managerial Project - ReviewLilly McAveeneyNo ratings yet

- 3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutDocument1 page3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutJuan bastoNo ratings yet

- Chap 10Document5 pagesChap 10Shiela DimaculanganNo ratings yet

- Mediterranean Villas Model HomesDocument2 pagesMediterranean Villas Model HomesestatemanilaNo ratings yet

- Cherryl Febryan Christyanto - 202030225Document6 pagesCherryl Febryan Christyanto - 202030225Cherryl Febryan ChristyantoNo ratings yet

- Company Profile: Marketing StrategyDocument5 pagesCompany Profile: Marketing StrategyMark PachuchuNo ratings yet

- DCF Modeling Examplye Deal Gallagher MohanDocument16 pagesDCF Modeling Examplye Deal Gallagher Mohansuraj k33% (3)

- Solutions For Notes and Loans ReceivableDocument4 pagesSolutions For Notes and Loans ReceivableKenaniah SanchezNo ratings yet

- Btax - Plq1-Answer KeyDocument6 pagesBtax - Plq1-Answer KeyJohn Victor Mancilla MonzonNo ratings yet

- Prelim SolutionDocument5 pagesPrelim SolutionMst TeriousNo ratings yet

- Rent vs. Buy Calculation: Inflation RateDocument3 pagesRent vs. Buy Calculation: Inflation RateOthman Alaoui Mdaghri BenNo ratings yet

- Ch4 Spreadsheets Update 2 13Document19 pagesCh4 Spreadsheets Update 2 13Toàn ĐìnhNo ratings yet

- Commission Rates For Real Estate Agents: Nivashinee Jayakumar CommissionsDocument1 pageCommission Rates For Real Estate Agents: Nivashinee Jayakumar Commissionsmkk valashNo ratings yet

- Myka Eleonor Estole Quiz 5Document8 pagesMyka Eleonor Estole Quiz 5Julienne UntalascoNo ratings yet

- A.cre Hotel Acquisition Model Basic v1.11 c0gtm7Document28 pagesA.cre Hotel Acquisition Model Basic v1.11 c0gtm7Patrick ChibabulaNo ratings yet

- Ditta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Document36 pagesDitta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Ummaya MalikNo ratings yet

- Ans 4Document6 pagesAns 4Kenneth Jules GarolNo ratings yet

- OM 650 SW 1 10pagesDocument10 pagesOM 650 SW 1 10pagesjuan ospinaNo ratings yet

- Financial Study FormatDocument29 pagesFinancial Study FormatOrcajada, Mariz Allysa S.No ratings yet

- 110 B - Studio - 30.29 SQM - 2702 - BankDocument1 page110 B - Studio - 30.29 SQM - 2702 - BankNiño Marco LeeNo ratings yet

- Thq002-Inst. Sales PDFDocument2 pagesThq002-Inst. Sales PDFAndrea AtendidoNo ratings yet

- Fabozzi CH 03 Measuring Yield HW AnswersDocument5 pagesFabozzi CH 03 Measuring Yield HW AnswershardiNo ratings yet

- 4-Year Journey Model PortfolioDocument1 page4-Year Journey Model PortfolioJamesNo ratings yet

- Simulasi PT Barito Putera Hino 6.4 Ps Dump 11032019Document1 pageSimulasi PT Barito Putera Hino 6.4 Ps Dump 11032019bintang_arifNo ratings yet

- Finm1416 Individual Compenent 4Document5 pagesFinm1416 Individual Compenent 4Ma HiNo ratings yet

- TheReserve JeffCrossing BR OM Feb24Document36 pagesTheReserve JeffCrossing BR OM Feb24samobtiaNo ratings yet

- Property Investor CondoDocument1 pageProperty Investor CondoNeedsterNo ratings yet

- Primus AutomationDocument23 pagesPrimus AutomationhimanshusangaNo ratings yet

- PQ3 BondsDocument2 pagesPQ3 BondsElla Mae MagbatoNo ratings yet

- Spartan Inc - German MotorsDocument4 pagesSpartan Inc - German MotorsFavian Maraville YadisaputraNo ratings yet

- Equipment Purchase Costs V2 07112014Document81 pagesEquipment Purchase Costs V2 07112014Tom GoodladNo ratings yet

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsFrom EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsNo ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument1 pageJoint Release U.S. Department of Housing and Urban Developmentapi-25887578No ratings yet

- December 2013 Construction at $930.5 Billion Annual RateDocument5 pagesDecember 2013 Construction at $930.5 Billion Annual Rateapi-25887578No ratings yet

- Roductivity and OstsDocument12 pagesRoductivity and Ostsapi-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument2 pagesJoint Release U.S. Department of Housing and Urban Developmentapi-25887578No ratings yet

- Full Report On Manufacturers' Shipments, Inventories and Orders September 2012Document9 pagesFull Report On Manufacturers' Shipments, Inventories and Orders September 2012api-25887578No ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument1 pageJoint Release U.S. Department of Housing and Urban Developmentapi-25887578No ratings yet

- Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, January 2012Document5 pagesEconomic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, January 2012api-25887578No ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument4 pagesJoint Release U.S. Department of Housing and Urban Developmentapi-25887578No ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument1 pageJoint Release U.S. Department of Housing and Urban Developmentapi-25887578No ratings yet

- January 2012 Construction at $827.0 Billion Annual RateDocument5 pagesJanuary 2012 Construction at $827.0 Billion Annual Rateapi-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- TreaspurchDocument2 pagesTreaspurchapi-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Wednesday, August 24, 2011, at 8:30 A.M. EdtDocument4 pagesWednesday, August 24, 2011, at 8:30 A.M. Edtapi-25887578No ratings yet

- Minutes of The Federal Open Market Committee August 9, 2011Document10 pagesMinutes of The Federal Open Market Committee August 9, 2011api-25887578No ratings yet

- News Release: Personal Income and Outlays: January 2011Document13 pagesNews Release: Personal Income and Outlays: January 2011api-25887578No ratings yet

- News Release: Personal Income and Outlays: December 2010Document12 pagesNews Release: Personal Income and Outlays: December 2010api-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Beginning of The Bias-Motivated Crimes UnitDocument4 pagesBeginning of The Bias-Motivated Crimes Unitapi-25887578No ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument6 pagesJoint Release U.S. Department of Housing and Urban Developmentapi-25887578No ratings yet

- Current Economic Conditions: Summary of Commentary OnDocument47 pagesCurrent Economic Conditions: Summary of Commentary Onapi-25887578No ratings yet

- Exchange Rate DeterminationDocument12 pagesExchange Rate DeterminationxpshuvoNo ratings yet

- Credit Creation Theory: The Concept of Money & How It Is CirculatedDocument2 pagesCredit Creation Theory: The Concept of Money & How It Is CirculatedMoud KhalfaniNo ratings yet

- Harp Du Refi Plus FaqsDocument32 pagesHarp Du Refi Plus FaqscrennydaneNo ratings yet

- Fin1 Eq2 BsatDocument1 pageFin1 Eq2 BsatYu BabylanNo ratings yet

- Statement - 25197479 - EUR - 2024 02 10 - 2024 03 11 1 PDFDocument5 pagesStatement - 25197479 - EUR - 2024 02 10 - 2024 03 11 1 PDFGabriel BuitiNo ratings yet

- Chapter 14Document29 pagesChapter 14kfeng561No ratings yet

- What Is The Principal Difference Between International Banking and Global BankingDocument1 pageWhat Is The Principal Difference Between International Banking and Global BankingBat OrgilNo ratings yet

- Paper Presentation EcbDocument3 pagesPaper Presentation EcberikaNo ratings yet

- Philippine Financial System - Bangko Sentral NG PilipinasDocument2 pagesPhilippine Financial System - Bangko Sentral NG PilipinasZeddy AvisoNo ratings yet

- 1939 - A Program For Monetary ReformDocument43 pages1939 - A Program For Monetary Reformcraggy_1No ratings yet

- Reduce EMI or TenureDocument22 pagesReduce EMI or TenureWhatsapp stuffNo ratings yet

- Chapter 8 SolucionesDocument6 pagesChapter 8 SolucionesIvetteFabRuizNo ratings yet

- Quiz 514Document17 pagesQuiz 514Haris NoonNo ratings yet

- Module 27 Practice Set 1Document5 pagesModule 27 Practice Set 1Jacqueline LiuNo ratings yet

- Are You Aware of Your Mortgage Reinstatement Letter?Document2 pagesAre You Aware of Your Mortgage Reinstatement Letter?PersonalStatementWriNo ratings yet

- Ch-30 Money Growth & InflationDocument37 pagesCh-30 Money Growth & InflationSnehal BhattNo ratings yet

- Schedule of Charges and Interest Rates PDFDocument5 pagesSchedule of Charges and Interest Rates PDFAjju PodilaNo ratings yet

- MCQ InflationDocument6 pagesMCQ Inflationashsalvi100% (4)

- Class A - Sesi 2 - Presenter 4 - Analysis of Umer Chapra PDFDocument12 pagesClass A - Sesi 2 - Presenter 4 - Analysis of Umer Chapra PDFputri asrinaNo ratings yet

- Chapter 3 (Unit 1)Document21 pagesChapter 3 (Unit 1)GiriNo ratings yet

- Understanding Inflation vs. DeflationDocument6 pagesUnderstanding Inflation vs. DeflationBrilliantNo ratings yet

- Functions of RBI (Reserve Bank of India)Document14 pagesFunctions of RBI (Reserve Bank of India)Veeral ShahNo ratings yet

- RBI Cuts Key Interest RatesDocument5 pagesRBI Cuts Key Interest RatesJagmohan SinghNo ratings yet

- Managing InflationDocument4 pagesManaging Inflationpraveen sagarNo ratings yet

- Macroeconomics Research Paper To Topic: " "Document5 pagesMacroeconomics Research Paper To Topic: " "Evghenia MartiniucNo ratings yet

- A Engr Econ 14Document10 pagesA Engr Econ 14Raunak AnandNo ratings yet

- AME Unit 3Document43 pagesAME Unit 3Soe Group 1No ratings yet

- The Determination of Exchange RatesDocument20 pagesThe Determination of Exchange RatesSauryadeep DwivediNo ratings yet

- IE - Chapter 7 (Final)Document52 pagesIE - Chapter 7 (Final)Linh ĐàmNo ratings yet

- Central Bank of Iraq: Press CommuniquéDocument9 pagesCentral Bank of Iraq: Press CommuniquéLawa samanNo ratings yet