Professional Documents

Culture Documents

F 9

Uploaded by

billyryan1100%(2)100% found this document useful (2 votes)

1K views32 pagesf9

Original Title

f9

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentf9

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

100%(2)100% found this document useful (2 votes)

1K views32 pagesF 9

Uploaded by

billyryan1f9

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 32

1

www.accaapc.com f9 final live online revision

ACCA F9 Financial Management

June2014

Live Online 2 Days Revision Note

Tutor: Steve Harris

2

www.accaapc.com f9 final live online revision

Lesco Group Limited, April 2015

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or

transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or

otherwise, without the prior written permission of Lesco Group Limited.

3

www.accaapc.com f9 final live online revision

Dear students:

Your ACCA F9 examiner would like to mix many topics into one

single question.

Our task in these 2days live revision is to cover the whole

syllabus by directly attempting as many past exam questions as

we can.

You may shout at the screen, OMG!! These 2 days would be the

tragedy of my life!! But don't worry I will make these questions

interesting because they are practical.

If you can do the following big questions YOU CAN BE A PRICE

WINNER because the following questions has covered every

aspects of the F9 exam you may see in the coming sitting and the

exam answer will be almost the same!

Print this out first before you attend our live revision.

Best of luck

Steve

4

www.accaapc.com f9 final live online revision

Plan

Topics:

Day1: investing + financing decision

Day2: working capital+business valuation+risk management

5

www.accaapc.com f9 final live online revision

Topic: investment appraisal

Tips:

Your examiner Tony will always examine this area in a very constant way.

So I decide to do these BIG3 questions in the live revision day1.

These BIG3 questions have mixed all of the possible areas that your examiner is going

to examine and if you can do these 3 questions well then no reasons to fail any

investment appraisal questions.

6

www.accaapc.com f9 final live online revision

Big investment questions 1

June2011 Q1 modified

BRT Co has developed a new confectionery line that can be sold for $500 per box and that

is expected to have continuing popularity for many years. The Finance Director has

proposed that investment in the new product should be evaluated over a four-year

time-horizon, even though sales would continue after the fourth year, on the grounds that

cash flows after four years are too uncertain to be included in the evaluation. The variable

and fixed costs (both in current price terms) will depend on sales volume, as follows.

Sales volume (boxes) less than 1 million 119 million 229 million 339 million

Variable cost ($ per box) 280 3.00 3.00 3.05

Total fixed costs ($) 1million 1.8million 2.8million 3.8million

Forecast sales volumes are as follows.

Year 1 2 3 4

Demand (boxes) 0.7million 1.6million 2.1million 3million

The production equipment for the new confectionery line would cost $2 million and an

additional initial investment of $750,000 would be needed for working capital. Capital

allowances (tax-allowable depreciation) on a 25% reducing balance basis could be claimed

on the cost of equipment. Profit tax of 30% per year will be payable one year in arrears. A

balancing allowance would be claimed in the fourth year of operation.

The average general level of inflation is expected to be 3% per year and selling price,

variable costs, fixed costs and working capital would all experience inflation of this level.

BRT Co uses a nominal after-tax cost of capital of 12% to appraise new investment

projects.

Required:

(a) Assuming that production only lasts for four years, calculate the net present

value of investing in the new product using a nominal terms approach and advise

on its financial acceptability (work to the nearest $1,000). (13 marks)

(b) Comment briefly on the proposal to use a four-year time horizon, and

calculate and discuss a value that could be placed on after-tax cash flows arising

after the fourth year of operation, using a perpetuity approach.

Assume, for this part of the question only, that before-tax cash flows and profit

tax are constant from year five onwards, and that capital allowances and working

capital can be ignored. (5 marks)

(c) Discuss THREE ways of incorporating risk into the investment appraisal

process. (7 marks)

7

www.accaapc.com f9 final live online revision

(d) Discuss how the net present value method of investment appraisal

contributes towards the objective of maximising the wealth of

shareholders(june2008 Q4). (5 marks)

(e) Discuss the problems faced when undertaking investment appraisal in the

following areas and comment on how these problems can be overcome:

(i) assets with replacement cycles of different lengths;

(ii) an investment project has several internal rates of return;

(iii) the business risk of an investment project is significantly different from

the business risk of current operations. (8 marks) (June2010 Q3)

(DEC2011 Q1)

Warden Co plans to buy a new machine. The cost of the machine, payable immediately, is

$800,000 and the machine has an expected life of five years. Additional investment in

working capital of $90,000 will be required at the start of the first year of operation. At the

end of five years, the machine will be sold for scrap, with the scrap value expected to be 5%

of the initial purchase cost of the machine. The machine will not be replaced and NPV of

project is $103,000 and internal rate of return calculated is 16%.

Production and sales from the new machine are expected to be 100,000 units per year.

Each unit can be sold for $16 per unit and will incur variable costs of $11 per unit.

Incremental fixed costs arising from the operation of the machine will be $160,000 per

year.

Warden Co has an after-tax cost of capital of 11% which it uses as a discount rate in

investment appraisal. The company pays profit tax one year in arrears at an annual rate of

30% per year. Capital allowances and inflation should be ignored.

(f) (i) Explain briefly the meaning of the term sensitivity analysis in the context

of investment appraisal;

(1 mark)

(ii) Calculate the sensitivity of the investment in the new machine to a change

in selling price and to a change in discount rate, and comment on your

findings.

(6 marks)

(g) Discuss the nature and causes of the problem of capital rationing in the

context of investment appraisal, and explain how this problem can be

overcome in reaching the optimal investment decision for a company.

(7 marks)

8

www.accaapc.com f9 final live online revision

Big investment question2

DEC2009 Q1 modified

ASOP Co is considering an investment in new technology that will reduce operating costs

through increasing energy efficiency and decreasing pollution. The new technology will cost

$1 million and have a four-year life, at the end of which it will have a scrap value of

$100,000.

A licence fee of $104,000 is payable at the end of the first year. This licence fee will increase

by 4% per year in each subsequent year.

The new technology is expected to reduce operating costs by $580 per unit in current price

terms. This reduction in operating costs is before taking account of expected inflation of 5%

per year.

Forecast production volumes over the life of the new technology are expected to be as

follows:

Year 1 2 3 4

Production

(units per year)

60, 000 75, 000 95, 000 80, 000

If ASOP Co bought the new technology, it would finance the purchase through a four-year

loan paying interest at an annual before-tax rate of 86% per year.

Alternatively, ASOP Co could lease the new technology. The company would pay four

annual lease rentals of $380,000 per year, payable in advance at the start of each year. The

annual lease rentals include the cost of the licence fee.

If ASOP Co buys the new technology it can claim capital allowances on the investment on

a 25% reducing balance basis. The company pays taxation one year in arrears at an annual

rate of 30%. ASOP Co has an after-tax weighted average cost of capital of 11% per year.

(a) Based on financing cash flows only, calculate and determine whether ASOP Co

should lease or buy the new technology. (11 marks)

(b) Using a nominal terms approach, calculate the net present value of buying the

new technology and advise whether ASOP Co should undertake the proposed

investment. (6 marks)

(c) Discuss how an optimal investment schedule can be formulated when capital

is rationed and investment projects are either:

(i) divisible; or

(ii) non-divisible. (5 marks)

9

www.accaapc.com f9 final live online revision

One of the subsidiary of ASOP Co called AIMS plans to replace an existing machine and

must choose between two machines. Machine 1 has an initial cost of $200,000 and will have

a scrap value of $25,000 after four years. Machine 2 has an initial cost of $225,000 and will

have a scrap value of $50,000 after three years. Annual maintenance costs of the two

machines are as follows:

Year 1 2 3 4

Machine1($/year) 25,000 29,000 32,000 35,000

Machine 2 ($/year) 15,000 20,000 25,000

Where relevant, all information relating to the above cash flow has already been adjusted

to include expected future inflation.

Taxation and capital allowances must be ignored in relation to Machine 1 and Machine 2.

Other information

AIMS Co has a nominal before-tax weighted average cost of capital of 12% and a nominal

after-tax weighted average ost of capital of 7%.

(d)Calculate the equivalent annual costs of Machine 1 and Machine 2, and discuss

which machine should be purchased (6amrks) (June2012 Q1)

(e)Critically discuss the use of sensitivity analysis and probability analysis as

ways of including risk in the investment appraisal process, referring in your

answer to the relative effectiveness of each method. (7 marks) (June2012 Q1)

10

www.accaapc.com f9 final live online revision

Big investment question3

June2009 Q2

PV Co is evaluating an investment proposal to manufacture Product W33, which has

performed well in test marketing rials conducted recently by the companys research and

development division. The following information relating to his investment proposal has

now been prepared.

Initial investment $2 million

Selling price (current price terms) $20 per unit

Expected selling price inflation 3% per year

Variable operating costs (current price terms) $8 per unit

Fixed operating costs (current price terms) $170,000 per year

Expected operating cost inflation 4% per year

The research and development division has prepared the following demand forecast as a

result of its test marketing rials. The forecast reflects expected technological change and its

effect on the anticipated life-cycle of Product W33.

Year 1 2 3 4

Demand(units) 60,000 70,000 120,000 45,000

It is expected that all units of Product W33 produced will be sold, in line with the companys

policy of keeping no nventory of finished goods. No terminal value or machinery scrap value

is expected at the end of four years, when roduction of Product W33 is planned to end. For

investment appraisal purposes, PV Co uses a nominal (money) iscount rate of 10% per year

and a target return on capital employed of 30% per year. Ignore taxation.

Required:

(a) Identify and explain the key stages in the capital investment decision-making

process, and the role of nvestment appraisal in this process. (7 marks)

(b) Calculate the following values for the investment proposal:

(i) net present value;

(ii) internal rate of return;

(iii) return on capital employed (accounting rate of return) based on average

investment; and

(iv) discounted payback period. (13 marks)

(c) Discuss your findings in each section of (b) above and advise whether the

investment proposal is financially acceptable. (5 marks)

(25 marks)

11

www.accaapc.com f9 final live online revision

Financing decision

Tips: again examiner will examine this topic in a very consistent way but also

very practical way.

Financing decision is much more difficult than investing decision so do make

sure you have practiced the following questions.

12

www.accaapc.com f9 final live online revision

1, June2011 Q2 modified

The finance director of AQR Co has heard that the market value of the company will

increase if the weighted average cost of capital of the company is decreased. The company,

which is listed on a stock exchange, has 100 million shares in issue and the current ex div

ordinary share price is $250 per share. AQR Co also has in issue bonds with a book value

of $60 million and their current ex interest market price is $104 per $100 bond. The current

after-tax cost of debt of AQR Co is 7% and the tax rate is 30%.

The recent dividends per share of the company are as follows.

Year 2006 2007 2008 2009 2010

Dividend per share (cents) 19.38 20.20 20.41 21.02 21.80

The finance director proposes to decrease the weighted average cost of capital of AQR Co,

and hence increase its market value, by issuing $40 million of bonds at their par value of

$100 per bond. These bonds would pay annual interest of 8% before tax and would be

redeemed at a 5% premium to par after 10 years.

Required:

(a) Calculate the market value after-tax weighted average cost of capital of AQR

Co in the following circumstances:

(i) before the new issue of bonds takes place;

(ii) after the new issue of bonds takes place.

Comment on your findings. (12 marks)

(b) Identify and discuss briefly the factors that influence the market value of

traded bonds. (5 marks)

(c) Discuss the directors view that issuing traded bonds will decrease the

weighted average cost of capital of AQR Co and thereby increase the market

value of the company. (8 marks)

(d) Discuss the circumstances under which the weighted average cost of capital

(WACC) can be used as a discount rate in investment appraisal. Briefly indicate

alternative approaches that could be adopted when using the WACC is not

appropriate. (7 marks) (DEC2011 Q3(d)

(e) Discuss the reasons why different bonds of the same company might have

different costs of debt. (6 marks) (DEC2009 Q2(b))

(f) Discuss whether a change in dividend policy will affect the share price of AQR

Co. (7 marks) (DEC2009 Q2(d))

13

www.accaapc.com f9 final live online revision

(g) Discuss whether the dividend growth model or the capital asset pricing model

offers the better estimate of the cost of equity of a company. (7 marks)

(June2008 Q1(c))

(H) Discuss the relationship between capital structure and weighted average

cost of capital, and comment on the suggestion that debt could be used to

finance a cash offer for AQR if the gearing ratio of AQR is relatively high.

(9 marks) (June2009 Q1(c))

(I) Discuss how the shareholders of Corhig Co can assess the extent to which

they face the following risks, explaining in each case the nature of the risk

being assessed:

(i) Business risk;

(ii) Financial risk;

(iii) Systematic risk. (9 marks) (June2012 Q4(d))

14

www.accaapc.com f9 final live online revision

2,Project specific discount rate and other cost of capital calculation

CJ Co is a profitable company which is financed by equity with a market value of $180

million and by debt with a market value of $45 million and it is considering to take project

B.

Project B

This project is a diversification into a new business area that will cost $4 million. A company

that already operates in the new business area, GZ Co, has an equity beta of 15. GZ Co is

financed 75% by equity with a market value of $90 million and 25% by debt with a market

value of $30 million.

Risk-free rate of return: 4%

Equity risk premium: 6%

(c) Calculate a project-specific cost of equity for Project B and explain the stages

of your calculation.

(6 marks)(DEC2010 Q1 C)

15

www.accaapc.com f9 final live online revision

3,JUNE2009 Q4(ratio+business finance)

JJG Co is planning to raise $15 million of new finance for a major expansion of existing

business and is considering a rights issue, a placing or an issue of bonds. The corporate

objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its

shareholders and to achieve continuous growth in earnings per share. Recent financial

information on JJG Co is as follows:

2008 2007 2006 2005

Turnover ($m) 28.0 24.0 19.1 16.8

Profit before interest and tax ($m) 9.8 8.5 7.5 6.8

Earnings ($m) 5.5 4.7 4.1 3.6

Dividends ($m) 2.2 1.9 1.6 1.6

Ordinary shares ($m) 5.5 5.5 5.5 4.5

Reserves ($m) 13.7 10.4 7.6 5.1

8% Bonds, redeemable 2015 ($m) 20 20 20 20

Share price ($) 8.64 5.74 3.35 2.67

The par value of the shares of JJG Co is $100 per share. The general level of inflation has

averaged 4% per year in the period under consideration. The bonds of JJG Co are currently

trading at their par value of $100. The following values for the business sector of JJG Co are

available:

Average return on capital employed 25%

Average return on shareholders funds 20%

Average interest coverage ratio 20 times

Average debt/equity ratio (market value basis) 50%

Return predicted by the capital asset pricing model 14%

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the

extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.

(12 marks)

(b) If the new finance is raised via a rights issue at $750 per share and the major

expansion of business has not yet begun, calculate and comment on the effect of

the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

16

www.accaapc.com f9 final live online revision

(c) Analyse and discuss the relative merits of a rights issue, a placing and an

issue of bonds as ways of raising the finance for the expansion. (7 marks)

(25 marks)

17

www.accaapc.com f9 final live online revision

4,DEC2010 Q2(business finance question)

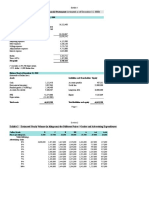

The following financial position statement as at 30 November 2010 refers to Nugfer Co, a

stock exchange-listed company, which wishes to raise $200m in cash in order to acquire a

competitor.

$m $m $m

Assets

Non-current assets 300

Current assets 211

Total assets 511

Equity and liabilities

Share capital 100

Retained earnings 121

Total equity 221

Non-current liabilities

Long term borrowings 100

Current liabilities

Trade payables 30

Short term borrowings 160

Total current liabilities 190

Total liabilities 290

Total equity and liabilities 511

The recent performance of Nugfer Co in profitability terms is as follows:

Year ending 30 November 2007 2008 2009 2010

$m $m $m $m

Revenue 122.6 127.3 156.6 189.3

Operating profit 41.7 43.3 50.1 56.7

Finance charges(interest) 6.0 6.2 12.5 18.8

Profit before tax 35.7 37.1 37.6 37.9

Profit after tax 25.0 26.0 26.3 26.5

Notes:

1. The long-term borrowings are 6% bonds that are repayable in 2012

2. The short-term borrowings consist of an overdraft at an annual interest rate of 8%

3. The current assets do not include any cash deposits

4. Nugfer Co has not paid any dividends in the last four years

5. The number of ordinary shares issued by the company has not changed in recent years

6. The target company has no debt finance and its forecast profit before interest and tax for

2011 is $28 million

18

www.accaapc.com f9 final live online revision

Required:

(a) Evaluate suitable methods of raising the $200 million required by Nugfer Co,

supporting your evaluation with both analysis and critical discussion. (15 marks)

(b) Briefly explain the factors that will influence the rate of interest charged on a

new issue of bonds. (4 marks)

(c) Identify and describe the three forms of efficiency that may be found in a

capital market.

(6 marks) (25 marks)

19

www.accaapc.com f9 final live online revision

5, JUNE2008 Q2 (covered in video)

THP Co is planning to buy CRX Co, a company in the same business sector, and is

considering paying cash for the shares of the company. The cash would be raised by THP Co

through a 1 for 3 rights issue at a 20% discount to its current share price.

The purchase price of the 1 million issued shares of CRX Co would be equal to the rights

issue funds raised, less issue costs of $320,000. Earnings per share of CRX Co at the time

of acquisition would be 448c per share. As a result of acquiring CRX Co, THP Co expects to

gain annual after-tax savings of $96,000.

THP Co maintains a payout ratio of 50% and earnings per share are currently 64c per share.

Dividend growth of 5% per year is expected for the foreseeable future and the company has

a cost of equity of 12% per year.

Information from THP Cos statement of financial position:

Equity and liabilities $000

Shares($1par value) 3,000

Reserves 4,300

7,300

Non-current liabilities

8% loan notes 5,000

Current liabilities 2,200

Total equity and liabilities 14,500

20

www.accaapc.com f9 final live online revision

Required:

(a) Calculate the current ex dividend share price of THP Co and the current

market capitalisation of THP Co using the dividend growth model. (4 marks)

(b) Assuming the rights issue takes place and ignoring the proposed use of the

funds raised, calculate:

(i) the rights issue price per share;

(ii) the cash raised;

(iii) the theoretical ex rights price per share; and

(iv) the market capitalisation of THP Co. (5 marks)

(c) Using the price/earnings ratio method, calculate the share price and market

capitalisation of CRX Co before the acquisition. (3 marks)

(d) Assuming a semi-strong form efficient capital market, calculate and comment

on the post acquisition market capitalisation of THP Co in the following

circumstances:

(i) THP Co does not announce the expected annual after-tax savings; and

(ii) the expected after-tax savings are made public. (5 marks)

(e) Discuss the factors that THP Co should consider, in its circumstances, in

choosing between equity finance and debt finance as a source of finance from

which to make a cash offer for CRX Co. (8 marks)

(25 marks)

21

www.accaapc.com f9 final live online revision

Working capital management

Pilot paper Q3 modified

Ulnad Co has annual sales revenue of $6 million and all sales are on 30 days credit,

although customers on average take ten days more than this to pay. Contribution

represents 60% of sales and the company currently has no bad debts.

Accounts receivable are financed by an overdraft at an annual interest rate of 7%.

Ulnad Co plans to offer an early settlement discount of 1.5% for payment within 15 days

and to extend the maximum credit offered to 60 days. The company expects that these

changes will increase annual credit sales by 5%, while also leading to additional

incremental costs equal to 0.5% of turnover. The discount is expected to be taken by 30%

of customers, with the remaining customers taking an average of 60 days to pay.

Required:

(a) Evaluate whether the proposed changes in credit policy will increase the

profitability of Ulnad Co. (6 marks)

(b) Renpec Co, a subsidiary of Ulnad Co, has set a minimum cash account balance of

$7,500. The average cost to the company of making deposits or selling investments is

$18 per transaction and the standard deviation of its cash flows was $1,000 per day

during the last year. The average interest rate on investments is 5.11%.

Determine the spread, the upper limit and the return point for the cash account of

Renpec Co using the Miller- Orr model and explain the relevance of these values

for the cash management of the company. (6 marks)

(c) Identify and explain the key areas of accounts receivable management. (6

marks)

(d) Discuss the key factors to be considered when formulating a working capital

funding policy. (7 marks)

(e) Discuss how risks arising from granting credit to foreign customers can be

managed and reduced. (8 marks) (June2009 Q3)

22

www.accaapc.com f9 final live online revision

One of the subsidiary of Ulnad is called KXP Co and In order to encourage customers to pay

on time, KXP Co proposes introducing an early settlement discount of 1% for payment

within 30 days, while increasing its normal credit period to 45 days. It is expected that, on

average, 50% of customers will take the discount and pay within 30 days, 30% of

customers will pay after 45 days, and 20% of customers will not change their current

paying behaviour.

Other information:

KXP Co is an e-business which trades solely over the internet. In the last year the company

had sales of $15 million. All sales were on 30 days credit to commercial customers.

Extracts from the companys most recent statement of financial position relating to working

capital are as follows:

$000

Trade receivables 2,466

KXP Co has an overdraft facility charging interest of 6% per year.

(f) Calculate the net benefit or cost of the proposed changes in trade receivables

policy and comment on your findings. (6 marks) (DEC2012 Q2)

(g) Identify and discuss the factors to be considered in determining the optimum

level of cash to be held by a company. (5 marks) (DEC2012 Q2)

(H) Discuss the key factors which determine the level of investment in current

assets.

(6 marks)

(June2008 Q3)

(I) Discuss the ways in which factoring and invoice discounting can assist in the

management of accounts receivable.

(6 marks)

(June2008 Q3)

23

www.accaapc.com f9 final live online revision

A factor has offered to manage the trade receivables of Bold Co in a servicing and

factor-financing agreement. The factor expects to reduce the average trade receivables

period of Bold Co from its current level to 35 days; to reduce bad debts from 09% of

turnover to 06% of turnover; and to save Bold Co $40,000 per year in administration

costs.

The factor would also make an advance to Bold Co of 80% of the revised book value of trade

receivables. The interest rate on the advance would be 2% higher than the 7% that Bold Co

currently pays on its overdraft. The factor would charge a fee of 075% of turnover on a

with-recourse basis, or a fee of 125% of turnover on a non-recourse basis.

Assume that there are 365 working days in each year and that all sales and supplies are on

credit. Current trade receivable balance is $3.5m and sales revenue is $21.3m.

(J) Calculate the value of the factors offer:

(i) on a with-recourse basis;

(ii) on a non-recourse basis. (7 marks) (DEC2011 Q2)

(k) Explain the meaning of the term cash operating cycle and discuss the

relationship between the cash operating cycle and the level of investment in

working capital. Your answer should include a discussion of relevant

working capital policy and the nature of business operations.

(7 marks)

(DEC2011 Q2)

(l) Identify the objectives of working capital management and discuss the

conflict that may arise between them.

DEC2007 Q4 (3 marks)

24

www.accaapc.com f9 final live online revision

Accounts payable management

PKA Co has used a foreign supplier for the first time and must pay $250,000 to the supplier in six

months time. The financial manager is concerned that the cost of these supplies may rise in euro

terms and has decided to hedge the currency risk of this account payable. The following information

has been provided by the companys bank:

Spot rate ($ per ): 1998 0002

Six months forward rate ($ per ): 1979 0004

Money market rates available to PKA Co:

Borrowing Deposit

One year euro interest rates: 61% 54%

One year dollar interest rates: 40% 35%

(m) Evaluate whether a money market hedge or a forward market hedge should

be used to hedge the foreign account payable.

DEC2007 Q4 (8 marks)

25

www.accaapc.com f9 final live online revision

Another subsidiary of Ulnad is called WQZ Co and it is considering making the following

changes in the area of working capital management:

Inventory management

It has been suggested that the order size for Product KN5 should be determined using the

economic order quantity model (EOQ).

WQZ Co forecasts that demand for Product KN5 will be 160,000 units in the coming year

and it has traditionally ordered 10% of annual demand per order. The ordering cost is

expected to be $400 per order while the holding cost is expected to be $512 per unit per

year. A buffer inventory of 5,000 units of Product KN5 will be maintained, whether orders

are made by the traditional method or using the economic ordering quantity model.

(n) Calculate the cost of the current ordering policy and the change in the costs of

inventory management that will arise if the economic order quantity is used

to determine the optimum order size for Product KN5.

(6 marks)DEC2010 Q3

(o) Briefly describe the benefits of a just-in-time (JIT) procurement policy.

(5 marks) DEC2010 Q3

(p) Critically discuss the similarities and differences between working capital policies in the

following areas:

(i) Working capital investment;

(ii) Working capital financing. (9 marks) (june2012 Q2)

26

www.accaapc.com f9 final live online revision

June2012 Q2 (overtrading)

Income statement extracts

2011 2010

Revenue 14,525 10,375

Cost of sales 10,458 6,640

PBIT 4,067 3,735

Interest 355 292

Profit before tax 3,712 3,443

Taxation 1,485 1,278

Distributable profit 2,227 2,165

Statement of financial position extracts

2011 2010

$000 $000 $000 $000

Non-current assets 15,284 14,602

Current assets

Inventory 2,149 1,092

Receivables 3,200 1,734

5,349 2,826

20,633 17,428

Current liabilities

Payables 2,865 1,637

Overdraft 1,500 250

4,365 1,887

Equity

Shares 8,000 8,000

Reserves 4,268 3,541

12,268 11,541

Long term liabilities

7%Bonds 4,000 4,000

Total equity &liabilities 20,633 17,428

27

www.accaapc.com f9 final live online revision

Average ratios for the last two years for companies with similar business operations to

Wobnig Co are as follows:

Current ratio 17 times

Quick ratio 11 times

Inventory days 55 days

Trade receivables days 60 days

Trade payables days 85 days

Sales revenue/net working capital 10 times

(a)Using suitable working capital ratios and analysis of the financial information

provided, evaluate whether Wobnig Co can be described as overtrading

(undercapitalised). (12 marks)

28

www.accaapc.com f9 final live online revision

June2009 Q3 Cash budget

Statement of financial position at the current date (extracts)

$000 $000 $000

Non-current assets 48,965

Current assets

Inventory 8,160

Receivable 8,775

16,935

Current liabilities

Overdraft 3,800

Payable 10,200

14,000

Net current assets 2,935

Total assets-current liabilities 51,900

Cash flow forecasts from the current date are as follows:

Month1 Month2 Month3

Cash operating receipts ($000) 4,220 4,350 3,808

Cash operating payments ($000) 3,950 4,100 3,750

Six-monthly interest on traded bonds ($000) 200

Capital investment ($000) 2,000

The finance director has completed a review of accounts receivable management and has

proposed staff training and operating procedure improvements, which he believes will

reduce accounts receivable days to the average sector value of 53 days. This reduction

would take six months to achieve from the current date, with an equal reduction in each

month. He has also proposed changes to inventory management methods, which he hopes

will reduce inventory days by two days per month each month over a three-month period

from the current date. He does not expect any change

in the current level of accounts payable.

HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual

rate of 617% per year, with payments being made each month based on the opening

balance at the start of that month. Credit sales for the year to the current date were

$49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of

sales are expected to be maintained in the coming year. Assume that there are 365 working

days in each year.

29

www.accaapc.com f9 final live online revision

Required:

(a) Discuss the working capital financing strategy of HGR Co. (7 marks)

(b) For HGR Co, calculate:

(i) the bank balance in three months time if no action is taken; and

(ii) the bank balance in three months time if the finance directors proposals

are implemented.

Comment on the forecast cash flow position of HGR Co and recommend a suitable

course of action.

(10 marks)

30

www.accaapc.com f9 final live online revision

Business valuation and risk management

DEC2012 Q4

GWW Co is a listed company which is seen as a potential target for acquisition by financial

analysts. The value of the company has therefore been a matter of public debate in recent

weeks and the following financial information is available:

Year 2009 2010 2011 2012

Profit after tax($m) 8.5 8.9 9.7 10.1

Total dividends($m) 5.0 5.2 5.6 6.0

Statement of financial position information for 2012

$000 $000 $000

Non-current assets 91.0

Current assets

Inventory 3.8

Receivable 4.5 8.3

99.3

Equity finance

Share capital 20.0

Reserves 47.2 67.2

Non-current liabilities

8% bonds 25

Current liabilities 7.1

Total liabilities 99.3

The shares of GWW Co have a nominal (par) value of 50c per share and a market value of

$400 per share. The cost of equity of the company is 9% per year. The business sector of

GWW Co has an average price/earnings ratio of 17 times. The 8% bonds are redeemable at

nominal (par) value of $100 per bond in seven years time and the before-tax cost of debt

of GWW Co is 6% per year.

The expected net realisable values of the non-current assets and the inventory are $860m

and $42m, respectively.

In the event of liquidation, only 80% of the trade receivables are expected to be collectible.

31

www.accaapc.com f9 final live online revision

Required:

(a) Calculate the value of GWW Co using the following methods:

(i) market capitalisation (equity market value);

(ii) net asset value (liquidation basis);

(iii) price/earnings ratio method using the business sector average

price/earnings ratio;

(iv) dividend growth model using:

(1) the average historic dividend growth rate;

(2) Gordons growth model (the bre model).

The total marks will be split equally between each part. (10 marks)

(b) Discuss the relative merits of the valuation methods in part (a) above in

determining a purchase price for GWW Co. (8 marks)

(c) Calculate the following values for GWW Co:

(i) the before-tax market value of the bonds of GWW Co;

(ii) debt/equity ratio (book value basis);

(iii) debt/equity ratio (market value basis).

Discuss the usefulness of the debt/equity ratio in assessing the financial risk of

GWW Co.

The total marks will be split equally between each part. (7 marks)

(25 marks)

32

www.accaapc.com f9 final live online revision

June2012 Q3 modified

Zigto Co is a medium-sized company whose ordinary shares are all owned by the members

of one family. It has recently begun exporting to a European country and expects to receive

500,000 in six months time. The prospect of increased exports to the European country

means that Zigto Co needs to expand its existing business operations in order to be able to

meet future orders. All of the family members are in favour of the planned expansion, but

none are in a position to provide additional finance. The company is therefore seeking to

raise external finance of approximately $1 million. At the same time, the company plans to

take action to hedge the exchange rate risk arising from its

European exports.

Zigto Co could put cash on deposit in the European country at an annual interest rate of 3%

per year, and borrow at 5% per year. The company could put cash on deposit in its home

country at an annual interest rate of 4% per year, and borrow at 6% per year. Inflation in

the European country is 3% per year, while inflation in the home country of Zigto Co is 45%

per year.

The following exchange rates are currently available to Zigto Co:

Current spot exchange rate 2000 euro per $

Six-month forward exchange rate 1990 euro per $

One-year forward exchange rate 1981 euro per $

(a) Explain the nature of a mudaraba contract and discuss briefly how this form of

Islamic finance could be used to finance the planned business expansion. (5

marks)

(b) Calculate whether a forward exchange contract or a money market hedge

would be financially preferred by Zigto Co to hedge its future euro receipt. (5

marks)

(c) Calculate the one-year expected (future) spot rate predicted by purchasing

power parity theory and explain briefly the relationship between the expected

(future) spot rate and the current forward exchange rate.

(3 marks)

(d) Describe other methods, including derivatives, that Boluje Co could use to

hedge against exchange rate risk.

(8 marks)DEC2008 Q4

(e)Discuss the factors to be considered in formulating the dividend policy of a

stock-exchange listed company.

(10marks) DEC2010 Q4

You might also like

- F5 FinalDocument18 pagesF5 FinalPrashant PandeyNo ratings yet

- CIMA F1 Financial Operations KitDocument433 pagesCIMA F1 Financial Operations KitAnonymous 5z7ZOp67% (3)

- RFBT-04: LAW ON Credit Transactions: - T R S ADocument10 pagesRFBT-04: LAW ON Credit Transactions: - T R S AAdan Nada100% (1)

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Document71 pagesQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- Alfa P&L and Equity StatementsDocument4 pagesAlfa P&L and Equity StatementsAnna Frolova100% (1)

- f9 Mock-ExamDocument15 pagesf9 Mock-ExamSarad KharelNo ratings yet

- F9 - Mock C - QuestionsDocument7 pagesF9 - Mock C - QuestionspavishneNo ratings yet

- Cost and Management Accounting Sample TestDocument22 pagesCost and Management Accounting Sample TestSudip Issac Sam67% (3)

- ACCA F9 Past Paper AnalysisDocument6 pagesACCA F9 Past Paper AnalysisPawan_Vaswani_9863100% (1)

- ACCA F7 Revision Mock June 2013 ANSWERS Version 4 FINAL at 25 March 2013 PDFDocument24 pagesACCA F7 Revision Mock June 2013 ANSWERS Version 4 FINAL at 25 March 2013 PDFPiyal Hossain100% (1)

- F9 Progress Test 2: Key Financial Calculations for Machine ProjectsDocument3 pagesF9 Progress Test 2: Key Financial Calculations for Machine ProjectsCoc GamingNo ratings yet

- Auditing and Assurance Manual ICABDocument20 pagesAuditing and Assurance Manual ICABমোঃ আশিকুর রহমান শিবলু100% (1)

- Essay Part 1Document56 pagesEssay Part 1Sachin KumarNo ratings yet

- Equity Valuation ModelsDocument37 pagesEquity Valuation ModelsDisha BakshiNo ratings yet

- CMA Part 2 Study Plan Using HOCK MaterialsDocument26 pagesCMA Part 2 Study Plan Using HOCK MaterialsSanthosh K KomurojuNo ratings yet

- MCQ 1-Questions f5 AccaDocument6 pagesMCQ 1-Questions f5 AccaAmanda7100% (1)

- Chapter 09 Sol StudentsDocument12 pagesChapter 09 Sol StudentsBinh HoangNo ratings yet

- ACCA F8 Sample Study NoteDocument25 pagesACCA F8 Sample Study Notebillyryan1No ratings yet

- L2 Certificate in Bookkeeping and Accounting PDFDocument26 pagesL2 Certificate in Bookkeeping and Accounting PDFKhin Zaw HtweNo ratings yet

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamNo ratings yet

- ACCA F9 Workbook Questions 1.1 PDFDocument92 pagesACCA F9 Workbook Questions 1.1 PDFYashvin Alwar100% (1)

- CAF8 CMA QuestionbankDocument228 pagesCAF8 CMA QuestionbankMohsin Akbar100% (3)

- F9 - Mock A - AnswersDocument15 pagesF9 - Mock A - AnswerspavishneNo ratings yet

- Express F9 NotesDocument64 pagesExpress F9 NotesSolomon Austin100% (1)

- Acca Tips F7, F8, F9Document3 pagesAcca Tips F7, F8, F9MoaXam MirxaNo ratings yet

- Financial Management Pilot Exam QuestionsDocument24 pagesFinancial Management Pilot Exam QuestionsafreenessaniNo ratings yet

- Cima F1 Chapter 4Document20 pagesCima F1 Chapter 4MichelaRosignoli100% (1)

- Workbook of Mapit Accountancy of f9Document178 pagesWorkbook of Mapit Accountancy of f9Sumaira Khalid100% (1)

- ACCA Study Text Book F9 Financial Management Exam 4 Focused LearningDocument128 pagesACCA Study Text Book F9 Financial Management Exam 4 Focused LearningTichaona Makwara100% (1)

- f2 Revesion Notes by AmmarDocument76 pagesf2 Revesion Notes by Ammarammar_acca9681100% (1)

- F9 JUNE 17 Mock AnswersDocument15 pagesF9 JUNE 17 Mock AnswersottieNo ratings yet

- ACCA F5 Course Notes PDFDocument330 pagesACCA F5 Course Notes PDFAmanda7100% (1)

- ACCA F5 Exam Tips for Activity Based CostingDocument32 pagesACCA F5 Exam Tips for Activity Based CostingVagabond Princess Rj67% (3)

- F9 2014-2019 Past Year QDocument133 pagesF9 2014-2019 Past Year QFarahAin FainNo ratings yet

- Acca f9 Class Notes 2010 Final 21 JanDocument184 pagesAcca f9 Class Notes 2010 Final 21 JanArshadul Hoque Chowdhury75% (4)

- Consolidated Financial StatementsDocument33 pagesConsolidated Financial StatementsTamirat Eshetu Wolde100% (1)

- Express Notes ACCA F9Document62 pagesExpress Notes ACCA F9wickygeniusNo ratings yet

- CMA FAR ExamDocument30 pagesCMA FAR ExamAbd-Ullah AtefNo ratings yet

- F2 Management Accounting Overheads & Absorption CostingDocument10 pagesF2 Management Accounting Overheads & Absorption CostingCourage KanyonganiseNo ratings yet

- CMA Unit 1 New 2020Document91 pagesCMA Unit 1 New 2020Emin SaftarovNo ratings yet

- F9 Past PapersDocument32 pagesF9 Past PapersBurhan MaqsoodNo ratings yet

- ACCAF5 - CourseNotes2017 - 2nd Half - 150617 - WatermarkDocument164 pagesACCAF5 - CourseNotes2017 - 2nd Half - 150617 - WatermarkOmaxe Tv100% (2)

- CIMA C5 Mock TestDocument21 pagesCIMA C5 Mock TestSadeep Madhushan100% (1)

- Tutorial Letter 501/0/2020: Financial StrategyDocument13 pagesTutorial Letter 501/0/2020: Financial StrategydevashneeNo ratings yet

- CMAPart2 PDFDocument53 pagesCMAPart2 PDFarslaan89No ratings yet

- Dec 2007 - AnsDocument10 pagesDec 2007 - AnsHubbak KhanNo ratings yet

- F7 Workbook Q & A PDFDocument247 pagesF7 Workbook Q & A PDFREGIS Izere100% (1)

- Question Bank Volume 2 QDocument231 pagesQuestion Bank Volume 2 QCecilia Mfene Sekubuwane100% (1)

- Financial ManagementDocument144 pagesFinancial ManagementKenadid Ahmed Osman100% (2)

- Cma Part 1 Mock Test 3Document37 pagesCma Part 1 Mock Test 3soner onurNo ratings yet

- E1-CIMA All Exam Question SolveDocument266 pagesE1-CIMA All Exam Question Solvepin2icb50% (2)

- Performance Management: Intermediate LevelDocument585 pagesPerformance Management: Intermediate LevelNyanda Jr10100% (1)

- Hock Section B QuestionsDocument137 pagesHock Section B QuestionsMustafa AroNo ratings yet

- DipIFR TextbookDocument375 pagesDipIFR TextbookEmin SaftarovNo ratings yet

- f1 Answers Nov14Document14 pagesf1 Answers Nov14Atif Rehman100% (1)

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- P 4 Cktqns 1 BPDFDocument10 pagesP 4 Cktqns 1 BPDFBinnie Kaur100% (1)

- Question One Acca 2014 June QN 1Document4 pagesQuestion One Acca 2014 June QN 1Joseph Timasi ChachaNo ratings yet

- Assignment For CB TechniquesDocument2 pagesAssignment For CB TechniquesRahul TirmaleNo ratings yet

- ACCA P5 Sample Study NoteDocument11 pagesACCA P5 Sample Study Notebillyryan1100% (1)

- ACCA P3 Sample Study NoteDocument16 pagesACCA P3 Sample Study Notebillyryan1No ratings yet

- ACCA F1 Sample Study NoteDocument31 pagesACCA F1 Sample Study Notebillyryan1100% (3)

- P2 Mock ExamDocument37 pagesP2 Mock Exambillyryan1No ratings yet

- ACCA F9 Financial Management Revision Note Answer Accounting Practise Center (A.P.C)Document105 pagesACCA F9 Financial Management Revision Note Answer Accounting Practise Center (A.P.C)billyryan1No ratings yet

- ACCA F4 Sample Study NoteDocument9 pagesACCA F4 Sample Study Notebillyryan1No ratings yet

- ACCA P1 Sample Study NoteDocument23 pagesACCA P1 Sample Study Notebillyryan1No ratings yet

- ACCA F7 Sample Study NoteDocument13 pagesACCA F7 Sample Study Notebillyryan1No ratings yet

- ACCA F2 Sample Study NoteDocument21 pagesACCA F2 Sample Study Notebillyryan10% (1)

- P3 MockDocument23 pagesP3 Mockbillyryan1No ratings yet

- p1 Mock Exam PaperDocument25 pagesp1 Mock Exam Paperbillyryan1No ratings yet

- 2 PDocument238 pages2 Pbillyryan1100% (3)

- 7 P PDFDocument11 pages7 P PDFbillyryan1No ratings yet

- 5Document11 pages5billyryan1No ratings yet

- F5 Revision QuestionsDocument19 pagesF5 Revision Questionsbillyryan1No ratings yet

- 8Document13 pages8billyryan1No ratings yet

- P 5Document18 pagesP 5billyryan1No ratings yet

- 3Document12 pages3billyryan1No ratings yet

- ACCA P3 Live Online Revision JUNE2014Document83 pagesACCA P3 Live Online Revision JUNE2014billyryan1100% (4)

- ACCA f7 Live Online Revision JUNE2014Document25 pagesACCA f7 Live Online Revision JUNE2014billyryan1No ratings yet

- F8 2days Live Online Revision ClassDocument85 pagesF8 2days Live Online Revision Classbillyryan167% (3)

- P 5Document12 pagesP 5billyryan1No ratings yet

- ACCA f7 Live Online Revision JUNE2014Document25 pagesACCA f7 Live Online Revision JUNE2014billyryan1No ratings yet

- P 7Document47 pagesP 7billyryan1No ratings yet

- P 2Document26 pagesP 2billyryan1No ratings yet

- F8 2days Live Online Revision ClassDocument85 pagesF8 2days Live Online Revision Classbillyryan167% (3)

- P 4Document56 pagesP 4billyryan1No ratings yet

- P 3Document20 pagesP 3billyryan1No ratings yet

- Analysis and Interpretation of Financial Statements: Christine Talimongan ABM - BezosDocument37 pagesAnalysis and Interpretation of Financial Statements: Christine Talimongan ABM - BezostineNo ratings yet

- 2 - Example Business PlanDocument14 pages2 - Example Business Planmuftahmail721No ratings yet

- Exhibits and Student TemplateDocument7 pagesExhibits and Student Templatesatish.evNo ratings yet

- 01 Basilan Estate V CIRDocument2 pages01 Basilan Estate V CIRBasil MaguigadNo ratings yet

- Service-Charges 01.01.2022 WEBDocument58 pagesService-Charges 01.01.2022 WEBRenesh RNo ratings yet

- Level Whitepaper On Financial WellbeingDocument15 pagesLevel Whitepaper On Financial WellbeingHajji AnwerNo ratings yet

- Principles and Methods for Improving CollectionsDocument7 pagesPrinciples and Methods for Improving Collectionsrosalyn mauricioNo ratings yet

- Updates in Financial Reporting StandardsDocument24 pagesUpdates in Financial Reporting Standardsloyd smithNo ratings yet

- Booklet 2Document127 pagesBooklet 2alok pandeyNo ratings yet

- Stock Corp By-LawsDocument35 pagesStock Corp By-LawsAngelica Sanchez100% (3)

- Securities and Exchange Board of India: Master CircularDocument236 pagesSecurities and Exchange Board of India: Master CircularViral_v2inNo ratings yet

- Capital Budgeting NotesDocument3 pagesCapital Budgeting NotesSahil RupaniNo ratings yet

- Interim Report On Devolved GovernmentDocument341 pagesInterim Report On Devolved GovernmentSpartacus OwinoNo ratings yet

- Death ClaimDocument29 pagesDeath Claimparikshit purohitNo ratings yet

- t8. Money Growth and InflationDocument53 pagest8. Money Growth and Inflationmimi96No ratings yet

- This Study Resource Was: Case Analysis Note GoncharDocument4 pagesThis Study Resource Was: Case Analysis Note GoncharMickey JindalNo ratings yet

- Foreign Exchange Risk Management Practices - A Study in Indian ScenarioDocument11 pagesForeign Exchange Risk Management Practices - A Study in Indian ScenariobhagyashreeNo ratings yet

- Pelatihan Penyusunan Laporan Keuangan Bagi Usaha Industri Kreatif Di TangerangDocument7 pagesPelatihan Penyusunan Laporan Keuangan Bagi Usaha Industri Kreatif Di Tangerangfaesal fazlurahmanNo ratings yet

- 1234449Document19 pages1234449Jade MarkNo ratings yet

- Joint Venture Agreement Template 03Document33 pagesJoint Venture Agreement Template 03Maria AlvarezNo ratings yet

- ACC 570 CQ3b Practice Tax QuestionsDocument2 pagesACC 570 CQ3b Practice Tax QuestionsMohitNo ratings yet

- The Following Is River Tours Limited S Unadjusted Trial Balance atDocument2 pagesThe Following Is River Tours Limited S Unadjusted Trial Balance atMiroslav GegoskiNo ratings yet

- Doa TradeDocument17 pagesDoa TradeEduardo WitonoNo ratings yet

- MACROECONOMICS MADE SIMPLEDocument19 pagesMACROECONOMICS MADE SIMPLEnorleen.sarmientoNo ratings yet

- Chapter 4 Assignment Recording TransactionsDocument6 pagesChapter 4 Assignment Recording TransactionsjepsyutNo ratings yet

- DBP Vs GuarinaDocument2 pagesDBP Vs GuarinaMonalizts D.100% (1)

- Form 16 TDS Certificate SummaryDocument2 pagesForm 16 TDS Certificate SummaryPravin HireNo ratings yet