Professional Documents

Culture Documents

Project Report On Customer Preference For Current Account Services at ING VYSYA Bank

Uploaded by

Anil MakvanaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Report On Customer Preference For Current Account Services at ING VYSYA Bank

Uploaded by

Anil MakvanaCopyright:

Available Formats

i

A

PROJECT REPORT

ON

Customer Preference for Current Account Service: Comparative Study

between selected Banks.

For

The ING VYSYA Bank Ltd.

Submitted to

Marwadi Education Foundations Group of Institutions

In partial fulfillment of the requirement of the award for the degree of

Master of Business Administration

Under

Gujarat Technological University

Under the guidance of

Faculty Guide: Company Guide:

Prof. Bhoomi Parekh Mr. Viren Mehta

Assistant Professor Cluster Head

Submitted by

Makvana Anil Jerambhai

Enrolment No: 128270592070

MBA Semester III

Marwadi Education Foundations Group of Institutions

MBA Program

Affiliated to Gujarat Technological University

Ahmedabad

July 2013

ii

iii

iv

Student Declaration

I Makvana Anil hereby declare that the report for Summer Training Project entitled ING VYSYA

Bank on Customer Preference for Current Account Service: - Comparative Study between

selected Banks. Is a result of my own work and my indebtedness to other work publications,

references, if any, have been duly Acknowledged.

Place: Rajkot

Date: Makvana Anil J.

v

Preface

Education is the process of sharpening ones mind and which is given in the school &

colleges in form of various subjects. When any subject is thought theoretically in class it is known

as academics, but when it is studied with the subject application in real life. It is known as

professional education.

The field of commercial study consists of business administration, which is the good mixture

of both theory subject and practical subject. Thus, it makes the students familiar with the running

of various industries.

As a student of MBA, a professional degree courses, it required having the knowledge

about theoretical as well as practical knowledge. Theoretical knowledge provided me by the

sexperienced staff of my college and the practical knowledge and training is provided by the ING

Vysya Bank Pvt Ltd.

vi

Acknowledgement

Life of human beings is full of interactions. No one is self-sufficient by himself whenever

anyone is doing some serious and important work a lot of help from the people concerned is

needed &one less specially obliged towards them. We cannot forget acknowledging them in few

words as without the guidance & co-ordination of them in our project report would not have been

possible.

A large number of individual contributed to this project. We are thankful to all of them for their help

and encouragement. Our writing in this project report has also been influenced by a number of

website and standard textbooks. As far as possible, they have been fully acknowledged at the

appropriate place .We express our gratitude to all of them.

I also express my gratitude to DEAN Dr. S.C.REDDY Sir and all the others who have made even

the smallest contribution to make this project a success

First of all we owe our heartfelt gratitude to our guide Prof. Bhoomi Parekh and Prof.

Bhargav Pandya for their noble guidance throughout the completion of the Project.

Last but not least, also give our sincere thanks to all the people to directly indirectly have

help and encourage us in finding the way to us collecting the requisite information and completing

the project effectively and timely.

vii

Index

Sr.No. Particular Page no.

Part 1 General information

1 Industry Overview 1

1.1)History 2

1.2) Growth and Performance 9

1.3) Market players in the industry 12

2 Company Overview 17

2.1) History 18

2.2) Growth and development 20

2.3) Performance and other key performing data 22

2.4) Product / Service overview 23

2.5 Departmental overview 26

2.6) SWOT analysis 29

Part 2 Research Work

3 Introduction of the study 31

3.1) Background of the study 33

3.2) Review of literature 34

3.3) Statement of problem 36

3.4) Objective of the study 36

3.5) Contribution and learning from the project 36

4 Research Methodology 37

4.1) Research design 39

4.2) Sampling method 39

4.3) Sampling size 39

4.4) Sources of data 39

4.5) Data collection instrument 40

5 Analysis and Interpretation of data 41

6 Results and findings 52

viii

7 Suggestion and conclusion 55

8 Limitation of the study 58

9 Bibliography 59

10 Annexure 60

ix

List of Tables

Sr.No. Particulars Page No.

1 Parameter of Banking sector efficiency 11

2 Market players In the Industry 13

3 Growth and Development of ING Vysya Bank 21

4 Performance and key performance data 22

5 Comparative analysis of Current Account schemes

provided by Banks.

42

List of Graphs

Graph No. Particular Page

No.

1. Business Turnover 43

2 Accounts with the Bank 44

3 Extra benefits associated with Current Account free of cost 45

4 Speedy Transaction with respect to 46

5 Bank charges lesser penalty for not maintaining minimum

balance for Current Account

47

6 Do you believe your Bank charges lower charge for you

Current Account Facility

48

7 Free Deposit Limit Per Month 49

8 Aware of Current Account offered by ING Vysya Bank 50

9 Interest In ING Vysya Bank 51

1

Part I General

Information

1. Industry Overview

2

1.1 HISTORY OF BANKING

As early as 2000 B.C. the Babylonians had developed a banking system. There is evidence to

show the temples of Babylon were used as banks. After a period of time, there was a spread of

irreligion, which soon destroyed the public sense of security in depositing money and valuable in

temples. The priests were longer acting as financial agents. The Romans did minute regulations,

as to conduct private banking and to create confidence in it. Loan banks were also common in

Rome. From these the poor citizens received loans without paying interest, against security of land

for 3 or 4 years.

"Bank means a bench or table for changing Money."

The word Bank is said to be derived from French word Bancs or Banquets, i.e., a branch. It is

believed that the early bankers, the Jews of Lombardy, transacted their business on benches in

the marketplace. Others believes it is derived from German word Back meaning a joint stock

fund.

The word BANK acts as the bridge between the people who needs money and who have excess

money with them. In the past, when barter system was In the existence, at that time there Is no

any use of money. There is no such mediator which is commonly accepted In the day to day life

for exchange of our products or services. But with changing in time, money became the medium

for each and every products as well as services. Later on money became very important tool for

smooth running of economy. Money became the main tool for every transaction.

In the economic development of nation banks occupy in important place. Banking institutions from

an important part of the money market and are indispensable in modern developing society.

Banking is the life blood of modern economic. It may truly be said that modern commerce is so

dependent upon banking that any cessation of banking activity, even for a day or two, would

completely parlay the economic life of a nation. From its original narrow scope and modest

purpose of taking care of other peoples money and lending a part it. Banking has developed to

such an extent that, in countries likes England, France and U.S.A.

Generally, banks do the business of money they take deposits of moneys from client and give loan

to the person who has need of money. But in this age, for the convenience of customer, banks

provide some other services to their customer such as bankers Cheque overdraft. Internet

banking, ATM facility, paying of bills, credit card, telegraphic transfer, insurance, Demat etc.

3

Reserve Bank of India

The Reserve Bank of India (RBI) is India's central banking institution, which formulates

the monetary policy with regard to the Indian rupee. It was established on 1 April 1935

during the British Raj in accordance with the provisions of the Reserve Bank of India Act,

1934. The share capital was divided into shares of 100 each fully paid, which was entirely

owned by private shareholders in the beginning. Following India's independence in 1947,

the RBI was nationalized in the year 1949.RBI manages Indias money supply and foreign

exchange and also serves as a bank for the Government and for Indias commercial banks.

In the 1950s, the Indian government, under its first Prime Minister Jawaharlal Nehru,

developed a centrally planned economic policy that focused on the agricultural sector. In

the 1960s, As a result of bank crashes, the RBI was requested to establish and monitor a

deposit insurance system. 1966 Cooperative banks come under RBI regulation. As a result,

the RBI had to play the central part of control and support of this public banking sector.

Commercial Banks

Commercial banks in India have traditionally focused only on meeting the short-term

financial needs of industry, trade and agriculture. Commercial banks can be classified into

two categories namely Scheduled Commercial Banks and Non-Scheduled Commercial

Banks (Local Area Banks). Scheduled Commercial Banks are banks that are listed in the

schedule to the Reserve Bank of India Act, 1934, and may further be classified as public

sector banks, private sector banks, correspondent banks, foreign banks and regional rural

banks.

Public Sector Banks

Public sector banks constitute the largest category in the Indian banking system. They

include the State Bank of India and its 7 associate banks, 19 nationalized banks and 196

regional rural banks. As of June 30, 2004, apart from the regional rural banks, the other

public sector banks have over 46,500 branches. Public Sector Banks collectively account

for approximately 73.2% of the outstanding gross bank credit and 77.9% of the aggregate

deposits of the scheduled commercial banks. The large network of public sector bank

branches enables them to fund themselves out of low cost deposits. The State Bank of

India is the largest public sector bank in India.

4

Private Sector Banks

After the first phase of bank nationalization was completed in 1969, public sector banks

made up the largest portion of Indian banking. In July 1993, as part of the banking reform

process and as a measure to induce competition in the banking sector, RBI permitted entry

by the private sector into the banking system. This resulted in the introduction of nine

private sector banks. These banks are collectively known as the new private sector banks.

There are ten new private sector banks at present. In addition, 20 private sector banks

existing prior to July 1993 are currently operating as on June 2004

Foreign banks

As of June 30, 2004, there were 32 foreign banks with 215 branches operating in India. As

part of the liberalization process, RBI has permitted foreign banks to operate more freely,

subject to requirements largely similar to those imposed on domestic banks. Foreign banks

operate in India through branches of their parent banks. In fiscal 2003, the Government

announced that foreign banks would be permitted to incorporate subsidiaries in India.

Subsidiaries of foreign banks will have to adhere to all banking regulations, including priority

sector lending norms, applicable to domestic banks.

Cooperative Banks

Cooperative banks cater to the financing needs of agriculture, small industry and self-

employed businessmen in urban and semi-urban areas of India. The state land

development banks and the primary land development banks provide long-term credit for

agriculture. In the light of liquidity and insolvency problems experienced by some

cooperative banks in fiscal 2001, RBI undertook several interim measures, pending formal

legislative changes, including measures related to lending against shares, borrowings in the

call market and term deposits placed with other urban cooperative banks. Presently, RBI is

responsible for supervision and regulation of urban co-operative societies, and the National

Bank for Agriculture and Rural Development (NABARD) for State Co-operative Banks and

District Central Co-operative Banks.

5

Non-Bank Finance Companies

There are over 13,671 non-bank finance companies in India as at end-June 2004, mostly in

the private sector. All non-bank finance companies are required to register with RBI in terms

of the Reserve Bank of India (Amendment) Act, 1997. The nonbank finance companies, on

the basis of their principal activities are broadly classified into four categories namely

Equipment Leasing, Hire Purchase, Loan and Investment Companies and deposits and

business activities of Residuary Non-Banking Companies (RNBCs).

Housing Finance Companies

Housing finance companies form a distinct sub-group of the non-bank finance companies

and are regulated by National Housing Bank (NHB). As a result of the various incentives

given by the Government for investing in the housing sector in recent years, the scope of

their business has grown substantially. Until recently, Housing Development Finance

Corporation Limited was the premier institution providing housing finance in India. In recent

years, several other players including public and private sector banks have entered the

housing finance industry. The National Housing Bank and the Housing and Urban

Development Corporation Limited are the two Government-controlled financial institutions

created to improve the availability of housing finance in India. The National Housing Bank

Act provides for refinancing and securitization of housing loans, foreclosure of mortgages

and setting up of the Mortgage Credit Guarantee Scheme.

Specialized Financial Institutions

In addition to the long-term lending institutions, there are various specialized financial

institutions that cater to the specific needs of different sectors. They include the National

Bank for Agricultural and Rural Development, Export Import Bank of India, Small Industries

Development Bank of India, Risk Capital and Technology Finance Corporation Limited,

Tourism Finance Corporation of India Limited, National Housing Bank, Power Finance

Corporation Limited and the Infrastructure Development Finance Corporation Limited.

6

Insurance Companies

Currently, there are 27 insurance companies in India, of which 13 are life insurance

companies, 13 are general insurance companies and one is a reinsurance company. Of the

13 life insurance companies, 12 are in the private sector and one is in the public sector.

Among the general insurance companies, eight are in the private sector and five are in the

public sector. The reinsurance company, General Insurance Corporation of India, is in the

public sector. Life Insurance Corporation of India, General Insurance Corporation of India

and public sector general insurance companies also provide long-term financial assistance

to the industrial sector.

Mutual Funds

From 1963 to 1987, Unit Trust of India was the only mutual fund operating in India. It was

set up in 1963 at the initiative of the Government and RBI. From 1987 onwards; several

other public sector mutual funds entered this sector. These mutual funds were established

by public sector banks, the Life Insurance Corporation of India and General Insurance

Corporation of India. The mutual funds industry was opened up to the private sector in

1993. The industry is regulated by the SEBI (Mutual Fund) Regulation 1996.

Impact of Liberalization on the Indian Financial Sector

Until 1991, the financial sector in India was heavily controlled and commercial banks and

long-term lending institutions, the two dominant financial intermediaries, had mutually

exclusive roles and objectives and operated in a largely stable environment, with little or no

competition. Long-term lending institutions were focused on the achievement of the

Governments various socio-economic objectives, including balanced industrial growth and

employment creation, especially in areas requiring development

Banking Sector Reform

Most large banks in India were nationalized in 1969 and thereafter were subject to a high

degree of control until reform began in 1991. In addition to controlling interest rates and

entry into the banking sector, these regulations also channeled lending into priority sectors.

Banks were required to fund the public sector through the mandatory acquisition of low

interest-bearing Government securities or statutory liquidity ratio bonds to fulfill statutory

liquidity requirements.

7

Committee on the Financial System (Narasimham Committee I)

The Committee on the Financial System (The Narasimham Committee I) was set up in August

1991 to recommend measures for reforming the financial sector. Many of the recommendations

made by the committee, which addressed organizational Issues, accounting practices and

operating procedures, were implemented by the Government. The major recommendations that

were implemented included the following:

With fiscal stabilization and the Government increasingly resorting to market borrowing to

raise resources, the statutory liquidity ratio or the proportion of a banks net demand and

time liabilities that were required to be invested in Government securities was reduced from

38.5% in the pre-reform period to 25.0% in October 1997. This meant that the significance

of the statutory liquidity ratio shifted from being a major instrument for financing the public

sector in the pre-reform era to becoming a prudential requirement;

similarly, the cash reserve ratio or the proportion of a banks net demand and time liabilities

that were required to be deposited with RBI was reduced from 15.0% in the pre-reform

period to 4.5% currently;

special tribunals were created to resolve bad debt problems;

Most of the restrictions on interest rates for deposits were removed. Commercial banks

were allowed to set their own level of interest rates for all deposits except savings bank

deposits;

Substantial capital infusion to several state-owned banks was approved in order to bring

their capital adequacy closer to internationally accepted standards. By the end of fiscal

2002, aggregate recapitalisation amounted to Rs. 217.5 crore. The stronger public sector

banks were given permission to issue equity to further increase capital; and banks were

granted the freedom to open or close branches.

Committee on Banking Sector Reform (Narasimham Committee II)

The second Committee on Banking Sector Reform (Narasimham Committee II) submitted

its report in April 1998. The major recommendations of the committee were in respect of

capital adequacy requirements, asset classification and provisioning, risk management and

merger policies. RBI accepted and began implementing many of these recommendations in

October 1998.

8

DEFINATION OF BANK

The bank is dealer in credit its own and other peoples. - Crowhther

A bank is a financial intermediary, a dealer in loans and debt. - Cairncroses

Accepting for the purpose of lending of investment of deposits of money from public repayable on

demand or otherwise and withdraw able by Cheque, Draft, order or otherwise.

- Indian Banking Regulation Act 1949

9

1.2 Growth and Performance

The growth in the Indian Banking Industry has been more qualitative than Quantitative and it is

expected to remain the same in the coming years. Based on The projections made in the "India

Vision 2020" prepared by the Planning Commission and the Draft 10th Plan, the report forecasts

that the pace of expansion in the balance-sheets of banks is likely to decelerate.

The total assets of all scheduled commercial banks by end-March 2010 is estimated at Rs

40, 90,000 crores. That will comprise about 65 per cent of GDP at current Market prices as

compared to 67 per cent in 2002-03. Bank assets are expected To grow at an annual composite

rate of 13.4 per cent during the rest of the decade as against the growth rate of 16.7 per cent that

existed between 1994-95 and 2002-03. It is expected that there will be large additions to the

capital base and reserves on the liability side.

The Indian Banking industry, which is governed by the Banking Regulation Act

Of India, 1949 can be broadly classified into two major categories, non-scheduled banks and

scheduled banks. Scheduled banks comprise commercial Banks and the co-operative banks. In

terms of ownership, commercial banks can Be further grouped into nationalized banks, the State

Bank of India and its group Banks, regional rural banks and private sector banks

(The old/ new domestic and foreign). These banks have over 67,000 branches spread across the

country.

The Public Sector Banks (PSBs), which are the base of the Banking sector in India account for

more than 78 per cent of the total banking industry assets. Unfortunately they are burdened with

excessive Non-Performing assets (NPAs),Massive manpower and lack of modern technology. On

the other hand the Private Sector Banks are making tremendous progress. They are leaders in

Internet banking, mobile banking, phone banking, ATMs. As far as foreign banks are concerned

they are likely to succeed in the Indian Banking Industry.

In the Indian Banking Industry some of the Private Sector Banks operating is IDBI Bank, ING

Vyasa Bank, SBI Commercial and International Bank Ltd, Bank of Rajasthan Ltd. and banks from

the Public Sector include Punjab National bank, Vijaya Bank, UCO Bank, Oriental Bank, Allahabad

Bank among Others. ANZ Grindlays Bank, ABN-AMRO Bank, American Express Bank Ltd,

Citibank are some of the foreign banks operating in the Indian Banking Industry.

10

BANKING SYSTEM IN INDIA

The modern banking system began with the opening of Bank of England in 1694. Bank of

Hindustan was the first bank to be established in India, in 1770. The earliest institutions that

undertook banking business under the British regime were agency houses which carried on

banking business in addition to their trading activities. Most of these agency houses were closed

down during 1929-1932. Three Presidency banks known as Bank of Bengal, Bank of Bombay and

Bank of Madras were open in 1809, 1840 and 1843 respectively at Calcutta, Bombay and Madras.

These were later merged into the Imperial Bank of India in 1919 following a banking crisis.

The first bank of limited liability managed by Indians was the Oudh Commercial Bank started in

1881. Earlier between 1865 and 1870, only one bank, the Allahabad Bank Ltd., was established.

Subsequently, the Punjab National Bank began in 1894 with its office at Anarkali Market in Lahore

(now in Pakistan). The swadeshi movement, which began in 1906, prompted formation of a

number of commercial banks such as the people Bank of India Ltd., the central Bank of India, the

Indian Bank Ltd. And the Bank of Baroda Ltd. A series of banking crises between 1913-1917

witnessed the failure of 588 banks. The Banking Companies (Inspection Ordinance) came in

January, 1946 and Banking Companies (Restriction of Branches) act was passed in February,

1946. The Banking Companies Act was passed in February 1946, which was later amended to be

known as the Banking Regulation Act, 1949.

Meanwhile, the RBI Act 1934 was passed and the Reserve Bank Of India became the first central

bank of the country w.e.f. 01.04.1935, it took over the central banking activities from the Imperial

Bank of India. The RBI was nationalized on 01.01.1949. The Imperial Bank of India was partially

nationalized to form the Stat Bank of India in 1955. In 1959, subsidiaries of the SBI namely, Stat

Bank of Bikaner & Jaipur, Stat Bank of Hyderabad, State Bank of Indore, State Bank of Mysore,

State Bank of Patiala, State Bank of Saurashtra and State Bank of Travancore were established.

On July 19

th

1969, the Government of India took over ownership and control of 14 major banks in

the country with deposits exceeding R.s 50 crore each. Again on 15

th

April, 1980, six more banks

with total time and demand liabilities exceeding R.s 200 crores were nationalized. In 1993, one of

the nationalized banks namely, New Bank of India was merged with another nationalized bank i.e.

Punjab National Bank.

The status of public sector banks, private sector banks, foreign banks and Indian banks with

overseas presence has been dealt with individually.

11

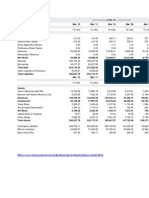

Parameter of banking sector efficiency

Year Return on

Assets (%)

Net

interest

Margin (%)

Cost-

income

ratio (%)

Business

per

employee

(Rs.Lakh)

Business

per branch

(Rs. Lakh)

2001 0.54 3.1 25.9 2.1 34.7

2002 0.82 2.8 22.3 2.5 39.5

2003 1.05 2.9 22.1 2.8 43.0

2004 1.21 3.1 23.7 3.1 47.7

2005 0.97 3.1 26.1 3.5 53.6

2006 0.96 3.0 26.8 4.1 62.6

2007 1.00 2.9 24.0 4.6 68.6

2008 1.10 2.6 21.0 5.6 79.8

2009 1.10 2.6 19.2 6.5 90.1

2010 1.01 2.5 20.2 7.1 92.1

2011 1.06 2.9 21.6 7.7 99.5

2012 1.05 2.9 18.5 8.3 99.3

12

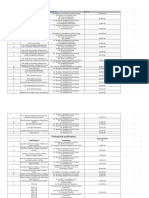

1.4 Market players in the Industry

13

No. Nationalized

bank & SBI &

associate bank

Private bank Co-operative bank Foreign bank

1. Bank of Baroda AXIS bank AMCO bank Ltd. Abu Dhabi commercial bank

2. Bank of India HDFC bank Kalupur commercial

Coop bank Ltd.

Australia & New Zealand bank

3. Allahabad bank ICICI bank Madhavpura

Mercantile Coop bank

Ltd.

Bank International Indonesia

4. Andhra bank Indusland bank Mehsana Urban Coop

bank Ltd.

Bank of America NA

5. Bank of

Maharashtra

ING Vysya

bank

Nutan Nagrik

Sahakari bank Ltd.

Bank of Bahrain & Kuwait

6. Punjab national

bank

ABN Amro

bank

Rajkot Nagrik

Sahakari bank Ltd.

Bank of Ceylon

7. Central bank of

India

Catholic Syrian

bank

Sardar Bhiladwala

Pardi peoples Coop

bank Ltd.

Bank of Nova Scotia

8. Indian bank Dhanlaxmi

bank

Surat peoples Coop

bank Ltd.

Bank of Tokyo Mitsubishi UFJ

9. Indian Overseas

bank

Federal bank Amanath Coop bank

Ltd.

Barclay Bank PLC

10. Punjab & Sind

bank

Karnataka

bank

Andhra Pradesh

Mahesh Coop Urban

bank Ltd.

BNP Paribas

11. Oriental bank of

commerce

Karur Vysya

bank

Charminar Coop

Urban bank Ltd.

Calyon bank

12. Syndicate bank Kotak

Mahindra bank

Vasavi Coop Urban

bank Ltd.

Chinatrust commercial bank

13. UCO bank Lakshmi Vilas

bank

Indian Mercantile

Coop bank Ltd.

Citibank N.A.

14. Union bank of

India

Tamilnadu

Mercantile

bank

Abhyudaya Coop

bank Ltd.

Credit Suisse

14

15. United bank of

India

The South

Indian bank

Bassein Catholic

Coop bank Ltd.

Commonwealth Bank of

Australia

16. Vijya bank YES bank Bharat Coop bank

Ltd.

DBS bank

17. Repco bank UP agro

corporation

bank

Bharati Sahakari

Coop bank Ltd.

RHB bank

18. IDBI bank City union bank Bombay Mercantile

Coop bank Ltd.

Deutsche Bank AG

19. State bank of

India

Gondal Nagrik

Sahakari Bank

Ltd.

Citizen Credit Coop

bank Ltd.

Standard Chartered bank

20. State bank of

Bikaner & Jaipur

Cosmos Coop Urban

bank Ltd.

UBS

21. State bank of

Hyderabad

Dombivli Nagrik

Sahakari Coop bank

Ltd.

Shinhan bank

22. State bank of

Mysore

Goa Urban Coop

bank Ltd.

Sonali bank

23. State bank of

Patiala

Gopinath Patli Parsik

Janata Sahakari bank

Ltd.

Swapnil bank

24. State bank of

Travancore

Greater Bombay

Coop bank Ltd.

HSBC

25. State bank of

Atitmand &

Beawar

Jalgaon Janata

Sahakari bank Ltd.

FirstRand bank

26. State bank of

Banglore

Janakalyan Sahakari

bank Ltd.

Royal bank of Scotland

27. State bank of

Hemadri

Janalaxmi Coop bank

Ltd.

JPMorgan Chase bank

28. Janata Sahakari bank

Ltd.

Krung Thai bank

29. Kallappanna Awade

Ichalkaranji Janata

Masreq bank psc

15

Sahakari bank Ltd.

30. Kalyan Janata

Sahakari bank Ltd.

Mizuho corporate bank

31. Karad Urban Coop

bank Ltd.

VTB

32. Mahanagar Coop

bank Ltd.

Woori bank

33. Mapusa Urban Coop

bank of Goa Ltd.

State bank of Mauritius

34. Nagar Urban Coop

bank Ltd.

35. Nasik Merchants

coop bank Ltd.

36. New India Coop bank

Ltd.

37. NKGSB Coop bank

Ltd.

38. Pravara Sahakari

Coop bank Ltd.

39. Punjab & Maharashtra

Coop bank Ltd.

40. Rupee Coop bank

Ltd.

41. Sangli Urban Coop

bank Ltd.

42. Saraswat Coop bank

Ltd.

43. Shamrao Vithal Coop

bank Ltd.

44. Solapur Janata

Sahakari bank Ltd.

45. Thane Bharat

Sahakari bank Ltd.

46. Thane Janata

Sahakari bank Ltd.

16

47. The Kapol Coop bank

Ltd.

48. Zoroastrian Coop

bank Ltd.

49. Nagpur Nagrik

Sahakari bank Ltd.

50. Shikshak Sahakari

bank Ltd.

51. The Akola Janata

commercial Coop

bank Ltd.

52. The Akola Urban

Coop bank Ltd.

53. The Khamgaon Urban

Coop bank Ltd.

Source:

List of banks in India - Wikipedia, the free encyclopedia

http://www.bankingawareness.com/banking-gk/list-of-co-operative-banks-in-india/

17

2. Company overview :-

18

2.1 History

ING VYSYA Bank Ltd is a premier private sector bank with retail, private and wholesale banking

platforms that serve over two million customers. With 80 years of history in India and leveraging

INGs global financial expertise, the bank offers a broad range of innovative and established

products and services, across its 527 branches. The bank, which has close to 10,000 employees,

is also listed in Bombay Stock Exchange Limited and National Stock Exchange of India Limited.

ING Vysya Bank was ranked among top 5 Most Trusted Brands among private sector banks in

India in the Economic Times Brand Equity Neilsen survey 2011.

The bank was formed from the 2002 acquisition of an equity stake in Indian Vysya Bank by the

Dutch ING Group. This merger marked the first between an Indian bank and a foreign bank. Prior

to this transaction, Vysya Bank had a seven-year old strategic alliance with erstwhile Belgian bank

Banque Bruxelles Lambert, which was also acquired by ING Group in 1998.

About ING Group

ING is a global financial institution of Dutch origin offering banking, investments, life insurance and

retirement services.

More than 84,000 ING employees server over 61 million private, corporate and institutional

customers in over 40 countries in Europe, North America, Latin America, Asia and Australia.

We draw on our experience and expertise, our commitment to excellent service and our global

scale to meet the needs of a broad customer base, comprising individuals, families, small,

businesses, large corporations, institutions and governments

1) Global headquarters

The Group's corporate headquarters, ING House, is located in the business district

of Zuidas in Amsterdam, Netherlands. It was designed by Roberto Meyer and Jeroen van

Schooten and was officially inaugurated on September 16, 2002 by Prince Willem-

Alexander of the Netherlands. The light-infused building features a 250-seat auditorium,

foyer, restaurant, library and an extensive art collection.

19

2.12 COMPANY PROFILE

Name of Company : ING Vysya Bank Ltd.

Type : Private Limited

Industry : Banking, Finance, Service, Insurance (BFSI)

Founded : 2002 (est.1930 as Vysya Bank)

Headquarters : Bangalore, India

Key People : Shailendra Bhanderi (CEO & MD)

Arun Thiagarajan (Chairman of the Board)

Revenue : Rs. 5588 Cr ($1.0B) (as on March 31, 2013)

Total Assets : Rs.54836 Cr ($9.9B) (as on March 31, 2013)

Employees : Over 10,000

No. of Branches : 527

No. of ATMs : 405

Corporate Identify:-

20

2.2 Growth and Development

Rural India accounts for roughly 70% of the population located in 6, 37,000 villages across the

country. Out of the 89.30 million farmer households 45.9 million do not have access to credit either

from the institutional or non-institutional sources (NSSO 2008). Though the banking industry has

shown tremendous growth during the last few decades in all areas relating to financial viability,

profitability and competiveness, there are concerns that banks have not been able to include

certain segments of the population, especially the under-privileged sections of society, into the fold

of basic banking services. The financially excluded sections of society also include the urban slum

dwellers and migrant workers in urban areas. This has been an area of concern and focus of the

Government and Reserve Bank of India (RBI)

Several initiatives have been underway to empower the marginalized sections through awareness

and education and access to basic banking services such as savings, credit and insurance.

However data collated through various surveys indicate that for every 100 adult persons there are

only 17 credit accounts and 54 savings accounts with all the financial institutions put together

(June 2007), thereby highlighting the need for more concerted efforts from the Government,

Regulators and the Banks Towards ensuring financial inclusion The term 'Financial inclusion' (FI)

is defined as including the excluded sections of disadvantaged and low income groups into the

formal financial sectors by delivery of banking services at an affordable cost. The services offered

under FI constitute 'no frills' accounts, access to savings products, providing easy and right

quantum of credit at affordable interest rates, insurance etc.

Our bank has drawn a three year plan to achieve Financial Inclusion objectives and has taken up

several steps in this regard. The highlights of these are:

We are providing Banking Services in 295 villages across the country

As on September 2010, the Bank has opened 84000 No frill accounts.

Covered 6.27 lac persons under financial inclusion.

21

1930 Set up in Bangalore

1948 Scheduled Bank

1985 Largest Private sector Bank

1987 The Vysya Bank Leasing Ltd. Commenced

1988 Pioneered the concept of Co-Branding of credit cards

1990 Promoted vysya Bank Housing Finance Ltd.

1992 Deposits Cross R.s 1000 Crores

1993 Number of Branches Crossed 300

1996 Signs strategic Alliance with BBL., Belgium. Two National Awards By gem &

Jewellery export promotion council for excellent performance in export promotion.

1998 Cash Management services & Commissioning of VSAT. Golden Peacock Award

for the Best HR practices by institute of Directors. Rated as best Domestic Bank in

India by Global Finance (International Financial Journal-June 1998)

2000 State-of the art date Centre at ITPL, Bangalore. RBI clears Setting up of ING Vysya

Life Insurance Company

2001 ING VYSYA Commenced Life Insurance Business.

2002 The Bank Launched a range of Products & services Like the vys vyapar plus, the

range of loan schemes for traders, ATM services, smartserv, Personal assistant

service, save & secure, an account that provides accident hospitalization and

insurance cover, sambandh, the international Debit Card and the Mi-bank net

Banking service.

2002 ING takes over the Management of the Bank from October 7

th

, 2002

2002 RBI clears the new names of the Bank as ING VYSYA Bank Ltd, Vide Their Letter

of 17.12.02

2003 Introduced Customer friendly products like orange savings, orange current and

protected Home Loans

2004 Introduced Protected Home Loans Housing Loan Product

2005 Introduced Solo- My own Account for Youth And Customer service Line- Phone

Banking Service

2006 Introduced solo My own Account for youth and customer service line- phone

banking service

2010 Bank has opened 84000 No Frill accounts.

22

2.3) Performance and key performance data

Sr.N

o.

Indicators

2007-

2008

2008-

2009

2009-2010

2010-2011 2011-2012

1 Deposits 5342.66 6655.63 7212.95 9136.68 12060.00

2 Advances 3200.71 3896.54 4621.65 6384.27 8510.00

3 Share Capital 81.97 86.91 91.92 121.11 291.00

4 Reserves 503.68 613.35 786.85 931.09 1040.00

5 Investments 2869.22 2943.98 3003.79 3989.00

6 Net Profit 72.93 90.48 55.37 111.13 137.00

7

Working

Capital

6088.12 7563.06 8433.48

10599.54 13824.00

8

Net NPA

Percentage

2.29% 2.08% 1.78%

1.54% 4.79%

23

2.3 Products/ Service overview

1) E-TICKETING :-

You can book your railway, air and bus tickets online through Online ING Vysya Bank.

To book your train ticket, just log on to irctc.co.in and create an ID there at if you do not have one.

Submit your travel plan and book the ticket(s)-either

2) ING E-TAX:-

You can pay your taxes online through ING E-Tax. This facility enables you to pay TDS, Income

tax, Indirect tax, Corporation tax, Wealth tax, Estate Duty and Fringe Benefits tax. Click the e-Tax

link in the home page. You are displayed a page with two links Direct Tax and Indirect Tax.

3) Bill Payment:-

A simple and convenient service for viewing and paying your bills online.

No more late payments

No more queues

No more hassles of depositing Cheque

4) RTGS/NEFT:-

You can transfer money from your ING Bank account to accounts in other banks using the

RTGS/NEFT service. The RTGS system facilitates transfer of funds from accounts in one bank to

another on a "real time" and on "gross settlement" basis. This system is the fastest possible

interbank money transfer facility available through secure banking channels in India. RTGS

transaction requests will be sent to RBI immediately during working hours post working hours

requests are registered and sent to RBI on next working day. You can also schedule a transaction

for a future date. You can transfer an amount of Rs.1 lac and above using RTGS system.

National Electronic Funds Transfer (NEFT) facilitates transfer of funds to the credit account with

the other participating bank. RBI acts as the service provider and transfers the credit to the other

BanksAccount.

NEFT transactions are settled in batches based on the following timings

1. 6 settlements on weekdays - at 09:00, 11:00, 12:00, 13:00, 15:00 and 17:00 hrs.

2. 3 settlements on Saturdays - at 09:00, 11:00 and 12:00 hrs.

24

5) E-Payment:-

You can pay your insurance premium, mobile phone bills and also you can purchase mutual fund

units by coming from the billers website and selecting ING bank of India in the payment option.

6) Fund Transfer:-

The Funds Transfer facility enables you to transfer funds within your accounts in the same branch

or other branches. You can transfer aggregating Rs.1 lakh per day to own accounts in the same

branch and other branches. To make a funds transfer, you should be an active Internet Banking

user with transaction rights. Funds transfer to PPF account is restricted to the same branch.

7) Third Party Transfer:-

You can transfer funds to your trusted third parties by adding them as third party accounts. The

beneficiary account should be any branch ING. Transfer is instant. You can do any number of

Transactions in a day for amount aggregating Rs.1lakh.

8) Demand Draft:-

The Internet Banking application enables you to register demand drafts requests online. You can

get a demand draft from any of your Accounts (Savings Bank, Current Account, Cash Credit or

Overdraft). You can set limits for demand drafts issued from your accounts or use the bank

specified limit for demand drafts.

9) Cheque Book Request:-

You can request for a Cheque book online. Cheque book can be requested for any of your

Savings, Current, Cash Credit, and Over Draft accounts. You can opt for Cheque books with 25,

50 or 100 Cheque leaves. You can either collect it from branch or request your branch to send it

by post or courier. You can opt to get the Cheque book delivered at your registered address or you

can provide an alternate address. Cheque books will be dispatched within 3 working days from the

date of request.

10) Account Opening Request:-

Online ING enables you to open a new account online. You can apply for a new account only in

branches where you already have accounts. Funds in an existing account are used to open the

new account. You can open Savings, Current, Term Deposit and Recurring Deposit accounts of

Residents, NRO and NRE types.

25

11) Account Statement :-

The Internet Banking application can generate an online, downloadable account statement

for any of your accounts for any date range and for any account mapped to your username.

The statement includes the transaction details, opening, closing and accumulated balance in

the account.

12) Transaction Enquiry :-

Online ING provides features to enquire status of online transactions. You can view and

verify transaction details and the current status of transactions. Your VISA transactions can

also be viewed separately. Just log on to retail section of the Internet Banking site with your

credentials and select the Status Enquiry link under the Enquiries tab. You will be displayed

all online transactions you have performed. To view details of individual transactions, you

need to click the Transaction Reference number link. You are displayed the debit and credit

account details, transaction amount, narration and transaction status

13) Demat Account Statement :-

Online ING enables you to view Demat account statement and maintain such accounts.

The bank acts as your depository participant. In the third party site, you can mark a lien on

your Demat accounts and use the funds to trade on stock using funds in your ING savings

account.

26

2.5 Departmental overview

ING Vysya Bank has over 80 years of operating experience in the banking/financial services &

insurance sector and currently serves over 2 million Indian consumers. The bank offers an entire

range of financial products and services, organized under three strategic lines of business: retail,

private and wholesale banking.

Retail Banking

With 527 branches and 10 counters, 28 satellite offices and 470 ATM's nationwide, ING Vysya's

retail operation offers checking accounts, savings deposits/CD's, retail wealth management

services, consumer loans, agricultural/rural banking and retail life insurance products. The bank

has rapidly expanded its distribution footprint and has created a national brand presence through

several innovative marketing campaigns.

Private Banking

ING Vysya's private bank operates on an advisory-driven model. Specialized market research

remains the bank's focus for the introduction of new tailored products to serve the high-end private

banking segment.

Corporate/Wholesale Banking

The wholesale banking business provides corporate clients in India a range of commercial,

transactional and electronic banking products. The bank offers client focused products including

working capital finance, trade and transactional services, foreign exchange, term loans and cash

management services. The wholesale banking business comprises four business sub-segments

and multiple product offerings. The business segments Corporate and Investment Banking,

Emerging Corporatism, Banking and Financial Institutions and financial markets.

Agriculture and Rural Banking

Agriculture and Rural Banking deals with all business related to agriculture and allied activities,

Gold Loans, loans to SHGs and lending to government sponsored schemes. Working Capital and

Agriculture Term Loans for Poultry, Dairy, Cold storage units etc. are also being offered to cater

diverse needs of the farming community. The Bank has accelerated retail agricultural lending at a

few places in North India and Central India especially in Rajasthan, Uttarakhand, Maharashtra,

Gujarat and Madhya Pradesh.

27

Personal Banking:

The personal banking department of ING Vysya Bank Ltd offers high quality services and solutions

to cater to the financial needs and preferences. The high end solutions make them a one stop

organization to fulfill the needs and requirements of the customers. Some of the well-known

services offered in the segment of personal banking are:

Mutual Funds

Tax Savings Bonds

Savings Account

NRI Services

Credit & Debit Card

Internet Banking

Phone Banking

Mobile Banking

Self-Banking

Term deposits

Demat accounting

Wealth management

Debit and credit card accounting

Payment services

28

Current Account

In this type of account person can deposit there money any time and can withdrew it anytime. In

this kind of account no Interest is paid. Moreover some banks charge/take service

charges for providing the facility. This type of account is mostly opened by the Business

community.

In the current account there are sub parts of the account:-

Orange Current Account

Advantage Current Account

General Current Account

Comfort Current Account

Flexi Current Account

29

2.6 SWOT Analysis

30

Strengths:-

ING as one on the Biggest Financial MNC. 7

th

in 500 Fortune .

Only foreign bank which has acquired an Indian Private Bank (Vysya Bank)

Higher rate of interest than other private banks.

Most of the financial plans are legalized under 80 (ccc)

Top notch customer care and staff behavior

Unique features with different kinds of accounts

Working hours

Weakness:-

Very few branches

Less variety of financial / banking products

Location

Less Advertisement

Customer not awareness

Few ATM

Opportunities:-

New segment of doctors, students and CAs as they like innovation in their financial needs

and like to enjoy the services.

High class (Upper strata population of city)

Increase In different kind of financial products

NGO and Public Relations

Threats:-

Presence of Two top private banking players in the market (ICICI, Axis Bank & HDFC)

Larger Market share already captured

31

Part II Research Work

32

1. Introduction of the study

Research is done to gain some knowledge so as to it may aid in understanding the

information gathered on specific topic. It is a scientific way of undertaking information on

specific and particular subjects. It is a scientific investigation to understand the cause and

effect as well as the reasons trough investigations. It is an academic activity and it is to be

used in technical sense.

Research indicates scientific and inductive thinking and it promotes the development of

logical habits of thinking and organization. The research methodology has gone through

which path to solve the research problem and which tools have been adopted to achieve

the desired objective and more importantly it tells why only that path or tools have been

chosen and not other.

Today competition and markets both have expanded. The company every now and then

cannot afford to undertake research activities as research involves huge cost. The

companies undertake research activities when it perceives that something is going wrong or

theyre in lack of information to solve a particular problem. In such cases only company

undertakes research activities. The research activity is totally dependent on managerial

problem and research objective.

33

3.1 Background of the study

Definition of comparative Analysis:-

The item-by-item comparison of two or more comparable alternatives, processes,

qualifications, sets of data, systems, or the like. In accounting, for example, changes in a

financial statements items over several accounting periods may be presented together to

detect the emerging trends In the companys operations and results. See also comparability

analysis.

34

3.2 Review of literature

1. Harry L. Marsh:-

A comparative analysis of crime coverage in newspapers in the United States and other

countries from 19601989

Research findings in the United States and other countries disclosed four areas in which

newspaper crime coverage was essentially the same: there is an overrepresentation of violent

crimes and an underrepresentation of property crimes; the percentages of violent crimes reported

in newspapers do not match official crime statistics; crime coverage presents a false image of the

effectiveness of police and courts in controlling crime and punishing criminals; and newspaper

coverage fails to educate readers as to causes of crime or how to avoid personal victimization.

2. Zaher, T.S., & Hassan, M.K.:-

A Comparative Literature Survey of Islamic Finance and Banking Nov 2001,

This paper provides a comprehensive review of the literature of the Islamic finance as well as

introduces Islamic financial instruments in order to compare them with those existing in other parts

of the world. It also discusses the legal problems that investors in Islamic financial instruments

encounter.

As the paper assesses the performance of the Islamic banking and financial sector and highlights

the regulations, current challenges, and bottlenecks, it concludes that:

Lack of developed markets in which Islamic financial instruments can be traded is one of

the problems caused by the lack of cooperation among Muslim financial institutions;

Further growth and development of the Islamic financial system will depend largely on the

nature of innovations introduced in the market;

Islamic financial system can offer alternatives at the microfinance level

35

3. Lucun Yang2

An Empirical Analysis of Current Account Determinants in Emerging Asian Economies

Large and persistent current account surplus in emerging Asia as a whole have attracted

considerable attention in recent years. However, limited empirical work has been done to

the diverging current account balances of the individual emerging Asian economies. Based

on the saving-investment approach, this paper provides an empirical investigation of both

the short-run and long-run determinants of current accounts for 8 largest emerging Asian

economies over the period 1980-2009 by using quarterly data. The empirical work adopts a

VAR (Vector Autoregression) framework and uses Johansen cointegration technique to

identify the short-run and long-run current account determinants for each selected

economy. The study finds that current accounts behave differently in emerging Asian

economies and no single pattern can be found. After controlling for the effects of income

growth, results indicate that, for most of the selected economies, both initial stocks of net

foreign assets and trade openness play important roles in explaining the long-run behaviors

of current accounts, but have less important roles in interpreting the short-run variations in

current accounts. Real exchange rate plays a less important role in current account

adjustments in both short-run and long-run than the common literature suggest

36

3.3 Statement of problem

During one month my Summer Internship I learn so many thing and I find some problem which

is faced by bank. ING Vysya Bank is Multinational Private Bank and faster growing. But Due to

very less Few Branches Available in Rajkot city. Bank need to more advertisement and

Marketing.

3.4 Objectives of the study

Any activity done without any objective in a mind cannot turn fruitful. An objective provides a

specific direction to an activity. Objectives may range from very general to very specific, but they

should be clear enough to point out with reasonable accuracy what researcher wants to achieve

through the study and how it will be helpful to the decision maker in solving problem.

PRIMARY OBJ ECTIVE:

To know the Current Account scheme provide by the Banks.

SECONDARY OBJ ECTIVE:

To Compare the Current Account Product of selected Banks.

3.5 Contribution and learning from the project

I have done my summer training at ING Vysya Bank. I was given in training by ING Vysya Bank

for during one month which I learned about Current Account, its importance and the main focus on

customer Preference about Current Account.

I have learned many valuable things which will be very helpful in my career.

I have learned about the Current Account, its benefits and its importance.

I compare the Current account scheme of selected Bank and I come to know the

Preference about customer.

I have also come to know about Comparative analysis in the field of banks.

37

CH.4 Research

Methodology

38

Research

is defined as human activity based on intellectual application in the investigation of matter. The

primary purpose for applied research is discovering, interpreting, and the development of methods

and systems for the advancement of human knowledge on a wide variety of scientific matters of

our world and the universe.

The term research is also used to describe an entire collection of information about a particular

subject.

Methodology is the method followed while conducting the study on a particular project. Through

this methodology a systematic study is conducted on the basis of which the basis of a report is

produced .It is a written game plan for conducting Research. Research methodology has many

dimensions. It includes not only the research methods but also considers the logic behind the

methods used in the context of the study and explains why only a particular method or technique

has been used. It also helps to understand the assumptions underlying various techniques and by

which they can decide that certain techniques will be applicable to certain problems and other will

not. Therefore in order to solve a research problem, it is necessary to design a research

methodology for the problem as the some may differ from problem to problem. The methodology

adopted for studying the objectives was surveying the in-house customers of this bank in the

city of Rajkot.

NATURE

The methodology adopted to achieve the project objective involved descriptive research method.

The information required for fulfilling the objective of study was collected from various primary and

secondary sources.

TYPE OF RESEARCH

This study is DESCRIPTIVE in nature. It helps in breaking vague problem into smaller and

precise problem and emphasizes on discovering of new ideas and insights.

39

4.1 Research Design

A framework or blueprint for conducting The ING Vysya Bank research project.

It specifies the details of the procedures necessary for obtaining the information needed to

structure and solve The ING Vysya Bank research problem. A good research design will ensure

that the marketing research project is conducted effectively and efficiently.

4.2 SAMPLING METHOD

This survey is conducted by CONVENIENT SAMPLING METHOD

4.3 Sample Size

It refers to how many people to be surveyed. Sample size should be optimum to do survey to get

more reliable result. For research sampling size was 50 people who like to do import export.

4.4 Data Sources

The sources from which we get the information or data for research is known as data

sources. It is very important the reliable source of information for keeping accuracy in both the

data collection as well as the decision making. The researcher can gather primary data and

secondary data.

1) Primary Data:-

The data that are freshly gathered for specific purpose or for a specific research project.

The researcher collects the data on his own without any use of secondary data. Here we got

the information by filled up the 50 questionnaires through respondents. We started our

investigation by examine primary data without collecting secondary data.

2) Secondary Data:-

The data which already exists somewhere and it was gathered for same other purpose in

the past. Here we got the information through internet by using different websites. We started

our investigation by examine secondary data to see whether the problem can be partly or

wholly solved without collecting costly primary data.

When the required data do not exist or out dated, inaccurate, incomplete or

unreliable then we collected the primary data through various research approaches.

40

4.5 RESEARCH INSTRUMENT

Questionnaire

In research we have used questionnaire as a research instrument.

For our report we have used STRUCTURED QUESTIONNAIRE that includes both types of

questions. In questionnaire few Open ended question and most of the question are close ended.

In close ended type of questions we have used multiple choice questions.

41

Ch.5 ANALYSIS AND

INTERPRETATION OF

DATA

42

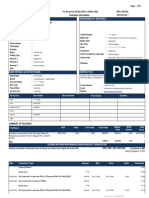

Comparative Analysis of Current Account scheme provided by Banks.

Particular

ING Vysya

Bank

HDFC

Bank

Axis Bank ICICI Bank

Account name Orange

Current

Account

Merchant

Current

Account

Business

Current

Account

Roaming

Current Account

Average quarterly balance 100000 150000 150000 150000

AQB maintenance charges Free 900 per

quarter

Nominal

Cost

Nominal Cost

Third Party Cash withdrawal /

Deposit

Free Free Free Free

Net Banking Free Free Free Free

Mobile Banking Free Free Free Free

Free DD Free up to

20000000

Free Up to

50000

Free up to

50000

Free up to

50000

RTGS Facility Free Free Free Free

DD/PO wavier Free Free Free Free

Account statement Free Free Free Free

43

Survey Analysis [Customer Questionnaire]

(A) Current Account of Respondents in The Bank.

Business Turnover Annual:-

income %

less than 10,00,000 48

1000000-2000000 34

2000000-4000000 4

4000000-6000000 4

6000000-8000000 4

8000000-10000000

10000000 or Above 6

In this chart we can say that, out of 50 Respondents there are 48 % Respondents Turnover

is less than 10,00,000 R.s and the highest Turnover 1,00,00,000 R.s there are 6 %

Respondent.

48

34

4

4

4

0

6

Business Turnover%

less than 10,00,000

1000000-2000000

2000000-4000000

4000000-6000000

6000000-8000000

8000000-10000000

10000000 or Above

44

1) Accounts with the Bank

Bank Account %

Axis Bank 20

ING Vysya Bank 14

ICIC+I Bank 26

HDFC Bank 34

Other 6

In this chart we can say that out of 50 Respondent 34 % are having Bank account in the

HDFC Bank because of their brand and quality of service. In ING Bank only 14 %

Respondent Having Bank Account in the ING Vysya Bank due to not aware about ING

Vysya Bank and Very few of Branches.

20

14

26

34

6

0

10

20

30

40

Axis Bank ING Vysya

Bank

ICICI Bank HDFC Bank Other

Account in the Banks %

%

45

Extra benefits associated with Current Account

extra benefits associated with Current Account %

Axis Bank 16

ING Vysya Bank 12

ICICI Bank 26

HDFC Bank 34

Other 12

In this chart we can say that out of 50 Respondent 34 % Respondent say that HDFC Bank

provide extra benefit and ING Vysya bank provide benefit 12 % And ING Vysya Bank

Provide 12 % Benefit.

16

12

26

34

12

0

10

20

30

40

Axis Bank ING Vysya

Bank

ICICI Bank HDFC Bank Other

Extra Benefit Provide Banks %

%

46

Speedy Transaction with respect to.

Speedy Transaction %

Axis Bank 24

ING Vysya Bank 16

ICICI Bank 26

HDFC Bank 32

Other 2

In this chart out of 50 Respondent there are 32 % say that HDFC Bank speedy Transaction

and 16% Respondent say that ING Vysya Bank Is not more than other Bank.

24

16

26

32

2

0

5

10

15

20

25

30

35

Axis Bank ING Vysya

Bank

ICICI Bank HDFC Bank Other

Speedy transaction %

%

47

Bank charges lesser penalty for not maintaining minimum balance for Current

Account.

Bank charges lesser penalty for not Maintaining minimum balance for Current Account. %

Axis Bank 22

ING Vysya Bank 16

ICICI Bank 24

HDFC Bank 28

Other 10

Above the charts Most of the banks provide lesser penalty for not maintaining minimum

balance. HDFC Bank is highest 28 % and ING Vysya Bank Respondents are 16 %

22

16

24

28

10

0

5

10

15

20

25

30

Axis Bank ING Vysya

Bank

ICICI Bank HDFC Bank Other

lesser penalty for not Maintaining

minimum balance%

%

48

Do you believe your Bank charges lower Charge for your Current Account Facility?

Do you Believe your Bank charges lower Charge for your Current Account Facility %

Yes 70

No 30

In this chart we can say that Majority of the respondent say that their Bank charges are less and

remaining 30 % respondents are says that their customers are believe that charges is high.

70

30

Bank charges %

yes

no

49

Aware of Current Account offered by ING VYSYA Bank

Aware about ING VYSYA Bank %

Yes 35

No 65

In this chart we can say that only 35 % Respondent aware about ING Vysya Bank because

of less Branches and Less Advertisement.

35

65

Aware about ING VYSYA Bank %

Yes

No

50

Interest in ING VYSYA BANK

People interested in ING VYSYA Bank %

Yes 25

No 75

In this chart out of 50 Respondent 75 % not Interested in the ING Vysya Bank due to less of

Branches and Product. Only 25 % Respondents are interested in the ING Vysya Bank.

25

75

People intrested in ING VYSYA Bank %

Yes

No

51

If no, why would you not prefer to open an Account with ING VYSYA BANK?

1. Peoples are not aware about ING VYSYA Bank

2. Limited Branches

3. Very Few ATMs

52

CH.6 Result and

Finding

53

RESULTS

In this Project the final results are as under.

Out of 50 Respondent 48 % are Turnover is less than 10,00,000 R.s

Out of 50 Respondent 34 % are having Bank account in the HDFC Bank and In the ING

Vysya Bank having 14 % current Account.

Most of the Respondent satisfied with their Current Bank

ING Vysya Bank is multiple and fast growing bank.

54

FINDINGS

From the one month experience of my research project with ING Vysya Bank Researcher has

come to know a lot of things and it has enhanced knowledge to a great extent. Researcher found

so many good things, which are, very well executed by the company. Findings are as under:

More number of people has account with public banks. Majority of the respondents whether

in public sectors or in private sector banks have current account with banks.

Number of problem faced by the people is more in public sector banks.

People want a change in the behavior of the staff of the Private sector Banks.

Most of the respondent does not want to shift from their present Bank.

Most of the respondent loyal for their Present Bank

55

CH 7. Suggestions and

conclusion

56

7 Suggestions and conclusion

Many of the respondents are not aware about their key services. Bank has to take some

initiatives.

Bank can post a list of the services that they can render to the customer inside the bank

premises.

ING Vysya Bank has to improve its brand image i.e. create a position in the mindset of the

customer.

It should more emphasize on advertisement. Advertisement Is most powerful tool for

position and brand in the mindset of customer.

ING Vysya Bank should ask for their customer feedback to know whether the consumers

are satisfied or dissatisfied.

Due to intense competition in the financial market. ING Vysya Bank should adopt better

strategy to attract more customer.

57

Conclusion

After having all the required information for preparing my report, I have tried to

analyze each and every function of ING Vysya Bank. During my report all the member of ING

Vysya Bank had well co-operate me. I have also found that there is a very good level of

commitment in all the staff members. During my report preparation, I have tried to cover each

functional area of the bank; I can conclude that the ING is one of the leading banks in banking

sector, and with advanced technologies and educated staff to trying to positioning in the banking

market. But due to some weakness, ING is also suffering from such limitations.

58

8. Limitations of the study

Research is self-financed so money is major constraint

Time is only 4 weeks, so much of economic fluctuations are not seen

Businessman has no Time to give response.

Sometime Response should be buyers.

59

10 Bibliography

Bibliography

Principles & practices of Banking (second edition ed.). (2008). Indian Institute of Banking & Finance.

Chandra, P. (2012). Financial Management. Rajkot: Tata mcgraw Hill education Pvt Ltd.

Iyengar, G. (2007). Introduction to Banking (First Edition ed.). (G. Iyengar, Ed.) New Delhi, New Delhi,

India.

Paul, P. d. (2007). Management Of Banking (second Edition ed.). South Asia: Dorling Kindersley.

Works Cited

Wikipedia. (n.d.). List of Banks in India. Retrieved july 08, 2013, from www.Wikipedia.com:

http://www.bankingawarness.com/banking-gk/list-of-co-operative-banks-in-india

60

Annexures

Questionnaire

Customer Preference for Current Account Services: A Comparative study

between Selected Banks.

Dear Respondent,

We are conducting a research to know the general perception and attitude of customer towards

the products & services that are offered by ING Vysya Bank & other private banks (HDFC Bank,

Axis Bank and ICICI Bank) in Rajkot. The information will be valuable input the research and we

assume you that the information will be kept confidential. We hope that you will co-ordinate with us

and give quite a few minutes from your precious time and give the genuine answer.

Personal Detail :-

Name: - _______________________________

Gender:-

Male

Female

Occupation:-_____________________________

Contact No:-_____________________________

How much your Business Turnover Annual:-

1000000-2000000

2000000-4000000

4000000-6000000

6000000-8000000

8000000-10000000

10000000 or Above

61

1) Do you have Current Account?

Yes

No

2) With which Bank do you have Current Account :-

Axis Bank

ING VYASYA Bank

ICICI Bank

HDFC Bank

Other___________________________

3) Why did you prefer to open Current Account with :-

___________________________________________________________________________

___________________________________________________________________________

4) Which Bank Among the following provides extra benefits associated with Current Account free

of Cost (Tick the Bank)

Axis Bank

ING VYSYA Bank

HDFC Bank

ICICI Bank

Other__________

5) Which Bank according to you offers Speedy Transaction.

Axis Bank

ING VYSYA Bank

HDFC Bank

ICICI Bank

6) Which Bank charges lesser penalty for not maintaining minimum balance for Current Account?

Axis Bank

ING VYSYA Bank

HDFC Bank

ICICI Bank

62

7) Do you believe your Bank charges lower Charge for your Current Account Facility?

Yes

No

8) Which Bank according to you provide below facilities at the lowest charges (Please Tick)

Particular Axis Bank ING VYSYA

Bank

ICICI Bank HDFC Bank

Free

Remittance

1. DD

2. PO

3. RTGS

4. EFT

5. NEFT

9) Which Bank Provide the Free Deposit Limit Per Month?

Axis Bank

ING VYASYA Bank

ICICI Bank

HDFC Bank

Other___________________________

10) Are you aware of Current Account offered by ING VYSYA Bank?

Yes

No

11) Are you interest in ING VYSYA BANK?

Yes

No

12) If no, why would you not prefer to open an Account with ING VYSYA Bank

______________________________________________________________________________

______________________________________________________________________________

You might also like

- AttendHRM User ManualDocument131 pagesAttendHRM User ManualSeshukumar Mathampalli100% (1)

- Agent Banking in Mobile Applicationv.4 - WithcommentsDocument25 pagesAgent Banking in Mobile Applicationv.4 - WithcommentsCielo CuisiaNo ratings yet

- A Project Report ON Recruitment and Selection in ICICI Bank LTDDocument8 pagesA Project Report ON Recruitment and Selection in ICICI Bank LTDnitika_gupta219481No ratings yet

- Kotak MahindraDocument52 pagesKotak MahindraPranay JuwatkarNo ratings yet

- Balance Sheet of Axis BankDocument8 pagesBalance Sheet of Axis BankKushal GuptaNo ratings yet

- Project ReportDocument21 pagesProject Reportbhagya100% (1)

- Final Final BlackbookDocument105 pagesFinal Final BlackbookIsha PednekarNo ratings yet

- Merchant BankingDocument25 pagesMerchant Bankingsshishirkumar50% (2)

- Best Practices 2 Sindhu Durg DCCB PDFDocument13 pagesBest Practices 2 Sindhu Durg DCCB PDFPRALHADNo ratings yet

- KalupurDocument70 pagesKalupuranushree100% (5)

- Kalupur 14719Document78 pagesKalupur 14719Parmar HitendrakumarNo ratings yet

- Summer Training Project: (Seth Jai Parkash Mukand Lal Institute of Engineering and Technology, Radaur)Document86 pagesSummer Training Project: (Seth Jai Parkash Mukand Lal Institute of Engineering and Technology, Radaur)Anonymous 7q2hVLAB2pNo ratings yet

- Roll No. 161 (PROJECT REPORT ON "IMPACT OF E-BANKING ON SERVICE QUALITY OF BANKS")Document96 pagesRoll No. 161 (PROJECT REPORT ON "IMPACT OF E-BANKING ON SERVICE QUALITY OF BANKS")Varun Rodi0% (1)

- Merchant Banking (In The Light of SEBI (Merchat Bankers) Regulations, 1992)Document38 pagesMerchant Banking (In The Light of SEBI (Merchat Bankers) Regulations, 1992)Parul PrasadNo ratings yet

- HDFC ServicesDocument16 pagesHDFC ServicesVenkateshwar Dasari NethaNo ratings yet

- Comparison of Sbi Yono With Other Banking AppsDocument16 pagesComparison of Sbi Yono With Other Banking AppsgaganpreetNo ratings yet

- Comprehensive Study On Financial Analysis of HDFC Bank: Prepared byDocument38 pagesComprehensive Study On Financial Analysis of HDFC Bank: Prepared byshrutilatherNo ratings yet

- Ranson Dantis Project Black Book TybmsDocument87 pagesRanson Dantis Project Black Book Tybmsranson dantisNo ratings yet

- Summer Internship Report - HDFC Digital BankingDocument32 pagesSummer Internship Report - HDFC Digital BankingMantosh SinghNo ratings yet

- Punjab N Sind BankDocument45 pagesPunjab N Sind BankAkshay Sachdeva100% (1)

- SBI Mobile BankingDocument64 pagesSBI Mobile Bankingankit161019893980No ratings yet

- Tanggal Uraian Transaksi Nominal Transaksi SaldoDocument2 pagesTanggal Uraian Transaksi Nominal Transaksi Saldopujilau malauNo ratings yet

- Punjab National Bank Project ReportDocument40 pagesPunjab National Bank Project ReportVarun100% (40)

- Origin and Performance of Regional Rural Bank of IndiaDocument13 pagesOrigin and Performance of Regional Rural Bank of IndiaHetvi TankNo ratings yet

- Online Payment SystemDocument30 pagesOnline Payment SystemDjks YobNo ratings yet

- Kotak Mahindra Bank 121121123739 Phpapp02Document112 pagesKotak Mahindra Bank 121121123739 Phpapp02RahulSinghNo ratings yet

- Customer Satisfaction With Regard To ATM ServicesDocument75 pagesCustomer Satisfaction With Regard To ATM Servicesdinesh_v_0076945100% (2)

- Retail BankingDocument73 pagesRetail Bankingnatakhatnirmal33% (3)

- Karnataka Bank Vishal Chopra 05110Document64 pagesKarnataka Bank Vishal Chopra 05110Kiran Gowda100% (1)

- SBI (State Bank of India)Document2 pagesSBI (State Bank of India)dashgreevlankeshNo ratings yet

- An Organizational Study On South Indian Bank: Internship Project ReportDocument106 pagesAn Organizational Study On South Indian Bank: Internship Project ReportalexanderchundattuNo ratings yet

- S.No Names Bank Branch IFSC CodeDocument2 pagesS.No Names Bank Branch IFSC CodesuneethaNo ratings yet

- Study of Cash Management at Standard Chartered BankDocument115 pagesStudy of Cash Management at Standard Chartered BankVishnu Prasad100% (2)

- HDFC Summer Project ReportDocument60 pagesHDFC Summer Project Reportumanggg90% (10)

- RDocument2 pagesRMukesh ManwaniNo ratings yet

- Manappuram Finance: Positive All-Round Results Should Set The ToneDocument8 pagesManappuram Finance: Positive All-Round Results Should Set The Tonevikasaggarwal01No ratings yet

- Agenda 15 - Transaction Limits in CBS System For Different Types of TransactionsDocument13 pagesAgenda 15 - Transaction Limits in CBS System For Different Types of TransactionsJay MeskaNo ratings yet

- E BankingDocument49 pagesE BankingParas PundirNo ratings yet

- E Banking Report - Punjab National BankDocument65 pagesE Banking Report - Punjab National BankParveen ChawlaNo ratings yet

- Cosmos Co-Operative Bank: Introducation & HistoryDocument28 pagesCosmos Co-Operative Bank: Introducation & HistoryMahesh DoijodeNo ratings yet

- Bidding Document For Core Bank System For Tadb 2018Document282 pagesBidding Document For Core Bank System For Tadb 2018Krishna BabuNo ratings yet

- A Comparative Study On SBI and HDFC in Ambala City Ijariie5997Document11 pagesA Comparative Study On SBI and HDFC in Ambala City Ijariie5997vinayNo ratings yet

- E Banking Consumer BehaviourDocument116 pagesE Banking Consumer Behaviourrevahykrish93No ratings yet