Professional Documents

Culture Documents

Walmart's Financial Reporting Analysis

Uploaded by

Rabab BICopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Walmart's Financial Reporting Analysis

Uploaded by

Rabab BICopyright:

Available Formats

Wal-Marts Financial Reporting Analysis

SECTION 1: EXECUTIVE SUMMARY

In this section provide a brief overview of the corporation. Participants are not limited but, at a minimum, should provide the following information: Official name of the corporation Wal-Mart Stores Inc. Location of the corporate headquarters 702 SW 8th Street Bentonville, AR 72716 The state in which the company is incorporated Arizona Company Internet address http://www.walmart.com Stock symbol of the corporation and the exchange on which it is traded WMT Fiscal year-end of the corporation January 31, 2011 Date of the 10-K filing according to the financial statements provided Last Tuesday of March The Companys independent accountant/auditor Wal-Mart's independent accountants are responsible for auditing Wal-Mart's The primary products(s) and/or services (s) of the corporation Wal-Mart is one of the largest chains, which operates in three large segments: The Walmart U.S., the Walmart International, and the Sams Club. In this report we are

Wal-Marts Financial Reporting Analysis

focusing mainly on Walmart US. This latter is has a momentous presence in the retail industry, operating throughout the United States. The Walmart U.S segment includes the Companys mass merchant concept under the Walmart or Wal-Mart brand, as well as walmart.com. (Reuters, n.d) Walmart offers various lines of products and services including the following: Retail goods, which consists of a large variety of categories, namely electronics, home furnishing, sporting goods, baby products, and grocery items (Washington, n.d) Photo Services: Walmart makes a photo lab available for customers inside the stores and online. They are provided the possibility to upload their photos via the companys website, or drop them off for developing via a store kiosk (Washington, n.d) Pharmacy: Walmart started pharmacy operations as of 2006. Since then, it has been providing customers with prescriptions, which they could pick-up in-store or be shipped by mail. Walmart has available a catalog of 300 generic medications for no more than four dollars in-store, and ten dollars for a 90-day supply (Washington, n.d) Financial Services: Besides the aforementioned products and services, Walmart also provides its customers with a wide range of financial services, namely a non-annual-fee credit card, a debit card ready to obtain in-strore or online, money transfer service through MoneyGram, and check cashing and check printing. At Walmart, customers can also purchase money orders, gift cards, and pays bills (Washington, n.d)

Wal-Marts Financial Reporting Analysis

Wireless Services: Last but not least, Walmart partnered with T-mobile only to give birth to The Walmart Family Talk Wireless, which is a service that provides customers with a family plan for unlimited text and voice calls (Washington, n.d)

SECTION2: BALANCE SHEET ANALYSIS

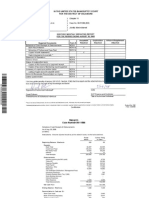

Vertical Analysis WAL-MART STORES INC (WMT) BALANCE SHEET

Fiscal year ends in January Assets Current assets Cash Cash and cash equivalents Total cash Receivables Inventories Prepaid expenses Other current assets 2013-01 % 2012-01 %

7781000

3.83%

6,550,000

3.39%

7,781,000

3.83%

6,550,000

3.39%

6,768,000

3.33%

5,937,000

3.07%

43,803,000

21.57%

40,714,000

21.05%

1,588,000

0.78%

1,685,000

0.87%

89,000

0.05%

Wal-Marts Financial Reporting Analysis

Total current assets Non-current assets Property, plant and equipment Land Fixtures and equipment Other properties Property and equipment, at cost Accumulated Depreciation Property, plant and equipment, net Goodwill Other long-term assets Total non-current assets Total assets Liabilities and stockholders' equity Liabilities Current liabilities Short-term debt

59,940,000

29.51%

54,975,000

28.42%

25,612,000

12.61%

23,499,000

12.15%

43,699,000

21.52%

41,916,000

21.67%

102,413,000

50.42%

95,523,000

49.39%

171,724,000

84.55%

160,938,000

83.21%

(55,043,000)

(27.10)%

(48,614,000)

(25.14)%

116,681,000

57.45%

112,324,000

58.08%

20,497,000

10.09%

20,651,000

10.68%

5,987,000

2.95%

5,456,000

2.82%

143,165,000

70.49%

138,431,000

71.58%

203,105,000

100.00%

193,406,000

100.00%

12,392,000

6.10%

6,022,000

3.11%

Wal-Marts Financial Reporting Analysis

Capital leases Accounts payable Taxes payable Accrued liabilities Other current liabilities Total current liabilities Non-current liabilities Long-term debt Capital leases Deferred taxes liabilities Minority interest Other long-term liabilities Total non-current liabilities Total liabilities Stockholders' equity Common stock Additional paid-in capital

327,000

0.16%

326,000

0.17%

38,080,000

18.75%

36,608,000

18.93%

5,062,000

2.49%

1,164,000

0.60%

15,957,000

7.86%

18,154,000

9.39%

26,000

0.01%

71,818,000

35.36%

62,300,000

32.21%

38,394,000

18.90%

44,070,000

22.79%

3,023,000

1.49%

3,009,000

1.56%

7,613,000

3.75%

7,862,000

4.07%

5,395,000

2.66%

4,446,000

2.30%

519,000

0.26%

404,000

0.21%

54,944,000

27.05%

59,791,000

30.91%

126,762,000

62.41%

122,091,000

63.13%

332,000

0.16%

342,000

0.18%

3,620,000

1.78%

3,692,000

1.91%

Wal-Marts Financial Reporting Analysis

Retained earnings Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity

72,978,000

35.93%

68,691,000

35.52%

(587,000)

(0.29)%

(1,410,000)

(0.73)%

76,343,000

37.59%

71,315,000

36.87%

203,105,000

100.00%

193,406,000

100.00%

Year to Year Change WAL-MART STORES INC (WMT) BALANCE SHEET

Fiscal year ends in January Assets Current assets Cash Cash and cash equivalents Total cash Receivables

1,231,000 18.79

2013-01

2012-01

+/- $

7,781,000

6,550,000

7,781,000

6,550,000

1231000

18.79

6,768,000

5,937,000

831000

14.00

Wal-Marts Financial Reporting Analysis

7

3089000 7.59

Inventories Prepaid expenses Other current assets Total current assets Non-current assets Property, plant and equipment Land Fixtures and equipment Other properties Property and equipment, at cost Accumulated Depreciation Property, plant and equipment, net Goodwill Other long-term assets Total non-current assets Total assets Liabilities and stockholders' equity

43,803,000

40,714,000

1,588,000

1,685,000

(97000)

(5.76)

89,000

(89000)

(100.00)

59,940,000

54,975,000

4965000

9.03

25,612,000

23,499,000

2113000

8.99

43,699,000

41,916,000

1783000

4.25

102,413,000

95,523,000

6890000

7.21

171,724,000

160,938,000

10786000

6.70

(55,043,000)

(48,614,000)

(6429000)

13.22

116,681,000

112,324,000

4357000

3.88

20,497,000

20,651,000

(154000)

(0.75)

5,987,000

5,456,000

531000

9.73

143,165,000

138,431,000

4734000

3.42

203,105,000

193,406,000

9699000

5.01

Wal-Marts Financial Reporting Analysis

Liabilities Current liabilities Short-term debt Capital leases Accounts payable Taxes payable Accrued liabilities Other current liabilities Total current liabilities Non-current liabilities Long-term debt Capital leases Deferred taxes liabilities Minority interest Other long-term liabilities Total non-current liabilities Total liabilities

(5676000) (12.88) 6370000 105.78

12,392,000

6,022,000

327,000

326,000

1000

0.31

38,080,000

36,608,000

1472000

4.02

5,062,000

1,164,000

3898000

334.88

15,957,000

18,154,000

(2197000)

(12.10)

26,000

(26000)

(100.00)

71,818,000

62,300,000

9518000

15.28

38,394,000

44,070,000

3,023,000

3,009,000

14000

0.47

7,613,000

7,862,000

(249000)

(3.17)

5,395,000

4,446,000

949000

21.35

519,000

404,000

115000

28.47

54,944,000

59,791,000

(4847000)

(8.11)

126,762,000

122,091,000

4671000

3.83

Wal-Marts Financial Reporting Analysis

Stockholders' equity Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive

823000 (58.37) (10000) (2.92)

332,000

342,000

3,620,000

3,692,000

(72000)

(1.95)

72,978,000

68,691,000

4287000

6.24

income Total stockholders' equity Total liabilities and stockholders' equity

(587,000)

(1,410,000)

76,343,000

71,315,000

5028000

7.05

203,105,000

193,406,000

9699000

5.01

Horizontal Analysis WAL-MART STORES INC (WMT) BALANCE SHEET

Current Fiscal year ends in January. Assets Current assets Cash Prior

Year/Base Year/Base

Wal-Marts Financial Reporting Analysis

10

Cash and cash equivalents Total cash Receivables Inventories Prepaid expenses Other current assets Total current assets Non-current assets Property, plant and equipment Land Fixtures and equipment Other properties Property and equipment, at cost Accumulated Depreciation Property, plant and equipment, net Goodwill Other long-term assets

105.22%

88.57%

105.22%

88.57%

132.99%

116.66%

120.61%

112.10%

53.65%

56.93%

0.00%

67.94%

115.51%

105.94%

105.03%

96.36%

106.88%

102.52%

114.79%

107.07%

111.16%

104.17%

118.09%

104.30%

108.16%

104.12%

122.28%

123.19%

145.00%

132.14%

Wal-Marts Financial Reporting Analysis

11

Total non-current assets Total assets Liabilities and stockholders' equity Liabilities Current liabilities Short-term debt Capital leases Accounts payable Taxes payable Accrued liabilities Other current liabilities Total current liabilities Non-current liabilities Long-term debt Capital leases Deferred taxes liabilities Minority interest

111.18%

107.50%

112.42%

107.05%

217.94%

105.91%

97.32%

97.02%

113.48%

109.09%

3224.20%

741.40%

85.33%

97.08%

0.00%

55.32%

122.80%

106.52%

94.35%

108.30%

95.97%

95.52%

113.93%

117.66%

199.45%

164.36%

Wal-Marts Financial Reporting Analysis

12

Other long-term liabilities Total non-current liabilities Total liabilities Stockholders' equity Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity

127.21%

99.02%

102.44%

111.47%

113.06%

108.89%

0.00%

0.00%

101.20%

103.21%

114.09%

107.39%

(58.82%)

(141.28%)

111.38%

104.05%

112.42%

107.05%

Balance sheet Analysis The vertical, horizontal and year to year change analysis of the balance sheet of Walmart shows that the companys current assets for the current year has increased from the previous year with a significant increase in cash and account receivables. The company has also invested in long-term assets in the current year. Though the company got rid of some of its current liabilities from the previous year, its short-term debt has increased by more than 100%. The company has also been successful in paying off a significant portion of its long-term debt.

Wal-Marts Financial Reporting Analysis

13

Though the increase in cash indicates profitability, a persistent increase in cash also indicates that the company is unable to make the most of its cash in hand. Therefore, the company should watch its cash in hand closely. The company also needs to revisit its credit policies to ensure that it does not have a lot of money stuck in account receivables. There has been a slight drop in the goodwill of the company from the previous year, which indicates a loss of confidence of the shareholders in the company. The companys short-term liabilities have increased by more than 12%. It has a significant investment in Land and other long-term assets. The companys retained earnings form a major part of their equity. The company has been very successful in keeping a balance between its debt and equity financing.

SECTION 3: INCOME STATEMENT

Vertical Analysis WAL-MART STORES INC (WMT) INCOME STATEMENT

Fiscal year ends in January Revenue Cost of revenue 2013-01 % 2012-01 % 2011-01 %

469,162,000

100.00%

446,950,000

100.00%

421,849,000

100.00%

352,488,000

75.13%

335,127,000

74.98%

315,287,000

74.74%

Wal-Marts Financial Reporting Analysis

14

Gross profit Operating expenses Sales, General and administrative Total operating expenses Operating income Interest Expense Other income (expense) Income before income taxes Provision for income taxes Minority interest Other income Net income from continuing operations Net income from discontinuing ops Other

116,674,000

24.87%

111,823,000

25.02%

106,562,000

25.26%

88,873,000

18.94%

85,265,000

19.08%

81,020,000

19.21%

88,873,000

18.94%

85,265,000

19.08%

81,020,000

19.21%

27,801,000

5.93%

26,558,000

5.94%

25,542,000

6.05%

2,251,000

0.48%

2,322,000

0.52%

2,205,000

0.52%

187,000

0.04%

162,000

0.04%

201,000

0.05%

25,737,000

5.49%

24,398,000

5.46%

23,538,000

5.58%

7,981,000

1.70%

7,944,000

1.78%

7,579,000

1.80%

757,000

0.16%

688,000

0.15%

604,000

0.14%

757,000

0.16%

688,000

0.15%

604,000

0.14%

17,756,000

3.78%

16,454,000

3.68%

15,959,000

3.78%

-67,000

-0.01%

1,034,000

0.25%

-757,000

-0.16%

-688,000

-0.15%

-604,000

-0.14%

Wal-Marts Financial Reporting Analysis

15

Net income

16,999,000

3.62%

15,699,000

3.51%

16,389,000

3.89%

Year to Year Change WAL-MART STORES INC (WMT) INCOME STATEMENT

Fiscal year ends +/- $ in January Revenue Cost of revenue Gross profit Operating expenses 2013-01 2012-01

22,212,000 4.97

% 2011-01

+/- $

469,162,000

446,950,000

421,849,000

47,313,000

11.22

352,488,000

335,127,000

17,361,000

5.18

315,287,000

37,201,000

11.80

116,674,000

111,823,000

4,851,000

4.34

106,562,000

10,112,000

9.49

Sales, General and administrative Total operating expenses Operating income

88,873,000 85,265,000 3608000 4.23 81,020,000 7,853,000 9.69 88,873,000 85,265,000 3,608,000 4.23 81,020,000 7,853,000 9.69

27,801,000

26,558,000

1,243,000

4.68

25,542,000

2,259,000

8.84

Wal-Marts Financial Reporting Analysis

16

(71,000) (3.06)

Interest Expense Other income (expense) Income before income taxes Provision for income taxes Minority interest Other income Net income from continuing operations Net income from discontinuing ops Other Net income

2,251,000

2,322,000

2,205,000

46,000

2.09

187,000

162,000

25,000

15.43

201,000

(14,000)

(6.97)

25,737,000

24,398,000

1,339,000

5.49

23,538,000

2,199,000

9.34

7,981,000

7,944,000

37,000

0.47

7,579,000

402,000

5.30

757,000

688,000

69000

10.03

604,000

153,000

25.33

757,000

688,000

69000

10.03

604,000

153,000

25.33

1302000 17,756,000 16,454,000

7.91 15,959,000 1,797,000 11.26

(67,000)

67000

(100.00)

1,034,000

(1,034,000)

(100.00)

(757,000)

(688,000)

(69000)

10.03

(604,000)

(153,000)

25.33

16,999,000

15,699,000

1300000

8.28

16,389,000

610,000

3.72

Wal-Marts Financial Reporting Analysis

17

Horizontal Analysis WAL-MART STORES INC (WMT) INCOME STATEMENT

Current Fiscal year ends in January Revenue Cost of revenue Gross profit Operating expenses Sales, General and administrative Total operating expenses Operating income Interest Expense Other income (expense) Income before income taxes

109.69% 105.24% 100.00%

Prior Year/Base

Two Years ago/Base

Year/Base

111.22%

105.95%

100.00%

111.80%

106.29%

100.00%

109.49%

104.94%

100.00%

109.69%

105.24%

100.00%

108.84%

103.98%

100.00%

102.09%

105.31%

100.00%

93.03%

80.60%

100.00%

109.34%

103.65%

100.00%

Wal-Marts Financial Reporting Analysis

18

Provision for income taxes Minority interest Other income Net income from continuing operations Net income from discontinuing ops Other Net income

105.30%

104.82%

100.00%

125.33%

113.91%

100.00%

125.33%

113.91%

100.00%

111.26%

103.10%

100.00%

0.00%

(6.48%)

100.00%

125.33%

113.91%

100.00%

103.72%

95.79%

100.00%

Income Statement Analysis

Among the items to consider: a. The money a business makes from its products and services is considered the company's Total Revenue. Wal-Mart Stores Inc.'s net sales increased from 2011 to 2012 and from 2012 to 2013 b. Cost of revenue taken out from Sales revenue gives the Gross Profit. Total revenue and Cost of revenue both were observed to increase over years. Wal-Mart Stores Inc.'s Gross Profit increased from 2011 to 2012 and from 2012 to 2013 c. Income taxes are excluded from the Business Total income which is calculated as the Net income. Wal-Mart Stores Inc.'s Net income decreased

Wal-Marts Financial Reporting Analysis

19

from 2011 to 2012 as the net income from discontinued ops was in loss and increased from 2012 to 2013 d. Operating Income divided by the total revenue gives the Profit margin. It means that means that a company can deliver merchandise or services to customers at much cheaper prices than competitors and still make money. Wal-Mart Stores Inc.'s Profit margin increased from 2011 to 2012 and from 2012 to 2013. e. Revenues are calculated as the total amount made by the sales in that annual period where as Expenses are calculated as the total amount used to make those products. According to the Income sheet walmarts revenue and expenses have a positive increased from 2011 to 2013. This implies walmart sold more products within the same period of time than their previous year f. Discontinued Operations - there was a positive Net income from discontinued operations in 2011,which turned into loss in 2012. This improved in 2013 where is there was no positive net income but did not run into loss either. This implies that walmart made income by discontinuing some operations in 2011 but could not achieve the same continuing forward in the future years. Extraordinary items - There are no Extra-ordinary items in the income statement. Changes in the accounting policy - EBITDA increased from 2011 to 2013 each year. There are no good or bad EBITDA numbers. Any positive number implies the company has profits. The income sheet implies that walmart has profitability improved every year from 2011 to 2013.

Wal-Marts Financial Reporting Analysis

20

SECTION 4: RATIO ANALYSIS

Compute the ratios for the most current year in following categories. The calculations used to determine the answers for the ratio analysis must be included in the appendix.

Liquidity Ratios Formula Current Ratio Acid (Quick) Ratio

Current assets/current liabilities

Ratio 0.83 0.20

(Cash equivalent+marketable securities+net receivable)/ current liabilities Current assets- current liabilities

Working Capital Cash Ratio

(11,878) 0.11

(cash equivalents+marketable securities)/ current liabilities

Days Sales in Receivables Accounts Receivable Turnover

Gross receivable/(net sales/365)

5.3

Net Sales/Average Gross Receivables Average Gross Receivables/(Net Sales/ 365)

68.87

Accounts Receivable Turnover in Days

5 days

Days Sales in Inventory

Ending Inventory/(Cost of Goods

45.3578

Wal-Marts Financial Reporting Analysis

21

Sold/365)

Inventory Turnover

Cost Of Goods Sold/ Average Inventory

10.64

Inventory Turnover in Days

Average Inventory / (Cost of Goods Sold/365)

34 days

Operating Cycle

Account Receivable Turnover in Days+ Inventory Turnover in Days

39 days

Sales to Working Capital Operating Cash Flow to Current Maturities of Long-term Debt and Current Notes Payable

Sales/ Average Working Capital

-48.54

No debt payable within one year

Operating Cash Flow/ Current Maturities of Long Term Debt and Current Notes Payable

Long-Term Debt Paying Ability Formula Ratio

Times Interest Earned

Recurring Earnings, Excluding Interest Expense, Tax Expense, Equity Earnings and Noncontrolling Earnings

12.43

Wal-Marts Financial Reporting Analysis

22

Interest Expense, Including Capitalized Interest

Debt Ratio

Total Liabilities / Total

Assets

0.62

Debt / Equity Ratio

Total Liabilities /

Shareholders Equity

1.65

Debt to Tangible Net Worth Ratio

Total Liabilities

(Shareholders Equity Intangible Assets)

1.65

Operating Cash Flow / Total Debt

0.47

Profitability Ratios Formula Net Profit Margin Net Income Before NonControlling Interests, Equity Income and Non recurring Items / Net Sales Total Asset turnover Net Sales/ Average Total Sales 469162000/4 58055000=1. 0242 Return on Assets Net Income Before Non8.57 Ratio 3.62

Wal-Marts Financial Reporting Analysis

23

Controlling Interests and NonRecurring Items/ Average Total Assets Sales to Fixed Assets Net Sales/ Average Fixed Assets (exclude Construction in progress) Return on Investment Net Income Before Non Controlling Interest & Non Recurring Items + {(Interest Expense) + (1- Tax Rate)} / Avg (Long term Liabilities + Equity) Return on Total Equity Net Income Before Non recurring Items - Dividend on Redeemable Preferred Stocks / Avg Total Equity Return on Common Equity Gross Profit Margin Gross Profit / Net Sales 24.38 22.27 469162000/5 7457000=8.1 654 18.2%

Investor Ratios Formula Ratio

Wal-Marts Financial Reporting Analysis

24

Degree of Financial Leverage

Earnings Before Interests and Taxes/ Earning Before Tax

27988000/257 37000=0.9709 5.04

EPS - Basic

( Net Income- Preferred Dividends)/ Weighted Average Number of Common Shares Outstanding (Operating Cash Flow- Preferred Dividends)/ Diluted Weighted Average Common Shares Outstanding

EPS - Diluted

5.02

Price / Earnings Ratio

Market Price Per Share/ Diluted Earning Per Share, before nonreturning items

14.48

Percentage of Earnings Retained

(Net Income before non-returning Items All Dividends)/ Net Income Before Non-returning Items

Dividend Payout

Dividends Per Common Share/Diluted Earning Per Share Before Non-returning Items Dividends Per Common Share/ Market Price Per Common Share ( Total Shareholders EquityPreferred Stock Equity)/ Number of Common Shares Outstanding

1.59

Dividend Yield

Book Value

23.04

Wal-Marts Financial Reporting Analysis

25

Operating Cash Flow / Cash Dividends

Operating Cash Flow/Cash Dividends

25591000/1.59 =16094968.55

ANALYSIS FOR LIQUIDITY RATIOS

Liquidity Ratios & Long term Debt Paying Ratios

In the above table, we are measuring the liquidity & Long term Debt Ratio. Those latter are measuring the ability of our company to pay-off its short-term debt obligations & Long term Debt paying ability of the company

By comparing the companys liquid assets and its liabilities, the greater the liquid assets compared to short term & Long term debt liabilities the better because it shows that the company can pay its debts that are due. Nevertheless, when the opposite happen, the company will have difficulties meeting its obligation and that is a bad sign for investors

Our corporation is in a good stand point, as the assets exceed liabilities, meaning that the company will be able to pay off debt that are due now and the ones that are upcoming in the future

Testing a companys liquidity & Long Term Debt ratio is the primary step for investors in analyzing a company. The firms personnel use this information to compare the firm to its competitors and allow them to implement changes within the industry

PROFITABILITY RATIOS:

Wal-Marts Financial Reporting Analysis

26

In the table above, we are discussing the profitability ratios, which is the businesss ability to generate earnings and comparing them to the expenses.

Every firm is concerned about its profitability ratio. The profitability helps us determine the companys bottom line and its return to investors. It also shows the overall efficiency and performance of the company.

Looking at the net profit margin, we can say that 3.62 cents of every dollar is a profit and that is pretty fair for our corporation.

Users of this information are company managers and owners because they are the ones looking at the firms ability to transform sales dollars into profit.

INVESTORS RATIOS

In this category we are measuring the investors ratios which are very important to consider when you want to invest in any company.

Investors should look closely into this category in order to know if the company is paying dividends, how much earning per share will they get, and how sensitive is the company to those earnings per share.

In our case, the Walmart Company is standing in a fair position. We can tell that from the degree in financial leverage that for every 1% change in operating income. EPS should change by 0.98% and that is fair for the company. As far as dividends, Walmart is paying high dividends compared to its competitors and it continues to raise every year.

Investors are the main users of this information because they are concerned about how much money they will get per share if they invest in this certain corporation.

Wal-Marts Financial Reporting Analysis

27

SECTION 5: CONCLUSIONS/RECOMMENDATIONS

Walmart should build some alliances and strategic joint ventures with other global retail companies in order to expand itself at the international front, enhance penetration into the global market and withstand the cultural shocks not coming in between the path to success. From the financial analysis that the account receivables are very high, we recommend that the company should revisit its credit policy. The company should ensure that its credit policy is not too lenient since it might in order to not have a lot of cash stuck in receivables. The company should be able to ensure that their accounts receivables turnover is quicker. We recommend Walmart should stick with its current policies and strategies for the continued best rewards it is reaping. Walmart needs to maintain consistency in its operations so that there are no significant changes in their statements across the years.

Wal-Marts Financial Reporting Analysis

28

Appendix

Liquidity Ratios

Current ratio = Current assets Current liabilities = 59,940 71,818 = 0.83

Quick ratio = Total quick assets Current liabilities = 14,549 71,818 = 0.20

Working Capital = Current Assets Current Liabilities = 59,940 71,818 = (11,878)

Cash ratio = Total cash assets Current liabilities = 7,781 71,818 = 0.11

Days Sales in Receivables = (Gross receivables* 365) Net sales

= 6768/(466114/365) = 5.3

Accounts Receivable Turnover = Net Sales Avg Gross Receivables = 466,114 6768 = 68.87

Wal-Marts Financial Reporting Analysis

29

Accounts Receivables Turnover in Days = Avg Gross Receivables * 365 Net Sales =6768* 365 466114 = 5

Days Sales in Inventory = (Ending Inventory * 365) / Cost Of Goods Sold = 43803000/(352488000/365) = 45.3578

Inventory turnover = Net sales Inventories = 466,114 43,803 = 10.64

Average inventory processing period = 365 Inventory turnover = 365 10.64 = 34

Operating cycle = Average inventory processing period + Average receivable collection period = 34 + 5 = 39

Sales to Working Capital = Sales Avg Working Capital = 466,114 {(-11,878) + (-7325)}/2 = -48.54

Long-Term Debt-Paying Ability Ratios

Times Interest Earned = Recurring Earnings, Excluding Interest Expense, Tax Expense, Equity Earnings and Non-controlling Earnings Interest Expense, Including Capitalized Interest. = 27,988 2,251 = 12.43

Debt Ratio = Total Liabilities Total Assets = 126,243 203,105 = 0.62

Debt / Equity Ratio = Total Liabilities Shareholders Equity = 126,243 76,343 = 1.65

Wal-Marts Financial Reporting Analysis

30

Debt to Tangible Net Worth Ratio = Total Liabilities (Shareholders Equity Intangible Assets) = 126,243 (76,343 0) = 1.65

Operating Cash Flow / Total Debt = 25591 / 54136 = 0.47

Profitability

Gross profit margin = 100 Gross profit Net sales = 113,626 466,114 = 24.38

ROE = Net Income Before Non recurring Items - Dividend on Redeemable Preferred Stocks / Avg Total Equity = 16,999 76,343 = 22.27

Return on Investment = Net Income Before Non Controlling Interest & Non Recurring Items + {(Interest Expense) + (1- Tax Rate)} / Avg (Long term Liabilities + Equity= 39,091 / 215,016 = 18.2%

You might also like

- Management and InformationDocument27 pagesManagement and InformationMohammadJony0% (1)

- Tows MatrixDocument5 pagesTows MatrixHummayun Aly100% (3)

- Financial Operation Analysis of Wal-Mart Stores Inc.Document26 pagesFinancial Operation Analysis of Wal-Mart Stores Inc.alka murarka100% (6)

- Rupa Marks Spencer Case StudyDocument6 pagesRupa Marks Spencer Case StudyRajiv VyasNo ratings yet

- Xiaomi: From Wikipedia, The Free EncyclopediaDocument18 pagesXiaomi: From Wikipedia, The Free EncyclopediaCris EzechialNo ratings yet

- Destiny 2000Document16 pagesDestiny 2000sam09257301100% (1)

- WalmartDocument21 pagesWalmartAlida JoseNo ratings yet

- Drivers of GlobalisationDocument4 pagesDrivers of Globalisationricha928No ratings yet

- Chap 8Document62 pagesChap 8Daniel Sineus100% (1)

- Fundamentals of Corporate Finance 8th Edition Brealey Test Bank PDFDocument79 pagesFundamentals of Corporate Finance 8th Edition Brealey Test Bank PDFa819334331No ratings yet

- Segment AnalysisDocument53 pagesSegment AnalysisamanNo ratings yet

- Dell Strategic ManagementDocument38 pagesDell Strategic ManagementRoben Joseph89% (9)

- Global Business TitlesDocument10 pagesGlobal Business TitlesChetan Somkuwar0% (1)

- Primark SWOT PESTLE Analysis Leadership CSRDocument12 pagesPrimark SWOT PESTLE Analysis Leadership CSRFadhil WigunaNo ratings yet

- Turkish Airlines Financial Statements Exel (Hamada SH)Document89 pagesTurkish Airlines Financial Statements Exel (Hamada SH)hamada1992No ratings yet

- Chap 12Document74 pagesChap 12NgơTiênSinhNo ratings yet

- Strategic Management Accounting Summary SampleDocument5 pagesStrategic Management Accounting Summary SampleGreyGordonNo ratings yet

- Walmart Financial Analysis and ValuationDocument9 pagesWalmart Financial Analysis and ValuationAbeer ArifNo ratings yet

- SWOT analysis of Microsoft CorporationDocument2 pagesSWOT analysis of Microsoft CorporationRosenna99No ratings yet

- Pest Analysis of ChinaDocument6 pagesPest Analysis of ChinaalwidaNo ratings yet

- Case Study - Srivatsa & Karan PDFDocument79 pagesCase Study - Srivatsa & Karan PDFSrivatsa ThumurikotaNo ratings yet

- PAS 34 key requirements for related party disclosuresDocument3 pagesPAS 34 key requirements for related party disclosuresGerlie OpinionNo ratings yet

- UCBP6002 Strategic Analysis Module GuideDocument11 pagesUCBP6002 Strategic Analysis Module GuideKishorKumar0% (1)

- Xiaomi Entering International MarketsDocument12 pagesXiaomi Entering International Marketsanto sadanandNo ratings yet

- Nestle (Strategy Project) SlidesDocument34 pagesNestle (Strategy Project) SlidesQasim Ali Pracha75% (4)

- C 13Document416 pagesC 13Arun Victor Paulraj50% (2)

- Jaguar Land Rover Industry AnalysisDocument16 pagesJaguar Land Rover Industry AnalysisJacqueline StephenNo ratings yet

- PrivateEquityFinalReport PDFDocument140 pagesPrivateEquityFinalReport PDFSachin GuptaNo ratings yet

- POM - WalMart Case StudyDocument25 pagesPOM - WalMart Case StudyLasya ChandNo ratings yet

- The BMW GroupDocument15 pagesThe BMW GroupSheraz KhanNo ratings yet

- Operations Management XYZ Co. For Alkyd Resin Student # Module #Document40 pagesOperations Management XYZ Co. For Alkyd Resin Student # Module #mokbelNo ratings yet

- Abdul Hamid GBS Unit-44Document13 pagesAbdul Hamid GBS Unit-44Jon TahsanNo ratings yet

- Oligopoly: Economics Market Form Market Industry Greek Strategic PlanningDocument33 pagesOligopoly: Economics Market Form Market Industry Greek Strategic PlanningNaseer Ahmad Azizi100% (1)

- Managerial ImplicationsDocument9 pagesManagerial Implicationsfadat_h0% (1)

- Revised SWOT With ExplanationDocument6 pagesRevised SWOT With ExplanationJomar ViconiaNo ratings yet

- Silicon Valley BankDocument1 pageSilicon Valley BankDaisy BajarNo ratings yet

- Wall Mart People ProblemsDocument5 pagesWall Mart People ProblemsShashank RajNo ratings yet

- International Business ManagemnetDocument12 pagesInternational Business ManagemnetPramod GowdaNo ratings yet

- Walmart's Global Expansion: A Case StudyDocument11 pagesWalmart's Global Expansion: A Case Studyttmuathu410100% (3)

- Dabur Financial Analysis Annual ReportDocument27 pagesDabur Financial Analysis Annual ReportVidit GargNo ratings yet

- Case Study EtradeDocument28 pagesCase Study EtradeZulnaim RamziNo ratings yet

- Test Bank For Foundations in Strategic Management 6th Edition Jeffrey S. HarrisonDocument9 pagesTest Bank For Foundations in Strategic Management 6th Edition Jeffrey S. HarrisonNhibinhNo ratings yet

- Ford Motor Company Case StudyDocument13 pagesFord Motor Company Case StudyLornaPeñaNo ratings yet

- New Heritage Doll Company Case StudyDocument10 pagesNew Heritage Doll Company Case StudyRAJATH JNo ratings yet

- Financial Accounting Libby 8th Edition Chapter 1 Q&AsDocument162 pagesFinancial Accounting Libby 8th Edition Chapter 1 Q&AsBrandon SNo ratings yet

- Case Study - The Swiss FrancDocument4 pagesCase Study - The Swiss FrancReynaldo Alvarado AcostaNo ratings yet

- Financial Ratio Analysis Dec 2013 PDFDocument13 pagesFinancial Ratio Analysis Dec 2013 PDFHạng VũNo ratings yet

- Running Head: The Body Shop CaseDocument19 pagesRunning Head: The Body Shop CaseDominique Meagan LeeNo ratings yet

- Hpcasestudy 110204022006 Phpapp02Document37 pagesHpcasestudy 110204022006 Phpapp02Ashna SharmaNo ratings yet

- 11thed Wilcox PPT Chapter10Document20 pages11thed Wilcox PPT Chapter10A M II R100% (1)

- Virgin Group Organization Chart and OverviewDocument3 pagesVirgin Group Organization Chart and Overviewerarun22No ratings yet

- IM Project - GB22 - Super Pasta in Jordan - Final Version - 04.22.2020pdf PDFDocument61 pagesIM Project - GB22 - Super Pasta in Jordan - Final Version - 04.22.2020pdf PDFMohamed AhmedNo ratings yet

- Fundamentals of Investments. Chapter1: A Brief History of Risk and ReturnDocument34 pagesFundamentals of Investments. Chapter1: A Brief History of Risk and ReturnNorina100% (1)

- Bisglob Week 1 - Kelompok 3Document31 pagesBisglob Week 1 - Kelompok 3Rizka AnandaNo ratings yet

- 5 Forces and Diamond ModelDocument23 pages5 Forces and Diamond ModelMohammad Imad Shahid KhanNo ratings yet

- Waking Up IBM: How A Gang of Unlikely Rebels Transformed Big BlueDocument17 pagesWaking Up IBM: How A Gang of Unlikely Rebels Transformed Big BluelaurencabotNo ratings yet

- Cymax Stores Inc Audit Year Ending 31 December 2015Document20 pagesCymax Stores Inc Audit Year Ending 31 December 2015Sean CraigNo ratings yet

- 10000006490Document17 pages10000006490Chapter 11 DocketsNo ratings yet

- Wal-Mart - 2002: A. Case AbstractDocument13 pagesWal-Mart - 2002: A. Case Abstractmustafa-memon-7379No ratings yet

- WalMart Business ValuationDocument27 pagesWalMart Business ValuationFikremarkos Abebe100% (2)

- Cost OverviewDocument4 pagesCost OverviewRabab BINo ratings yet

- Change Request Flow ChartDocument1 pageChange Request Flow ChartRabab BINo ratings yet

- CH 9 SolutionDocument1 pageCH 9 SolutionRabab BINo ratings yet

- Ch01 SolutionsDocument4 pagesCh01 SolutionshunkieNo ratings yet

- Starbucks CaseDocument8 pagesStarbucks CaseRabab BINo ratings yet

- AccountingDocument115 pagesAccountingDan Moloney50% (2)

- Practical Financial Management 7th Edition Lasher Solution ManualDocument27 pagesPractical Financial Management 7th Edition Lasher Solution Manualharold100% (19)

- ACFrOgB Hig3c9hwk GPxYSL YwErusr8K4lDkrDJMgt1 0KcEICnet0X6CdMZA2cLdsLJzKWkH9uE3NdtHtcecT2T2ZWZki8F4lcc3bNsCfdZPQ1rPCzFurUP7Sbhmx13gTU22S Nagg UmhOGxDocument8 pagesACFrOgB Hig3c9hwk GPxYSL YwErusr8K4lDkrDJMgt1 0KcEICnet0X6CdMZA2cLdsLJzKWkH9uE3NdtHtcecT2T2ZWZki8F4lcc3bNsCfdZPQ1rPCzFurUP7Sbhmx13gTU22S Nagg UmhOGxas2207530No ratings yet

- Brewer Chapter 14 Alt ProbDocument8 pagesBrewer Chapter 14 Alt ProbAtif RehmanNo ratings yet

- Accounting QuestionsDocument27 pagesAccounting QuestionsHarj SinghNo ratings yet

- Translation Methods: - Current/Noncurrent Method - Monetary/Nonmonetary Method - Temporal Method - Current Rate MethodDocument29 pagesTranslation Methods: - Current/Noncurrent Method - Monetary/Nonmonetary Method - Temporal Method - Current Rate MethodAruna SurapureddyNo ratings yet

- Supply and Demand: Understanding Equilibrium and DisequilibriumDocument53 pagesSupply and Demand: Understanding Equilibrium and DisequilibriumSamyuktha SaminathanNo ratings yet

- Analysis of Financial Statements - VICO Foods CorporationDocument19 pagesAnalysis of Financial Statements - VICO Foods CorporationHannah Bea LindoNo ratings yet

- Avoca LLC Annual Report 2018Document16 pagesAvoca LLC Annual Report 2018kdwcapitalNo ratings yet

- Cash Flow Statement GuideDocument37 pagesCash Flow Statement GuideAshekin MahadiNo ratings yet

- Cost Accounting Final ProjectDocument15 pagesCost Accounting Final Projectismail malikNo ratings yet

- Clarkson Lumber Company Operating ExpensesDocument7 pagesClarkson Lumber Company Operating Expensespawangadiya1210No ratings yet

- Financial Statement Analysis of Infosys Technologies LtdDocument11 pagesFinancial Statement Analysis of Infosys Technologies Ltdk_adhikaryNo ratings yet

- SHAMA Report AsimmalikDocument63 pagesSHAMA Report AsimmalikAsim Malik100% (1)

- CH 08 PDFDocument37 pagesCH 08 PDFErizal WibisonoNo ratings yet

- Distribution of ProfitDocument8 pagesDistribution of ProfitREACTION COPNo ratings yet

- Assumption College Tax1 Final Exam ReviewDocument7 pagesAssumption College Tax1 Final Exam ReviewEjie MarabeNo ratings yet

- Britannia Industries Ltd financial reportsDocument20 pagesBritannia Industries Ltd financial reportsVISHAL KUMARNo ratings yet

- Financial Ratio Analysis of Cadburys India and Nestle IndiaDocument11 pagesFinancial Ratio Analysis of Cadburys India and Nestle Indiaankitsaxena8870% (10)

- AP Long Test 1 - CHANGES&ERROR, CASH ACCRUAL, SINGLE ENTRYDocument12 pagesAP Long Test 1 - CHANGES&ERROR, CASH ACCRUAL, SINGLE ENTRYjasfNo ratings yet

- Chapt-12 Income Tax - CorporationsDocument8 pagesChapt-12 Income Tax - Corporationshumnarvios86% (7)

- CASE6 SolutionDocument15 pagesCASE6 SolutionMuhammad HamidNo ratings yet

- Quiz 18: Use The Following Information For Questions 3 To 5Document4 pagesQuiz 18: Use The Following Information For Questions 3 To 5CrisNo ratings yet

- Introduction To Business Finance Final Project Ratio Analysis of Al Abbas Sugar MillsDocument23 pagesIntroduction To Business Finance Final Project Ratio Analysis of Al Abbas Sugar MillsUmer Ali SangiNo ratings yet

- Manual - Intro To Financial Analytics by Kaizen Analytic LLP (Free Webinar) PDFDocument40 pagesManual - Intro To Financial Analytics by Kaizen Analytic LLP (Free Webinar) PDFBabar Ali100% (1)

- Case Study Repository MbaDocument144 pagesCase Study Repository Mbaraz gamer0% (1)

- Pre-Feasibility Study of 30,000 Bird Poultry HouseDocument31 pagesPre-Feasibility Study of 30,000 Bird Poultry HouseSaad Malik100% (7)

- Calculate Profit Margins Excel TemplateDocument4 pagesCalculate Profit Margins Excel TemplateMustafa Ricky Pramana SeNo ratings yet

- Vertical Analysis SMDocument4 pagesVertical Analysis SMMac b IBANEZNo ratings yet

- Chapter 7 Problem 7.3 Nathali, Jeffrey, TasyaDocument6 pagesChapter 7 Problem 7.3 Nathali, Jeffrey, Tasyavtech netNo ratings yet