Professional Documents

Culture Documents

Rumus Valuasi Saham

Uploaded by

Bima Sukma STCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rumus Valuasi Saham

Uploaded by

Bima Sukma STCopyright:

Available Formats

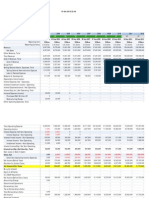

VALUASI SAHAM PT Wijaya Karya Tbk - WIKA EPS GROWTH/TAHUN ROE DER BI RATE HARGA SEKARANG YIELD SUN

(%) = = = = = 31% 21% 3.2 6.5% 2125

= = = = = = = = = = = = = = = = = = = = =

1% 1% 7.5% ROE 20.8% 13.3% 1 1 13.33 EARNING PREMIUM 13.3% 1.77 PER SUN 13.33 15.11 PER WAJAR 15.11 1148 1 1 -85.1%

EARNING PREMIUM (%)

PER SUN (X)

EARNING MULTIPLE PREMIUM

PER WAJAR (X)

HARGA WAJAR (Rp)

MARGIN Of SAFETY (%)

NB : Isi kolom warna Hijau

VALUASI SAHAM T Wijaya Karya Tbk - WIKA >15% >15% TOTAL YEARS <1,5X CAGR 31% 4 EPS AWAL EPS AKHIR 2008 2012 Rp26 Rp76

Dividend Payout Ratio

29%

+ +

BI RATE 6.5%

YIELD SUN 7.5%

: :

YIELD SUN 7.5%

x x

PER SUN 13.33

+ +

EARNING MULTIPLE PREMIUM 1.77

x x

EPS TAHUN TERAKHIR 76

HARGA SEKARANG 2125

: :

HARGA WAJAR 1148

VALUATION INPUT TUNING

WIJAYA KARYA (PERSERO) TBK (WIKA)

PT

Harga EPS (est) Dividend Payout Ratio BI Rate Risk Premium EPS Growth Projected PER Required Return

2,125 76 29.38 % 6.50 % 13 % 31 % 15.11 19.80%

Proyeksi EPS dan Dividend per Share Tahun EPS 1 99 2 130 3 170 4 222 5 290 Total 912 Projected Stock Price Total Stock Price 4,388 4,656

DPS 29 38 50 65 85 268

FAIR VALUE MARGIN OF SAFETY

1,887 -11.21%

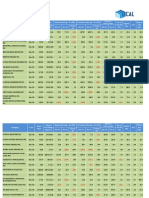

EPS GROWTH/TAHUN ROE DER BI RATE HARGA SEKARANG YIELD SUN (%)

= = = = =

RUMUS VALUASI SAHAM Tiga Pilar Sejahtera Food Tbk - AI 43% 12% 1.1 6.5% 1320

= = = = = = = = = = = = = = = = = = = = =

1% 1% 7.5% ROE 12.2% 4.7% 1 1 13.33 EARNING PREMIUM 4.7% 0.63 PER SUN 13.33 13.96 PER WAJAR 13.96 1005 1 1 -31%

EARNING PREMIUM (%)

PER SUN (X)

EARNING MULTIPLE PREMIUM

PER WAJAR (X)

HARGA WAJAR (Rp)

MARGIN Of SAFETY (%)

NB : Isi kolom warna Hijau

RUMUS VALUASI SAHAM ilar Sejahtera Food Tbk - AISA >15% EPS AWAL EPS AKHIR >15% TOTAL YEARS <1,5X CAGR

2008 2012

Rp17 Rp72 4 43%

Dividend Payout Ratio

11%

+ +

BI RATE 6.5%

YIELD SUN 7.5%

: :

YIELD SUN 7.5%

x x

PER SUN 13.33

+ +

EARNING MULTIPLE PREMIUM 0.63

x x

EPS TAHUN TERAKHIR 72

HARGA SEKARANG 1320

: :

HARGA WAJAR 1005

VALUATION INPUT TUNING

Tiga Pilar Sejahtera Food Tbk - AISA

Harga EPS (est) Dividend Payout Ratio BI Rate Risk Premium EPS Growth Projected PER Required Return

1,320 72 11.08 % 6.50 % 5% 43 % 13.96 11.20%

Proyeksi EPS dan Dividend per Share Tahun EPS 1 103 2 148 3 213 4 305 5 437 Total 1,206 Projected Stock Price Total Stock Price 6,107 6,241

DPS 11 16 24 34 48 134

FAIR VALUE MARGIN OF SAFETY

3,670 178.05%

EPS GROWTH/TAHUN ROE DER BI RATE HARGA SEKARANG YIELD SUN (%)

= = = = =

RUMUS VALUASI SAHAM PT Arwana Citramulia Tbk - ARN 10% 26% 0.5 6.5% 850

= = = = = = = = = = = = = = = = = = = = =

1% 1% 7.5% ROE 26.3% 18.8% 1 1 13.33 EARNING PREMIUM 18.8% 2.51 PER SUN 13.33 15.84 PER WAJAR 15.84 1346 1 1 37%

EARNING PREMIUM (%)

PER SUN (X)

EARNING MULTIPLE PREMIUM

PER WAJAR (X)

HARGA WAJAR (Rp)

MARGIN Of SAFETY (%)

NB : Isi kolom warna Hijau

RUMUS VALUASI SAHAM Arwana Citramulia Tbk - ARNA >15% >15%

EPS AWAL EPS AKHIR TOTAL YEARS

2008 2012

Rp59 Rp85 4 10%

<1,5X CAGR

Dividend Payout Ratio

47%

+ +

BI RATE 6.5%

YIELD SUN 7.5%

: :

YIELD SUN 7.5%

x x

PER SUN 13.33

+ +

EARNING MULTIPLE PREMIUM 2.51

x x

EPS TAHUN TERAKHIR 85

HARGA SEKARANG 850

: :

HARGA WAJAR 1346

VALUATION INPUT TUNING

Arwana Citramulia Tbk - ARNA

PT

Harga EPS (est) Dividend Payout Ratio BI Rate Risk Premium EPS Growth Projected PER Required Return

850 85 47.06 % 6.50 % 19 % 10 % 15.84 25.30%

Proyeksi EPS dan Dividend per Share Tahun EPS 1 93 2 102 3 112 4 122 5 134 Total 564 Projected Stock Price Total Stock Price 2,125 2,390

DPS 44 48 53 58 63 265

FAIR VALUE MARGIN OF SAFETY

774 -8.95%

EPS GROWTH/TAHUN ROE DER BI RATE HARGA SEKARANG YIELD SUN (%)

= = = = =

RUMUS VALUASI SAHAM PT Arwana Citramulia Tbk - ARN 21% 15% 0.6 6.5% 43050

= = = = = = = = = = = = = = = = = = = = =

1% 1% 7.5% ROE 15.2% 7.7% 1 1 13.33 EARNING PREMIUM 7.7% 1.03 PER SUN 13.33 14.36 PER WAJAR 14.36 29941 1 1 -44%

EARNING PREMIUM (%)

PER SUN (X)

EARNING MULTIPLE PREMIUM

PER WAJAR (X)

HARGA WAJAR (Rp)

MARGIN Of SAFETY (%)

NB : Isi kolom warna Hijau

RUMUS VALUASI SAHAM Arwana Citramulia Tbk - ARNA >15% >15%

EPS AWAL EPS AKHIR TOTAL YEARS

2008 2012

Rp977 Rp2,085 4 21%

<1,5X CAGR

Dividend Payout Ratio

38%

+ +

BI RATE 6.5%

YIELD SUN 7.5%

: :

YIELD SUN 7.5%

x x

PER SUN 13.33

+ +

EARNING MULTIPLE PREMIUM 1.03

x x

EPS TAHUN TERAKHIR 2,085

HARGA SEKARANG 43050

: :

HARGA WAJAR 29941

VALUATION INPUT TUNING

Arwana Citramulia Tbk - ARNA

PT

Harga EPS (est) Dividend Payout Ratio BI Rate Risk Premium EPS Growth Projected PER Required Return

43,050 2,085 47.06 % 6.50 % 8% 21 % 14.36 14.20%

Proyeksi EPS dan Dividend per Share Tahun EPS 1 2,520 2 3,046 3 3,681 4 4,450 5 5,378 Total 19,075 Projected Stock Price Total Stock Price 77,228 86,205

DPS 1,186 1,433 1,732 2,094 2,531 8,977

FAIR VALUE MARGIN OF SAFETY

44,381 3.09%

You might also like

- Business Finance 2Document19 pagesBusiness Finance 2Paul Manaloto100% (6)

- 4 Simple Volume Trading StrategiesDocument49 pages4 Simple Volume Trading StrategiesCharles Barony25% (4)

- Value Investor Excel Template Fxsneg8g3c20191217Document35 pagesValue Investor Excel Template Fxsneg8g3c20191217Kevin TanuNo ratings yet

- Final FIN 200 (All Chapters) FIXEDDocument65 pagesFinal FIN 200 (All Chapters) FIXEDMunNo ratings yet

- Advance Accounting 2 by GuerreroDocument13 pagesAdvance Accounting 2 by Guerreromarycayton100% (7)

- Stock Trading by Big MoneyDocument51 pagesStock Trading by Big MoneyMohd Nazri Zawawi100% (2)

- Lecture 1 - Into To TA Dow TheoryDocument29 pagesLecture 1 - Into To TA Dow TheoryAnonymous acRCvQDNo ratings yet

- (Faabay) SMART TRADERS NOT GLAMBERS PDFDocument235 pages(Faabay) SMART TRADERS NOT GLAMBERS PDFBundanya Fattach100% (1)

- Value Investing Beat The Market in Five Minutes! PDFDocument258 pagesValue Investing Beat The Market in Five Minutes! PDFRio Bayu PratamaNo ratings yet

- Analisis Teknikal SahamDocument17 pagesAnalisis Teknikal SahamSiti Nuraminah100% (2)

- Trading PlanDocument24 pagesTrading PlanEdo Bhe-Dhaw 翁明慧100% (1)

- Paham SahamDocument53 pagesPaham SahamMuhammad Fatur Rahman100% (3)

- Pennant Flag Pattern: Super AntDocument3 pagesPennant Flag Pattern: Super Antajekdur100% (2)

- How to Calculate Leverage on Binance FuturesDocument3 pagesHow to Calculate Leverage on Binance FuturesSNowyyNo ratings yet

- Analisa Teknikal - Intermediate - April 14Document93 pagesAnalisa Teknikal - Intermediate - April 14rikanapitupuluNo ratings yet

- Belajar AFL Yuuk..Document46 pagesBelajar AFL Yuuk..Nyamo Suendro100% (1)

- Trading Vs InvestingDocument220 pagesTrading Vs InvestingAziezach Iza AzaNo ratings yet

- Income Tax On Resident Foreign CorporationDocument6 pagesIncome Tax On Resident Foreign CorporationElaiNo ratings yet

- Tambah Kaya & Terencana Dengan Reksa DanaDocument111 pagesTambah Kaya & Terencana Dengan Reksa DanaMuhammad Syahbaini100% (1)

- Financial Management & Policy by James C. Van Horne 12th EditionDocument832 pagesFinancial Management & Policy by James C. Van Horne 12th EditionKashif Mirza82% (34)

- Lazy TraderDocument174 pagesLazy TraderPai MenNo ratings yet

- Introduction to Valuing Securities with DCF and Relative ModelsDocument94 pagesIntroduction to Valuing Securities with DCF and Relative ModelsRaiHan AbeDinNo ratings yet

- Rational Investor - Lukas Setia Atmaja PH.D PDFDocument196 pagesRational Investor - Lukas Setia Atmaja PH.D PDFLeo Nanda Julio67% (3)

- Ryan Filbert - Investasi Saham Ala Swing Trader DuniaDocument253 pagesRyan Filbert - Investasi Saham Ala Swing Trader DuniaSaniatul Latifah100% (2)

- Bandarmologi SemnarDocument4 pagesBandarmologi SemnarTirtahadi Chandra0% (1)

- Soal Ujian AK1Document126 pagesSoal Ujian AK1tyasardyraNo ratings yet

- Chapter 21Document28 pagesChapter 21Nak VanNo ratings yet

- What Is A Share or Stock?Document12 pagesWhat Is A Share or Stock?Vicky MbaNo ratings yet

- How to Analyze Stock Price Movements Using Tape ReadingDocument19 pagesHow to Analyze Stock Price Movements Using Tape Readinghani100% (4)

- Smart Traders Not Gamblers - Ellen May PDFDocument235 pagesSmart Traders Not Gamblers - Ellen May PDFAgief100% (1)

- Predicting Stock Prices with Technical AnalysisDocument34 pagesPredicting Stock Prices with Technical AnalysisFedy Firdianty100% (1)

- Akuntansi ManajemenDocument50 pagesAkuntansi Manajemenutari yani dewiNo ratings yet

- IGCSE Business Studies RevisionDocument27 pagesIGCSE Business Studies RevisionMightyManners82% (11)

- (Faabay) SMART TRADERS NOT GLAMBERS PDFDocument235 pages(Faabay) SMART TRADERS NOT GLAMBERS PDFBundanya Fattach100% (1)

- Berdasarkan laporan posisi keuangan di atas, apa yang dapat Anda analisis mengenai:1. Kemampuan perusahaan untuk membayar utang (solvability)2. Struktur modal perusahaanDocument82 pagesBerdasarkan laporan posisi keuangan di atas, apa yang dapat Anda analisis mengenai:1. Kemampuan perusahaan untuk membayar utang (solvability)2. Struktur modal perusahaanEnday TheaNo ratings yet

- Apple - Income StatementDocument5 pagesApple - Income StatementhappycolourNo ratings yet

- Seminar 20 APRIL 2019 PDFDocument122 pagesSeminar 20 APRIL 2019 PDFHerlin lovelyNo ratings yet

- Cash Flow Estimation and Risk Analysis: Answers To Selected End-Of-Chapter QuestionsDocument13 pagesCash Flow Estimation and Risk Analysis: Answers To Selected End-Of-Chapter QuestionsRapitse Boitumelo Rapitse0% (1)

- Buku Panduan RTI Ver 9.1Document50 pagesBuku Panduan RTI Ver 9.1Rocks LeeNo ratings yet

- HungryStock 2021Document16 pagesHungryStock 2021Frans AlfianNo ratings yet

- Indonesia Stock Market For Beginners: bagaimana berinvestasi di pasar sahamFrom EverandIndonesia Stock Market For Beginners: bagaimana berinvestasi di pasar sahamRating: 3 out of 5 stars3/5 (4)

- Stock Market Chart PatternsDocument7 pagesStock Market Chart PatternsBazi100% (1)

- Belajar Bareng Bandarmologi BasicDocument11 pagesBelajar Bareng Bandarmologi BasicAgus0% (1)

- Trading Class: Belajar Trading Dari Nol Sampai MahirDocument23 pagesTrading Class: Belajar Trading Dari Nol Sampai Mahirlintang kusumoNo ratings yet

- RK Gathering Market Outlook 2019 SummaryDocument86 pagesRK Gathering Market Outlook 2019 SummaryKiki Setya RiniNo ratings yet

- Technical Analysis GuideDocument32 pagesTechnical Analysis GuideSiti Nursyaidah Amini100% (1)

- Algoritma Market Maker: by Vier Abdul Jamal BIN AbdullahDocument9 pagesAlgoritma Market Maker: by Vier Abdul Jamal BIN Abdullahsidia tiktokNo ratings yet

- Belajar Trading ADVANCEDocument18 pagesBelajar Trading ADVANCEnatania nanakoNo ratings yet

- Analisis Pengaruh Faktor Fundamental Dan Nilai Kapitalisasi Pasar Terhadap Return SahamDocument23 pagesAnalisis Pengaruh Faktor Fundamental Dan Nilai Kapitalisasi Pasar Terhadap Return SahamMuhammad Himam Aula100% (2)

- Kotak Securities - Fundamental Analysis Book 1 - IntroductionDocument8 pagesKotak Securities - Fundamental Analysis Book 1 - IntroductionRajesh Bellamkonda0% (1)

- Valuasi Saham MppaDocument29 pagesValuasi Saham MppaGaos FakhryNo ratings yet

- FM 2012 WorksheetDocument9 pagesFM 2012 WorksheetBeing ShonuNo ratings yet

- Ipotstock Manual PDFDocument121 pagesIpotstock Manual PDFkiriungNo ratings yet

- Mengenal Candlestick PDFDocument27 pagesMengenal Candlestick PDFabahe RajaNo ratings yet

- Smart Traders Not GlambersDocument235 pagesSmart Traders Not GlambersDwikiNo ratings yet

- FIL Stock MarketDocument41 pagesFIL Stock Marketrekha_kumariNo ratings yet

- Safety Banner AlitaDocument3 pagesSafety Banner Alitaaswar100% (2)

- Hedging FuturesDocument39 pagesHedging Futuresapi-3833893100% (1)

- Vierjamal Mentoring ProgramDocument2 pagesVierjamal Mentoring ProgramErwin GinanjarNo ratings yet

- Nama Kelompok: Heldo Janika Windi Crysnalita Wulan FebriantiDocument11 pagesNama Kelompok: Heldo Janika Windi Crysnalita Wulan FebriantiWulan Febrianti100% (2)

- Intrinsic Value Calculator by MeDocument6 pagesIntrinsic Value Calculator by Menkw123No ratings yet

- CIA vs UIA for $5M investmentDocument2 pagesCIA vs UIA for $5M investmentdummy yummyNo ratings yet

- Mengenal Alat Ukur CaliperDocument19 pagesMengenal Alat Ukur Calipersafrudin100% (6)

- Results Update - Dec 2012 15.02Document10 pagesResults Update - Dec 2012 15.02ran2013No ratings yet

- IRIS Corporation Berhad - Rimbunan Kaseh To Come in Next Quarter - 120827Document2 pagesIRIS Corporation Berhad - Rimbunan Kaseh To Come in Next Quarter - 120827Amir AsrafNo ratings yet

- Fundamentals of Engineering Economics 4th Edition Park Solutions ManualDocument24 pagesFundamentals of Engineering Economics 4th Edition Park Solutions Manualjadehacr7u100% (18)

- Find P in year -1Document3 pagesFind P in year -1kevinjunior97No ratings yet

- Clase 4 Ingenieria EconomicaDocument55 pagesClase 4 Ingenieria EconomicaGrupo de Estudios FincosmerNo ratings yet

- Calculating equity cost of shares using dividend valuation modelsDocument2 pagesCalculating equity cost of shares using dividend valuation modelsHiền nguyễn thuNo ratings yet

- De Grey MiningDocument30 pagesDe Grey MiningSergey KNo ratings yet

- W4 Module 4 FINANCIAL RATIOS Part 2BDocument12 pagesW4 Module 4 FINANCIAL RATIOS Part 2BDanica VetuzNo ratings yet

- BBA Financial Management OverviewDocument458 pagesBBA Financial Management Overviewdivya kalyaniNo ratings yet

- Financial Statement AnalysisDocument10 pagesFinancial Statement Analysisishita gargNo ratings yet

- Chapter 8 Types of Major AccountsDocument42 pagesChapter 8 Types of Major AccountsMylene Salvador100% (1)

- Ferozsons AnalysisDocument27 pagesFerozsons Analysissmartguynauman100% (1)

- Old ManualDocument125 pagesOld ManualNelaFrankNo ratings yet

- Shareholders VsDocument2 pagesShareholders VsNidheesh TpNo ratings yet

- Final Project Report in 1Document91 pagesFinal Project Report in 1MKamranDanish100% (1)

- 1 GR No. 221626-2019-Light Rail Transit Authority v. Quezon CityDocument19 pages1 GR No. 221626-2019-Light Rail Transit Authority v. Quezon City0506sheltonNo ratings yet

- Problem Set I - Calculate ROE for Eastover and SouthamptonDocument4 pagesProblem Set I - Calculate ROE for Eastover and SouthamptonJoel Christian MascariñaNo ratings yet

- Accounting For ManagerDocument7 pagesAccounting For ManagerMasara OwenNo ratings yet

- Quiz On Mutual FundDocument7 pagesQuiz On Mutual FundTera ByteNo ratings yet

- Tata Steel Vs JSW SteelDocument12 pagesTata Steel Vs JSW SteelAshok NkNo ratings yet

- Tutorials on risk and return analysisDocument4 pagesTutorials on risk and return analysisraju RJNo ratings yet

- The Analysis of The Statement of ShareholdersDocument14 pagesThe Analysis of The Statement of ShareholdersPankaj KhindriaNo ratings yet

- Introduction to Derivatives: Risk Management, Trading Efficiency and ParticipantsDocument82 pagesIntroduction to Derivatives: Risk Management, Trading Efficiency and Participantskware215No ratings yet

- Lecture 07Document27 pagesLecture 07simraNo ratings yet

- ch09 1Document20 pagesch09 1Celestaire LeeNo ratings yet

- Mindtree ValuationDocument74 pagesMindtree ValuationAmit RanderNo ratings yet

- Nissim and Penman - Ratio Analysis and Equity Valuation From Research To PracticeDocument46 pagesNissim and Penman - Ratio Analysis and Equity Valuation From Research To PracticebarakinishuNo ratings yet