Professional Documents

Culture Documents

Causes & Effects of Effects of Inflation

Uploaded by

Dr. Pabitra Kumar MishraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Causes & Effects of Effects of Inflation

Uploaded by

Dr. Pabitra Kumar MishraCopyright:

Available Formats

01/11/2010

Causes & Effects of Inflation

A2 Economics, November 2010

Causes of inflation

Inflation is a sustained increase in the general level of prices There are many possible causes of price inflation in an economy for example

1. Demand and supply-side causes 2. Inflation from internal and external sources 3. Inflationary effects of government / regulatory intervention in the economy

Average rates of inflation vary widely across the world across countries at different stages of development

01/11/2010

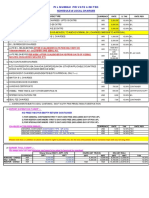

The consumer price index (CPI) Annual % change in the Consumer Price Index

6.0 5.0 4.0

Percent

UK Consumer Price Inflation

6.0 5.0 4.0 3.0

CPI Inflation target = 2%

3.0 2.0 1.0 0.0 -1.0 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11

2.0 1.0 0.0 -1.0

Source: UK Statistics Commission

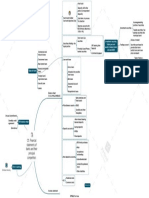

Mapping the main causes of inflation in the UK

Basic Pay Bonuses + overtime Import Prices + Commodity Prices Unit labour + costs + Exchange rate / Profit margins Global Economic Cycle =

Earnings

Rate of inflation

Productivity Taxes + Economic Cycle Secular Influences (e.g. ICT impact, quality of education) Fiscal Policy Profit Margins

Economic Cycle

01/11/2010

Demand-pull inflation

Demand pull inflation

When there is excess demand for goods and services Positive output gap (where actual GDP > Potential GDP) Businesses respond by raising prices to increase profit margins Demand-pull D d ll i inflation fl ti associated i t d with ith b boom phase of the cycle (SRAS becomes inelastic) Root causes of demand pull inflation are usually monetary in origin (excessive lending / growth of the money supply monetarist causes)

Main causes of demand pull inflation

A large depreciation of the exchange rate A reduction in direct or indirect taxation Rapid growth of the money supply as a consequence of increased bank and building society borrowing Rising consumer confidence and an increase in the rate of growth of house prices Faster economic growth in other countries providing a boost to UK exports overseas

01/11/2010

Illustrating demand-pull inflation

General Price Level LRAS SRAS1 P2 P1

AD1

AD2

Y1

Yfc Y2

National Income

SRAS responds to excess aggregate demand

General Price Level P3 P2 P1 LRAS SRAS2 SRAS1

AD1

AD2

Y1

Yfc Y2

National Income

01/11/2010

Demand-pull inflation using a nonlinear AS curve

General Price Level P3 LRAS

P2

P1

AD3 SRAS AD1 AD2

Y1

Y2 Yfc

Real National Income

Inflation gap for the UK Output Gap and = Actual output GDP - Potential GDP. CPI inflation - annual % change in prices

10.0 8.0 6.0 4.0

Per cent

The Output Gap and Consumer Price Inflation

10.0 8.0 6.0 4.0

CPI Inflation

2.0 0.0 -2.0 -4.0 -6.0 -8.0 90 92 94 96 98 00

Output gap

2.0 0.0 -2.0 -4.0 -6.0 -8.0

02

04

06

08

10

Source: UK Statistics Commission and OECD World Economic Outlook

01/11/2010

Cost Push Inflation

Causes:

External shocks ( (i.e. commodity y price fluctuations) ) A depreciation in the exchange rate (higher import costs) Acceleration in wages / unit labour costs in the labour market

Leads to an inward shift in SRAS curve Firms raise prices to protect their profit margins better able to do this when demand is price inelastic Wages often follow prices - a second-round effects of an increase in the cost of living Rise in actual inflation can lead to an increase in inflationary expectations

Illustrating cost-push inflation

LRAS

General Price Level

SRAS2 SRAS1

P2 P1

AD1

Y2

Y1

Yfc

National Income

01/11/2010

Illustrating cost-push inflation with a non-linear SRAS

LRAS General Price Level

P2 P1

SRAS2 SRAS1 AD1 AD2 Y3 Y2 Y1 Yfc Real National Income

Oil and CPI inflation Annualprices % change in the Consumer Price Index and monthly average for Brent Crude

150

US SD/Barrel

UK Inflation and Crude Oil Prices

150

Crude Oil Price

100 50 0 6.0 5.0 4.0 3.0 2.0 1.0 0.0

100 50 0 6.0 5.0 4.0 3.0 2.0 1.0 0.0

Percent P

Consumer Price Inflation

06

07

08

09

10

Source: UK Statistics Commission and IPE

01/11/2010

6 5 4

Percent

Wage Growth and Consumer Prices - A Link? Average Earnings and Consumer Annual % change in earnings and consumer prices Prices in the UK

Average Earnings

6 5 4 3

3 2 1 0 00 01 02 03 04 05 06 07 08 09 10

Consumer price inflation

2 1 0

Source: Reuters EcoWin

200

Index of have UK Import Prices Import prices can a direct Index 2003=100, source: Monthly Digest of Economic Statistics effect on the rate of inflation

200

175

175

150

150

125

Index

Finished Manufactured Goods

125

100

100

Total Import Price Index

75

75

Import Prices for Fuels

50

50

25 01 02 03 04 05 06 07 08 09 10

25

Imports of Goods exc oil Imports of Fuels

Imports of finished manufactures

Source: Reuters EcoWin

01/11/2010

Inflation and the Exchange for the UK How does the exchange rateRate affect Exchange rate index (top pane) and inflation (lower pane) inflationary pressures? 110

Sterling Exchange Rate Index

110 100 90 80 70

100

Index I

90 80 70 6.0 5.0 4.0 3.0 2.0 1.0 0.0

Consumer Price Inflation

6.0 5.0 4.0 3.0 2.0 1.0 0.0

Source: Reuters EcoWin

Percent P

95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10

Consequences of inflation

01/11/2010

The costs of inflation

Taken together, the verdict of economics, history and common sense is that inflation and deflation are costly. It is clear that high inflation in extreme cases hyperinflation can lead to a breakdown of the economy. There is now a considerable body of empirical evidence that inflation and output growth are negatively correlated in high-inflation countries. For inflation rates in single figures, the impact of i fl ti on growth inflation th i is l less clear. l Mervyn King adapted from a speech entitled The Inflation Target Ten Years On given in 2002

Costs and Consequences of Inflation (1)

Money loses its value or real purchasing power y as the value and people lose confidence in money of savings is reduced Inflation can get out of control - price increases lead to higher wage demands as people try to maintain their living standards. This is known as a wage-price spiral. Employees p y in p poor bargaining g gp positions lose out and suffer a reduction in their real living standards and relative income level (i.e. to other groups)

10

01/11/2010

Costs and Consequences of Inflation (2)

Inflation can favour borrowers at the expense of savers because inflation erodes the real value of existing debts- if real interest rates are negative Inflation can disrupt business planning and lead to lower capital investment Exporters may suffer if prices in the UK rise higher than those abroad causing a deterioration in global competitiveness g p and a worsening g of the balance of payments position A possible cause of higher unemployment Rising inflation is associated with higher policy interest rates - this reduces trend growth

UKUK Economic Growth and Inflation Real GDP Growth and Consumer Price Inflation. annual % change

10.0 7.5 5.0

Percent

Economic Growth and Inflation

10.0 7.5

Real GDP growth

5.0 2.5

2.5 0.0 -2.5 -5.0 -7.5 90

Consumer price inflation

0.0 -2.5 -5.0 -7.5

92

94

96

98

00

02

04

06

08

10

Source: UK Statistics Agency

11

01/11/2010

Anticipated inflation

When people are able to make accurate predictions of inflation inflation, they can take steps to protect themselves from its effects For example, trade unions may exercise their collective bargaining power to negotiate with employers for increases in money wages so as to protect the real wages of union members

Unanticipated inflation

Unanticipated inflation occurs when economic agents (people, (people businesses and governments) make errors in their inflation forecasts Actual inflation may end up well below, or significantly above expectations causing losses in real incomes and a redistribution of income and wealth from one group in society to another

12

01/11/2010

Bank of England/NOP, how do you expect prices to change over the next 12 months?

Inflation expectations

Inflation Expectations

6.0 5.0 4.0 3.0 2.0 1.0 0.0

6.0 5.0 4.0

Percent

3.0 2.0 1.0 0.0 04 05 06 07 08 09 10

How do you expect prices to change over the next 12 months? How has prices changed over the past 12 months?

Source: Bank of England

Some Inflation Web Resources

13

01/11/2010

Join our Facebook Fan Page

Revision Workshops

14

01/11/2010

Tutor2u Economics

Keepuptodatewitheconomics, resources,quizzesand worksheetsforyoureconomics course.

15

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- GEN009 Quiz 1 P2 SET A KDocument4 pagesGEN009 Quiz 1 P2 SET A KShane QuintoNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Pil Mumbai Private Limited: Schedule of Local ChargesDocument1 pagePil Mumbai Private Limited: Schedule of Local ChargesANMOL SUKHDEVENo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- e-StatementBRImo 107101000260307 Aug2023 20230905 004028Document12 pagese-StatementBRImo 107101000260307 Aug2023 20230905 004028Fedy HermawanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Financial Statement Analysis For MBA StudentsDocument72 pagesFinancial Statement Analysis For MBA StudentsMikaela Seminiano100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Brief Analysis of Section 7 (1) (A) of CGST Act 2017 - Scope of Supply - Taxguru - inDocument5 pagesBrief Analysis of Section 7 (1) (A) of CGST Act 2017 - Scope of Supply - Taxguru - inPrakhar MaheshwariNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Bank Bumiputra (M) BHD V Hashbudin Bin HashiDocument10 pagesBank Bumiputra (M) BHD V Hashbudin Bin HashiNorlia Md DesaNo ratings yet

- Learning MaterialsDocument38 pagesLearning MaterialsBrithney ButalidNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Cost of CapitalDocument8 pagesCost of CapitalSiva KotiNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Selling Skills - Role PlaysDocument10 pagesSelling Skills - Role PlaysPIYUSH RAGHUWANSHINo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- IPO Critical DisclosuresDocument93 pagesIPO Critical DisclosuresFarhin MaldarNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- PressRelease Last Date For Linking of PAN Aadhaar Extended 28 3 23Document1 pagePressRelease Last Date For Linking of PAN Aadhaar Extended 28 3 23Faisal SaeedNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- ACC222 EXAM: FINANCIAL MANAGEMENT QUESTIONSDocument5 pagesACC222 EXAM: FINANCIAL MANAGEMENT QUESTIONSmaica G.No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Structured Flowchart of The Loan Computation: StartDocument6 pagesStructured Flowchart of The Loan Computation: StarthalerNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- CHAPTER 6 Caselette - Audit of InvestmentsDocument30 pagesCHAPTER 6 Caselette - Audit of InvestmentsCharlene Mina0% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Chapter 6a (Depreciation)Document11 pagesChapter 6a (Depreciation)quraisha irdinaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- STUDY MATERIAL ON MONEY MARKET AND FINANCIAL SYSTEMDocument25 pagesSTUDY MATERIAL ON MONEY MARKET AND FINANCIAL SYSTEMPrateek VyasNo ratings yet

- The Functions of Bangladesh BankDocument10 pagesThe Functions of Bangladesh BankMd. Rakibul Hasan Rony93% (14)

- Solution To Trina Haldane - Question 4Document2 pagesSolution To Trina Haldane - Question 4Debbie Debz100% (2)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- BSBFIA301 Maintain Financial RecordsDocument7 pagesBSBFIA301 Maintain Financial RecordsMonique BugeNo ratings yet

- BLO Unit 1-1Document24 pagesBLO Unit 1-1Mohammad MAAZNo ratings yet

- Agrani Bank 2010Document78 pagesAgrani Bank 2010Shara Binte Hamid100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Equity ValuationDocument32 pagesEquity Valuationprince455No ratings yet

- Moniepoint Document 2023-07-28T05 05.xlaDocument42 pagesMoniepoint Document 2023-07-28T05 05.xlacurtispengeleroyNo ratings yet

- Sapsea Oh, I Think You Exaggerate The Matter, Mr. JasperDocument4 pagesSapsea Oh, I Think You Exaggerate The Matter, Mr. JasperlalownetoNo ratings yet

- Module 5 (TOPIC 7) - IMPAIRMENT OF ASSETS (INDIVIDUAL ASSETS)Document5 pagesModule 5 (TOPIC 7) - IMPAIRMENT OF ASSETS (INDIVIDUAL ASSETS)Khamil Kaye GajultosNo ratings yet

- FormulaDocument10 pagesFormulaAngel Alejo Acoba100% (1)

- Account Statement: 4445935743 Bhayander (W)Document17 pagesAccount Statement: 4445935743 Bhayander (W)Nitin kumar SinghNo ratings yet

- SWIFT and BAI2 transaction codes guideDocument40 pagesSWIFT and BAI2 transaction codes guideAdéla DoležalováNo ratings yet

- Activity Ratio Presentation CompleteDocument14 pagesActivity Ratio Presentation CompleteMohsin RazaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- C5. Financial Statements of Banks and Their Principal CompetitorsDocument1 pageC5. Financial Statements of Banks and Their Principal CompetitorsNguyen Hoai HuongNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)