Professional Documents

Culture Documents

Akm CH 8

Uploaded by

fariskysejayaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Akm CH 8

Uploaded by

fariskysejayaCopyright:

Available Formats

Valuation of Inventories: Cost-Basis Approach Inventory Issues Classification Inventories are: items held for sale, or goods to be used

in the production of goods to be sold. One inventory account. Purchase goods in form ready for sale. Three accounts Raw materials Work in process Finished goods Perpetual System Purchases of merchandise are debited to Inventory. Freight-in is debited to Inventory. Purchase returns and allowances and purchase discounts are credited to Inventory. Cost of goods sold is debited and Inventory is credited for each sale. Subsidiary records show quantity and cost of each type of inventory on hand. Periodic System Purchases of merchandise are debited to Purchases. Ending Inventory determined by physical count. Calculation of Cost of Goods Sold: Beginning inventory $ 100,000 Purchases, net 800,000 Goods available for sale 900,000 Ending inventory 125,000 Cost of goods sold $ 775,000 Inventory Control All companies need periodic verification of the inventory records by actual coun t, weight, or measurement, with the counts compared with the detailed inventory records. Companies should take the physical inventory near the end of their fiscal year, to properly report inventory quantities in their annual accounting reports. Basic Issues in Inventory Valuation Companies must allocate the cost of all the goods available for sale (or use) be tween the goods that were sold or used and those that are still on hand. (ilus) Basic Issues in Inventory Valuation Valuation requires determining The physical goods (goods on hand, goods in transit, consigned goods, special sa les agreements). The costs to include (product vs. period costs). The cost flow assumption (specific Identification, average cost, FIFO, retail, e tc.). Physical Goods Included in Inventory A company should record purchases when it obtains legal title to the goods. (ilus) Effect of Inventory Errors (ilus)

Physical Goods Included in Inventory Effect of Inventory Errors Purchases and Inventory Misstated (ilus) Costs Included in Inventory Product Costs - costs directly connected with bringing the goods to the buyer s pl ace of business and converting such goods to a salable condition. Period Costs generally selling, general, and administrative expenses. Treatment of Purchase Discounts Gross vs. Net Method

You might also like

- SMGR LK AuditedDocument155 pagesSMGR LK AuditedfariskysejayaNo ratings yet

- Diagnostic Control and Formal IncentivesDocument9 pagesDiagnostic Control and Formal IncentivesfariskysejayaNo ratings yet

- SfarticelDocument6 pagesSfarticelfariskysejayaNo ratings yet

- ESL Teacher: Teachers: This Free Lifeskills Worksheet May Be Copied For Classroom Use. Visit Us On TheDocument1 pageESL Teacher: Teachers: This Free Lifeskills Worksheet May Be Copied For Classroom Use. Visit Us On Thefariskysejaya100% (1)

- Busy Bus Driver: Teachers: This Free Lifeskills Worksheet May Be Copied For Classroom Use. Visit Us On TheDocument1 pageBusy Bus Driver: Teachers: This Free Lifeskills Worksheet May Be Copied For Classroom Use. Visit Us On TheAlmendrita Songbooks100% (1)

- New York Cab Driver WorksheetDocument1 pageNew York Cab Driver WorksheetBlassius LiewNo ratings yet

- A. Bagan Arus Fungsi Penagihan: MulaiDocument1 pageA. Bagan Arus Fungsi Penagihan: MulaifariskysejayaNo ratings yet

- Tafsir Ibnu Katsir Surat Al 'AshrDocument2 pagesTafsir Ibnu Katsir Surat Al 'AshrDion ErbeNo ratings yet

- Brinks CH 26Document6 pagesBrinks CH 26fariskysejayaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Template - 40-Audit-Committee-CharterDocument18 pagesTemplate - 40-Audit-Committee-CharterDENIS GICHURUNo ratings yet

- AuditingDocument8 pagesAuditingShahadath HossenNo ratings yet

- ch03 SolDocument12 pagesch03 SolJohn Nigz PayeeNo ratings yet

- Cash Flow and Fund Flow StatementDocument23 pagesCash Flow and Fund Flow StatementRishul BhasinNo ratings yet

- Test Questions GovernmentDocument17 pagesTest Questions GovernmentMerliza JusayanNo ratings yet

- Cardiff Cash Management V2.0Document108 pagesCardiff Cash Management V2.0elsa7er2000No ratings yet

- Cattle Fattening FinancialsDocument5 pagesCattle Fattening Financialsprince kupaNo ratings yet

- Summary Far 350 FinalDocument9 pagesSummary Far 350 Finalaz1anNo ratings yet

- Acctg180 - w04 Problems - Assets-Liabilities-Financial - Statement - AnalysisDocument16 pagesAcctg180 - w04 Problems - Assets-Liabilities-Financial - Statement - AnalysisAniNo ratings yet

- Forming An Opinion and Reporting On Financial StatementsDocument68 pagesForming An Opinion and Reporting On Financial StatementsLalaLaniba100% (1)

- Statement of Financial Position (In USD) POWR Year 2014 - 2016Document2 pagesStatement of Financial Position (In USD) POWR Year 2014 - 2016ElizabethNo ratings yet

- Audit MCQDocument20 pagesAudit MCQNitin BadganchiNo ratings yet

- Siklus AkuntansiDocument15 pagesSiklus AkuntansiBachrul AlamNo ratings yet

- Accounting For Branches and Combined FSDocument112 pagesAccounting For Branches and Combined FSAbrish MelakuNo ratings yet

- AppppDocument3 pagesAppppMaria Regina JavierNo ratings yet

- Accounting Research and Methods OrientationDocument40 pagesAccounting Research and Methods OrientationPang Siulien100% (1)

- Accounting Theory 7th Edition Godfrey PDFDocument7 pagesAccounting Theory 7th Edition Godfrey PDFNova TheresiaNo ratings yet

- Afar PBDocument7 pagesAfar PBJosephine MercadoNo ratings yet

- Cpa in Transit: Time Code Description Title ProfessorDocument1 pageCpa in Transit: Time Code Description Title ProfessorAJHDALDKJANo ratings yet

- CHAPTER 1 (Topic 1) - BELKAOUI-12092017 - MmaDocument41 pagesCHAPTER 1 (Topic 1) - BELKAOUI-12092017 - MmaAdobe ProNo ratings yet

- Ushahidi, Inc.: Financial StatementsDocument12 pagesUshahidi, Inc.: Financial StatementsChristinaHolmanNo ratings yet

- Sequencing by Legal Entity or LedgerDocument61 pagesSequencing by Legal Entity or LedgerMatthew PitkinNo ratings yet

- Cash Disbursement SystemDocument11 pagesCash Disbursement SystemMarisolNo ratings yet

- Non Integrated AccountingDocument4 pagesNon Integrated AccountingbinuNo ratings yet

- Financial Accounting Case StudiesDocument2 pagesFinancial Accounting Case StudiesRodlyn LajonNo ratings yet

- Study Question Bank Becker F7 DipIFRDocument134 pagesStudy Question Bank Becker F7 DipIFRNguyen Nhan100% (1)

- Quiz On Audit Engagement and PlanningDocument7 pagesQuiz On Audit Engagement and PlanningAdam SmithNo ratings yet

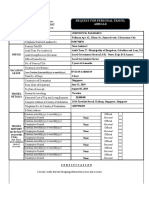

- Request For Personal Travel Abroad: Commonwealth Avenue, Quezon CityDocument5 pagesRequest For Personal Travel Abroad: Commonwealth Avenue, Quezon CityJonson PalmaresNo ratings yet

- Solution Additional Exercise 1 Chapter 6 7Document3 pagesSolution Additional Exercise 1 Chapter 6 7Doreen OngNo ratings yet

- Capability - Table New (5) 20190825073712 (2) 20191229131437Document1 pageCapability - Table New (5) 20190825073712 (2) 20191229131437Varikuppala SrikanthNo ratings yet