Professional Documents

Culture Documents

Fundamental Analysis Black Book

Uploaded by

waghaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental Analysis Black Book

Uploaded by

waghaCopyright:

Available Formats

CHAPTER-1 INTRODUCTION TO FUNDAMENTAL ANALYSIS

1.1 EXECUTIVE SUMMARY

Executive Summery is a brief introduction of each chapter. It contains very few details of each chapter. Executive Summery is a very important because the reader or user can know the details; objective etc of the report is a very useful to them on. The objective of this study is to understand the and fundamental analysis in insurance sector. The study may be viewed as a formal study wherein research problem requires examining the current state of the banks in a typically structured manner with validation - rejection of certain hypothesis and ascertaining probable opportunities.

METHODOLOGY METHODS OF DATA COLLECTION : Research Design Sources of Data Secondary Sources Articles Books Newspapers : : Descriptive & Causal. Primary and Secondary

Descriptive analysis will be used in order to draw conclusion. Outcome of the study will be presented in tables and graphs for easy understanding of the findings of the research. Frequency distribution charts are used while analyzing and number so achieved are presented in a percentage form so as to represent it through graph.

1.2 OBJECTIVES OF THE STUDY

The study is viewed as a formal study wherein research problem requires examining the current state of the fundamental analysis in insurance sector in a typically structured manner with validation - rejection of certain hypothesis and ascertaining probable opportunities.

1.3 INTRODUCTION

Fundamental Analysis involves examining the economic, financial and other qualitative and quantitative factors related to a security in order to determine its intrinsic value. It attempts to study everything that can affect the security's value, including macroeconomic factors (like the overall economy and industry conditions) and individually specific factors (like the financial condition and management of companies). Fundamental analysis, which is also known as quantitative analysis, involves delving into a companys financial statements (such as profit and loss account and balance sheet) in order to study various financial indicators (such as revenues, earnings, liabilities, expenses and assets). Such analysis is usually carried out by analysts,

brokers and savvy investors. Many analysts and investors focus on a single number--net income (or earnings)--to evaluate performance. When investors attempt to forecast the market value of a firm, they frequently rely on earnings. Many institutional investors, analysts and regulators believe earnings are not as relevant as they once were. Due to nonrecurring events, disparities in measuring risk and management's ability to disguise fundamental earnings problems, other measures beyond net income can assist in predicting future firm earnings. Fundamental analysis is the examination of the underlying forces that affect the well being of the economy, industry groups, and companies. As with most analysis, the goal is to derive a forecast and profit from future price movements. At the company level, fundamental analysis may involve examination of financial data, management, business concept and competition. At the industry level, there might be an examination of supply and demand forces for the products offered. For the national economy, fundamental analysis might focus on economic data to assess the present and future growth of the economy. To forecast future stock prices, fundamental analysis combines economic, industry, and company analysis to derive a stock's current fair value and forecast future value. If fair value is not equal to the current stock price, fundamental analysts believe that the stock is either over or under valued and the market price will ultimately gravitate towards fair value. Fundamentalists do not heed the advice of the random walkers and believe that markets are weak-form efficient. By believing that prices do not accurately reflect all available information, fundamental analysts look to capitalize on perceived price discrepancies.

1.4 TWO APPROACHES OF FUNDAMENTAL ANALYSIS While carrying out fundamental analysis, investors can use either of the following approaches 1. Top-down approach: In this approach, an analyst investigates both international and national economic indicators, such as GDP growth rates, energy prices, inflation and interest rates. The search for the best security then trickles down to the analysis of total sales, price levels and foreign competition in a sector in order to identify the best business in the sector. 2. Bottom-up approach: In this approach, an analyst starts the search with specific businesses, irrespective of their industry/region. Fundamental analysis of a business involves analyzing its financial statements and health, its management and competitive advantages, and its competitors and markets. When applied to futures and forex, it focuses on the overall state of the economy, interest rates, production, earnings, and management. When analyzing a stock, futures contract, or currency using fundamental analysis there are two basic approaches one can use; bottom up analysis and top down analysis.[1] The term is used to distinguish such analysis from other types of investment analysis, such as quantitative analysis and technical analysis. Fundamental analysis is performed on historical and present data, but with the goal of making financial forecasts. There are several possible objectives:

to conduct a company stock valuation and predict its probable price evolution, to make a projection on its business performance, to evaluate its management and make internal business decisions,

to calculate its credit risk.

Investors can use any or all of these different but somewhat complementary methods for stock picking. For example many fundamental investors use technicals for deciding entry and exit points. Many technical investors use fundamentals to limit their universe of possible stock to 'good' companies. The choice of stock analysis is determined by the investor's belief in the different paradigms for "how the stock market works". See the discussions at efficient-market hypothesis, random walk hypothesis, capital asset pricing model, Fed model Theory of Equity Valuation, market-based valuation, and behavioral finance. Fundamental analysis includes: 1. Economic analysis 2. Industry analysis 3. Company analysis On the basis of these three analyses the intrinsic value of the shares are determined. This is considered as the true value of the share. If the intrinsic value is higher than the market price it is recommended to buy the share . If it is equal to market price hold the share and if it is less than the market price sell the shares.

CHAPTER-2 STEPS TO EVALUATE FUNDAMENTAL ANALYSIS 2.1 GENERAL STEPS TO FUNDAMENTAL EVALUATION Even though there is no one clear-cut method, a breakdown is presented below in the order an investor might proceed. This method employs a top-down approach that starts with the overall economy and then works down from industry groups to specific companies. As part of the analysis process, it is important to remember that all information is relative. Industry groups are compared against other industry groups and companies against other companies. Usually, companies are compared with others in the same group. For example, a telecom operator (Verizon) would be compared to another telecom operator (SBC Corp), not to an oil company (ChevronTexaco). 2.1.1 Economic Forecast

First and foremost in a top-down approach would be an overall evaluation of the general economy. The economy is like the tide and the various industry groups and individual companies are like boats. When the economy expands, most industry groups and companies benefit and grow. When the economy declines, most sectors and companies usually suffer. Many economists link economic expansion and contraction to the level of interest rates. Interest rates are seen as a leading indicator for the stock market as well. Below is a chart of the S&P 500 and the yield on the 10-year note over the last 30 years. Although not exact, a correlation between stock prices and interest rates can be seen. Once a scenario for the overall economy has been developed, an investor can break down the economy into its various industry groups.

2.1.2 Group Selection If the prognosis is for an expanding economy, then certain groups are likely to benefit more than others. An investor can narrow the field to those groups that are best suited to benefit from the current or future economic environment. If most companies are expected to benefit from an expansion, then risk in equities would be relatively low and an aggressive growth-oriented strategy might be advisable. A growth strategy might involve the purchase of technology, biotech, semiconductor and cyclical stocks. If the economy is forecast to contract, an investor may opt for a more conservative strategy and seek out stable income-oriented companies. A defensive strategy might involve the purchase of consumer staples, utilities and energy-related stocks. To assess a industry group's potential, an investor would want to consider the overall growth rate, market size, and importance to the economy. While the individual company is still

important, its industry group is likely to exert just as much, or more, influence on the stock price. When stocks move, they usually move as groups; there are very few lone guns out there. Many times it is more important to be in the right industry than in the right stock! The chart below shows that relative performance of 5 sectors over a 7-month time frame. As the chart illustrates, being in the right sector can make all the difference.

2.1.3 Narrow Within The Group Once the industry group is chosen, an investor would need to narrow the list of companies before proceeding to a more detailed analysis. Investors are usually interested in finding the leaders and the innovators within a group. The first task is to identify the current business and competitive environment within a group as well as the future trends. How do the companies rank according to market share, product position and competitive advantage? Who is the current leader and how will changes within the sector affect the current balance of power? What are the barriers to entry? Success depends on an edge, be it marketing, technology, market share or innovation.A comparative analysis of the competition within a sector will help identify those companies with an edge, and those most likely to keep it.

2.1.4 Company Analysis

With a shortlist of companies, an investor might analyze the resources and capabilities within each company to identify those companies that are capable of creating and maintaining a competitive advantage. The analysis could focus on selecting companies with a sensible business plan, solid management and sound financials. 2.1.5 Business Plan The business plan, model or concept forms the bedrock upon which all else is built. If the plan, model or concepts stink, there is little hope for the business. For a new business, the questions may be these: Does its business make sense? Is it feasible? Is there a market? Can a profit be made? For an established business, the questions may be: Is the company's direction clearly defined? Is the company a leader in the market? Can the company maintain leadership? 2.1.6 Management In order to execute a business plan, a company requires top-quality management. Investors might look at management to assess their capabilities, strengths and weaknesses. Even the bestlaid plans in the most dynamic industries can go to waste with bad management (AMD in semiconductors). Alternatively, even strong management can make for extraordinary success in a mature industry (Alcoa in aluminum). Some of the questions to ask might include: How talented is the management team? Do they have a track record? How long have they worked together? Can management deliver on its promises? If management is a problem, it is sometimes best to move on.

2.1.7 Financial Analysis The final step to this analysis process would be to take apart the financial statements and come up with a means of valuation. Below is a list of potential inputs into a financial analysis. Accounts Payable Accounts Receivable Acid Ratio Amortization Assets - Current Assets - Fixed Book Value Brand Good Will Gross Profit Margin Growth Industry Interest Cover International Investment Liabilities - Current

Business Cycle Business Idea Business Model Business Plan Capital Expenses Cash Flow Cash on hand Current Ratio Customer Relationships Days Payable Days Receivable Debt Debt Structure Debt: Equity Ratio Depreciation Derivatives-Hedging Discounted Cash Flow Dividend Dividend Cover Earnings EBITDA Economic Growth Equity Equity Risk Premium Expenses

Liabilities - Long-term Management Market Growth Market Share Net Profit Margin Page view Growth Page views Patents Price/Book Value Price/Earnings PEG Price/Sales Product Product Placement Regulations R&D Revenues Sector Stock Options Strategy Subscriber Growth Subscribers Supplier Relationships Taxes Trademarks Weighted Average Cost of Capital

The list can seem quite long and intimidating. However, after a while, an investor will learn what works best and develop a set of preferred analysis techniques. There are many different valuation metrics and much depends on the industry and stage of the economic cycle. A complete financial model can be built to forecast future revenues, expenses and profits or an investor can rely on the forecast of other analysts and apply various multiples to arrive at a valuation. Some of the more popular ratios are found by dividing the stock price by a key value driver.

RATIO Price/Book Value Price/Earnings Price/Earnings/Growth Price/Sales Price/Subscribers Price/Lines Price/Page views Price/Promises

COMPANY TYPE Oil Retail Networking B2B ISP or cable company Telecom Web site Biotech

This methodology assumes that a company will sell at a specific multiple of its earnings, revenues or growth. An investor may rank companies based on these valuation ratios. Those at the high end may be considered overvalued, while those at the low end may constitute relatively good value.

2.1.8 Putting It All Together After all is said and done, an investor will be left with a handful of companies that stand out from the pack. Over the course of the analysis process, an understanding will develop of which companies stand out as potential leaders and innovators. In addition, other companies would be considered laggards and unpredictable. The final step of the fundamental analysis process is to synthesize all data, analysis and understanding into actual picks.

2.2 STRENGTHS OF FUNDAMENTAL ANALYSIS

2.2.1 Long-Term Trends Fundamental analysis is good for long-term investments based on very long-term trends. The ability to identify and predict long-term economic, demographic, technological or consumer trends can benefit patient investors who pick the right industry groups or companies.

2.2.2 Value Spotting Sound fundamental analysis will help identify companies that represent a good value. Some of the most legendary investors think long-term and value. Graham and Dodd, Warren Buffett and John Neff are seen as the champions of value investing. Fundamental analysis can help uncover companies with valuable assets, a strong balance sheet, stable earnings, and staying power.

2.2.3 Business Acumen One of the most obvious, but less tangible, rewards of fundamental analysis is the development of a thorough understanding of the business. After such painstaking research and analysis, an investor will be familiar with the key revenue and profit drivers behind a company. Earnings and earnings expectations can be potent drivers of equity prices. Even some technicians will agree to that. A good understanding can help investors avoid companies that are prone to shortfalls and identify those that continue to deliver. In addition to understanding the business, fundamental analysis allows investors to develop an understanding of the key value drivers and companies within an industry. A stock's price is heavily influenced by its industry group. By studying these groups, investors can better position themselves to identify opportunities that are high-risk (tech), low-risk (utilities), growth oriented (computer), value driven (oil), non-cyclical (consumer staples), cyclical (transportation) or income-oriented (high yield).

2.3 FUNDAMENTALS: QUANTITATIVE AND QUALITATIVE You could define fundamental analysis as "researching the fundamentals", but that doesn't tell you a whole lot unless you know what fundamentals are. As we mentioned in the introduction, the big problem with defining fundamentals is that it can include anything related to the economic well-being of a company. Obvious items include things like revenue and profit, but fundamentals also include everything from a company's market share to the quality of its management. The various fundamental factors can be grouped into two categories: quantitative and qualitative. The financial meaning of these terms isn't all that different from their regular definitions. Here is how the MSN Encarta dictionary defines the terms:

Quantitative capable of being measured or expressed in numerical terms. Qualitative related to or based on the quality or character of something, often as opposed to its size or quantity.

In our context, quantitative fundamentals are numeric, measurable characteristics about a business. It's easy to see how the biggest source of quantitative data is the financial statements.

10

You

can

measure

revenue,

profit,

assets

and

more

with

great

precision.

Turning to qualitative fundamentals, these are the less tangible factors surrounding a business things such as the quality of a company's board members and key executives, its brand-name recognition, patents or proprietary technology. QUANTITATIVE MEETS QUALITATIVE Neither qualitative nor quantitative analysis is inherently better than the other. Instead, many analysts consider qualitative factors in conjunction with the hard, quantitative factors. Take the Coca-Cola Company, for example. When examining its stock, an analyst might look at the stock's annual dividend payout, earnings per share, P/E ratio and many other quantitative factors. However, no analysis of Coca-Cola would be complete without taking into account its brand recognition. Anybody can start a company that sells sugar and water, but few companies on earth are recognized by billions of people. It's tough to put your finger on exactly what the Coke brand is worth, but you can be sure that it's an essential ingredient contributing to the company's ongoing success.

2.4 THE CONCEPT OF INTRINSIC VALUE Before we get any further, we have to address the subject of intrinsic value. One of the primary assumptions of fundamental analysis is that the price on the stock market does not fully reflect a stock's "real" value. After all, why would you be doing price analysis if the stock market were always correct? In financial jargon, this true value is known as the intrinsic value. For example, let's say that a company's stock was trading at $20. After doing extensive homework on the company, you determine that it really is worth $25. In other words, you determine the intrinsic value of the firm to be $25. This is clearly relevant because an investor wants to buy stocks that are trading at prices significantly below their estimated intrinsic value. This leads us to one of the second major assumptions of fundamental analysis: in the long run, the stock market will reflect the fundamentals. There is no point in buying a stock based on intrinsic value if the price never reflected that value. Nobody knows how long "the long run" really is. It could be days or years. This is what fundamental analysis is all about. By focusing on a particular business, an investor can estimate the intrinsic value of a firm and thus find opportunities where he or she can buy at

11

a discount. If all goes well, the investment will pay off over time as the market catches up to the fundamentals.

CHAPTER-3 MERITS AND DEMERITS, TOOLS AND RATIOS

3.1 HOW DOES FUNDAMENTAL ANALYSIS WORKS Fundamental analysis is carried out with the aim of predicting the future performance of a company. It is based on the theory that the market price of a security tends to move towards its 'real value' or 'intrinsic value.' Thus, the intrinsic value of a security being higher than the securitys market value represents a time to buy. If the value of the security is lower than its market price, investors should sell it. The steps involved in fundamental analysis are: 1. Macroeconomic analysis, which involves considering currencies, commodities and indices. 2. Industry sector analysis, which involves the analysis of companies that are a part of the sector. 3. Situational analysis of a company. 4. Financial analysis of the company.

12

5. Valuation The valuation of any security is done through the discounted cash flow (DCF) model, which takes into consideration: 1. Dividends received by investors 2. Earnings or cash flows of a company 3. Debt, which is calculated by using the debt to equity ratio and the current ratio (current assets/current liabilities)

2.5.1 Benefits Of Fundamental Analysis Fundamental analysis helps in: 1. Identifying the intrinsic value of a security. 2. Identifying long-term investment opportunities since it involves real-time data.

2.5.2 Drawbacks Of Fundamental Analysis

Too many ecnomic indicators and extensive macroeconomic data can confuse novice investors.The same set of information on macroeconomic indicators can have varied effects on the same currencies at different times.It is beneficial only for long-term investments 3.2 FUNDAMENTAL ANALYSIS TOOLS These are the most popular tools of fundamental analysis. 1.Earnings per Share EPS 2.Price to Earnings Ratio P/E 3.Projected Earning Growth PEG 4.Price to Sales P/S 5.Price to Book P/B 6.Dividend Payout Ratio 7.Dividend Yield 8.Book Value 9.Return on Equity

3.3 RATIO ANALYSIS

13

financial ratios are tools for interpreting financial statements to provide a basis for valuing securities and appraising financial and management performance. A good financial analyst will build in financial ratio calculations extensively in a financial modeling exercise to enable robust analysis Financial ratios allow a financial analyst to: 1. Standardize information from financial statements across multiple financial years to allow comparison of a firms performance over time in a financial model. 2. Standardize information from financial statements from different companies to allow an apples to apples comparison between firms of differing size in a financial model. 3. Measure key relationships by relating inputs (costs) with outputs (benefits) and facilitates comparison of these relationships over time and across firms in a financial model. In general, there are 4 kinds of financial ratios that a financial analyst will use most frequently, these are: 1. 2. 3. 4. Performance ratios Working capital ratios Liquidity ratios Solvency ratios

These 4 financial ratios allow a good financial analyst to quickly and efficiently address the following questions or concerns: 1) Performance ratios What return is the company making on its capital investment? What are its profit margins? 2) Working capital ratios How quickly are debts paid? How many times is inventory turned? 3) Liquidity ratios Can the company continue to pay its liabilities and debts? 4) Solvency ratios (Longer term) What is the level of debt in relation to other assets and to equity? Is the level of interest payable out of profits

3.4 TECHNICAL ANALYSIS is the practice of anticipating price changes of a financial instrument by analyzing prior price changes and looking for patterns and relationships in price history.

14

Since all the investors in the stock market want to make the maximum profits possible, they just cannot afford to ignore either fundamental or technical analysis. The price of a security represents a consensus. It is the price at which one person agrees to buy and another agrees to sell. The price at which an investor is willing to buy or sell depends primarily on his expectations. If he expects the security's price to rise, he will buy it; if the investor expects the price to fall, he will sell it. These simple statements are the cause of a major challenge in forecasting security prices, because they refer to human expectations. As we all know firsthand, humans expectations are neither easily quantifiable nor predictable. If prices are based on investor expectations, then knowing what a security should sell for (i.e., fundamental analysis) becomes less important than knowing what other investors expect it to sell for. That's not to say that knowing what a security should sell for isn't important--it is. But there is usually a fairly strong consensus of a stock's future earnings that the average investor cannot disprove.

3.5 WHY ONLY FUNDAMENTAL ANALYSIS

3.5.1 Long-term Trends Fundamental analysis is good for long-term investments based on long-term trends, very longterm. The ability to identify and predict long-term economic, demographic, technological or consumer trends can benefit patient investors who pick the right industry groups or companies.

3.5.2 Value Spotting Sound fundamental analysis will help identify companies that represent a good value. Some of the most legendary investors think long-term and value. Graham and Dodd, Warren Buffett and John Neff are seen as the champions of value investing. Fundamental analysis can help uncover companies with valuable assets, a strong balance sheet, stable earnings, and staying power. 3.5.3 Business Insights One of the most obvious, but less tangible, rewards of fundamental analysis is the development of a thorough understanding of the business. After such pains taking research and analysis, an investor will be familiar with the key revenue and profit drivers behind a company. Earnings and earnings expectations can be potent drivers of equity prices. Even some technicians will agree to that. A good understanding can help investors avoid companies that are prone to shortfalls and identify those that continue to deliver. In addition to understanding the business, fundamental analysis allows investors to develop an understanding of the key value drivers and companies within an industry. A stock's price is heavily influenced by its industry group. By studying these groups, investors can better position themselves to identify opportunities that are high-risk (tech), low-risk (utilities), growth oriented (computer), value driven (oil), non-cyclical (consumer staples), cyclical (transportation) or income-oriented (high yield).

15

3.5.4 Knowing Who's Who Stocks move as a group. By understanding a company's business, investors can better position themselves to categorize stocks within their relevant industry group. Business can change rapidly and with it the revenue mix of a company. This has happened with many of the pure internet retailers, which were not really internet companies, but plain retailers. Knowing a company's business and being able to place it in a group can make a huge difference in relative valuations. The charts of the technical analyst may give all kinds of profit alerts, signals and alarms, but theres little in the charts that tell us why a group of people make the choices that create the price patterns.

3.6 WEAKNESSES OF FUNDAMENTAL ANALYSIS

3.6.1 Time Constraints Fundamental analysis may offer excellent insights, but it can be extraordinarily time-consuming. Time-consuming models often produce valuations that are contradictory to the current price prevailing on Wall Street. When this happens, the analyst basically claims that the whole street has got it wrong. This is not to say that there are not misunderstood companies out there, but it is quite brash to imply that the market price, and hence Wall Street, is wrong. 3.6.2 Industry/Company Specific Valuation techniques vary depending on the industry group and specifics of each company. For this reason, a different technique and model is required for different industries and different companies. This can get quite time-consuming, which can limit the amount of research that can be performed. A subscription-based model may work great for an Internet Service Provider (ISP), but is not likely to be the best model to value an oil company. 3.6.3 Subjectivity Fair value is based on assumptions. Any changes to growth or multiplier assumptions can greatly alter the ultimate valuation. Fundamental analysts are generally aware of this and use sensitivity analysis to present a base-case valuation, an average-case valuation and a worst-case valuation. However, even on a worst-case valuation, most models are almost always bullish, the only question is how much so. The chart below shows how stubbornly bullish many fundamental analysts can be.

16

3.6.4 Analyst Bias The majority of the information that goes into the analysis comes from the company itself. Companies employ investor relations managers specifically to handle the analyst community and release information. As Mark Twain said, "there are lies, damn lies, and statistics." When it comes to massaging the data or spinning the announcement, CFOs and investor relations managers are professionals. Only buy-side analysts tend to venture past the company statistics. Buy-side analysts work for mutual funds and money managers. They read the reports written by the sell-side analysts who work for the big brokers (CIBC, Merrill Lynch, Robertson Stephens, CS First Boston, Paine Weber, DLJ to name a few). These brokers are also involved in underwriting and investment banking for the companies. Even though there are restrictions in place to prevent a conflict of interest, brokers have an ongoing relationship with the company under analysis. When reading these reports, it is important to take into consideration any biases a sell-side analyst may have. The buy-side analyst, on the other hand, is analyzing the company purely from an investment standpoint for a portfolio manager. If there is a relationship with the company, it is usually on different terms. In some cases this may be as a large shareholder. 3.6.5 Definition of Fair Value When market valuations extend beyond historical norms, there is pressure to adjust growth and multiplier assumptions to compensate. If Wall Street values a stock at 50 times earnings and the current assumption is 30 times, the analyst would be pressured to revise this assumption higher. There is an old Wall Street adage: the value of any asset (stock) is only what someone is willing to pay for it (current price). Just as stock prices fluctuate, so too do growth and multiplier assumptions. Are we to believe Wall Street and the stock price or the analyst and market assumptions?

17

It used to be that free cash flow or earnings were used with a multiplier to arrive at a fair value. In 1999, the S&P 500 typically sold for 28 times free cash flow. However, because so many companies were and are losing money, it has become popular to value a business as a multiple of its revenues. This would seem to be OK, except that the multiple was higher than the PE of many stocks! Some companies were considered bargains at 30 times revenues.

CHAPTER-4 FUNDAMENTAL ANALYSIS IN INSURANCE SECTOR

4.1 INTRODUCTION TO INSURANCE Insurance is a social device in which a group of individuals (insured) transfer risk to another party (insurer) in order to combine loss experience, which permits statistical prediction of losses and provides for payment of losses from funds contributed (premiums) by all members who transferred risk. Insurance plays a crucial role in every risk management program, regardless of size. In whichever form, insurance almost always represents the ultimate hedging device to protect the budget and the overall financial integrity of the firm against a single catastrophe or sharply skewed loss experience.

18

Insurance sector in India was traditionally dominated by state owned Life Insurance Corporation and General Insurance Corporation and its four subsidiaries. Government of India is now considering increase in FDI in insurance sector up to 49% from the existing 26%. Financial sector reforms in India in 90s have advocated the objectives of opening the constituent segments to competition & liberalized operations. The thrust of financial reforms was to promote a diversified, efficient and competitive financial system, with the ultimate objective of improving the allocative efficiency of resources through operational flexibility, improved financial viability and institutional strengthening. Increasing integration with global markets then became another catalyst for further reforms. The management of financial sector has been oriented towards gradual rebalancing between efficiency & stability and the changing shares of public and private ownership. Enhanced competition among diverse players has been encouraged. The banking and insurance system has witnessed greater levels of transparency and standards of disclosure. Risk: Risk can be defined as peril, danger, hazard, chance of bad consequences, loss, uncertainty, exposure to mischance. Risk may be defined as the possibility of adverse results flowing from any occurrence. It also represents the possibility of an outcome being different from the expected. If it is known for certain that a loss will occur, there is no risk. The term risk is used in insurance business to also mean either a peril to be insured against (e.g. fire is a risk to which property is exposed) or a person or property protected by insurance (e.g. young drivers are often not considered good risk for motor insurance companies). 4.2 PRESENT SCENARIO OF INSURANCE INDUSTRY India with about 200 million middle class household shows a huge untapped potential for players in the insurance industry. Saturation of markets in many developed economies has made the Indian market even more attractive for global insurance majors. The insurance sector in India has come to a position of very high potential and competitiveness in the market. Indians, have always seen life insurance as a tax saving device, are now suddenly turning to the private sector that are providing them new products and variety for their choice. Consumers remain the most important centre of the insurance sector. After the entry of the foreign players the industry is seeing a lot of competition and thus improvement of the customer service in the industry. Computerization of operations and updating of technology has

19

become imperative in the current scenario. Foreign players are bringing in international best practices in service through use of latest technologies The insurance agents still remain the main source through which insurance products are sold. The concept is very well established in the country like India but still the increasing use of other sources is imperative. At present the distribution channels that are available in the market are listed below. Direct selling Corporate agents Group selling Brokers and cooperative societies Banc assurance

Customers have tremendous choice from a large variety of products from pure term (risk) insurance to unit-linked investment products. Customers are offered unbundled products with a variety of benefits as riders from which they can choose. More customers are buying products and services based on their true needs and not just traditional money back policies, which is not considered very appropriate for long-term protection and savings. There is lots of saving and investment plans in the market. However, there are still some key new products yet to be introduced - e.g. health products. The rural consumer is now exhibiting an increasing propensity for insurance products. A research conducted exhibited that the rural consumers are willing to dole out anything between Rs.3, 500 and Rs.2, 900 as premium each year. In the insurance the awareness level for life insurance is the highest in rural India, but the consumers are also aware about motor, accidents and cattle insurance. In a study conducted by MART the results showed that nearly one third said that they had purchased some kind of insurance with the maximum penetration skewed in favor of life insurance. The study also pointed out the private companies have huge task to play in creating awareness and credibility among the rural populace. The perceived benefits of buying a life policy range from security of income bulk return in future, daughter's marriage, children's education and good return on savings, in that order, the study adds.

20

4.2.1 THE FUNCTIONS OF INSURANCE CAN BE BIFURCATED INTO THREE PARTS: 1. Primary Functions 2. Secondary Functions 3. Other Functions The primary functions of insurance include the following: A. Provide Protection - The primary function of insurance is to provide protection against future risk, accidents and uncertainty. Insurance cannot check the happening of the risk, but can certainly provide for the losses of risk. Insurance is actually a protection against economic loss, by sharing the risk with others. B. Collective bearing of risk - Insurance is a device to share the financial loss of few among many others. Insurance is a mean by which few losses are shared among larger number of people. All the insured contribute the premiums towards a fund and out of which the persons exposed to a particular risk is paid. C. Assessment of risk - Insurance determines the probable volume of risk by evaluating various factors that give rise to risk. Risk is the basis for determining the premium rate also. D. Provide Certainty - Insurance is a device, which helps to change from uncertainty to certainty. Insurance is device whereby the uncertain risks may be made more certain.

4.2.2 THE SECONDARY FUNCTIONS OF INSURANCE INCLUDE THE FOLLOWING: A. Prevention of Losses - Insurance cautions individuals and businessmen to adopt suitable device to prevent unfortunate consequences of risk by observing safety instructions; installation of automatic sparkler or alarm systems, etc. Prevention of losses cause lesser payment to the assured by the insurer and this will encourage for more savings by way of premium. Reduced rate of premiums stimulate for more business and better protection to the insured. B. Small capital to cover larger risks - Insurance relieves the businessmen from security investments, by paying small amount of premium against larger risks and uncertainty. C. Contributes towards the development of larger industries - Insurance provides development opportunity to those larger industries having more risks in their setting up. Even the financial

21

institutions may be prepared to give credit to sick industrial units which have insured their assets including plant and machinery. 4.2.3 THE OTHER FUNCTIONS OF INSURANCE INCLUDE THE FOLLOWING: A. Means of savings and investment - Insurance serves as savings and investment, insurance is a compulsory way of savings and it restricts the unnecessary expenses by the insured's For the purpose of availing income-tax exemptions also, people invest in insurance. B. Source of earning foreign exchange - Insurance is an international business. The country can earn foreign exchange by way of issue of marine insurance policies and various other ways. C. Risk Free trade - Insurance promotes exports insurance, which makes the foreign trade risk free with the help of different types of policies under marine insurance cover.

4.3 FEATURES OF INSURANCE INDUSTRY Insurance Policy India provides the clients with the details required for the coverage in the policy, date of commencement of the policy and their adopting organizations. It plays a important role in the Indian insurance sector. The Insurance Policy India is regulated by certain acts like the Insurance Act (1938), the Life Insurance Corporation Act (1956), General Insurance Business Nationalization) Act (1972), Insurance Regulatory and Development Authority IRDA) Act (1999). The insurance policy determines the covers against risks, sometime opens investment options with insurance companies setting high returns and also informs about the tax benefits like the LIC in India. There are two types of insurance covers: 1. Life insurance 2. General insurance 4.3.1 Life insurance-this sector deals with the risks and the accidents affecting the life of the customer. Alongside, this insurance policy also offers tax planning and investment returns. There are various types of life Insurance Policy India: a. Endowment Policy b. Whole Life Policy

22

c. Term Life Policy d. Money-back Policy e. Joint Life Policy f. Group Insurance Policy 4.3.2 General Insurance -this sector covers almost everything related to property, vehicle, cash, household goods, health and also one's liability towards others. The major segments covered under general Insurance Policy India are: b. Home Insurance b. Health Insurance c. Motor Insurance d. Travel Insurance Some of the well-known Insurance Policy in India are: A. Social Security Group Scheme - a scheme covering the age group of 18-60 years and an insurance of Rs.5000 for natural death and of Rs.25000 on due to accidental death. B. Shiksha Sahyog Yojana -a scheme providing an educational scholarship of Rs.300 per quarter per child is given for a period of four years. C. Jan Arogya Bima Policy -a scheme for the adults up to the age of 45 years is Rs.70 and for children it is Rs.50. The limit coverage is fixed at Rs.5000 per annum. D. Mediclaim Insurance Policy -a scheme covering the age group from 5-80 years with a tax benefit of up to Rs.10, 000. E. Jana Shree Bima Yojana -this is coverage of Rs.2, 000 on natural death and Rs.50, 000 for accidental death. The premium amount is fixed at Rs.200 for single member. F. Videsh Yatra Mitra Policy -a scheme-covering medical expenses during the period of overseas travel. G. Bhagya Shree Child Welfare Bima Yojana -a scheme covering one girl child in a family up to the age of 18 whose parents age does not exceed 60 years, with a premium of Rs.15 per annum.

23

H. Raj Rajeshwari Mahila Kalyan Yojana -a scheme providing protection to woman in the age group of 10 to 75 years with an insurance of Rs.25, 000 and premium Rs.15 per annum. I. Ashray Bima Yojana scheme-covering workers in case of loss of jobs.

Personal Accident Insurance Scheme for Kissan Credit Card a scheme covering all the KCC holders up to an age of 70 years. Insurance coverage includes 50,000 for accidental death and 25,000 for partial disability.

4.4 NEED OF INSURANCE Today, there is no shortage of investment options for a person to choose from. Modern day investments include gold, property, fixed income instruments, mutual funds and of course, life insurance. Given the plethora of choices, it becomes imperative to make the right choice when investing your hard-earned money. Life insurance is a unique investment that helps you to meet your dual needs - saving for life's important goals, and protecting your assets. Let us look at these unique benefits of life insurance in detail. 4.4.1 Asset Protection From an investor's point of view, an investment can play two roles - asset appreciation or asset protection. While most financial instruments have the underlying benefit of asset appreciation, life insurance is unique in that it gives the customer the reassurance of asset protection, along with a strong element of asset appreciation. The core benefit of life insurance is that the financial interests of one's family remain protected from circumstances such as loss of income due to critical illness or death of the policyholder. Simultaneously, insurance products also have a strong inbuilt wealth creation proposition. The customer therefore benefits on two counts and life insurance occupies a unique space in the landscape of investment options available to a customer. 4.4.2 Goal based savings Each of us has some goals in life for which we need to save. For a young, newly married couple, it could be buying a house. Once, they decide to start a family, the goal changes to planning for the education or marriage of their children. As one grows older, planning for one's retirement will begin to take precedence.

24

Clearly, as your life stage and therefore your financial goals change, the instrument in which you invest should offer corresponding benefits pertinent to the new life stage.

Life insurance is the only investment option that offers specific products tailor made for different life stages. It thus ensures that the benefits offered to the customer reflect the needs of the customer at that particular life stage, and hence ensures that the financial goals of that life stage are met.

4.5 BUSINESS MODEL OF INSURANCE COMPANY Insurance Business Model: Profit = Earned Premium + Investment Income - Incurred Loss Underwriting Expenses. An insurer's underwriting performance is measured in their combined ratio. The loss ratio (incurred losses and loss-adjustment expenses divided by net earned premium) is added to the expense ratio (underwriting expenses divided by net premium written) to determine the company's combined ratio. The combined ratio is a reflection of the company's overall underwriting profitability. A combined ratio of less than 100 percent indicates profitability, while anything over 100 indicates a loss. Insurance companies also earn investment profits on float. Float or available reserve is the amount of money, at-hand at any given moment that an insurer has collected in insurance premium but has not been paid out in claims. Insurers start investing insurance premium as soon as it is collected and keeps earning interest on it until claims are paid out. The investment regulations are made in exercise of power conferred by Sections 27A, 27B, 27D and 114A of the Insurance Act, 1938. 27A: Life insurance business investments, 27B: General insurance business investments, 27D: Manner & conditions of investment, 114A: power of Authority to make regulations, 27C: Prohibition for investment of funds outside India. Approved investments: Investments which are in accordance with the provisions of section 27A & 27B of Insurance Act, 1938 for life & general insurance respectively. Insurance companies in India have to invest in the following as per IRDA guidelines. Central Government securities

25

State Government securities Other Approved Securities Funding to State Governments for housing / electricity purposes Debentures/ bonds Preference shares Equity shares Term loans Unsecured short term loans

CHAPTER-5

5.1 TYPES OF INSURANCE COMPANIES

Insurance companies may be classified as Life insurance companies, who sell life insurance, annuities and pensions products. Non-life or general insurance companies, who sell other types of insurance. Reinsurance companies In most countries, life and non-life insurers are subject to different regulations, tax and accounting rules. The main reason for the distinction between the two types of company is that life business is very long term in nature coverage for life assurance or a pension can cover risks over many decades. By contrast, non- life insurance cover usually covers a shorter period, such as one year. Reinsurance companies are insurance companies that cover risks of other insurance companies, allowing them to reduce their risks and protect themselves from very large losses. The reinsurance market is dominated by a few very large companies, with huge reserves. In India, insurance business is divided into the following major categories: 1) Life Insurance (Transacted by life insurers) 2) Fire Insurance 3) Marine Insurance and 4) Miscellaneous Insurance (Transacted by non-life insurers) No composite insurance companies are permitted as per law.

26

Customer Protection: Insurance Industry has Ombudsmen in 12 cities. Each Ombudsman is empowered to redress customer grievances in respect of insurance contracts on personal lines where the insured amount is less than Rs. 20 lakhs, in accordance with the Ombudsman Scheme.

5.1.1 LIFE INSURANCE COMPANIES LICENCED BY IRDA (Sept. 2010) 1. Life Insurance Corporation of India 2. SBI Life Insurance Co. Ltd 3. Birla Sun Life Insurance Co. Ltd 4. HDFC Standard Life Insurance Co. Ltd 5. ICICI Prudential Life Insurance Co. Ltd 6. ING Vysya Life Insurance Company Pvt. Ltd. 7. Reliance Life Insurance Company Limited. 8. Met Life India Insurance Company Ltd. 9. Kotak Mahindra Old Mutual Life Insurance Limited 10. Tata AIG Life Insurance Company Limited 5.1.2 NON-LIFE INSURANCE COMPANIES LICENCED BY IRDA (Sept. 2010) 1. Bajaj Allianz General Insurance Co. Ltd 2. ICICI Lombard General Insurance Co. Ltd 3. IFFCO Tokio General Insurance Co. Ltd 4. National Insurance Co. Ltd 5. The New India Assurance Co. Ltd 6. The Oriental Insurance Co. Ltd 7. Reliance General Insurance Co. Ltd 8. Royal Sundaram Alliance Insurance Co. Ltd

27

9. Tata AIG General Insurance Co. Ltd 10. United India Insurance Co. Ltd

5.2 LIFE INSURANCE INDUSTRY IN INDIA More than a century in India. Large mobilization of savings next only to banks. Significant participant in the capital markets. Capital Deployed more than Rs. 16,400 Crores. Assets under management more than Rs. 8, 47,600 Crores. Invested in Infrastructure more than Rs. 90,200 Crores. Number of branches more than 8500. Number of direct employees- more than 2.5 lakhs. Number of agents more than 25 lakhs. Number of In-force policies approximately 26 Crores. Sum assured in-force more than 23,600 Crores. Four hazards of human life: 1. Loss of employment 2. Old age 3. Disability 4. Death Utility of life insurance: 1. Family protection 2. Savings 3. Tax saver 4. Collateral Life Insurance is a contract for payment of a sum of money to the person assured or to the person entitled for receiving the sum, on happening of an event insured against. Usually a contract provides payment of an amount on the date of maturity or on specified dates or on death of the assured. Contract provides for periodic payment of premium. Types: Medical/ Non-medical, with profit/ without profit, Single premium/ multiple premium, single life/ group. Whole Life Policies and Endowment policies are permanent type of policies.

28

Term assurances are temporary contracts which provide basic death risk cover. When a person has a reasonably large sum of money and wants to provide an income for himself after retirement he can buy an annuity. An annuity is a method by which a person can receive a yearly sum, an annuity, in return for payment to an insurance company of a sum of money. Insurance Regulation: World over, the State, in some form or the other depending upon its philosophy, administrative capabilities, socioeconomic/political compulsions and preferences regulates insurance business. The objective of regulation is to ensure that the business is run fairly, conducted by competent persons, does not result in undue losses to the insurers themselves resulting in their insolvency and that the legitimate interest of the insuring public is protected. IRDA has come out with various guidelines and regulations on different subjects.

5.3 DEVELOPMENT OF INDIA INSURANCE INDUSTRY Developments in Indian Insurance Industry: The Indian Insurance Industry is nearly two centuries old. The life insurance business began with the setting up of the Oriental Life

Insurance Company in 1818. The general insurance industry took roots with the setting up of the Triton Insurance Company in 1850 in Calcutta. Bombay Mutual life assured Society, formed in 1870 was the first Indian owned life insurer. In 1907, The Indian Mercantile

Insurance limited was set up to transact all classes of general insurance business. The first piece of legislation to regulate the conduct of life business was the Indian Life Assurance Companies Act, 1912. A comprehensive law was enacted in 1938 (the Insurance Act) which consolidated earlier legislation and provided for administrative and regulatory measures for the regulation of insurance business in India. Substantial amendments were made in 1950 to the Insurance Act to include provisions relating to investments, periodic filing of returns, equity capital requirements, controls on management expenses and commissions and for the appointment of administrators in respect of financially unsound companies. Around the time of India's Independence, there were 236 insurers in India, comprising of foreign companies and branches and provident societies. (These included 46 composite insurers.) The financial failure of some insurers at a time when the country was progressively moving towards a centrally planned command economy set the stage for nationalization of the life insurance business in 1956. The need for additional avenues of finance to fund Plan expenditure was another key consideration for passing the LIC Act in 1956, leading to the creation of the

29

Life Insurance Corporation of India with a capital contribution of Rs.5 crore from the Government of India. 245 Indian and foreign insurers and provident societies taken over by the central government. The other objectives of nationalization of the life insurance industry were: 1. To spread the reach of life insurance, particularly to rural areas 2. To conduct the business with utmost economy, in a spirit of trusteeship 3. To charge premiums no higher than warranted by strict actuarial considerations 4. To prudently invest funds in order to maximize yield to policy holders, consistent with safety of capital 5. To render prompt and efficient service to policy holders 6. Avoid preferential treatment in underwriting as also claims payment In 1968, Tariff Advisory Committee (TAC) was formed and rates and terms in Fire, Marine, Motor and Engineering businesses were brought under tariff. In 1972, non- life insurance business in India was nationalized by taking over the operations of then existing 107 companies and organizing them in to 4 companies- National, New India, oriental & United India. General Insurance Corporation of India (GIC) was formed as holding company for these 4 companies as also to take care of reinsurance needs. was realized by government as early as 1993 when the Committee on Reforms in Insurance Sector (CRIS) was formed under the Chairmanship of Mr. R N Malhotra. The committee was set up in the context of the several initiatives aimed at creating a more efficient and competitive financial system suitable for the requirements of the economy. The terms of reference of the Committee included examination of the present structure of the insurance industry and to make recommendations keeping in view the structural changes currently under way in other parts of the financial system and in the economy. The Committee was also required to make specific suggestions regarding LIC and GIC which would help to improve their functioning in the changing environment. Recommendations for the strengthening and modernizing of the insurance regulatory system and matters relevant for the healthy and long term development of the insurance sector were also sought from the Committee. In 1994, the committee submitted the report and some of the key recommendations were: i) Structure: Government stake in the insurance Companies to be brought down to 50% Government should take over the holding of GIC and its subsidiaries so that these

30

subsidiaries can act as independent corporations All the insurance companies should be given greater freedom to operate ii) Competition: Private Companies with a minimum paid up capital of Rs.1bn should be allowed to enter the industry. No Company should deal in both Life and General Insurance through a single entity. Foreign companies may be allowed to enter the industry in collaboration with the domestic companies. Postal Life Insurance should be allowed to operate in the rural market. Only one State Level Life Insurance Company should be allowed to operate in each state. iii) Regulatory Body: The Insurance Act should be changed. An Insurance Regulatory body should be set up Controller of Insurance (a part of the Finance Ministry then) should be made independent. iv) Investments: Mandatory Investments of LIC Life Fund in government securities to be reduced from 75% to 50%. GIC and its subsidiaries are not to hold more than 5% in any company (There holdings to be brought down to this level over a period of time if was more) v) Customer Service: LIC should pay interest on delays in payments beyond 30 day. Insurance companies must be encouraged to set up unit linked pension plans. Computerization of operations and updating of technology to be carried out in the insurance industry. The advantages of liberalization are expected to be in terms of: Development of nations infrastructure Market development through new intermediaries and distribution channels Enhanced level of customer satisfaction Competitive pricing as against tariff rates Professionalism & technology driven processes

The committee emphasized that in order to improve the customer services and increase the coverage of the insurance industry should be opened up to competition. But at the same time, the committee felt the need to exercise caution as any failure on the part of new players could ruin the public confidence in the industry. Hence, it was decided to allow competition by stipulating the minimum capital requirement of Rs.100 crores. The committee felt the need to provide greater autonomy to public sector insurance companies in order to improve their performance and enable them to act as independent companies with economic motives.

31

Opening up of Indian insurance sector for competition: Three major reasons for inviting competition in the sector where Government had monopoly, could be (1) low insurance penetration, (2) lack of customer focus and low service levels and (3) expectation of additional funding for infrastructure. New companies came into Indias insurance horizon from 2000 onward. GIC was separated from 4 state owned general insurance companies in 2001 and was made exclusively a reinsurance company 5.4 FUNDAMENTAL PRINCIPLE OF THE INSURANCE

1. Utmost Good Faith: In all General Insurance contracts we know that a property or interest or liability or life is offered for insurance and the insured has to take decisions on the acceptance of the proposal. If he decides to accept the proposal a premium commensurate with the risk has to be charged. To enable him to take necessary decision in this regard, the insurer must have certain facts about the risk offered. These facts influence the judgment of the insurer in deciding about the acceptance or otherwise of the risk and the rate of premium to be charged, if accepted. Such facts are known as material facts. 2. Insurable Interest: Insurable interest means the legal right to insure. Insurable Interest is a must and only then the insurance contract is enforceable at law. This principle differentiates a Contract of insurance from wager. Lack of insurable interest renders the contract null and void. For Insurable Interest to exist there must be Property, Rights, Interest, Life or Liability; this must be insured and the Insured should have a legally recognizable relationship thereto. The Insured should be benefited by the safety of the property or is prejudiced by its loss. Insurable Interest may arise in the following manner: Ownership: Absolute ownership entitles the owner to insure the property. This is the commonest method whereby Insurable Interest arises. Partial Interest is also insurable e.g. a mortgagee. A creditor can also insure the life of his debtor but only to the extent of his loan. Administrators and executors i.e. officials appointed by a court of law to take care of a property may also insure the property. Relationship does not automatically constitute insurable interest. The only relationship recognized by law for this purpose is the one between a husband and wife.

32

An employer can insure his employee under a Personal Accident Policy as he has insurable interest in them.

3. Indemnity: To place insured after a loss in the same financial position as far as possible as he occupied before the loss. There should not be a profit made by insured out of a loss. (Would not apply for life and personal lines of insurance business)

4. Contribution: An insured may have several insurances on the same subject matter. If he recovers his loss under all these insurances, he will obviously make a profit out of loss. This will be an infringement of the principle of indemnity. Common Law has, therefore, evolved the doctrine of contribution whereby the insured is prevented from recovering more than his loss, despite his having several insurances on the subject-matter. 5. Subrogation: The principle of indemnity seeks to prevent the insured from making profit out of loss. However, it may so happen that that the insured may recover his loss under his policy and he may also have rights against third parties. If, after the insurance claim is settled, the insured is allowed to enforce his rights against third parties and to retain whatever damages he receives from them, he will certainly make a profit and the principle of indemnity will be infringed. Common Law has therefore, evolved the doctrine of subrogation as corollary to the principle of indemnity. Subrogation may be defined as the transfer of rights and remedies of the insured to the insurers who have indemnified the insured in respect of the loss. The Common Law right of subrogation is implied an all contracts on indemnity, as it arises only after payment of loss. 6. Proximate cause: Generally, the claims are payable under insurance policies if they arise out of events which are proximately caused by the insured perils. In other words, the proximate cause of the event has to be peril covered by the policy, so as to constitute a valid claim. Proximate cause has been defined as "the active, efficient cause that sets in motion a train of events which brings about a result without the intervention of any force started and working actively from a new and independent source". 7. Intermediaries in insurance: Effective functioning of multiple agencies is an essential

prerequisite of the insurance business. The business primarily concerns with receipt of premium & issue of policy and claims processing & payment. There are various elements in this chain.

33

The insurance company (insurer), publicity, agents, brokers, consultants, surveyors, loss assessors, third party administrators, reinsurance brokers, courts and clients (insured). 8. Insurance legislation: Though Insurance Act, 1938 is the basic legislation governing insurance, there are many other acts directly or indirectly applicable to insurance. To name a few: Companies Act, 1958, The Negotiable Instruments Act, The Motor Vehicles Act, Carriage of Goods Act, Income Tax Act, The Life Insurance Corporation Act, 1956, The Marine Insurance Act, 1963, The General Insurance Business (Nationalization) Act, 1972, The Personal Injuries (Compensation Insurance) Act, 1963, The Public Liability Insurance Act, 1991, The War Injuries (Compensation Insurance) Act, 1943, Insurance Regulatory Development Authority Act, 1999. 9. Actuary: The business enterprise relies on advice and services rendered by professionals from various disciplines for smooth conduct of operations. Professionals could be from the field of engineering, information technology, accounting, auditing, taxation etc. Some of them would be involved full time being employed by the business while others would offer their services on a job or contract basis. In India, we are aware of services offered by professionals like

engineers, software consultants, chartered accountants and cost accountants. The actuarial profession in India is relatively unknown. An actuary is a financial expert, specializing in statistical estimation of various risks and their financial consequences. Actuary plays an

important role in designing and pricing of insurance covers. Also helps in the areas of loss reserving, investments etc. Actuaries assemble and analyze statistics to: Calculate probability of a loss. Determine rates that are fair for the company and the policyholder. Help determine the reserves and surplus the company must establish to cover future losses. 10. Scope for actuarial profession: Actuarial expertise can not only be used in the area of life insurance, but also in the areas of general insurance, health insurance, pension etc. In life insurance: Assessment and valuation of mortality risks In property insurance: risk appraisal and pricing accordingly In investment: investment decisions In health insurance: analysis of morbidity data and pricing accordingly

34

11. Underwriting: Underwriting is the process of selecting risks for insurance and determining in what amounts and on what terms the insurance company will accept the risk. The process also includes rejection of those risks that do not qualify. Underwriter is a technician trained in evaluating risks and determining rates and coverage for them. The term derives from the practice at Lloyd's of each person willing to accept a portion of the risk writing his name under the description of the risk. Underwriter is responsible for selecting the people and properties the company will insure. The way underwriters know which business to accept is determined by how the insurance company defines its market. That is, every company must decide which risks they want to accept and how much they must be compensated to accept those risks. Their insurance contracts and rates reflect their marketing decisions. Underwriters consider many things in making their decisions. Review applications. Evaluate hazards and risks: Determine what premium is sufficient for coverage.

35

CHAPTER-6 GENERAL NON LIFE INSURANCE AND COMPANY ANALYSIS 6.1 GENERAL / NON-LIFE INSURANCE One faces a lot of risks in our daily lives. Some of these lead to financial losses. Insurance is a way of protecting against these financial losses. For a payment (premium), an insurance company will take the responsibility of compensating the financial losses. One of the main reasons one should insure is to protect ones belongings and assets against financial loss. When one has earned and accumulated property, protecting it is prudent. The law also requires us to be insured against some liabilities. That is, in case we should cause a loss to another person, that person is entitled to compensation. To ensure that we can afford to pay that compensation, the law requires us to buy liability insurance so that the responsibility of paying the compensation is transferred to an insurance company. Insuring anything other than human life is called non-life or general insurance or Property & casualty insurance. Examples are insuring property like house and belongings against fire and theft or vehicles against accidental damage or theft. Injury due to accident or hospitalization for illness and surgery can also be insured. Your liabilities to others arising out of the law can also be insured and is compulsory in some cases like motor third party insurance. General Insurance comprises of insurance of property against fire, burglary etc. personal insurance such as Accident and Health Insurance and liability insurance which covers legal liabilities. Marine Hull & Cargo also fall under this group. There are also other miscellaneous covers. Non-life insurance companies have products that cover property against Fire and allied perils, flood, storm etc. There are products that cover property against burglary, theft etc. The non-life companies also offer policies covering machinery against breakdown, there are policies that cover the hull of ships and so on. A Marine Cargo policy covers goods in transit including by sea, air and road. Further, insurance of motor vehicles against damages and theft forms a major chunk of non- life insurance business.

36

Personal insurance covers include policies for Accident, Health etc. Products offering Personal Accident cover are benefit policies. Health insurance covers offered by non-life insurers are mainly hospitalization covers either on reimbursement or cashless basis. Nowadays health insurance policies which cover hospitalization costs have also a cashless settlement of claims. That is, you dont have to pay for the treatment at the hospital and then make a claim for reimbursement of the expenses. The insurance company has a service provider called the third party administrator (TPA) health services, who liaises with the hospitals and directly makes the payment for your treatment as per the terms of your policy and coverage. Cashless service is offered through Third Party Administrators (TPA) who have arrangements with various service providers, i.e., hospitals. TPAs also provide service for reimbursement claims. Sometimes the insurers themselves process reimbursement claims. Accident and health insurance policies are available for individuals as well as groups. A group could be a group of employees of an organization or holders of credit cards or deposit holders in a bank etc. Normally when a group is covered, insurers offer group discounts. Liability insurance covers such as Motor Third Party Liability Insurance, Workmens Compensation Policy, Public Liability Insurance Policy etc. offer cover against legal liabilities that may arise under the respective statutes Motor Vehicles Act, The Workmens Compensation Act etc. Some of the covers such as Motor Third Party and Workmens Compensation policy are compulsory by statute. Liability Insurance not compulsory by statute is also gaining popularity these days. There are general insurance products that are in the nature of package policies offering a combination of the covers mentioned above. For instance, there are package policies available for householders and shop keepers. Most general insurance covers are annual contracts.

However, there are few products that are somewhat long-term. It is important for proposers to read and understand the terms and conditions of a policy before they enter into an insurance contract. The proposal form needs to be filled in completely and correctly by a proposer to ensure that the cover is adequate and the right one. In case of an indemnity cover (one that seeks to compensate the actual loss)--for instance, a policy that covers property, if there are two policies in vogue, the loss shall be shared by both the policies. In no case can an insured get more than the actual pecuniary loss incurred. In indemnity policies, the upper limit of a claim is the sum assured and this usually applies for the period of the policy. Certain policies, however, allow for reinstatement of the Sum Insured by

37

payment of proportionate premium for the remaining period of the policy. The actual claim will be the actual extent of financial loss as validated by documents like bills. If the property is underinsured, the insured shall bear a rateable proportion of the loss. There can be more than one claim in the policy period but the sum assured is usually the limit for the policy period unless reinstated. In India general insurance policies are annual and the premium payment is in advance as per sec. 64 VB of insurance act. No risk commences unless you have paid the premium in full. It is a feeling in most buyers that if one buys a policy and dont make a claim, it is a loss. So, why should one buy insurance? General insurance is not meant to be for savings or investment returns. It is meant for protection. What you pay for is the protection against a risk. To approach it as something from which returns should be obtained is not the correct approach as there is a price to pay for protecting a property worth lakhs for a few hundred rupees. 6.1.1 Rural Insurance: Sections 32 B and 32 C of the Insurance Act provide for obligation on insurers towards rural and social sector, as may be specified by IRDA. IRDA has, accordingly issued regulation for Obligations of insurers to Rural & Social Sectors 2000. 6.1.2 Existing Rural Insurance Covers: Cattle insurance, Poultry insurance, Sericulture (silk worm) insurance, Honey Bee insurance, Horticulture/ floriculture insurance, failed well insurance, Agricultural pump set policy, Cycle rickshaw policy, and animal driven cart insurance. 6.1.3 Crop Insurance: India is one of the few countries in the world to have an agricultural insurance scheme. On the basis of experience gained on implementation of Comprehensive Crop Insurance scheme from 1984 till 1988, a new scheme National Agricultural Insurance Scheme (Rashtriya Krishi Bima Yojana) was introduced in 1999. 6.2 GENERAL INSURANCE PRODUCTS: 6.2.1 Fire Insurance- Fire insurance covers you against loss or damage to property caused by fire or lightning and a list of other perils. 6.2.2 Consequential Loss Insurance- Consequential Loss insurance covers you for loss in net profit and fixed charges following interruption of business caused by risks which are insured under a Fire policy.

38

6.2.3 Marine Insurance- Marine insurance covers loss or damage to goods whilst in transit by sea, air or rail. Marine Hull insurance is available for the vessel. 6.2.4 Motor Insurance- Motor insurance covers motor vehicle against loss or damage caused by accidents. It also covers legal liability for bodily injury or property damage to third parties. 6.2.5 Health Insurance- Hospital and Surgical expenses insurance covers hospital expenses, surgical expenses incurred as a result of accident, sickness or disease. 6.2.6 Personal Accident Insurance- Personal Accident insurance will cover you for bodily injury or death arising from an accident. 6.2.7 Money Insurance-Money insurance will cover loss or damage to money whilst in transit and by theft from locked drawer, safe or strong room or by hold-up while in your premises. 6.2.8 Fidelity Guarantee Insurance- Fidelity Guarantee insurance provides cover for loss of money or goods either belonging to employers or for which they are responsible as a result of acts of fraud or dishonesty by an employee. 6.2.9 Workmen's Compensation Insurance- Workmen's Compensation insurance provides payment for accidental bodily injury and/or disease sustained by your employees whilst in the course of employment. 6.2.10 Public Liability Insurance- Public Liability insurance covers your legal liability to third parties for accidental bodily injury or loss of or damage to property whilst in the course of business. 6.2.11 Machinery Breakdown Insurance- Machinery Breakdown insurance covers unforeseen and sudden damage to machinery whilst at work or at rest and during cleaning, inspection, overhaul or removal to other position in the workplace. 6.2.12 Machinery and Equipment All Risks Insurance- Machinery and Equipment All Risks insurance covers all risks of accidental physical loss or damage to property including the risk of loading and unloading. 6.2.13 Contractors All Risks Insurance- Contractors All Risks insurance covers the loss or damage to contract works and all other materials on site as well as legal liability to third parties arising out of the performance of a contract.

39

6.3 SOME TERMS USED IN GENERAL INSURANCE 6.3.1 Proposer/applicant: A person seeking insurance. Proposal form: When buying insurance, customers must fill out an application. Details on the application help the insurance company decide what policy and premium level is right for that customer. It is important to make sure all details on the application are correct or the payout may be affected. 6.3.2 Business interruption: Provides coverage for a loss of earnings if the policyholder's business is shut down by fire, windstorm, explosion, or other insured event. 6.3.3 Claim: A demand made by the insured, or the insured's beneficiary, for payment of the benefits provided by the contract. 6.3.4 Deductible/excess: This is the amount the insured will be required to contribute before they can make a claim. 6.3.5 Exclusions: Specific circumstances listed in the policy for which the insurer will not provide benefit payments. 6.3.6 Insurer: The party that provides, for a fee, benefits in the event of loss. Your insurance company is your insurer. 6.3.7 Insured: In property and liability insurance, the person to whom, or on whose behalf, benefits are payable. If you take out an insurance policy, you are the insured. Insurance 6.3.8 Penetration: The proportion of premium generated by a countrys insurance industry of the Gross Domestic Product of the economy explains penetration of insurance in a country.

6.4 COMPANY ANALYSIS

40

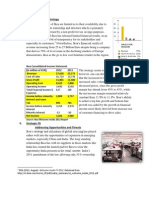

After analyzing the economy and the respondent industry that are taken into consideration now its turn of the companies in the insurance industry and their performance and the environment they are operating into. Here we have taken 2 companies of insurance industry and have analyzed it. The companies are, 1. ICICI Prudential Life Insurance Company 2. Bajaj Allianz Life Insurance Company Limited While analyzing the company the factor considered are Current Ratio, Debt to Equity and Interest coverage of each company. VALUATION RATIOS CURRENT RATIO =Current Assets /Current Liabilities Debt to Equity =Total Debt (Short Term +Long Term)/Equity+Preference Interest Coverage=Earnings Before Interest And Tax/Interest

6.4.1. ICICI Prudential Life Insurance Company Incorporation Year Chairperson Managing Director Registered Office 2000 Ms.Chanda D. Kochhar Mr.V. Vaidyanathan, ICICI Pru Life Towers, 1089 Appasaheb Marathe Marg, Prabhadevi, Mumbai 400025. Website www.iciciprulife.com

ICICI Prudential Life Insurance Company is a joint venture between ICICI Bank, a premier financial powerhouse, and prudential plc. a leading international financial services group headquartered in the United Kingdom. ICICI Prudential was amongst the first private sector insurance companies to begin operations in December 2000 after receiving approval from Insurance Regulatory Development Authority (IRDA).

41