Professional Documents

Culture Documents

ACCT550 Homework Week 6

Uploaded by

Natasha DeclanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT550 Homework Week 6

Uploaded by

Natasha DeclanCopyright:

Available Formats

E10-1(Acquisition Costs of Realty) The expenditures and receipts below are related to land, land improvements, and buildings

acquired for use in a business enterprise. The receipts are enclosed in parentheses. a) b) c) d) e) f) g) h) i) j) k) l) m) n) o) p) Money borrowed to pay building contractor (signed a note) Payment for construction from note proceeds Cost of land fill and clearing Delinquent real estate taxes on property assumed by purchaser Premium on 6-month insurance policy during construction Refund of 1-month insurance premium because construction completed early Architects fee on building Cost of real estate purchased as plant site (land $20,000 and building $50,000) Commission fee paid to real estate agency Installation of fences around property Cost of razing and removing building Proceeds from salvage of demolished building Interest paid during construction on money borrowed for construction Cost of parking lots and driveways Cost of trees and shrubbery planted (permanent in nature) Excavation costs for new building ($275,000) 275,000 10,000 7,000 6,000 (1,000) 25,000 250,000 9,000 4,000 11,000 (5,000) 13,000 19,000 14,000 3,000

Instructions Identify each item by letter and list the items in columnar form, using the headings shown below. All receipt amounts should be reported in parentheses. For any amounts entered in the Other Accounts column, also indicate the account title. Item A B C D E F G H I J K L M N O P Land Land Improvements Buildings $275,000 $10,000 $7,000 $6,000 ($1,000) $25,000 $250,000 $9,000 $4,000 $11,000 ($5,000) $13,000 $19,000 $14,000 $3,000 Other Accounts ($275,000) Notes Payable

E10-3 (Acquisition Costs of Trucks) Shabbona Corporation operates a retail computer store. To improve delivery services to customers, the company purchases four new trucks on April 1, 2012. The terms of acquisition for each truck are described below. 1. Truck #1 has a list price of $15,000 and is acquired for a cash payment of $13,900. Trucks Cash 13,900 13,900

2. Truck #2 has a list price of $20,000 and is acquired for a down payment of $2,000 cash and a zero-interest-bearing note with a face amount of $18,000. The note is due April 1, 2013. Shabbona would normally have to pay interest at a rate of 10% for such a borrowing, and the dealership has an incremental borrowing rate of 8%. Trucks ($18,000*.90909) + $2,000 Discount on Notes Payable Cash Notes Payable 18,364 1,636 2,000 18,000

3. Truck #3 has a list price of $16,000. It is acquired in exchange for a computer system that Shabbona carries in inventory. The computer system cost $12,000 and is normally sold by Shabbona for $15,200. Shabbona uses a perpetual inventory system. Trucks 15,200 Cost of Goods Sold 12,000 Inventory Sales Revenue

12,000 15,200

4. Truck #4 has a list price of $14,000. It is acquired in exchange for 1,000 shares of common stock in Shabbona Corporation. The stock has a par value per share of $10 and a market price of $13 per share. Trucks 13,000 Common Stock 10,000 Paid-in Capital in Excess of Par 3,000 ((1,000 shares x $13) - $10,000 par)

Instructions Prepare the appropriate journal entries for the foregoing transactions for Shabbona Corporation. (Round computations to the nearest dollar.)

E10-7 (Capitalization of Interest) McPherson Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $5,000,000 on January 1, 2012. McPherson expected to complete the building by December 31, 2012. McPherson has the following debt obligations outstanding during the construction period. Construction loan12% interest, payable semiannually, issued December 31, 2011 Short-term loan10% interest, payable monthly, and principal payable at maturity on May 30, 2013 Long-term loan11% interest, payable on January 1 of each year; principal payable on January 1, 2016 Instructions (Carry all computations to two decimal places.) (a) Assume that McPherson completed the office and warehouse building on December 31, 2012, as planned at a total cost of $5,200,000, and the weighted average of accumulated expenditures was $3,800,000. Compute the avoidable interest on this project. Avoidable Interest = Weighted-Average Accumulated Expenditures x Interest Rate $2,000,000 x 12% = $240,000 $1,800,000 x 10.38 = $186,840 Total Avoidable Interest for this project ($240,000+$186,840) = $426,840 Weighted-average interest rate 10% short-term loan 11% long-term loan Total Principal $1,600,000 $1,000,000 $2,600,000 Interest $160,000 $110,000 $270,000 $2,000,000 $1,600,000

$1,000,000

Total Interest / Total Principal = $270,000 / $2,600,000 = 10.38%

(b) Compute the depreciation expense for the year ended December 31, 2013. McPherson elected to depreciate the building on a straight-line basis and determined that the asset has a useful life of 30 years and a salvage value of $300,000.

Construction load Short-term loan

Actual Interest $2,000,000 x 12% = $1,600,000 x 10%=

$240,000 $160,000

Long-term loan

$1,000,000 x 11%= Total $5,200,000 426,840 $5,626,840

$110,000 $510,000

Cost Interest capitalized Total cost

Depreciation Expense = ($5,626,840 - $300,000) / 30 years = $177,561 P10-8 (Nonmonetary Exchanges) Holyfield Corporation wishes to exchange a machine used in its operations. Holyfield has received the following offers from other companies in the industry. Instructions For each of the four independent situations, prepare the journal entries to record the exchange on the books of each company.

1. Dorsett Company offered to exchange a similar machine plus $23,000. (The exchange has commercial substance for both parties.) Holyfield Corporation Cash Machinery Accumulated Depreciation Loss on Exchange in Machinery ($100,000-92,000) Machinery Dorsett Company Machinery Accumulated Depreciation-Machinery Loss on Disposal of Machinery ($75,000 69,000) Cash Machinery 92,000 45,000 6,000 23,000 120,000 23,000 69,000 60,000 8,000 160,000

2. Winston Company offered to exchange a similar machine. (The exchange lacks commercial substance for both parties.) Holyfield Corporation Machinery Accumulated Depreciation-Machinery Loss on Disposal of Machine 92,000 60,000 8,000

Machinery Winston Company Machinery ($92,000-$11,000) Accumulated Depreciation-Machinery Machinery

160,000 92,000 71,000 152,000

3. Liston Company offered to exchange a similar machine, but wanted $3,000 in addition to Holyfields machine. (The exchange has commercial substance for both parties.) Holyfield Corporation Machinery Accumulated Depreciation-Machinery Loss on Disposal of Machine Machinery Cash Liston Corporation Machinery Accumulated Depreciation-Machinery Cash Machinery Gain on Disposal of Machinery ($95,000 - $85,000) 95,000 60,000 8,000 160,000 3,000

92,000 75,000 3,000 160,000 10,000

4. In addition, Holyfield contacted Greeley Corporation, a dealer in machines. To obtain a new machine, Holyfield must pay $93,000 in addition to trading in its old machine. Holyfield Machine Cost Accumulated Depreciation Fair value $160,000 60,000 92,000 Dorsett $120,000 45,000 69,000 Winston $152,000 71,000 92,000 Liston $160,000 75,000 95,000 Greeley $130,000 -0185,000

Holyfield Corporation Machinery Accumulated Depreciation-Machinery Loss on Disposal of Machine Machinery Cash 185,000 60,000 8,000 160,000 93,000

Greely Corporation Cash Inventory Sales Revenue Cost of Goods Sold Inventory 93,000 92,000 185,000 130,000 130,000

You might also like

- ACCT550 Homework Week 7Document4 pagesACCT550 Homework Week 7Natasha Declan100% (2)

- BE10 practice problems and solutionsDocument14 pagesBE10 practice problems and solutionsJoshua Solite0% (1)

- Ch10 - Soal Dan LatihanDocument29 pagesCh10 - Soal Dan Latihanevelyn aleeza100% (3)

- A311Chapter 10 ProblemsDocument43 pagesA311Chapter 10 ProblemsVibria Rezki AnandaNo ratings yet

- E7 24Document3 pagesE7 24Muhammad Syafiq RamadhanNo ratings yet

- Chapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Document9 pagesChapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Dyan Novia67% (3)

- Aset TetapDocument9 pagesAset TetapMAYONA MEGAHTANo ratings yet

- Fix Asset&Intangible AssetDocument7 pagesFix Asset&Intangible AssetAdinda0% (1)

- ACCT550 Homework Week 2Document5 pagesACCT550 Homework Week 2Natasha Declan100% (2)

- Rika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02Document5 pagesRika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02MARCHO AGUSTANo ratings yet

- Lafidan Rizata Febiola - 041711333237 - 5 - Tugas Akm 1 Week 11Document12 pagesLafidan Rizata Febiola - 041711333237 - 5 - Tugas Akm 1 Week 11Lafidan Rizata Febiola100% (4)

- Capitalization of Interest and Depreciation CalculationDocument7 pagesCapitalization of Interest and Depreciation Calculationfabiarachid100% (1)

- T4 - (Assets) - Qs and SolutionDocument22 pagesT4 - (Assets) - Qs and SolutionCalvin MaNo ratings yet

- Tugas Intangible AssetDocument31 pagesTugas Intangible AssetMonica0% (1)

- Chapter 8 Supplemental Questions: E8-1 (Inventoriable Costs)Document7 pagesChapter 8 Supplemental Questions: E8-1 (Inventoriable Costs)Dyan NoviaNo ratings yet

- P11Document7 pagesP11Arif RahmanNo ratings yet

- Tugas Ch. 15 - Week 10Document9 pagesTugas Ch. 15 - Week 10Lafidan Rizata FebiolaNo ratings yet

- Chapter 16 Homework SolutionsDocument11 pagesChapter 16 Homework Solutionsyuri100% (2)

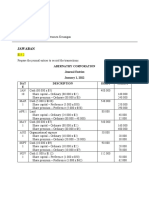

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- PROBLEM Tugas AKM 2Document33 pagesPROBLEM Tugas AKM 2Dina Dwi Ningrum67% (3)

- Inventory Valuation TutorialDocument4 pagesInventory Valuation TutorialSalma HazemNo ratings yet

- Homework Week 1Document9 pagesHomework Week 1ela kikay100% (1)

- Answers To Olivia CompanyDocument34 pagesAnswers To Olivia CompanyRIZLE SOGRADIELNo ratings yet

- Calculating EPS for Complex Capital StructuresDocument4 pagesCalculating EPS for Complex Capital StructuresNaoya FaldinyNo ratings yet

- DDDocument4 pagesDDAmelia Salini100% (1)

- Erika Christina - LD53 - Latihan KPDocument14 pagesErika Christina - LD53 - Latihan KPNatasha HerlianaNo ratings yet

- Intermediate AccountingDocument58 pagesIntermediate AccountingSismiko eka Putra60% (5)

- Akuntansi KeuanganDocument11 pagesAkuntansi KeuanganDyan NoviaNo ratings yet

- Tugas Persediaan 2Document6 pagesTugas Persediaan 2Bertha Liona0% (2)

- Jawaban BE15 - AKMDocument3 pagesJawaban BE15 - AKMMazz BadruezNo ratings yet

- Problem Ch.14Document3 pagesProblem Ch.14kenny 322016048100% (1)

- AKM 2 - Forum 7 - Andres - 43220110067Document13 pagesAKM 2 - Forum 7 - Andres - 43220110067tes doangNo ratings yet

- Soal Latihan Minggu 4Document9 pagesSoal Latihan Minggu 4Alifia AprizilaNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Nisha Nur Aini - 43219110183 - TM 02 - AKM IIDocument11 pagesNisha Nur Aini - 43219110183 - TM 02 - AKM IInisha nuraini100% (1)

- Chapter 7 SolutionsDocument6 pagesChapter 7 SolutionsJay100% (1)

- PR E2-3, E2-7, E7-1, E7-4Document5 pagesPR E2-3, E2-7, E7-1, E7-4jopi jopNo ratings yet

- Stocks 131-135Document3 pagesStocks 131-135Rej Patnaan100% (1)

- E15-2 (Recording The Issuance of Ordinary and Preference Shares) AbernathyDocument5 pagesE15-2 (Recording The Issuance of Ordinary and Preference Shares) AbernathyAsuna SanNo ratings yet

- Chapter 6 and 7 NR and BPDocument2 pagesChapter 6 and 7 NR and BPCa Ada100% (1)

- Nama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure InternalDocument6 pagesNama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure Internalmelvina siregarNo ratings yet

- FIFO, LIFO, and Average Cost MethodsDocument14 pagesFIFO, LIFO, and Average Cost MethodsMenaz Sadaka100% (1)

- Laserwords Building Construction and Interest CapitalizationDocument6 pagesLaserwords Building Construction and Interest CapitalizationMedlin Yustisia RirringNo ratings yet

- Chapter 7. KeyDocument8 pagesChapter 7. KeyHuy Hoàng PhanNo ratings yet

- 645873Document3 pages645873mohitgaba19No ratings yet

- Muh - Syukur (A031191077) Akuntansi Keuangan - Exercise E.12.9Document3 pagesMuh - Syukur (A031191077) Akuntansi Keuangan - Exercise E.12.9RismayantiNo ratings yet

- Tugas Ifrs Chapter 7.2Document4 pagesTugas Ifrs Chapter 7.2Nabilla salsaNo ratings yet

- E13-2 Selected 2010 Transactions of Darby CorporationDocument2 pagesE13-2 Selected 2010 Transactions of Darby CorporationEvelyn Roldan100% (6)

- Homework Week7Document3 pagesHomework Week7Arista Yuliana SariNo ratings yet

- IFRS Edition (2nd) : Plant Assets, Natural Resources, and Intangible AssetsDocument62 pagesIFRS Edition (2nd) : Plant Assets, Natural Resources, and Intangible Assetsmajestic accounting100% (1)

- Melton Company Special Order AnalysisDocument2 pagesMelton Company Special Order AnalysisclalalacNo ratings yet

- ACY4001 Individual Assignment 2 SolutionsDocument7 pagesACY4001 Individual Assignment 2 SolutionsMorris LoNo ratings yet

- Calculate Current Liability for Paid Vacation DaysDocument6 pagesCalculate Current Liability for Paid Vacation DaysfidelaluthfianaNo ratings yet

- 5 - Lafidan Rizata Febiola - 041711333237 - Akm1 - M - Tugas Week 12Document14 pages5 - Lafidan Rizata Febiola - 041711333237 - Akm1 - M - Tugas Week 12SEPTINA GUMELAR R100% (1)

- Week 5 Tute Chapter 4 SolutionsDocument8 pagesWeek 5 Tute Chapter 4 SolutionsRaine PiliinNo ratings yet

- Uts - Akm3 - Suci Purnama Devi - F0318108 - E17.9 & P21.13 PDFDocument4 pagesUts - Akm3 - Suci Purnama Devi - F0318108 - E17.9 & P21.13 PDFSuci Purnama Devi100% (1)

- Final Upload Buad 280 Practice Exam Midterm 3Document7 pagesFinal Upload Buad 280 Practice Exam Midterm 3Connor JacksonNo ratings yet

- Final Answer Key Buad 280 Practice Exam Midterm 3Document7 pagesFinal Answer Key Buad 280 Practice Exam Midterm 3Connor JacksonNo ratings yet

- Topic 4 PP&EDocument62 pagesTopic 4 PP&Efastidious_5100% (1)

- CH 10 Revision 1Document4 pagesCH 10 Revision 1Deeb. DeebNo ratings yet

- Aicpa Reg 6Document170 pagesAicpa Reg 6Natasha Declan100% (1)

- ACCT 555 Audit Week 7Document5 pagesACCT 555 Audit Week 7Natasha DeclanNo ratings yet

- Acct 555 Audit Week 4 MidtermDocument6 pagesAcct 555 Audit Week 4 MidtermNatasha DeclanNo ratings yet

- AC 571 - Final Exam (Study Guide)Document14 pagesAC 571 - Final Exam (Study Guide)Natasha Declan100% (1)

- MGT 597 SolutionsDocument6 pagesMGT 597 SolutionsNatasha DeclanNo ratings yet

- ACCT555 Midterm Exam 1.31.2014Document6 pagesACCT555 Midterm Exam 1.31.2014Natasha DeclanNo ratings yet

- AC 571 - Final Exam (Study Guide)Document14 pagesAC 571 - Final Exam (Study Guide)Natasha Declan100% (1)

- ACCT 571 Week 4 AssignmentDocument4 pagesACCT 571 Week 4 AssignmentNatasha DeclanNo ratings yet

- Acct571 Week 1 QuizDocument2 pagesAcct571 Week 1 QuizNatasha DeclanNo ratings yet

- AC571 Week 1 HW AssignmentDocument1 pageAC571 Week 1 HW AssignmentNatasha DeclanNo ratings yet

- AC 571 Quiz (Week 1)Document4 pagesAC 571 Quiz (Week 1)Natasha DeclanNo ratings yet

- CPA A 4 Audit EvidenceDocument28 pagesCPA A 4 Audit EvidenceNatasha DeclanNo ratings yet

- FIN515 Week 5 Project Graded ADocument2 pagesFIN515 Week 5 Project Graded ANatasha DeclanNo ratings yet

- FIN516 Week Quiz 6Document7 pagesFIN516 Week Quiz 6Natasha DeclanNo ratings yet

- MGMT 597 Week 6 HomeworkDocument8 pagesMGMT 597 Week 6 HomeworkNatasha Declan100% (1)

- Acct557 Wk4 QuizDocument4 pagesAcct557 Wk4 QuizNatasha Declan100% (1)

- MGMT 597 Week 6 HomeworkDocument8 pagesMGMT 597 Week 6 HomeworkNatasha Declan100% (1)

- FIN515 MidtermDocument9 pagesFIN515 MidtermNatasha DeclanNo ratings yet

- AC555 - Audit Final ExamDocument8 pagesAC555 - Audit Final ExamNatasha Declan0% (1)

- FIN515 Homework1Document4 pagesFIN515 Homework1Natasha DeclanNo ratings yet

- FIN515 Week 2 Homework AssignmentDocument6 pagesFIN515 Week 2 Homework AssignmentNatasha DeclanNo ratings yet

- FIN 515 Week 6 Exam Set 1Document5 pagesFIN 515 Week 6 Exam Set 1Natasha DeclanNo ratings yet

- FIN515 Week 1 Homework AssignmentDocument8 pagesFIN515 Week 1 Homework AssignmentNatasha DeclanNo ratings yet

- AC555 External Auditing Chapter 2 Test WK 1Document23 pagesAC555 External Auditing Chapter 2 Test WK 1Natasha DeclanNo ratings yet

- Fin515 Week 4 ExamDocument5 pagesFin515 Week 4 ExamNatasha DeclanNo ratings yet

- Acct557 Quiz 2Document3 pagesAcct557 Quiz 2Natasha DeclanNo ratings yet

- Acct557 Quiz 3Document5 pagesAcct557 Quiz 3Natasha DeclanNo ratings yet

- Acct557 Quiz 2Document3 pagesAcct557 Quiz 2Natasha DeclanNo ratings yet

- Acct557 Quiz 2Document3 pagesAcct557 Quiz 2Natasha DeclanNo ratings yet

- AMWAY AnnualReport2013Document84 pagesAMWAY AnnualReport2013humairaemilyNo ratings yet

- ACCELE2Document8 pagesACCELE2Karylle AnneNo ratings yet

- Government GrantsDocument2 pagesGovernment GrantsGerrelle Cap-atanNo ratings yet

- Compensation Guide 03 2023Document12 pagesCompensation Guide 03 2023Haiyun ChenNo ratings yet

- L'Oreal DF 2006Document161 pagesL'Oreal DF 2006JORGENo ratings yet

- Chapter 1 Multi-National CorporationsDocument60 pagesChapter 1 Multi-National CorporationsSHREYANS PRASHANT ZAMBAD IPM 2020 -25 BatchNo ratings yet

- 6 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginDocument17 pages6 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginMikhail Ayman Mastura100% (1)

- Profitability AnalysisDocument12 pagesProfitability AnalysisJudyeast AstillaNo ratings yet

- Tottenham Case SolutionDocument14 pagesTottenham Case SolutionVivek SinghNo ratings yet

- Financial Accounting Theory Test BankDocument13 pagesFinancial Accounting Theory Test BankPhilip Castro100% (3)

- Idx 2rd Quarter Statistic 2021 List IPODocument1 pageIdx 2rd Quarter Statistic 2021 List IPOandree elnusaNo ratings yet

- Final Version - Psu Course Syllabus - Acc111 - Term 231Document10 pagesFinal Version - Psu Course Syllabus - Acc111 - Term 231aaaasb21No ratings yet

- P 1212Document17 pagesP 1212cusip1No ratings yet

- Inputs: Instructions: Using Absolute and Relative Cell Reference, Compute Companies Gross Margin and Net IncomeDocument25 pagesInputs: Instructions: Using Absolute and Relative Cell Reference, Compute Companies Gross Margin and Net IncomeSarah MadhiNo ratings yet

- Weller Company Cash FlowDocument3 pagesWeller Company Cash FlowMd. Omar Sakib HossainNo ratings yet

- RATIO ANALYSIS OF H&MDocument9 pagesRATIO ANALYSIS OF H&MAbdallah MohammedNo ratings yet

- Concepts in Federal Taxation 2016 23rd Edition Murphy Solutions Manual 1Document103 pagesConcepts in Federal Taxation 2016 23rd Edition Murphy Solutions Manual 1hiedi100% (35)

- VAL UE FRO M Fitn ESS: Talwalkars Better Value Fitness Limited Annual Report, 2015-16Document124 pagesVAL UE FRO M Fitn ESS: Talwalkars Better Value Fitness Limited Annual Report, 2015-16ranbirholicNo ratings yet

- Cecil Jameson Attorney Financial StatementsDocument11 pagesCecil Jameson Attorney Financial StatementsHY YH75% (4)

- 04 Financial Planning and ForecastingDocument32 pages04 Financial Planning and ForecastingAnn TierraNo ratings yet

- SEC 17-Q (1st QRTR 31 March 2014)Document49 pagesSEC 17-Q (1st QRTR 31 March 2014)RCCruzNo ratings yet

- Gitman 12e 525314 IM ch11rDocument22 pagesGitman 12e 525314 IM ch11rAnn!3100% (1)

- CH 02 - Financial Stmts Cash Flow and TaxesDocument32 pagesCH 02 - Financial Stmts Cash Flow and TaxesSyed Mohib Hassan100% (1)

- Lecture 3Document14 pagesLecture 3Lol 123No ratings yet

- Creating Value Beyond The Deal: Financial Services: Maximise Success by Keeping An Intense Focus On Three Key ElementsDocument24 pagesCreating Value Beyond The Deal: Financial Services: Maximise Success by Keeping An Intense Focus On Three Key ElementsNick HuNo ratings yet

- Town of Barre Fy 2020 Pending Preliminary Valuations by Owner With ExplanationDocument54 pagesTown of Barre Fy 2020 Pending Preliminary Valuations by Owner With ExplanationAndrew GolasNo ratings yet

- CH 05Document92 pagesCH 05Indah LestariNo ratings yet

- Module 2 Business Combination ProportionateDocument3 pagesModule 2 Business Combination ProportionateasdasdaNo ratings yet

- Syn 7 - Introduction To Debt Policy and ValueDocument11 pagesSyn 7 - Introduction To Debt Policy and Valuerudy antoNo ratings yet

- Petty Cash Book EntriesDocument6 pagesPetty Cash Book EntriesGeorgeNo ratings yet