Professional Documents

Culture Documents

ImmuLogic Pharmaceutical1

Uploaded by

awesomelycrazyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ImmuLogic Pharmaceutical1

Uploaded by

awesomelycrazyCopyright:

Available Formats

ImmuLogic Pharmaceuticals

Case Submission for New Enterprise Finance to Prof. Sabarinathan

Anup C V (1011009) Purnima Gopalakrishnan (1011044) Subin Kuriyil ()

1. Critically examine the perspectives of each of the actors presented in Cases B1 to B4. What is the key motivation of each of the actors? How do these motivations from the ideal interests of ImmunoLogic as a company? Malcolm Gefter: He founded ImmuLogic in 1987. He was one of the leading researchers in the field of immunology. He had extensive connections with the industry through consulting, industry connections, director of biotechnology start up Angenics. ImmuLogic was based on 2 key premises: 1. Treatment of allergies 2. Treatment of auto immune diseases This was commercialised through Immulogic. He remained professional and objective in his dealings with them despite his involvement in the development of the firm. He sold back 1/3rd of his shares to reduce his vested interests in the company and allow him to give dispassionate strategic direction to the company. His argument for IPO: 1) Need for IPO to allow negotiation and better position before negotiating strategic alliance with larger pharmaceutical firms to commercialise allergy drugs 2) Competitor Cytels offering might disadvantage ImmuLogic given limited investors in technology He understood the implications of a hot issue IPO and believed valuation could be potentially carried out using comparable valuations of other biotech companies and Immulogic s own valuation from round C financing. Potential Divergence from ImmuLogic interests: He potentially stands to gain from the 500,000 shares he holds if a hot issue results in share price increases. Also because he is the founder of this firm his ambition to commercialise it might be clouding his perspective and cause him to go for an IPO too soon which may not be in the best interests of Immulogic as it might influence future offerings. Henry Mc Cance: He is a partner at a VC firm, Greylock. This VC did not focus purely on exit options but took on an active role by involving themselves in management and development of the company they invested in. The firm had very close longstanding ties with a small number of investors, individuals and annual management fees were incentivised basis the operating budget versus assets managed. The VC had previously invested in early biotech companies as a lead investor. They already possessed an understanding of the challenges in a biotech company, the risks entailed and the stage of the company at which IPOs were issued. They had the reputation of a savvy investor as all their early investments turned out very successful.

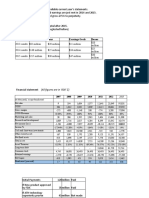

The close ties Greylock had with the geography and parent University of Immulogic led to an early interest in the firm. They used the opinions of leaders of other early bio tech firms and the opinions of Gefters peers in the scientific community to evaluate the viability of Immulogics proposition. Gefters personality and knowledge across fields of science and business created trust in the venture. Potential Divergence from Immulogic interests: The VC has no particular expertise in the field of biotechnology and is not in the best position to judge the readiness of Immulogic for an IPO. Their potential decision is clouded by their past experience with biotech firms. They believe that profitability is not a driving factor for IPOs in the biotech industry and it is a weapon of negotiation to go for an IPO. They feel that though high risk Immulogic is a high quality investment. Another reason for a hurried decision could be the need to get into line for an IPO quickly and signal quality given the trends in the industry. Also the window for biotech offerings would be limited and would close soon. While in the short run, the VC did not stand to gain from a hot issue, given comparable data subsequent IPO offerings could benefit them and associated investors significantly. ( Chart and Table B2-1). Even if the hot issue did result in better trading and the VC could not benefit due to the lock in period, they might be able to sell at a later point. Their relationship with the underwriter could result in a potential under pricing of the IPO which is not in the interest of the funds to be raised for Immulogics functioning. Katherine Kirk: She was an underwriter with Hambrecht and Quist who was researching Immulogic as part of her research into potential clients who were promising. She felt that it was too early for an IPO in 1990. She believed that valuation of firm would be affected by a failed IPO and believed that human trials were the right point to look into an IPO. Her job also involved advising the CEO on the strategy to enter the IPO process. However business trends contrary to this made Immulogic question the need to wait for clinical trials. Key relationships by H and Q were its long standing relationships with mutual funds, pension managers and other purchasers. Most of them purchase it for resale. Potential Divergence from goals of Immulogic: It was potentially a great source of revenue to underwrite an IPO for a growing firm in light of secondary offerings especially high technology IPOs. Selling concessions would ensue for both investment banks and underwriters. They ensured IPOs would be hot deals. The prices were set such that prices would surge as trading opened. VCs initially invested were also clients. They had to balance the pricing to keep investors and VCs happy. The Tables B3-3 and B3-4 reflect the downturn variations in recent times for biotechnology. Philip Gross: VP at Harvard Management Company. Biotechnology in his opinion was a high risk high return venture. It was attractive due to potential for large returns and risky in terms of market swing. Their emerging industry fund focussed on biotechnology post which there was a shift to value investing where undervalued companies were invested in. They did not take huge risks. Analysts were responsible for up turns and down turns of the portfolios they were managing.

Potential Divergence from Interests of Immulogic: He was not generally in the business of IPOs. He believed that it was necessary to evaluate the company from an independent perspective in terms of science. He also valued firms based on comparable projected 1997 earnings which were likely to over value the firm. He also felt that the current condition of the market was not best and a single reversal could collapse the market. 5. Given the situation at Immulogic whose views do you think will prevail in terms of its strategy going forward? The Venture Capitalist is most likely to prevail in terms of strategy decisions. The VC believes in active role of management and development. They are most likely to pressure the firm to go ahead with an IPO given very close ties with investors. The previous experience of investment in early biotech which was very successful would influence their decision to go ahead with IPO. They also had extensive ties with the founder given that MIT was a limited partner at Greylock. They had established the scientific credentials of the firm. They believed strongly in the using IPO raised capital as a balance sheet weapon in negotiating the strategic alliances and future IPOs. This would be in line with the attitude of the founder. He believed in the same principle and stood to benefit from an IPO same as VCs. The VC was of the opinion that the window for IPO would be very limited and there was a need to get into line as quickly as possible to signal quality. They would bring the underwriter on board as they had a previous relationship with H and Q and could influence any recommendations given that they could make the decision to potentially move to a different underwriter. The underwriters and the clients stood to gain from a hot issue IPO as did the venture capitalists. As the VC had the most influence on the key actors in the IPO offering and also stood to gain from it the most, their strategy was likely to be the one to go ahead with.

You might also like

- Session 9 Case Discussion Immulogic Pharmaceutical CorporationDocument32 pagesSession 9 Case Discussion Immulogic Pharmaceutical CorporationK RameshNo ratings yet

- ImmuLogic IPO Valuation and AlternativesDocument3 pagesImmuLogic IPO Valuation and Alternativesmiguel50% (2)

- Investment Banking Case QuestionsDocument5 pagesInvestment Banking Case Questionschoijin9870% (1)

- Questions Immulogic BarkaiDocument3 pagesQuestions Immulogic BarkaiVinesh SingodiaNo ratings yet

- ADECCO SA’S ACQUISITION OF OLSTEN CORPDocument6 pagesADECCO SA’S ACQUISITION OF OLSTEN CORPAditya AnandNo ratings yet

- Adecco Sa'S Acquisition of Olsten CorpDocument18 pagesAdecco Sa'S Acquisition of Olsten CorpAditya AnandNo ratings yet

- Earn Pay-Outs: Sales Goals Bonus Earnings Goals BonusDocument5 pagesEarn Pay-Outs: Sales Goals Bonus Earnings Goals BonusUjjwal BhardwajNo ratings yet

- Sealed Air Corp Case Write Up PDFDocument3 pagesSealed Air Corp Case Write Up PDFRamjiNo ratings yet

- Sealed AirDocument7 pagesSealed AirAnju BabuNo ratings yet

- Sealed Air Corporation-V5 - AmwDocument8 pagesSealed Air Corporation-V5 - AmwChristopher WardNo ratings yet

- Earn out structure and performance parameters for pharmaceutical M&ADocument3 pagesEarn out structure and performance parameters for pharmaceutical M&AAnurag PGXPM15No ratings yet

- Adecco QuestionsDocument1 pageAdecco Questionsptan123No ratings yet

- Sealed Air NotesDocument5 pagesSealed Air Notessumeshncn100% (1)

- Corporation Finance - Adecco CaseDocument6 pagesCorporation Finance - Adecco CaseYing Wang0% (3)

- Adecco SA's Acquisition of Olsten CorpDocument1 pageAdecco SA's Acquisition of Olsten CorpBeQa Gelashvili100% (1)

- SHPLDocument4 pagesSHPLMOHIT SINGHNo ratings yet

- WalMart Case FINALDocument17 pagesWalMart Case FINALMohit MishuNo ratings yet

- Midland Energy Case: In-Class QuestionsDocument3 pagesMidland Energy Case: In-Class Questionsmarcella roringNo ratings yet

- Chap ADocument35 pagesChap Arupahil123No ratings yet

- Williams 2002: - A Case On Financial DistressDocument18 pagesWilliams 2002: - A Case On Financial DistressGmitNo ratings yet

- MGTO BLR 24 Case Study AnalysisDocument17 pagesMGTO BLR 24 Case Study Analysisshubham mallNo ratings yet

- Gyaan Kosh Term 4 MGTODocument25 pagesGyaan Kosh Term 4 MGTOYash NyatiNo ratings yet

- Sealed Air CorporationDocument7 pagesSealed Air CorporationMeenal MalhotraNo ratings yet

- Case Analysis - Vertex Pharmaceuticals: R&D Portfolio ManagementDocument18 pagesCase Analysis - Vertex Pharmaceuticals: R&D Portfolio ManagementArsheen Kaur Chugh100% (1)

- The Best Deal Gillette Could GetDocument1 pageThe Best Deal Gillette Could Get连文琪No ratings yet

- Warren Buffett Case AnswerDocument5 pagesWarren Buffett Case Answeryunn lopNo ratings yet

- Case Study-Finance AssignmentDocument12 pagesCase Study-Finance AssignmentMakshud ManikNo ratings yet

- Cameron's licensing agreement with McTaggart analyzedDocument2 pagesCameron's licensing agreement with McTaggart analyzedJoao SousaNo ratings yet

- Impairing The Microsoft - Nokia PairingDocument54 pagesImpairing The Microsoft - Nokia Pairingjk kumarNo ratings yet

- Group Planning Document Template For Viking - v1 ScribdDocument3 pagesGroup Planning Document Template For Viking - v1 ScribdDharna KachrooNo ratings yet

- Investment Banking Group AssignmentDocument2 pagesInvestment Banking Group AssignmentDao DuongNo ratings yet

- Calculating AHC's Cost of Capital Using CAPMDocument9 pagesCalculating AHC's Cost of Capital Using CAPMElaineKongNo ratings yet

- Questions USX RevisedDocument1 pageQuestions USX RevisedShyngys SuiindikNo ratings yet

- M&A Case Competition: - Roche Acquisition of GenentechDocument19 pagesM&A Case Competition: - Roche Acquisition of GenentechJuan Diego Vasquez BeraunNo ratings yet

- 83592481 (1)Document3 pages83592481 (1)MedhaNo ratings yet

- Analysis of The Cost of Capital at AmeritradeDocument1 pageAnalysis of The Cost of Capital at AmeritradeLiran HarzyNo ratings yet

- GE Health Care Case: Executive SummaryDocument4 pagesGE Health Care Case: Executive SummarykpraneethkNo ratings yet

- Take Home Quiz: This Study Resource WasDocument4 pagesTake Home Quiz: This Study Resource Wasகப்பல்ஹசன்நபி0% (1)

- WilliamsDocument20 pagesWilliamsUmesh GuptaNo ratings yet

- Adecco's Acquisition of Olsten to Expand US Market ShareDocument3 pagesAdecco's Acquisition of Olsten to Expand US Market ShareArchismanNo ratings yet

- FreeMove Alliance Group5Document10 pagesFreeMove Alliance Group5Annisa MoeslimNo ratings yet

- Valuing Companies by Cash Flow Discounting Ten Methods and Nine TheoriesDocument16 pagesValuing Companies by Cash Flow Discounting Ten Methods and Nine TheoriesparthkosadaNo ratings yet

- Zip Co Ltd. - Acquisition of QuadPay and Capital Raise (Z1P-AU)Document12 pagesZip Co Ltd. - Acquisition of QuadPay and Capital Raise (Z1P-AU)JacksonNo ratings yet

- Assignment On OBDocument24 pagesAssignment On OBHarshit MarooNo ratings yet

- Marriott CaseDocument1 pageMarriott CasejenniferNo ratings yet

- Case Discussion PointsDocument3 pagesCase Discussion PointsMeena100% (1)

- Michael McClintock Case1Document2 pagesMichael McClintock Case1Mike MCNo ratings yet

- Mujnir Khan Assignment 1Document5 pagesMujnir Khan Assignment 1Munir KhanNo ratings yet

- Sun Life Financial and Indian Economic Surge: Case Analysis - International BusinessDocument9 pagesSun Life Financial and Indian Economic Surge: Case Analysis - International Businessgurubhai24No ratings yet

- Walmart Financial Analysis and ValuationDocument9 pagesWalmart Financial Analysis and ValuationAbeer ArifNo ratings yet

- AutoZone financial analysis and stock repurchase impactDocument1 pageAutoZone financial analysis and stock repurchase impactmalimojNo ratings yet

- Why Nations Fail NotesDocument5 pagesWhy Nations Fail NotesMuhammad Salman ShahNo ratings yet

- MCI Case Questions PDFDocument1 pageMCI Case Questions PDFAlex Garma0% (1)

- Meson Capital Partners - Odyssey Marine ExplorationDocument66 pagesMeson Capital Partners - Odyssey Marine ExplorationCanadianValueNo ratings yet

- Biovail Corporation QuestionsDocument2 pagesBiovail Corporation QuestionsshwetaitNo ratings yet

- BCE: INC Case AnalysisDocument6 pagesBCE: INC Case AnalysisShuja Ur RahmanNo ratings yet

- Anadarko Case Study 2Document7 pagesAnadarko Case Study 2izazNo ratings yet

- Assignment ON Case Analysis of Harnischfeger Corporation: Submitted To Submitted by Dr. Shikha Bhatia Shreya PGFB1144Document3 pagesAssignment ON Case Analysis of Harnischfeger Corporation: Submitted To Submitted by Dr. Shikha Bhatia Shreya PGFB1144simplyshreya99No ratings yet

- Healthcare Startup Funding StrategyDocument5 pagesHealthcare Startup Funding StrategyAndrii DutchakNo ratings yet

- MOQ Limited Is A Listed ASX Company That Is Acquainted To DevelopDocument6 pagesMOQ Limited Is A Listed ASX Company That Is Acquainted To DevelopRitam ChatterjeeNo ratings yet

- Jiyuu No TsubasaDocument58 pagesJiyuu No TsubasaIgor AraújoNo ratings yet

- Final Test Course 6Document6 pagesFinal Test Course 6Juan Pablo Gonzalez HoyosNo ratings yet

- Dimension Specification: IdentificationDocument5 pagesDimension Specification: IdentificationАлександр ОлейникNo ratings yet

- Programming in C Data Structures 15pcd13 NotesDocument112 pagesProgramming in C Data Structures 15pcd13 Noteshavyas100% (1)

- Codigo de Cores para ResistorDocument5 pagesCodigo de Cores para ResistorrogeriocorreaNo ratings yet

- 360137KPPRA Template Manual v1.0Document38 pages360137KPPRA Template Manual v1.0Usman JilaniNo ratings yet

- CM P4621 22 ISSUE A Winche Cabrestante MacGregorDocument185 pagesCM P4621 22 ISSUE A Winche Cabrestante MacGregorpevalpevalNo ratings yet

- Alexandra Heller-Nicholas - Rape-Revenge Films - A Critical Study-McFarland (2011)Document239 pagesAlexandra Heller-Nicholas - Rape-Revenge Films - A Critical Study-McFarland (2011)Leonardo Tesser100% (1)

- Operation ContractsDocument38 pagesOperation ContractsjafferkazmiNo ratings yet

- Pakistan Monthly Climate Summary April 2022Document6 pagesPakistan Monthly Climate Summary April 2022Husnain Ali wajidNo ratings yet

- LANGUIDO-Self in Philosophical PerspectiveDocument1 pageLANGUIDO-Self in Philosophical PerspectiveDeza LanguidoNo ratings yet

- Bucher LRV Hydraulic ValveDocument90 pagesBucher LRV Hydraulic Valvedean_lockey0% (1)

- Department of Education: Republic of The PhilippinesDocument4 pagesDepartment of Education: Republic of The PhilippinesGraceRasdasNo ratings yet

- RG-6 Coaxial Cable CCS Conductor SpecificationsDocument2 pagesRG-6 Coaxial Cable CCS Conductor SpecificationsShashank SaxenaNo ratings yet

- Rough Draft Ethnography PaperDocument2 pagesRough Draft Ethnography Paperapi-240256411No ratings yet

- BS-400 Installation Guide (v1.0) PDFDocument28 pagesBS-400 Installation Guide (v1.0) PDFDENo ratings yet

- Symbols Mechanical and Elements: Acoustical As Schematic DiagramsDocument25 pagesSymbols Mechanical and Elements: Acoustical As Schematic Diagramsamine bouizarNo ratings yet

- GDKDocument30 pagesGDKRobert Aguilar100% (4)

- Clean Gas Turbines with GTC 1000Document1 pageClean Gas Turbines with GTC 1000Chiheb Eddine KourasNo ratings yet

- N2-5 Decimal Ops 2Document10 pagesN2-5 Decimal Ops 2Lala JafarovaNo ratings yet

- National and Official Languages in Language PlanningDocument4 pagesNational and Official Languages in Language PlanningAleaaaxxNo ratings yet

- Crash 2023 06 14 - 16.32.10 FMLDocument5 pagesCrash 2023 06 14 - 16.32.10 FMLEspeciales ???No ratings yet

- Ethnolinguistics: See AlsoDocument3 pagesEthnolinguistics: See AlsoChika PutriNo ratings yet

- Hidden Risks by Nicholas Taleb NassibDocument276 pagesHidden Risks by Nicholas Taleb NassibAugustin Presecan100% (1)

- Mechanical Instruments and ToolsDocument14 pagesMechanical Instruments and ToolsShakib Shaikh100% (3)

- Lenovo Ideapad L340 Gaming Series Hardware Maintenance ManualDocument62 pagesLenovo Ideapad L340 Gaming Series Hardware Maintenance ManualUmar VrathdarNo ratings yet

- LG Ab-Q60lm3t1 SpecsDocument15 pagesLG Ab-Q60lm3t1 SpecsJerine BabuNo ratings yet

- VaR I PDFDocument84 pagesVaR I PDFSunil ShettyNo ratings yet

- 3BTG811792-3014 Functional Description - PP - SmartDeviceTemplateLibDocument51 pages3BTG811792-3014 Functional Description - PP - SmartDeviceTemplateLibMaheshwar - Cnervis AutomationNo ratings yet

- Land Rights Regulations SummaryDocument4 pagesLand Rights Regulations SummaryBaraka Francis100% (1)