Professional Documents

Culture Documents

Worksheet PDF

Uploaded by

Naomi BakerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Worksheet PDF

Uploaded by

Naomi BakerCopyright:

Available Formats

Worksheet

Page 1 of 4

* Page already viewed Manual Accounting Practice Set Technology Boutique, US GAAP Edition 3

Feedback: Worksheet

This is a feedback page. Please review this page carefully because later pages in this practice set build on the feedback provided here. After you have reviewed your feedback page, click Continue at the bottom of this page to move on to the next page of your practice set.

Your progress

Your grading

Your grading outcome (still in progress) Awarded Total Points (prior to this page) Points (on this page) Points (after this page) Total 736 72 831 76 170

808 1,077

Completed:

74% (approximately)

Remaining pages will take: up to 5.5 hours

The time frames we provide are a guide only. It may take you more or less time to complete each step.

Now that you have completed the June bank reconciliation process, you are asked to complete the worksheet for Intermaweb Computer. The worksheet is an internal document that exists outside the journals and ledgers. It is often used in the manual accounting system to help record adjusting entries and prepare financial statements. After you have prepared the worksheet, in the next section of the practice set you will be asked to use the completed worksheet to help journalize and post adjusting entries to general ledger. You will also use this worksheet to assist you in preparing the financial statements for Intermaweb Computer in a later section of this practice set. The details of the end of month adjustments for June are as follows:

Office Furniture owned by the business: original purchase price was $10,000, estimated useful life was 5 years, and estimated residual value was $1,000 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year. Office Equipment owned by the business: original purchase price was $52,000, estimated useful life was 9 years, and estimated residual value was $3,000 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year. The water usage for the month of June is estimated to be $119. The estimated electricity payable as at the end of the month is $486. Sales staff work every single day during the week including weekends and are paid on a weekly basis. Wages were last paid up to and including 24 June. Wages incurred after that day (from June 25 to June 30 inclusive) are estimated to have been $1,900 per day. Interest expense incurred during the month of June but not yet paid to BitiBank for the bank loan is $270. Interest earned from short-term investments in ZNZ Bank for the month of June is $115. Office supplies totaling $2,246 are still on hand at June 30. 15 days of rent remained pre-paid at the start of June. 3 months of advertising remained pre-paid at the start of June. 5 months of insurance remained pre-paid at the start of June.

When calculating the portion of prepayments that expire during the month of June, you are asked to assume that an equal amount of expense is incurred per month. After taking a physical count of inventory at the end of the month, the balance of inventory on hand as at June 30 is found to be equal to the closing balance of the Merchandise Inventory account. This means there is no adjusting entry required for inventory shrinkage. Instructions for worksheet Complete all columns in the worksheet. To do this, you need to use the account balances provided in the general ledger to fill out the Unadjusted Trial Balance columns. You are also required to calculate the end of month adjustments for June and enter them into the worksheet before completing the remaining columns. Note that not all boxes in each column of the worksheet will need to be filled. Remember to enter all answers to the nearest whole dollar. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. If you want to print this page, please read and follow the special printing information to ensure you can print the worksheet in full.

(Q=832.worksheetQuestion)

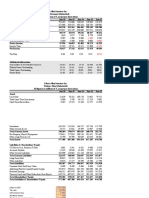

Intermaweb Computer

http://www.perdisco.com/elms/qsam/html/qsam.aspx

10/8/2013

Worksheet

Page 2 of 4

Worksheet

For the month ended June 30, 2013

Acct. Account Name No. 100 Cash 102 Short-term Investments 112 Interest Receivable 110 ARC - Accounts Receivable Control 120 Merchandise Inventory 130 Office Supplies 140 Prepaid Rent 141 Prepaid Advertising 142 Prepaid Insurance 150 Office Furniture 151 Accum Depn: Office Furniture 160 Office Equipment 161 Accum Depn: Office Equipment 210 APC - Accounts Payable Control 220 Wages Payable 221 Electricity Payable 222 Water Payable 225 Interest Payable 240 Sales Tax Payable 250 Bank Loan Payable 300 Common Stock 301 Retained Earnings 400 Sales Revenue 403 Interest Revenue 500 Cost of Goods Sold 511 Advertising Expense 516 Wages Expense 540 Rent Expense 541 Electricity Expense 542 Water Expense 543 Insurance Expense 544 Office Supplies Expense 545 Salary Expense 560 Depn Expense: Office Furniture 561 Depn Expense: Office Equipment 571 Interest Expense 572 Admin. Expense - Bank Charges

Unadjusted Trial Balance Debit 242562 23000 Credit

Adjustments Debit Credit

Adjusted Trial Balance Debit 242562 23000 Credit

Income Statement Debit Credit

Balance Sheet Debit 242562 23000 115 129438 70040 2246 1600 2000 2240 10000 Credit

115 129438 70040 2495 4800 3000 2800 10000 3600 52000 25407 13440 11400 58 127 486 119 270 33368 54000 55000 239985 354740 693 189380 1000 45490 11400 3200 486 119 560 249 5400 150 454 270 13 115 454 150 249 3200 1000 560

115 129438 70040 2246 1600 2000 2240 10000 3750 52000 25861 13440 11400 544 246 270 33368 54000 55000 239985 354740 808 189380 1000 56890 3200 486 119 560 249 5400 150 454 270 13 189380 1000 56890 3200 486 119 560 249 5400 150 454 270 13 354740 808

3750 52000 25861 13440 11400 544 246 270 33368 54000 55000 239985

http://www.perdisco.com/elms/qsam/html/qsam.aspx

10/8/2013

Worksheet

Page 3 of 4

Totals

780418

780418

18003

18003

793412

793412

258171

355548

535241

437864

Net income or loss Totals

97377 355548 355548 535241

97377 535241

Feedback

Intermaweb Computer

Worksheet

For the month ended June 30, 2013

Unadjusted Trial Balance Debit 100 102 112 110 120 130 140 141 142 150 151 160 161 210 220 221 222 225 240 250 300 301 400 403 500 511 516 540 541 542 543 544 545 560 561 571 572 Cash Short-term Investments Interest Receivable ARC - Accounts Receivable Control Merchandise Inventory Office Supplies Prepaid Rent Prepaid Advertising Prepaid Insurance Office Furniture Accum Depn: Office Furniture Office Equipment Accum Depn: Office Equipment APC - Accounts Payable Control Wages Payable Electricity Payable Water Payable Interest Payable Sales Tax Payable Bank Loan Payable Common Stock Retained Earnings Sales Revenue Interest Revenue Cost of Goods Sold Advertising Expense Wages Expense Rent Expense Electricity Expense Water Expense Insurance Expense Office Supplies Expense Salary Expense Depn Expense: Office Furniture Depn Expense: Office Equipment Interest Expense Admin. Expense - Bank Charges Totals 13 780,418 780,418 17,945 17,945 5,400 150 454 270 45,490 189,380 1,000 11,400 3,200 428 119 560 249 33,368 54,000 55,000 239,985 354,740 693 115 189,380 1,000 56,890 3,200 428 119 560 249 5,400 150 454 270 13 793,354 793,354 58 127 52,000 25,407 13,440 11,400 428 119 270 454 129,438 70,040 2,495 4,800 3,000 2,800 10,000 3,600 150 52,000 25,861 13,440 11,400 486 246 270 33,368 54,000 55,000 239,985 354,740 808 189,380 1,000 56,890 3,200 428 119 560 249 5,400 150 454 270 13 258,113 355,548 535,241 437,806 354,740 808 249 3,200 1,000 560 242,562 23,000 115 Credit Adjustments Debit Credit Adjusted Trial Balance Debit 242,562 23,000 115 129,438 70,040 2,246 1,600 2,000 2,240 10,000 3,750 52,000 25,861 13,440 11,400 486 246 270 33,368 54,000 55,000 239,985 Credit Income Statement Debit Credit Balance Sheet Debit 242,562 23,000 115 129,438 70,040 2,246 1,600 2,000 2,240 10,000 3,750 Credit

Acct. No.

Account Name

Net income or loss Totals

97,435 355,548 355,548 535,241

97,435 535,241

Manual Accounting Practice Set Technology Boutique, US GAAP Edition 3 (VTU3p)

http://www.perdisco.com/elms/qsam/html/qsam.aspx

10/8/2013

Worksheet

Page 4 of 4

2010 Perdisco / latin /. v., learn thoroughly http://www.perdisco.com Terms Of Use | Privacy Policy | Wednesday, October 09, 2013, 07:58

http://www.perdisco.com/elms/qsam/html/qsam.aspx

10/8/2013

You might also like

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- ACCT1501 Perdisco Adjusting EntriesDocument16 pagesACCT1501 Perdisco Adjusting Entriesloz9993% (57)

- The Controller's Function: The Work of the Managerial AccountantFrom EverandThe Controller's Function: The Work of the Managerial AccountantNo ratings yet

- Worksheet SOLN I Got GgedDocument2 pagesWorksheet SOLN I Got GgedDaniel ZhuangNo ratings yet

- Transactions - Week 2 HelpDocument14 pagesTransactions - Week 2 HelpAndy Trossen75% (20)

- Perdisco Practice Set Solution Bank Reconciliation PDFDocument8 pagesPerdisco Practice Set Solution Bank Reconciliation PDFkashishNo ratings yet

- Bank ReconciliationDocument8 pagesBank ReconciliationFareed Ahmed0% (2)

- End of Month PostingDocument9 pagesEnd of Month PostingMark Francis Alvarez Sagge50% (2)

- Perdisco Solution - Transactions - Week 1Document11 pagesPerdisco Solution - Transactions - Week 1My Assignment Guru100% (1)

- Schedule of AccountsDocument3 pagesSchedule of AccountsA67% (3)

- End of Month PostingDocument9 pagesEnd of Month Postingabhii10275% (8)

- Perdisco - Transactions - Week 3Document14 pagesPerdisco - Transactions - Week 3Saifullah Waqar100% (2)

- Transactions - Week 3Document17 pagesTransactions - Week 3Dan100% (34)

- Bank Reconciliation PDFDocument8 pagesBank Reconciliation PDFOr Gio44% (9)

- Perdisco - Transactions - Week 5Document12 pagesPerdisco - Transactions - Week 5Saifullah Waqar100% (1)

- Perdisco Answers Week1Document3 pagesPerdisco Answers Week1Michael Nguyen85% (26)

- WorksheetDocument3 pagesWorksheetabhii10282% (38)

- Transactions - Week 4Document10 pagesTransactions - Week 4Jade Zhang25% (4)

- Bank Reconciliation PDFDocument8 pagesBank Reconciliation PDFmuller1234100% (1)

- Perdisco Week 3Document19 pagesPerdisco Week 3csyc64% (14)

- Transactions - Week 2Document14 pagesTransactions - Week 2Dan100% (7)

- Perdisco Practice Set Solution - Week 2Document13 pagesPerdisco Practice Set Solution - Week 2My Assignment Guru88% (49)

- Bank Reconciliation PerdiscoDocument8 pagesBank Reconciliation Perdiscoabhii10238% (24)

- Perdisco - Transactions - Week 4Document15 pagesPerdisco - Transactions - Week 4Saifullah Waqar67% (3)

- Perdisco WEEK2Document5 pagesPerdisco WEEK2malhar1182% (11)

- End of Month PostingDocument9 pagesEnd of Month PostingemcobbNo ratings yet

- Transactions - Week 5 PDFDocument10 pagesTransactions - Week 5 PDFOr Gio92% (12)

- Transactions - Week 3Document11 pagesTransactions - Week 3MlndsamoraNo ratings yet

- Perdisco Week 1Document17 pagesPerdisco Week 1csyc67% (3)

- ACCT1501 Perdisco 1-3Document20 pagesACCT1501 Perdisco 1-3alwaysyjae86% (7)

- Schedules of AccountsDocument3 pagesSchedules of Accountsabhii10267% (6)

- 4 Transactions - Week 4Document19 pages4 Transactions - Week 4Karina Gabriella Sanchez83% (6)

- Post-Closing Trial BalanceDocument3 pagesPost-Closing Trial BalanceSuszie Sue70% (10)

- Transactions - Week 4 PDFDocument10 pagesTransactions - Week 4 PDFAngela75% (4)

- 2 Transactions - Week 2Document16 pages2 Transactions - Week 2Karina Gabriella Sanchez100% (1)

- Post-Closing Trial Balance PDFDocument3 pagesPost-Closing Trial Balance PDFOr Gio100% (3)

- Perdisco Solution - Transactions - Week 2Document11 pagesPerdisco Solution - Transactions - Week 2My Assignment GuruNo ratings yet

- End of Month PostingDocument10 pagesEnd of Month PostingSuszie Sue93% (14)

- Transactions - Week 1Document11 pagesTransactions - Week 1baekhyuneeeee90% (21)

- Perdisco WEEK3Document5 pagesPerdisco WEEK3malhar11100% (2)

- End of Month Posting PDFDocument9 pagesEnd of Month Posting PDFOr Gio100% (12)

- Financial Statements PDFDocument9 pagesFinancial Statements PDFAngela88% (16)

- Adjusting Entries PDFDocument15 pagesAdjusting Entries PDFOr Gio100% (3)

- Perdisco Week 1Document3 pagesPerdisco Week 1malhar1192% (13)

- PrediscoDocument3 pagesPrediscoOr Gio100% (4)

- Financial Statements PDFDocument9 pagesFinancial Statements PDFOr Gio100% (10)

- Week 1-5Document2 pagesWeek 1-5Or Gio100% (1)

- Perdisco WEEK4Document3 pagesPerdisco WEEK4malhar1177% (13)

- Transactions - Week 1Document14 pagesTransactions - Week 1Karina Gabriella Sanchez100% (1)

- Adjusting EntriesDocument21 pagesAdjusting EntriesJashveer Seetahul100% (2)

- Transactions - Week 1Document12 pagesTransactions - Week 1Dan67% (18)

- Mine-Transactions - Week 2Document11 pagesMine-Transactions - Week 2Andy Trossen100% (2)

- Practice Set Information 2014Document3 pagesPractice Set Information 2014PrueyGeeNo ratings yet

- ACCT504 Case Study 1 The Complete Accounting Cycle-13varnadoDocument16 pagesACCT504 Case Study 1 The Complete Accounting Cycle-13varnadoRegina Lee FordNo ratings yet

- BBA 4002 BUDGETING AND CONTROL (INDUSTRIAL PROJECT PAPAERDocument14 pagesBBA 4002 BUDGETING AND CONTROL (INDUSTRIAL PROJECT PAPAERWindy TanNo ratings yet

- FI504 Case Study 1 The Complete Accounting CycleDocument16 pagesFI504 Case Study 1 The Complete Accounting CycleElizabeth Hurtado-Rivera0% (1)

- W4Me Problem 3Document8 pagesW4Me Problem 3Jason Berglund0% (1)

- Trial Balance (Excel Format)Document4 pagesTrial Balance (Excel Format)Mohammed Shabil50% (2)

- Roxanne Robinson - FI504 Case Study 1 The Complete Accounting CycleDocument16 pagesRoxanne Robinson - FI504 Case Study 1 The Complete Accounting CycleroxannerobinsonNo ratings yet

- COMPLETE ACCOUNTING CYCLEDocument16 pagesCOMPLETE ACCOUNTING CYCLEhereforanswersNo ratings yet

- Beximco Pharma-Financial AnalysisDocument26 pagesBeximco Pharma-Financial AnalysisIffat Binte Rabbani100% (1)

- VOL 3 18. Book Value Per ShareDocument15 pagesVOL 3 18. Book Value Per ShareJohn Vincent CruzNo ratings yet

- Herry Sutanto Dkk-Makalah-Pelaporan Keuangan BAZ Dan LAZDocument9 pagesHerry Sutanto Dkk-Makalah-Pelaporan Keuangan BAZ Dan LAZmuhammad rexy pratamaNo ratings yet

- EY ENTRANCE TEST final-ACE THE FUTUREDocument18 pagesEY ENTRANCE TEST final-ACE THE FUTURETrà Hương100% (1)

- Financial Analysis of Dewan Mushtaq GroupDocument26 pagesFinancial Analysis of Dewan Mushtaq Groupسید نیر سجاد البخاري100% (2)

- Chapter07 XlssolDocument49 pagesChapter07 XlssolEkhlas AmmariNo ratings yet

- Penguin Corporation Acquired 80 Percent of The Outstanding Voting StockDocument1 pagePenguin Corporation Acquired 80 Percent of The Outstanding Voting Stocktrilocksp SinghNo ratings yet

- Company Finance Balance Sheet Consolidated (Rs in CRS.)Document3 pagesCompany Finance Balance Sheet Consolidated (Rs in CRS.)rohanNo ratings yet

- Working Capital Management of Sanvijay RollingDocument81 pagesWorking Capital Management of Sanvijay RollingAnuradhaNo ratings yet

- ACC111 Final ExamDocument10 pagesACC111 Final ExamGayle Montecillo Pantonial OndoyNo ratings yet

- Aspin Kemp - Associates Holding Corp. Consolidated FS 2017 PDFDocument25 pagesAspin Kemp - Associates Holding Corp. Consolidated FS 2017 PDFAnonymous nVXCkl0ANo ratings yet

- Domondon Acctg 3 Prelim ExamDocument3 pagesDomondon Acctg 3 Prelim ExamPrince Anton DomondonNo ratings yet

- Capital Budgeting Sample Questions ExplainedDocument2 pagesCapital Budgeting Sample Questions ExplainedNCTNo ratings yet

- PT. BHUMI SAPROLITE INDONESIA Financial ProjectionsDocument8 pagesPT. BHUMI SAPROLITE INDONESIA Financial Projectionsfahbi firnandaNo ratings yet

- Financial Statements ForecastingDocument16 pagesFinancial Statements ForecastingDeep AnjarlekarNo ratings yet

- Hotel Budget TemplateDocument44 pagesHotel Budget TemplateClarisse30No ratings yet

- BAV Assignment-1 Group8Document18 pagesBAV Assignment-1 Group8Aakash SinghalNo ratings yet

- Multiple Choice Partnership and CorporationDocument14 pagesMultiple Choice Partnership and CorporationTrina Joy HomerezNo ratings yet

- Calculate Payback Period, NPV-Chapter 2Document13 pagesCalculate Payback Period, NPV-Chapter 2Khuetu NguyenhoangNo ratings yet

- Junior Philippine Accounting Midterms ReviewDocument5 pagesJunior Philippine Accounting Midterms ReviewezraelydanNo ratings yet

- Oman - Oil SectorDocument15 pagesOman - Oil Sectorsultana792No ratings yet

- Fanatical Fashions A Department Store Has The Following Unadjusted AccountDocument1 pageFanatical Fashions A Department Store Has The Following Unadjusted AccountFreelance WorkerNo ratings yet

- Slide Management AccountingDocument152 pagesSlide Management AccountingChitta LeeNo ratings yet

- Acca f9 and p4 Answers To Reinforcing Questions p4Document80 pagesAcca f9 and p4 Answers To Reinforcing Questions p4Calvince OumaNo ratings yet

- ACCT 210-Fall 21-22-Revision Sheet - FinalDocument3 pagesACCT 210-Fall 21-22-Revision Sheet - FinalAndrew PhilipsNo ratings yet

- Module 5Document16 pagesModule 5Distor, Jane F.No ratings yet

- Class Assignment-02: Mittal School of Business, Lovely Professional University, Phagwara-144401, Punjab, India, 2021Document10 pagesClass Assignment-02: Mittal School of Business, Lovely Professional University, Phagwara-144401, Punjab, India, 2021Ria HembromNo ratings yet

- Consolidated Financial Statements ProblemsDocument2 pagesConsolidated Financial Statements ProblemsRafael BarbinNo ratings yet

- ACYAVA1 Comprehensive Examination Quiz Instructions: Started: Jun 4 at 13:00Document37 pagesACYAVA1 Comprehensive Examination Quiz Instructions: Started: Jun 4 at 13:00Joel Kennedy BalanayNo ratings yet

- Management Advisory Services - Final RoundDocument14 pagesManagement Advisory Services - Final RoundRyan Christian M. CoralNo ratings yet