Professional Documents

Culture Documents

ACCT550 Homework Week 2

Uploaded by

Natasha DeclanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT550 Homework Week 2

Uploaded by

Natasha DeclanCopyright:

Available Formats

E4-4 (Multiple-Step and Single-Step) Two accountants for the firm of Allen and Wright are arguing about

the merits of presenting an income statement in a multiple-step versus a singlestep format. The discussion involves the following 2012 information related to Webster Company ($000 omitted). Administrative expense Officers salaries $4,900 Depreciation of office furniture and equipment 3,960 Cost of goods sold 63,570 Rent revenue 17,230 Selling expense Transportation-out 2,690 Sales commissions 7,980 Depreciation of sales equipment 6,480 Sales revenue 96,500 Income tax expense 7,580 Interest expense 1,860 Instructions (a) Prepare an income statement for the year 2012 using the multiple-step form. Common shares outstanding for 2012 total 40,550 (000 omitted). (b) Prepare an income statement for the year 2012 using the single-step form. (c) Which one do you prefer? Discuss. A. Multiple-Step Form Webster Company Income Statement For the Year Ended December 31, 2012 Sales Revenue Cost of goods sold Gross profit on sales Operating Expenses Selling expenses Transportation-out $2,690 Sales commissions 7,980 Depreciation of sales equipment 6,480 $17,150 Administrative expenses Officers salaried $4,900 Dep. of office furniture & equipment 3,960 $8,860 Income from operations Other Revenues and Gaines Rent Revenue Income from operations Other Expenses and Losses Interest Expense Income before income taxes $96,500 63,570 32,930

26,010 $6,920 17,230 24,150 1,860 22,290

Income tax Net income

7,580 $14,710 ====== $.36 ===

Earnings per capital share ($14,710 / 40,550 shares) B.

Single-Step Form Webster Company Income Statement For the Year Ended December 31, 2012 Revenues Sales Revenue Rent revenue Total revenues Expenses Cost of goods sold Selling expenses Administrative expenses Interest expense Income tax expense Total expenses Net Income

$96,500 17,230 $113,730 63,570 17,150 8,860 1,860 7,580 $99,020 $14,710 ====== $.36 ===

Earnings per capital share ($14,710 / 40,550 shares)

C. I prefer the Single-Step Form of Income Statement because of its simplicity and conciseness, easily understood by users, emphasis on total costs and expenses and net income and it does not imply priority of one revenue or expense over another.

E4-12 (Earnings per Share) At December 31, 2011, Schroeder Corporation had the following stock outstanding. 8% cumulative preferred stock, $100 par, 107,500 shares Common stock, $5 par, 4,000,000 shares $10,750,000 $20,000,000

During 2012, Schroeder did not issue any additional common stock. The following also occurred during 2012. Income from continuing operations before taxes Discontinued operations (loss before taxes) Preferred dividends declared Common dividends declared Effective tax rate $21,650,000 3,225,000 860,000 2,200,000 35%

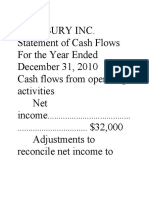

Instructions Compute earnings per share data as it should appear in the 2012 income statement of Schroeder Corporation. (Round to two decimal places.) Schroeder Corporation Income Statement For the Year Ended December 31, 2012 Net income: Income before income tax Income tax (35%*$21,650,000) Income from continuing operations Discontinued operations Loss before income tax $3,225,000 Income tax (35%*3,225,000) 1,128,750 Net income

$21,650,000 7,577,500 14,072,500

2,096,250 $11,976,250 ========= $860,000 4,000,000

Preferred dividends declared Weighted average shares outstanding

Earnings per share Income from continuing operations ($14,072,500-860,000)/4,000,000 Discontinued operations, net of tax ($2,096,250 / 4,000,000) Net income (11,976,250-860,000)/4,000,000

$3.30 (.52) $2.78 ====

P4-1 (Multiple-Step Income, Retained Earnings) Presented below is information related to Dickinson Company for 2012. Retained earnings balance, January 1, 2012 $980,000 Sales revenue 25,000,000 Cost of goods sold 16,000,000 Interest revenue 70,000 Selling and administrative expenses 4,700,000 Write-off of goodwill 820,000

Income taxes for 2012 1,244,000 Gain on the sale of investments (normal recurring) 110,000 Loss due to flood damage-extraordinary item (net of tax) 390,000 Loss on the disposition of the wholesale division (net of tax)440,000 Loss on operations of the wholesale division (net of tax) 90,000 Dividends declared on common stock 250,000 Dividends declared on preferred stock 80,000 Instructions Prepare a multiple-step income statement and a retained earnings statement. Dickinson Company decided to discontinue its entire wholesale operations and to retain its manufacturing operations. On September 15, Dickinson sold the wholesale operations to Rogers Company. During 2012, there were 500,000 shares of common stock outstanding all year. Dickinson Company Income Statement For the Year Ended December 31, 2012 Sales Revenue Cost of goods sold Gross profit Selling and administrative expenses Income from operations Other revenues and gains Gain on the sale of investments 110,000 Interest revenue 70,000 Other expenses and losses Write off of goodwill Income from continuing operations before taxes Income tax Income from continuing operations Discontinued operations Loss on operations, net of tax 90,000 Loss on disposal, net of tax 440,000 Income before extraordinary item Extraordinary item-loss from flood damage, net of tax Net income $25,000,000 16,000,000 9,000,000 4,700,000 4,300,000

180,000 (820,000) 3,660,000 (1,244,000) 2,416,000

(530,000) 1,866,000 (390,000) $1,496,000 ==========

Earnings per share Income from continuing operations ($2,416,000-$80,000) /500,000 shares Discontinued operations Loss on operations, net of tax ($90,000/500,000) ($.18) Loss on disposal, net of tax ($440,000/500,000) ($.88) Income before extraordinary item (1,866,000-80,000)/500,000 Extraordinary loss, net of tax ($390,000/500,000 Net Income ($1,496,000-80,000)/500,000

$4.67

(1.06) $3.61 (.78) $2.83 ====

Dickinson Company Retained Earnings Statement For the Year Ended December 31, 2012 Retained earnings, January 1 Add: Net income Less: Dividends Preferred stocks $80,000 Common stocks 250,000 Retained earnings, December 31 $980,000 1,496,000 2,476,000

330,000 $2,146,000 ========

You might also like

- Knight Frank The Wealth Report 2022Document104 pagesKnight Frank The Wealth Report 2022Cristian BenczeNo ratings yet

- AC517Document11 pagesAC517Inaia ScottNo ratings yet

- Intro and Excerpt of Chapter One From The Violence of Organized Forgetting by Henry A. GirouxDocument33 pagesIntro and Excerpt of Chapter One From The Violence of Organized Forgetting by Henry A. GirouxCity LightsNo ratings yet

- Akuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-IDocument14 pagesAkuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-Imuhammad alfariziNo ratings yet

- IFRS Edition (2nd) : Plant Assets, Natural Resources, and Intangible AssetsDocument62 pagesIFRS Edition (2nd) : Plant Assets, Natural Resources, and Intangible Assetsmajestic accounting100% (1)

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocument7 pagesE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- Fischer11e Smchap04 FinalDocument28 pagesFischer11e Smchap04 FinalWilliam Omar VelezNo ratings yet

- Pembahasan CH 3 4 5Document30 pagesPembahasan CH 3 4 5bella0% (1)

- Job Costing at Law Firm and University PressDocument22 pagesJob Costing at Law Firm and University PressAlmirNo ratings yet

- Answer Key Chapters 1 7Document40 pagesAnswer Key Chapters 1 7Sheila Mae Guerta Lacerona74% (38)

- ACCT550 Homework Week 6Document6 pagesACCT550 Homework Week 6Natasha DeclanNo ratings yet

- IFRS Edition-2nd: The Accounting Information SystemDocument88 pagesIFRS Edition-2nd: The Accounting Information SystemmariaNo ratings yet

- Managerial Accounting (ACC720) : Financial Statement AnalysisDocument39 pagesManagerial Accounting (ACC720) : Financial Statement AnalysisNor Cahaya100% (1)

- Erika Christina - LD53 - Latihan KPDocument14 pagesErika Christina - LD53 - Latihan KPNatasha HerlianaNo ratings yet

- More Cash Flow ExercisesDocument4 pagesMore Cash Flow ExercisesLorenzodeLunaNo ratings yet

- Aberdeen Asset Management PLC - Ar - 09!30!2015Document168 pagesAberdeen Asset Management PLC - Ar - 09!30!2015Tanu ChaurasiaNo ratings yet

- Comprehensive Problems Solution Answer Key Mid TermDocument5 pagesComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneNo ratings yet

- CH 14Document71 pagesCH 14Febriana Nurul HidayahNo ratings yet

- CH 4 - Brief Exercises - 16thDocument18 pagesCH 4 - Brief Exercises - 16thkesey100% (2)

- Sarkar Sailboats Bond EntriesDocument2 pagesSarkar Sailboats Bond EntriesannisaNo ratings yet

- Exercises: Ex. 9-143-Lower-Of-Cost-Or-Net Realizable ValueDocument9 pagesExercises: Ex. 9-143-Lower-Of-Cost-Or-Net Realizable ValueManuel Magadatu100% (1)

- Fin515 Week 4 ExamDocument5 pagesFin515 Week 4 ExamNatasha DeclanNo ratings yet

- Answers To Olivia CompanyDocument34 pagesAnswers To Olivia CompanyRIZLE SOGRADIELNo ratings yet

- Presented Below Is The Trial Balance of Vivaldi Spa at December 31, 2019Document2 pagesPresented Below Is The Trial Balance of Vivaldi Spa at December 31, 2019SalsabiilaNo ratings yet

- Business and Management SL P2 PDFDocument8 pagesBusiness and Management SL P2 PDFLodewijk BajarinNo ratings yet

- Akuntansi Keuangan MenengahDocument4 pagesAkuntansi Keuangan Menengahariena alifia s100% (1)

- 3rd Annual Private Wealth Management Summit 2019Document11 pages3rd Annual Private Wealth Management Summit 2019Sreejit NairNo ratings yet

- Intermediate Accounting: Assignment 2Document2 pagesIntermediate Accounting: Assignment 2Putri SerlyNo ratings yet

- Socialism vs. Capitalism - Differences, Similarities, Pros, ConsDocument8 pagesSocialism vs. Capitalism - Differences, Similarities, Pros, ConsJuan MartinezNo ratings yet

- Business Ethics and Social Responsibility: Introduction To The Notion of Social EnterpriseDocument28 pagesBusiness Ethics and Social Responsibility: Introduction To The Notion of Social EnterpriseIris Rivera-Perez100% (12)

- Modul Pembelajaran Akuntansi Keuangan 1 Pra UTSDocument10 pagesModul Pembelajaran Akuntansi Keuangan 1 Pra UTSirsaNo ratings yet

- Ch23 StudentSolutionsDocument14 pagesCh23 StudentSolutionsMegan Collins100% (4)

- Tugas Persediaan 2Document6 pagesTugas Persediaan 2Bertha Liona0% (2)

- VivaldiDocument3 pagesVivaldiAlia Azhara100% (1)

- AKM 2 - Forum 7 - Andres - 43220110067Document13 pagesAKM 2 - Forum 7 - Andres - 43220110067tes doangNo ratings yet

- Nama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure InternalDocument6 pagesNama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure Internalmelvina siregarNo ratings yet

- Week1 SolutionsDocument14 pagesWeek1 SolutionsM Mustafa100% (1)

- Exercise 6Document1 pageExercise 6Kayla SheltonNo ratings yet

- E7 25Document2 pagesE7 25Muhammad Syafiq RamadhanNo ratings yet

- Tugas 6 AKM1 Muhammad Alfarizi 142200278 EA-IDocument9 pagesTugas 6 AKM1 Muhammad Alfarizi 142200278 EA-Imuhammad alfariziNo ratings yet

- Regression Line of Overhead Costs On LaborDocument3 pagesRegression Line of Overhead Costs On LaborElliot Richard100% (1)

- TR 2 IndahDocument3 pagesTR 2 IndahIndahyuliaputriNo ratings yet

- BE10 practice problems and solutionsDocument14 pagesBE10 practice problems and solutionsJoshua Solite0% (1)

- 20210213174013D3066 - Soal Cost System and Cost AccumulationDocument6 pages20210213174013D3066 - Soal Cost System and Cost AccumulationLydia limNo ratings yet

- Excercise 19Document7 pagesExcercise 19raihan aqilNo ratings yet

- Test 2 HomeworkDocument12 pagesTest 2 HomeworkMiguel CortezNo ratings yet

- Week 2 Homework (Chap. 4) - PostedDocument4 pagesWeek 2 Homework (Chap. 4) - PostedMs. Nina100% (5)

- Income statement and financial position documents solutionsDocument59 pagesIncome statement and financial position documents solutionsNam PhươngNo ratings yet

- Rika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02Document5 pagesRika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02MARCHO AGUSTANo ratings yet

- Flynn Design AgencyDocument4 pagesFlynn Design Agencycalsey azzahraNo ratings yet

- Chapter 6 and 7 NR and BPDocument2 pagesChapter 6 and 7 NR and BPCa Ada100% (1)

- Ananda Febrian P.S - 041911333118 - Tugas Akm 8Document5 pagesAnanda Febrian P.S - 041911333118 - Tugas Akm 8sari ayuNo ratings yet

- P11Document7 pagesP11Arif RahmanNo ratings yet

- Chapter 13 CASH FLOWDocument2 pagesChapter 13 CASH FLOWKezia N. ApriliaNo ratings yet

- T4 - (Assets) - Qs and SolutionDocument22 pagesT4 - (Assets) - Qs and SolutionCalvin MaNo ratings yet

- Exercise - Dilutive Securities - AdillaikhsaniDocument4 pagesExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsanNo ratings yet

- Arini Alfahani - Tugas AKM IDocument2 pagesArini Alfahani - Tugas AKM Iarini alfahaniNo ratings yet

- Acct 201 3nd AssingnmentDocument2 pagesAcct 201 3nd Assingnmentapi-280585803No ratings yet

- Kisi2 UAS AKM TerjawabDocument8 pagesKisi2 UAS AKM TerjawabBakhtiar AlakadarnyaNo ratings yet

- Exercise CH 16-1 ch16-2 ch16-3Document8 pagesExercise CH 16-1 ch16-2 ch16-3Chelsea WulanNo ratings yet

- Pertemuan 12 - Investasi Obligasi PDFDocument21 pagesPertemuan 12 - Investasi Obligasi PDFayu utamiNo ratings yet

- Lansbury Inc cash flow analysisDocument10 pagesLansbury Inc cash flow analysis/// MASTER DOGENo ratings yet

- Chapter 4 CourseDocument15 pagesChapter 4 CourseMagdy KamelNo ratings yet

- Uswatur Rizkiyah - 180422623171 - JJ - Tugas AKL II - P1-3Document4 pagesUswatur Rizkiyah - 180422623171 - JJ - Tugas AKL II - P1-3Kiki amaliaNo ratings yet

- DDDocument4 pagesDDAmelia Salini100% (1)

- Classification and Measurement of Financial AssetsDocument2 pagesClassification and Measurement of Financial AssetsRahmat DarmawanNo ratings yet

- Akuntansi Tugas 4Document2 pagesAkuntansi Tugas 4Biyan ArdanaNo ratings yet

- KIeso Chapter 18 Part 1Document8 pagesKIeso Chapter 18 Part 1Pelangi DiamondNo ratings yet

- 3 Cash - Assignment PDFDocument6 pages3 Cash - Assignment PDFCatherine RiveraNo ratings yet

- Tugas Mandiri Lab. Ak. Meng 1 - PersediaanDocument9 pagesTugas Mandiri Lab. Ak. Meng 1 - PersediaanZachra MeirizaNo ratings yet

- Acct 555 Audit Week 4 MidtermDocument6 pagesAcct 555 Audit Week 4 MidtermNatasha DeclanNo ratings yet

- ACCT 555 Audit Week 7Document5 pagesACCT 555 Audit Week 7Natasha DeclanNo ratings yet

- ACCT555 Midterm Exam 1.31.2014Document6 pagesACCT555 Midterm Exam 1.31.2014Natasha DeclanNo ratings yet

- Aicpa Reg 6Document170 pagesAicpa Reg 6Natasha Declan100% (1)

- Acct571 Week 1 QuizDocument2 pagesAcct571 Week 1 QuizNatasha DeclanNo ratings yet

- AC 571 Quiz (Week 1)Document4 pagesAC 571 Quiz (Week 1)Natasha DeclanNo ratings yet

- ACCT 571 Week 4 AssignmentDocument4 pagesACCT 571 Week 4 AssignmentNatasha DeclanNo ratings yet

- AC571 Week 1 HW AssignmentDocument1 pageAC571 Week 1 HW AssignmentNatasha DeclanNo ratings yet

- MGT 597 SolutionsDocument6 pagesMGT 597 SolutionsNatasha DeclanNo ratings yet

- AC 571 - Final Exam (Study Guide)Document14 pagesAC 571 - Final Exam (Study Guide)Natasha Declan100% (1)

- CPA A 4 Audit EvidenceDocument28 pagesCPA A 4 Audit EvidenceNatasha DeclanNo ratings yet

- AC 571 - Final Exam (Study Guide)Document14 pagesAC 571 - Final Exam (Study Guide)Natasha Declan100% (1)

- MGMT 597 Week 6 HomeworkDocument8 pagesMGMT 597 Week 6 HomeworkNatasha Declan100% (1)

- FIN 515 Week 6 Exam Set 1Document5 pagesFIN 515 Week 6 Exam Set 1Natasha DeclanNo ratings yet

- FIN516 Week Quiz 6Document7 pagesFIN516 Week Quiz 6Natasha DeclanNo ratings yet

- FIN515 MidtermDocument9 pagesFIN515 MidtermNatasha DeclanNo ratings yet

- Acct557 Wk4 QuizDocument4 pagesAcct557 Wk4 QuizNatasha Declan100% (1)

- MGMT 597 Week 6 HomeworkDocument8 pagesMGMT 597 Week 6 HomeworkNatasha Declan100% (1)

- FIN515 Week 1 Homework AssignmentDocument8 pagesFIN515 Week 1 Homework AssignmentNatasha DeclanNo ratings yet

- FIN515 Week 5 Project Graded ADocument2 pagesFIN515 Week 5 Project Graded ANatasha DeclanNo ratings yet

- FIN515 Homework1Document4 pagesFIN515 Homework1Natasha DeclanNo ratings yet

- AC555 External Auditing Chapter 2 Test WK 1Document23 pagesAC555 External Auditing Chapter 2 Test WK 1Natasha DeclanNo ratings yet

- Acct557 Quiz 2Document3 pagesAcct557 Quiz 2Natasha DeclanNo ratings yet

- FIN515 Week 2 Homework AssignmentDocument6 pagesFIN515 Week 2 Homework AssignmentNatasha DeclanNo ratings yet

- AC555 - Audit Final ExamDocument8 pagesAC555 - Audit Final ExamNatasha Declan0% (1)

- Acct557 Quiz 3Document5 pagesAcct557 Quiz 3Natasha DeclanNo ratings yet

- Acct557 Quiz 2Document3 pagesAcct557 Quiz 2Natasha DeclanNo ratings yet

- Acct557 Quiz 2Document3 pagesAcct557 Quiz 2Natasha DeclanNo ratings yet

- Role of SACCOs as models for financial services in UgandaDocument11 pagesRole of SACCOs as models for financial services in UgandashjahsjanshaNo ratings yet

- Prophetic Finance and Economics - Mufti Faraz AdamDocument279 pagesProphetic Finance and Economics - Mufti Faraz AdamAbubakr MaljeeNo ratings yet

- Fiscal Policy and Its ObjectivesDocument2 pagesFiscal Policy and Its ObjectivesSamad Raza Khan100% (1)

- India's Mining Regulation: A Chance To Correct CourseDocument4 pagesIndia's Mining Regulation: A Chance To Correct CourseOxfamNo ratings yet

- Adam SmithDocument20 pagesAdam Smithpratik shindeNo ratings yet

- Glossary: Dr. I. Thiagarajan & Chitra RangamaniDocument38 pagesGlossary: Dr. I. Thiagarajan & Chitra RangamaniantroidNo ratings yet

- 1.1 Slides - Income Statements - Components and Format of An Income Statement PDFDocument13 pages1.1 Slides - Income Statements - Components and Format of An Income Statement PDFascentcommerceNo ratings yet

- High-Income Countries 2022Document1 pageHigh-Income Countries 2022Rocco RNo ratings yet

- K. Palepu - Business Analysis Valuation - Ch.1Document40 pagesK. Palepu - Business Analysis Valuation - Ch.1Alessandro ConficoniNo ratings yet

- PNB Savings Bank Annual Report 2017 PDFDocument132 pagesPNB Savings Bank Annual Report 2017 PDFWil PerniaNo ratings yet

- Week 2 Notes From AssignmentsDocument11 pagesWeek 2 Notes From AssignmentsTamMaxNo ratings yet

- Comaroffs, Occult Economies (1999)Document26 pagesComaroffs, Occult Economies (1999)Francois G. RichardNo ratings yet

- Zakatonomics Ebook May 2013Document58 pagesZakatonomics Ebook May 2013omarbahgatNo ratings yet

- Wealth Insights Newsletter March 2021Document49 pagesWealth Insights Newsletter March 2021P.S.K.B MohanNo ratings yet

- Factors of Production & Utility DefinedDocument22 pagesFactors of Production & Utility DefinedJomoshNo ratings yet

- Mochamad Difa Satrio Wicaksono - 170810190004 - Kelompok 14Document6 pagesMochamad Difa Satrio Wicaksono - 170810190004 - Kelompok 14Difa SatrioNo ratings yet

- PuzzleDocument11 pagesPuzzleVolety Sai SudheerNo ratings yet

- MULTIPLE CHOICE-ComputationalDocument5 pagesMULTIPLE CHOICE-Computationaljie calderonNo ratings yet

- Vargas Sk16 XL Ch03 Grader SA1Center HWDocument6 pagesVargas Sk16 XL Ch03 Grader SA1Center HWKim Castro AdoraNo ratings yet

- The Effects of Part-Time Work On School StudentsDocument53 pagesThe Effects of Part-Time Work On School StudentsAqif IsaNo ratings yet

- The Possible Misdiagnosis of A Crisis: PerspectivesDocument6 pagesThe Possible Misdiagnosis of A Crisis: PerspectivesthecoolharshNo ratings yet

- Patrick McEvoy-Halston's BlogDocument1,573 pagesPatrick McEvoy-Halston's BlogPatrick McEvoy-HalstonNo ratings yet