Professional Documents

Culture Documents

Worldbank - Znizenie Odvodov

Uploaded by

Dennik SME100%(1)100% found this document useful (1 vote)

63 views2 pagesOriginal Title

worldbank_znizenie odvodov

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

100%(1)100% found this document useful (1 vote)

63 views2 pagesWorldbank - Znizenie Odvodov

Uploaded by

Dennik SMECopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

‘The World Bank

‘Washington, D.C. 20433,

USA,

‘SHIGEO KATSU

Fax. (202) §22.2758

May 12, 2009

Mr. Peter Socha, President

Mr. Viktor Kouril, Vice President

ADSS

Bajkalska 30, P.O. Box 86

820 05 Bratislava 25

Slovak Republic

Dear Messrs. Socha and Kouril,

‘Thank you for your letter inquiring about the World Bank’s recommended

measures for financing the fiscal deficit of pensions systems as a result of the global

economic and financial crisis — a topic addressed at the Pensions Conference held in

Bratislava on May 4, 2009.

The list of possible measures to address the fiscal deficit of pension systems were

reviewed in the presentation made by Zoran Anusic, World Bank Senior Economist, with

a careful consideration of their advantages and drawbacks. Here are the main points of

this assessment:

- The preferred source of financing the additional short-run PAYG deficit is to

reduce expenditures elsewhere in the pension or central budget or to resort to

borrowing, where feasible:

- Temporary second pillar rate reduction has been considered by some countries as

a source of financing PAYG deficit. While this measure would bring extra

revenues to the first pillar in the short run, it would also generate sizable

additional expenditures in the long run, increase the implicit public debt and,

especially if prolonged, undermine the credibility of the second pillar and the

development of long term instruments in the capital market. On the whole,

therefore, there are more arguments against second pillar rate reduction than in

favor;

- Opening of the second pillar for exit to all contributors and new entrants, already

done by the Slovak Republic, is a measure with significant costs over and above

those enumerated above for the temporary rate reduction. These include the

irreversibility of decisions made by individuals based on short run developments

when pension policies and the structure of pension systems should be based on

long run considerations;

-2- May 12, 2009

- Simultaneous introduction of voluntary opt-out from the second pillar and

reduction of the second pillar rate would seriously undermine the viability of the

second pillar and, in the case of Slovakia, damage the long-term fiscal

sustainability of the pension system.

In summary then while we understand that countries under severe fiscal duress

and few other options may need to resort to sub-optimal responses, we have serious

reservations about prolonged second pillar rate reductions, especially when combined

with a voluntary opt-out option.

Our broader messages are twofold. We would advise governments 1) to avoid

the temptation to respond hastily and make decisions now that are better made once more

information is available on the depth and the duration of the economic downturn; and 2)

to keep the focus on the long run challenges of putting in place a fiscally affordable

pension system given the demographic trends in Slovakia and many other countries in

Central and Eastern Europe which would require parametric changes to PAYG pillars.

Finally, we believe that the rationale for multi-pillar pension systems is as strong as ever,

with the case for risk diversification as a critical feature of pension systems having

received a further boost in light of the global crisis.

Let me add in closing that we will soon be finalizing a note on pension systems in

crisis in Eastern Europe and Central Asia, following a regional conference that was held

in Brussels on May 8. The note will further explore the issues that I have touched upon

above. In the meantime, you might be interested in consulting the recent World Bank's

Pension Primer Note that provides additional details. I attach the link below:

http://siteresources. worldbaik.org/INTPENSIONS/Resources/395443-

1121194657824/PRPNote-Financial_Crisis_12-10-2008.pdf

Sincerely yours, —————

eS a

Shigeo Katsu

Vice President

Europe and Central Asia Region

You might also like

- Dôvodová Správa K VZN č.131 - MZ 24.11.2023Document3 pagesDôvodová Správa K VZN č.131 - MZ 24.11.2023Dennik SMENo ratings yet

- Uznesenie Vlády K Návrhu Na Vyhlásenie Núdzového StavuDocument9 pagesUznesenie Vlády K Návrhu Na Vyhlásenie Núdzového StavuDennik SMENo ratings yet

- Verejný Prísľub Tempus - TransDocument8 pagesVerejný Prísľub Tempus - TransDennik SMENo ratings yet

- Príspevok Z Programu Podpora Najmenej Rozvinutých OkresovDocument31 pagesPríspevok Z Programu Podpora Najmenej Rozvinutých OkresovDennik SMENo ratings yet

- Výzva LekárovDocument57 pagesVýzva LekárovDennik SMENo ratings yet

- Epizoda 1 - Posledny FolowerDocument44 pagesEpizoda 1 - Posledny FolowerDennik SMENo ratings yet

- Utvorenie Volebnych Okrskov Urcenie Volebnej MiestnostiDocument2 pagesUtvorenie Volebnych Okrskov Urcenie Volebnej MiestnostiDennik SMENo ratings yet

- Návrh Trasy Električkovej Trate Na Sídlisko KVPDocument1 pageNávrh Trasy Električkovej Trate Na Sídlisko KVPDennik SMENo ratings yet

- Banská BystricaDocument4 pagesBanská BystricaDennik SMENo ratings yet

- Zoznam Úkrytov Civilnej Ochrany Vo Vlastníctve Mesta PrešovDocument2 pagesZoznam Úkrytov Civilnej Ochrany Vo Vlastníctve Mesta PrešovDennik SMENo ratings yet

- Utvorenie Volebných Okrskov A Určenie Volebných Miestností Pre Voľby Do Národnej Rady Slovenskej RepublikyDocument1 pageUtvorenie Volebných Okrskov A Určenie Volebných Miestností Pre Voľby Do Národnej Rady Slovenskej RepublikyDennik SMENo ratings yet

- Právna Analýza Uznesenia K PčolinskémuDocument7 pagesPrávna Analýza Uznesenia K PčolinskémuDennik SMENo ratings yet

- Okrsky NR SR 2023Document1 pageOkrsky NR SR 2023Dennik SMENo ratings yet

- Utvorenie Volebných Okrskov A Určenie Volebných Miestností Pre Voľby Do Národnej Rady Slovenskej RepublikyDocument1 pageUtvorenie Volebných Okrskov A Určenie Volebných Miestností Pre Voľby Do Národnej Rady Slovenskej RepublikyDennik SMENo ratings yet

- Opatrenia Proti Vlne OmicronuDocument27 pagesOpatrenia Proti Vlne OmicronuDennik SME100% (1)

- Epidemiologická Situácia A Návrh Opatrení Na Koniec Roka 2021Document15 pagesEpidemiologická Situácia A Návrh Opatrení Na Koniec Roka 2021projektnskNo ratings yet

- Záverečná Správa Kontrolnej Komisie Zriadenej Kvôli Úmrtiu LučanskéhoDocument23 pagesZáverečná Správa Kontrolnej Komisie Zriadenej Kvôli Úmrtiu LučanskéhoDennik SMENo ratings yet

- Núdzový Stav A Zákaz VychádzaniaDocument19 pagesNúdzový Stav A Zákaz VychádzaniaDennik SMENo ratings yet

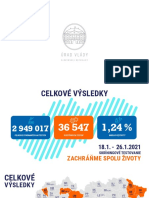

- Finálne Výsledky Celoplošného TestovaniaDocument3 pagesFinálne Výsledky Celoplošného TestovaniaDennik SMENo ratings yet

- Britský Variant Na SlovenskuDocument4 pagesBritský Variant Na SlovenskuDennik SMENo ratings yet

- Režim Na HraniciachDocument6 pagesRežim Na HraniciachDennik SMENo ratings yet

- Nový Covid AutomatDocument12 pagesNový Covid AutomatDennik SMENo ratings yet

- Tretia Verzia Covid AutomatuDocument27 pagesTretia Verzia Covid AutomatuDennik SMENo ratings yet

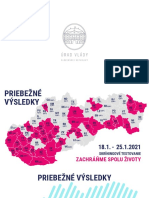

- Priebežné Výsledky Celoplošného TestovaniaDocument4 pagesPriebežné Výsledky Celoplošného TestovaniaDennik SMENo ratings yet

- Vakcinácia Prebieha Postupne Na Základe Prioritizácie.Document1 pageVakcinácia Prebieha Postupne Na Základe Prioritizácie.Dennik SMENo ratings yet

- Čo Robiť Ak Ste Chorý Na Covid-19?Document4 pagesČo Robiť Ak Ste Chorý Na Covid-19?Dennik SMENo ratings yet

- Epidemiologická SituáciaDocument31 pagesEpidemiologická SituáciaDennik SMENo ratings yet

- 2020 12 15 Záznam Kontrolnej Komisie MSSRDocument3 pages2020 12 15 Záznam Kontrolnej Komisie MSSRprojektnskNo ratings yet

- Epidemiologická Situácia Na SlovenskuDocument27 pagesEpidemiologická Situácia Na SlovenskuDennik SMENo ratings yet

- Epidemiologická Situácia Na SlovenskuDocument26 pagesEpidemiologická Situácia Na SlovenskuDennik SMENo ratings yet