Professional Documents

Culture Documents

Project Report On Fixed Deposit in Devgiri Bank

Uploaded by

Kamlakar AvhadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Report On Fixed Deposit in Devgiri Bank

Uploaded by

Kamlakar AvhadCopyright:

Available Formats

1

Vivekananda shikshan santhas VIVEKANAND ARTS, SARADAR DALIPSHIG COMERCE & SCIENCE COLLEGE AURANGBAD

Project Report On FIXED DEPOSIT Submitted to

Dr. Babasaheb Ambedker Marathwada University Aurangabad

By

Mr. BAWASKAR KISHOR BHIMRAO B.B.A.VI SEMESTER 2011-2012Guided by MR. GANESH DOKE.SIR

Vivekananda shikshan santhas VIVEKANAND ARTS, SARADAR DALIPSHIG COMERCE & SCIENCE COLLEGE AURANGBAD CERTIFICATE

This is to certify that project entitled fixed deposit Submitted by MR.BAWASKAR KISHOR BHIMRAO is as per the requirement of Dr.Babasaheb Ambedkar Marathwada university in the partial fulfillment of BBA (Bachelor of business Administration) 6 IV Sem for the academic year 2011-2012

GUID MR.GANESH DOKE SIR DR.A.T.GAIKWAD

DRICTOR

TO WHO OMSOVER IT MAY CONCERN

this is to Certify that Mr BAWASKAR KISHOR BHIMRAO of B.B.A Student of department of Managemant studies Dr .Babasaheb Ambedkar Marathwada university Aurangabad has undergone training and completed a project on FIXED DEPOSITS of deogiri nagari co-oprative Bank Aurangabad he has carried out this project for deogiri co-oprative Bank date 23/1/2012 to 22/3/2012 in the spen of project duration his candidature was found to be very we wish him a bright futures

MANAGER . MANDLIK MR.ABHAY

DECLARATION

I hereby declarer that project worked entitled "production management to the Dr. B. A.M University, Aurangabad , is a record of an original work done by me under the guidance of Ganesh doke sir, faculty member, college institute of management studies, samarthnager, Aurangabad, and this project work has not performed the basis for the award of any degree/ associate ship/ fellowship and similar project if any Mr BAWAKAR KISHOR BHIMRAO BBA 3rd year

Acknowledgement

I like to thanks Mr. Gopal Balloj sir and all teachers of our department who helped me directly or indirectly in completion of this project. I would also like to thanks for their support and cooperation during the tenure of the project.

Mr . BAWASKAR KISHOR BHIMRAO

INDEX

SR.NO

Content

Pg. No

1 2 3 4 5 6

INTRODUCTION COMPANY PROFILE INTRODUCTION OF PROJECT TOPIC SCOPE&OBJECTIVE RESEARCH & METHODOLOGY ANALYSIS OF THE PROJECT

7 8 9

LIMITATION OF STUDY CONCLUSION&SUMMARY BBLIOGRAPHY

Chapter 1

INTRODUCATION OF FIXED DEPOSIT

with invesmant avenves increasing the day it is quit easy to forget that until the reformera kicked off in 1991 indianhad very limited means of investing their saving while it is true that we have net yet the money developed economic ther are anumber of instrument today that were unheard of amidst the lay investors just a short decade age .on the hand investors are still straggling nature of some securities and on the others intermediaries are trying to raise the investors awareness. Stok favorite such as fixed deposits are men while enjoying a reneved burst of popularity . the slump in the capitak market and larger amount o losses by investers in I p o .are buta cauple of facters for this hunt for security by investors evenat the lost of lower returns.the central bank R B I and the market regulatiotion S E B I have been attempatiting to rein in operators from ashing in on this rush for fixed deposit. In fact between 1994 and 1996 afew states like tamil nadu saw literal sxplosiars off fixed deposits offers with promise of impossibal returns like 36 percent to evan so percent per annum is some their saving go uping smoke at the hand of such corporate entities . it is only recentily that credit rating has been made mandatory for fixed deposit raising exercises as werw prudential norms howeres the batterlesson result in investors ignoting almost allother factors barring security while investing ther saving thus the past two yerrs having seen a huges growth in hand deposit and in fixed deposit levels of the batters segment of india. In this segment we willreglotry past detaiks on the three main categories of fixed deposits. The fund can be used to pledge lone if a fix deposit maturity day is approaching but a customer need fund urgently than the customers can apply for pledge loan to avid interst loss.

10

The und can be withdrawn ahead of the marurity day If customer need fund argently they can also apply for withdrawing ahead of the maturity day if the customer want to totallywithdrowan the fund before the maturity day

fixed deposit refers to the service that customer set deposit term whan making depositand deposit principle at one time .after whichthey can totally a partially withdraw principle and interests. Higher interst rate the interst rate of fixed deposits are higher than that of currant deposit fixed deposit is a traditional wealth management tool the longer the interest rate .

the account can set to re deposit customers can set re deposit term whan makingdeposit and the principle and past tax interest will be automatically re deposit term on the maturity day. . The fund can be used to pledge lone if a fix deposit maturity day is approaching but a customer need fund urgently than the customers can apply for pledge loan to avid interst loss. The und can be withdrawn ahead of the marurity day If customer need fund argently they can also apply for withdrawing ahead of the maturity day if the customer want to totallywithdrowan the fund before the maturity day

11

What are fixed deposit

Fixed deposits are loan arrangements where a specific amount of funds is placed on deposit under the name of the account holder. The money placed on deposit earns a fixed rate of interest, according to the terms and conditions that govern the account. The actual amount of the fixed rate can be influenced by such factors at the type of currency involved in the deposit, the duration set in place for the deposit, and the location where the deposit is made. The most unusual characteristic of a fixed deposit is that the funds cannot be withdrawn for a specified period of time. In most cases, fixed deposits carry a duration of five years. During that time, the money remains in the account and cannot be withdrawn for any reason. Individuals, corporate entities, and even non-profit organizations that wish to set aside funds and limit their access to the funds for a period of time often find that fixed deposits are a simple way to accomplish this goal. As an added benefit, the monies in the account will earn a fixed rate of interest regardless of any fluctuations in interest rates that apply to other types of accounts. However, both these benefits can also turn into disadvantages under certain circumstances. Because the money cannot be withdrawn until the duration is complete, the funds cannot be used even in emergency situations. Changes in the going interest rate may also rise to a point above and beyond the interest rate applied to existing deposits. This means account holders are actually earning less interest with fixed deposits than with other types of loans and accounts. While the interest rate on fixed deposits cannot be changed, there is sometimes a way to work around the issue of obtaining use of funds in an

12

emergency situation. At times, the lending institution where the fixed deposit is placed may be willing to extend a separate loan to the account holder, using the fixed account as collateral. While not ideal, this can at least make it possible to deal with the current financial crunch. Fixed deposits are a credible way to make a return on investment that is somewhat higher than a standard savings account. The use of fixed deposits can also be helpful when working with various types of currency. By establishing what is known as a Foreign Currency Fixed Deposit or FCFD, it is possible to choose the type of currency involved in the deposit and lock in a rate of interest. If the choice of currency is a good one, this means the investor can enjoy a healthy fixed deposit currency rate for the duration of the deposit and earn more than with a standard fixed deposit strategy. However, going with an FCFD does contain a slightly higher amount of risk, since the funds deposited must be converted to the currency of choice and then converted back when the deposit is fulfilled. If the currency did not fare well in the interim, there is some chance of obtaining a loss, due to the changes in the rate of exchange from the time the fixed deposit was activated until the time the deposit is considered complete .

13

Chapter 2

INTRODUCTION OF BANK

14

Deogiri Nagri Co- oprative Bank Was Established In 23th Jan 1984. The bank have 18 Branches including their Training Centre. The modern DATA centre , head office. All Offices are Air Conditioned , well equipped , fully computerized and interconnected. Deogiri Bank is the first bank in Marathwada to opt core banking pattern for its working. The bank is in the process of establishing ATM all over the city to cater banking services to its customer round the lock. The concept of Deogiri Nagri Co- oprative Bank was originated by Late Pralhadji Abhayankar & the bank came into being under the dynamic leadership of Shri. Haribhau Bagade (Ex Minister), Late Shri.Jayantrao Choudhari (Dhamangaonkar), Late ShriChandumalChotlani, Late Dr. V.G. Gharpure, ShriSukhdevNawle, Mrs. KumudRangnekar, Shri S.G. Gokhle, Dr M.U. Deshpande, Shri G.R. Rege took active part in establishing of the bank. The first branch of the Bank was opened on 23th Jan 1985. At present the bank has its area of operations in Aurangabad, Jalna, Ahemadnagar, Parabhani&Jalgaon District. The Reserve Bank has opened all Maharashtra as area of operation for us. The bank is also planning to tie up with state and national players to expand its network. The Bank has raised paid-up capital of 14.79 crores paid through its 33,000 Members. On 30-Jun-11 the Bank owns funds and reserves of 114.79 crores. The bank has Deposits of 456.22 crores, Advances of 333.66 crores, thus the total business is of 789.88 crores.

15

The CRAR of the bank is 11% and the Net NPA 0.20%. which is one of thbest level. The performance of the Bank is the best in co-operative banking sector.

Bank Profile

Deogiri Nagri Co- oprative Bank is largest bank in Marathwada. Any type of financial problem for any sector of business bank supporting to them. Bank has good Asset value and efficient staff for achieving their desire goal. Deogiri nagri Co- oprative bank get permission from reserve bank of india to launch four new branches in pune city. In upcoming year bank use new and advanced technology, mobile van service,pre printed cheque books facilities to the customer.for growing the whole income of the bank bank made contract between new life insurance companies. Member and recover share capital is the power of co- oprative organization.own fund is the economical capacity of any commericial organization,increment in that fund it reflect confidence of member over the bank.at time of year ending bank get the Rs.14.38cr share capital from 32688 member.comparism with last year performance between member & share capital. 2687 member and recover share capital Rs.1.92cr it is extra. According to banks rules and regulations member have to purchase 2500 Rs.share for membership.

16

Deogiri nagari Co- oprative bank have 100.06cr fund at the time of year ending. It is extra camparing with last yaer performance. The amount of extra fund is 4.21cr rupees in percentage 4.39% .bank move their maximum profit in reserve fund from net profit and increase their goodwill. This is emblemof bank management and efficiency. In 2010-2011 bank started to provide fund supply in all sector, it is good for bank growth for that purpose establishment of new branches, making technical side perfect etc.getting that benefit bank made expenditure on it. Because this reason the bank had get Rs.7.22cr. net profit. 4.10cr profit is extra compare with last year performance.

Capital availability

The ratio between total risk part of property and capital fund is called as capital availability. In open economy the capital availability is the good for people co- oprative bank system. successful management of risk and growth in capital fund Deogiri nagari Co- oprative bank done 11.79% the ratio of capital availability on dated 31th march 2011. Accordinf to reserve bank of indias rules and regulations it is compulsory keep to maintain 9% (Amount in lacs) No. A B C D E Particulars Tier-1 capital Tier-2 capital Total capital(A+B) Total risk weight of property C.R.A.R. 31/03/2010 3852.26 782.39 4634.65 31197.45 14.86% 31/03/2011 3033.98 1107.55 4141.53 35120.07 11.79%

17

Depostie

Deogiri Nagari Co- oprative Bank have available Rs. 458.99cr Deposite at time of report year ending. After using all facility and securities which provided by bank people made their fixed deposite in bank, because of that reason bank have increase their deposite fund for the rupees of 51.01cr. which is 12.50% extra comparing with last year performance. To adjusting with national level changeable commercial environment bank have change deposites scheme and keep the cost of deposite is .5.75%. For the purpose os deposite security bank have made insurance from reserve bank of indias Deposite department , installment of that insurance bank has been fill regularly.

Deposite Mixture of bank on Dated 31/03/2011

(Amount in lakh) 31/03/2010 2191.89 5.37% 10441.30 28194.86 40798.05 25.52% 69.11% 100%

Kinds Of Deposite Current deposite Saving deposite Fixed deposite Total

31/03/2011 3042.31 13109.65 29746.75 45898.71

6.63% 28.56% 64.81% 100%

18

Loan

The total amount of loans are Rs.322.67crat the time of report year ending. It is extra of Rs.40.49cr compare with last year performance in percentages 14.35% .at the time of new loan issue,bank were done loan investigation and risk management. Deogiri nagari co- oprative bank follows all rules and regulations regarding loan distribution to weak sector. The ratio of primary sector loan at the time of year ending is 54.62% and another ratio of weak sector loan distribution is 18.10% bank. Bank tries to distribute small scale loan to public.

Recovery of non-performing assets

Deogiri nagari co- oprative bank made some rules and regulations for the purpose of non performing assets recovery. The ratio between total loan and non performing assets is just 0.20% on dated 31th march 2011. Last year the ratio of is 0.37%. deogiri bank established director recovery committee at the central level for controlling the ratio of non performing assets. Bank take review of each and every branch regarding loan recovery. Bank achieve their aim regarding loan recovery using Maharashtra State Co- oprative Act 1960 of section 101, securitization Act, Negotiable Instrument Act. Director, Employee, member made very important role Behind this achievement, they contribute their time for achieving loan recovery regarding non performing assets. Bank set target for next financial year regarding non performing assets and its ratio with total amount of loan is 0.00%. Total of whole amount loan recovery plan and their account detail

19

(Amount in lacs) Loan Distributed Account No. Loan Amount 141 118.44

OTS (remaining Amount) 163.77

OTS Amount 116.88

Discounted Amount 46.89

Classification of outstanding payment

The Ratio of Deogiri Nagari Co- oprative Bank regarding outstanding payment on dated 31th march 2011 is 16.76%. which is mention in following Table. (Amount in lacs) No. 1. 2. 3. 4. 5. Year Lower than 1 year Between 1-2 year Between 2-3 year Between 3-5 year More than 5 year Total No. Of Account 3673 303 145 180 193 4494 Total 3210.44 721.72 326.69 297.70 851.50 5408.05

Information of legal action against outstanding payment holder

No. 1. 2. 3. 4. 5.

(Amount in lacs) Particulars Notice from office Notice from advocate Cases to bring a charge but under hiring(section 91,101) Cases under hiring but not awarded(section 91,101) Awarded(section 91 , 101)

Loan holder 2381 1462 71 -580

Total amount 1255.25 2324.59 148.85 1679.36

20

Total

4494

5408.05

Investment

Deogiri Nagari Co- oprative bank have Total investment on dated 31th march 2011 is Rs.208.83cr.comparing with last year investment it is extra 7.52cr. making good plan for loan recovery and trying its implementation it reflecting with increasing bank liquidity and this is also useful for investment increment. Bank liquidity management is on top at time of report year ending. Bank follows CRR and SLR rules and regulation from the date of its foundation. Minimum 25% amount is compulsory to invest in government securities. Deogori nagari co- oprative bank invest in government securities Rs.119.04cr in percentage 26.26% on dated 31th march 2011 at the time of report year ending.

Human resource development

Deogori nagari co- oprative bank have its own training centre with advance technology for the purpose of increase the employees effectiveness and efficiency. Bank made such program for employees training according following schedule.197 employees use this training centre. No. 1. Whoever Deogiri nagri co- oprative bank fulltime/halftime training program Total Total No. of Trainy 197 197 No.of program 14 14

Insurance business

21

Bank made insurance from insurance companies to secure their securities amount. Lot many insurance companies coming in that market follow all rules and regulation. Bank made such transaction with different insurance companies and reserve bank of india give permission for that. Bank made contract for general insurance between FUTURE GANERALLY INSURANCE COMPANY PVT.LTD.in report year.

Computerization

Bank started SMS service for each and every account holder for their each every transaction.in upcoming year bank start NET Statement facility for every transaction. Bank make mutual contract between another bank for ATM transaction. Using advanced technology bank tries gives good service to the customer. Bank knows needs of customer. Bank use computer technology with their perfect security. Bank provide RTGS and ECS facility to customer for more than two lacs transaction with ICICI bank.

Profit Distribution

Deogiri Nagari Co- oprative bank earned net profit Rs.72199901.84 at the report year ending, with last surplus net profit of Rs.72.02 including this total net profit Rs.72199973.91 are available.

Profit Distribution Chart

No. 1. 2. 3. 4. 5. 6. 7. 8. Particulars Statutory Fund Profit (12%) Servent development fund Member development fund Building fund Dharmaday fund Investment up-down fund Deffered asset reserve Amount in rupees 18050000.00 16000000.00 1000000.00 1500000.00 20580624.00 1000000.00 10000000.00 4069276.00

22

9.

Surplus net profit Total amount

73.91 72199973.91

Account inspection and Investigation

Central government and state government made control over the public co- oprative banks through the reserve bank of india, dwell control on co- oprative banks from state and central government.these two controller take inspection and account investigation of public cooprative banks. Deogiri nagari co- oprative bank appointed M.B.Jaju company for Internal account investigation for accurate working within the bank. Without this there are two more company made investigation regarding accounts one is S.E.Kalantri and second is Prassanna P.Kala and Associates. In 2010-2011 financial year Mr. Indapurkar and Mundada partner M.g mundada(statutory Accountant) Aurangabad Made their Auditing And account inspection and give bank one of the best rating. They are gave rating in accountancy for best performance, rating A given to the bank.

Director Board And Its Different Committees

Director Board and Different Committees of banking management made their role for effective control. They are arranging the meeting on different issue. Bank appointed knowledgeable personnel within their different committees. The Director Board give permission to establish new vice committees. Using their knowledge regarding banking sector bank achieve their desire goal. They decide their goal for next financial year. Deogiri Nagari co- oprative bank follows all rules and regulation of reserve bank of India and responsible for member and its deposite securities.

23

No. 1. 2. 3. 4. 5. 6. 7. 8.

Particulars Director Board Meeting Loan Committee Meeting Loan Recovery Committee Meeting Worker Committee Meeting Audit And Inspection Committee Meeting Purchase Committee Meeting Investment Committee Meeting Assets liabilities management committee meeting

No. Of Meeting 20 18 05 05 02 06 06 06

Banking regulation act 1949 section 29 and 31

Last Year Amount March 2010 39699053.00 Life and Debtor Cash in hand (with ATM) Cash at bank State bank of India Notified banks and nationalized banks Maharashtra state cooprative bank and district centralized bank (CASH) Other commercials and cooprative bank(CASH) Term deposits in banks Maharashtra state cooprative bank Current year amount March 2011 712695 86.00 111451808.34 15898829.60

101025977.36 25849315.35

19317692.75

40576175.31

146192985.46

167926 813.25

513195258.00

328611576.00

24

689394454.00

1202589712.00

794911500.00 8500000.00

50.00 3010000.00 4125000.00 810546550.00

0.00 0.00

and district centralized banks term deposits Nationalized and other commercials banks term deposits Investment (shares) District centralized and state cooprative banks shares Trustee Org.& other share Co- oprative Org. Shares Aurangabad district centralized bank Maharashtra co- oprative bank. Mumb ai Apex Bank,Mumbai Pvt. Fund Investment State partnership fund/fund investment

555123962.00

883735 538.00

1190444000.00 7000000.00

50.00 3010000.00 4125000.00 120457 9050.0 0

0.00 0.00

2199028300.46 613620.00 Loan issued Short term loan Government security shares 362949.00 National

232751 0987.2 5

25

33879457.00 97422689.41 29677911.11 686637712.59 9063452.00 8575762.00 3005550.59 2471952.00 438965081.48 1310313188.18

51097504.55 724262560.20 248427221.31 47905931.91 761490.95 1072454708.92

security Other security Gold/silver security Term deposits security Cash credit/overdraft Mortgage security cash credit Default guarantee payment account IBP and Bills Discount Advanced against supply bills L.C. discounting Project financing Arrears Rs.371430386.00 Suspected and bad debts Rs.200795129.80 Arrears of directors board Middle term loan Higher purchase/ vehicle security Mortgage term security Personal guarantees Home

44331103.05 130213650.87 13546991.61 889674881.52 8957889.00 1118332.00 3009365.59 535000.00 442992687.48 1534742850.12

7047593803 662191643.83 422243415.61 42986008.16 725766.95 1198622772.58

26

253560335.64 185424488.00 438984823.64

construction Other

2821752720.74

282226681.66 Arrears Rs.162795044.00 Suspected and bad 211130327.00 debts Rs.105287650.12 493357008.66 Arrears of board of director Long term loan Home construction loan Industrial & Other loan Arrears Rs.6579481.00 Suspected and bad debts Rs.22199694.75 Arrears of board of director Total loan

322672 2631.3 6

5020781021.20 4132348.44 28870014.74 121627533.43 526830.45 28282793.00 566107983.98 594390776.98 Bills available for recovery Dead stock, furniture, fixture Building and land Bank vehicle Interest receivable On investment On loan

555423 3618.6 1 272372 2.75 327486 78.77 26963487.00 684301167.73 119397 677.68 216215 1.45

27

711264 654.73 6085394.29 6584.00 760317.53 1835584.00 778980.00 16590.00 1116107.00 0.00 346500.00 30000000.00 23513254.47 64459311.29 0.00 152509595.00 7885656.35 0.00 5995183087.88 830490.00 64016380.00 Branch coordination Differed tax assets Goodwill on merger account Loss (if Happened) Total LC Bank gurantee receivable Other property & Receivable Deposits receivable Library books Stationary & printing stock Deposits for building Clearing Telephone deposits Building rental in advance M.S.E.B. Deposits Tax receivable Advance tax paid Other receivable 3012099.12 7077.00 1084504.59 1835584.00 1611681.00 201703.00 300000.00 548638.00 42779987.00 55620000.00 6441851.96 113443 125.67 461308 .36 156578 871.00 591424 2.26 0.00

669892 8051.2 8 535885 .00 670877 09.00

28

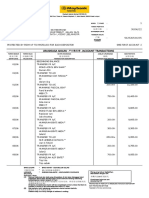

Expenditure Detail of the year 01/04/2010 To 31/03/2011

Last Year Amount March 2010 291223367.00 52210.18 291275577.1 Detail Of expenditure Interest paid On Fixed Deposits On Loan Current year amount March 2011 263852182.00 631742.00 26448392 4.00

29

50114486.17

174375.00 6537336.00 1067462.85 1546328.00 1770955.78 69500.00 3750540.50 419675.00 616130.00 7909089.32 30000.00 7951108.04 2587515.36 0.00 168952.00 50587577.00 7528972.00 43058605.00

Salary, allowances, providend fund, gratuity, P.F. Management expenditure, Bonus etc. Director Fess & allowances Rent , tax, insurance,lig hting Post offices ,telephone & fax charges Auditing charges Stationary , printing and advertising Legal advisor fees Fixed insurance 46560495.00 premium (4069276.00) General council expenditure Commission Depreciation State cooprative education fund Office expenses Other expenditure Election expenditure

75805941. 36

174750.00 6568092.0 0 1645075.3 8 1774391.0 0 2060917.7 0 150000.00 4213995.5 0 409849.00 563426.00 8765356.0 0 30000.00 9760184.9 8 1494793.9 4 0.00 170566.00

42491219. 00

30

Training expenditure Tax Current year tax Deffered tax

0.00 0.00 494408.00 6913000.00 7407408.00 1971414.09

Fringe benefit tax Other provision Suspected and bad debts provision Standard assets provision Investment depreciation Goodwill on merger account Total Net Profit Total

0.00 17500000.00 2065649.00 9923000.00 29488649. 00 1971414.0 9

428426458.29 31227446.41 459653904.70

45202254 4.95 72199901. 84 52422244 6.79

31

Profit And Loss Statement

Last Year Amount March 2010 2848881 72.28 1611397 811.83 4460279 54.11 3001633. 96 9359707. 20 1242568. 43 22041.00 Particulars of production Current year amount March 2011

Interest received 350447467.81 On Loan 133703203.86 On Investme nt Commis sion & bill of exchang e Investiga tion charges and other income Locker rent Extra refund provisio n

4841506 71.67 3342284 .99 1019367 8.69 1692459 .44 2484335 2.00

4596539 04.70 0.00 4596533 904.70

Total Income Rs. Loss Total

5242224 46.79 0.00 5242224 46.79

32

NOTES FORMING THE PART OF BALANCE SHEET AS AT 31st MARCH 2011 AND PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31st MARCH 2011. Significant accounting policies: Accounting convention: The financial statements are drawn up in accordance with the historical cost conventions and on the going concern basis. It conform to the generally accepted accounting principles & practice prevailing in the co- operative banks in India except otherwise stated. Statement of compliance: The consolidated financial statement of bank is prepared in accordance with Indian accounting Standards. Investments: In accordance with the Reserve Bank of India directives applicable to Urban co- operative banks, the bank has classified its investment portfolio as on 31st march 2011 under held to maturity. Further, in complicance with the said the valuation of investments under Held to Maturity category have been valued at acquisition cost. Any premium on acquisition of security is amortized over the balance period of maturity. Advances : The bank has clasified advances into standard, doubtful and loss assets in accordance with the guideline issued by Reserve Bank Of India from time to time. Provisions on advances classified as sub-standard, doubtfuland loss assets is made in accordance with the directives issed by the Reserve Bank Of India from time to time. In addition, a general provision has been made on all standard Assets as per Reserve Bank Of India directives. An additional provision of Rs.1654.76 lacs has been made for BDDR over and above the provision as required by Reserve Bank Of India directives.

33

The overdue interest in respect of advances classified as NonPerforming Assets is provided saparately under Overdue Interest Reserve: as per the directives issed by the Reserve Bank Of India Provision for loan Losses specific provisions for possible loan lossesare based on a continuous review of the loans and advancesportfolio and the parameters set the Reserve Bank Of India

Accordingly, specific provisions have been made as follows: Sr. No. Particulars Amount (in Lacs) 1. Gross NPA 4225.04 2. Provison as per RBI Norms 2512.75 3. Additional Provision 1652.76 Fixed Assets And Depreciation: Fixed Asset are stated at historocal cost except premises which includes land and Buildings which are stated at revalued amount. cost includes incidental expenses incurred on acquisition and installation of the assets. Land and building were revalued during the financial year 20072008 and asset Revaluation Reserve is created to the extent of revalued cost. Depreciation is calculated on written down value basis on fixed assets. Depreciation charge on revalued amount is debited to the revaluation reserve. Fixed asstes are depreciated at the rate considered appropriate by the management. Details are listed below: Assets Method Rate Premises WDV 2.5% Furniture & Fixtures WDV 10% Vehicle WDV 15% Electrical % Electronic Items WDV 25% Computers WDV 33.33%

Depreciation on fixed assets purchased during the year is charged for the full year, if the assets is purchased and retained for 180days or more, otherwise it is charged at 50% of the normal rate. No depreciation is charged on fixed assets sold/disposed off during the year as per generally accepted norms.

34

Revenue Recognition

Interest Income: In terms of the provisions of the accounting

standard-9 issued by Institute of Chartered Accountants of India on revenue recognition, the interest receivable is recognized on accrual basis. Interest ceases to be taken into revenue when the recovery of interest and/principal is in arrears for three months or more. Interest received on advances classified as non-performing is accounted for on cash basis. Interest falling due and remaining unrealised on non performing advances is credited to overdue interest reserve account. Fees and commission Income: The bank earns fees and commission income from a diverse range of services it provides to its customers. This includes fees and commission income arising on financial services provided by bank. Fees and commission income other than fees receivable are recognized on cash basis. Commission received in advance on bank guarantee is shown as advance commission received.

Rental income(Locker Rent): Dividend:

Rental income is recognized on accrual basis. Dividends on investments are accounted for as and when received.

Retirement Benefits to Employees:

The banks contribution to providend fund is accounted for on basis of contribution to the scheme and is charges to the profit and loss account. The bank has made payment for gratuity to LIC based on information received form LIC. During the year under audit the bank has made premium payment of Rs.98.00 lacs towards gratuity fund. The provision for leave encashment is made on accrual basis.

Segment reporting:

According to accounting standard-17 on segment reporting issued by the institute of chartered accountants of India, a segment is a

35

distinguishable component of the group that is engaged in providing services (Business Segment) or in providing services within a particular economic environment (Geographical Segment) which subject to risks and rewards that are different from those of other segments. The AS-17 on segmental information is not applicable to the bank.

Taxation:

9.1 Current taxation

Current tax assets and liabilities consist of amounts expected to be recovered from or paid to the taxation authorities in respect of the current as well as prior years. The tax rates and laws used to compute the amount are those that are enacted or substantially enacted by the balance sheet date. Provision for taxation is made on the basis of the profit for the year as adjusted for taxation purposes in accordance with the provisions of the relevant statues.

9.2 Deferred Tax:

As per the accounting standard-22 accounting for taxes on income issued by institute of chartered accountants of India, Deferred tax assets are recognized to the extent that it has become probable that future taxable profits will allow the deferred tax reflects the impact of current year timing differences between taxable income and accounting income for the year and reversal of timing differences of earlier years. Deferred tax assets and liabilities are measured at the tax rates that are expected to apply in the year when the assets are realized or the liabilities are settled, based on tax rates and tax laws that have been enacted or substantially enacted at the deferred Tax are as under:

10.Impact of Deferred Tax Assets:

Net Profit Before adjusting Deferred Tax Rs.68130625.84 Deferred Tax Provision Rs.4069276.00 Net Profit after adjusting Deferred Tax Rs.72199901.84 Hence the net profit has increased by Rs.4069276.00 due to provision of deferred tax but same is overstated due to excess calculation.

11. Goodwill

Goodwill is amortised over 5 years.

36

12.

of.

Events Occuring after the balance sheet date are taken care

13. Directors Responsibility Statement:

The Board of Directors takes the responsibility for the preparation and presentation of these final Statements.

14.

st

Reconciliation of various inter branch accounts is made up to 31 March 2011. The Bank is taking effective steps in adjusting the outstanding entries.

15. Contingent Liabilities:

Contingent Liabilities on account of bank guarantees and letters of credit are as follows: 31.032.2010 64016380.00 830490.00 Particulars Bank Guarantee Letter of Credit 31.03.2011 67087709.00 535885.00

16. Previous years figure have been regrouped/ rearranged whenever necessary to confirm to the presentation of the accounts of the current year.

Account related Information:

Sr. Particulars No 1. Capital to risk assets ratio 2. Investment: Book value Face value Market value 31/03/2010 14.86% 20131.26 18697.58 18850.79 31/01/2011 11.79% 20883.15 19546.65 19553.50

37

3.

Advance against Real Estate Construction business Housing Advances against shares debentures Advances to directors & their relatives, companies, firms in which they are interested Funds Based Non-funds Based Average cost of deposits NPAs Gross NPAs Net NPAs Movement in NPAs Towards NPAs Opening balance (+)Additions during the year (-) reduction during the year Closing balance Profitability Interest income as percentage of working funds Non interest income as percentage of working funds Operating profit as percentage of working funds Returns on assets Business (deposits + Advances) per employees Profit per employees

0.00 3480.99 3014.66 Nil

0.00 3484.17 3252.13 Nil

4. 5.

6. 7.

7.01 0.00 7.05% 15.10% 0.37%

0.00 0.00 5.75% 13.09% 0.20%

8.

4346.17 4553.11 4637.26 4261.96 8.23% 0.25%

4262.02 1088.75 1125.71 4225.04 8.17% 0.68%

9.

1.54% 0.58% 392.13 1.81 0.00 69.13 4020.76

2.47% 1.44% 457.11% 4.22 175.00 99.23 4171.92

10. Provision made towards NPAs Depreciation in investment 11 Movement in provisions Towards NPAs

38

Opening Balance (+) additions during the year (-) Reduction during the year Closing balance Towards depreciation on investments Opening balance (+) additions during the year (-)Reduction during the year Closing balance Towards standard assets Opening balance (+)additions during the year (-) reduction during the year Closing balance Towards NPAs Towards depreciation on investment Towards standard assets Foreign currency assets Foreign currency liabilities

151.16 0.00 4171.92 380.20 69.13 0.00 449.33 108.66 4.94 0.00

186.58 190.99 4167.51 449.33 99.23 0.00 548.56 113.60 20.66 0.00

113.60 4171.92 449.33 113.60 Nil Nil 134.26 4167.51 548.56 134.26 Nil Nil

12.

13.

39

DEOGIRI NAGRI CO- OPRATIVE BANK LTD; AURANGABAD STATUTORY REPORT:

We have audited the attached balance sheet of DEOGIRI NAGARI CO- OPRATIVE BANK LTD. AURANGABAD as at 31st march 2011 and also annexed thereto profit and loss account of the bank for the year ended on the date annexed thereto. These financial statements are the responsibility of the banks management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in India. Those standards require that we plan and perform to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion. further to our comments and observations contained in audit memorandum in part A,B and C, we report that; We have obtained all the information and explanations, which to the best of our knowledge and belief were necessary for the purpose of our audit. In our opinion, proper books of account as required by Law have been kept by the bank so far, as appears from our examination of those books. The balance sheet and profit and loss account dealt with by this report, are in agreement with the book of accounts. In our opinion, and to the best of our information and according to the explanation given to us, the said account give a true and fair view, in conformity with the accounting principles generally accepted in India. Other point as per part A,B And C our report:

40

In case of balance sheet, of state of affairs of the bank as 31st March 2011 In the case of profit and loss account, profit of the bank for the ear ended on the date. For the year 2010-2011 audit class A is awarded to Bank.

For INDAPURKAR & MUNDADA Place: Aurangabad Date: 30/06/2011 Chartered Accountant

Chapter 3

Fixed Deposit

41

Fixed Deposit Meaning

In deposit terminology, the term Fixed Deposit refers to a savings account or certificate of deposit that pays a fixed rate of interest until a given maturity date. Funds placed in a Fixed Deposit usually cannot be withdrawn prior to maturity or they can perhaps only be withdrawn with advanced notice and/or by having a penalty assessed.

Fixed Deposit Example

For example, a Fixed Deposit will often be used by individuals, businesses and financial institutions around the world as a means of storing their liquid funds for a fixed period of time for future use. In the retail market, Fixed Deposits are relatively safe investments when provided by insured financial institutions such as banks, savings and loan corporations and credit unions that are duly regulated within the country in which they operate. Also, while the term Fixed Deposit is in common usage in India and some other countries, Fixed Deposits are also known as term deposits in countries like Australia, Canada and New Zealand, as time deposits in the United States and as bonds in Great Britain.

42

INTRODUCTION OF FIXED DEPOSIT

There are several options available when it comes to where to make a fixed deposit. One of the most common areas where a fixed deposit is offered is the banks. All types of banks, be they public sector or private sector or even co-operative banks, offer fixed deposits for their customers. This makes fixed deposits one of the most accessible options for investors because of the fact that most people have a bank account at some place or the other. The second option for investing in a fixed deposit is with a financial institution. There are several institutions that offer a deposit option. This can include housing finance institutions or even other lending institutions that offer deposits as a means of raising funds for their activities. It can also include various non-banking finance companies that are trying to raise funds through the route of deposits so that they can tap a larger investor base for their fund requirements. There is one more area where fixed deposits are offered; these are the companies that seek to raise funds through this route. Various companies from the manufacturing to the service sector need funds for financing their various activities and they raise money through the route of company fixed deposits. The features of all these deposits are the same; the only difference is being the entity that is issuing the deposit, so there will be a difference in the risk element for the investor in these deposits. Fixed Deposits in companies that earn a fixed rate of return over a period of time are called Company Fixed Deposits. Financial institutions and Non-Banking Finance Companies (NBFCs) also accept such deposits. Deposits thus mobilised are governed by the Companies Act under Section 58A. These deposits are unsecured, i.e., if the company defaults, the investor

43

cannot sell the documents to recover his capital, thus making them a risky investment option

Term of deposit

A term deposit account is an account where the investor / depositor agrees to a fixed term and interest rate for locking their money away in an account. These accounts offer more security on the rate of return that the investor can expect when compared with high interest savings accounts. The history behind the term deposit is that the bank offers a higher interest rate and return to the depositor when there is certainty over the length of time that the bank can have access to the depositor's money to re-lend to other borrowers (and therefore make a profit). The bank rewards the secured term from the depositor with a higher interest paid to the depositor. Term deposit accounts are a 'fixed return' option to compare against high interest savings accounts, however high interest savings accounts now feature very comparable interest rates to those offered on term deposits (historically term deposits offered far higher rates of interest than a traditional savings account). The key difference is that the interest rates on savings accounts are variable. A term deposit is an account where you deposit your money and at the time of deposit, you know in advance how much you will be paid in interest, and when you'll be paid. When selecting your term deposit, you will see different rates of interest available from the bank / institution for different terms. As an investment vehicle, term deposits are easy to establish and quick to get started, unlike an investment in property or the stock market which both have significant lead time.

44

Interest Rates and Payments:

Term deposits typically feature a fixed interest rate, as opposed to the variable rates of interest offered on high interest savings accounts which move up and down in response to official interest rate rises. A fixed interest rate means that you get a fixed return on your investment, regardless of whatever happens with interest rates and the economy. This means that there is more certainty and security in a term deposit compared to a savings account, and less volatility than other investments in assets like property, commercial property or the stockmarket. For terms shorter than one year, your interest will be paid at maturity of the term deposit. This means that for a 6 month term deposit, you will be paid your interest payment at a date 6 months after your deposit, as well having access to the original deposit amount at this date. This short term deposit is not advantageous if you rely on a regular monthly income stream. For term deposit terms longer than one year, you will have an option of when you you would like to receive interest, from monthly options for interest payments to semi annually.

45

The following options apply for payments of term deposits: Less than one year: Maturity - your interest is paid at the end of the term Longer than one year: Maturity - your interest is paid at the end of the term Longer than one year: annually, semi-annually, quarterly interest payment options are also available. The payment frequency differs between term deposit providers so be sure to pick an interest payment time frame that suits your requirement for income. Both the banks and depositors view term deposit lengths in the same way: Short-term term deposits: one month deposit through to six month deposits. Long-term : term deposits over 12 months in length and up to 5 years, and in some instances up to 7 years. We compare the term deposit options.

46

Features & Benefits of Term Deposits

One of the great benefits of the term deposits is that the bank / provider is paying you for access to your money, so there are usually no establishment fees or ongoing account fees. However, there is always a catch with any financial product and the catch is that if you break the term and leave early, there will be a penalty. If you need to get your money out early, you will be charged either a penalty fee or awarded only a reduced interest rate for the period instead of the interest rate agreed to at the initiation of the term deposit. This will differ between institutions, so check the terms and conditions carefully. The key to a successful term deposit is to be comfortable with the term that you are committing to.

Use of Multiple Institutions

To access term deposit accounts, many providers don't require you to have an account with that institution as you can nominate an existing account to have your interest and balance paid into at maturity.

Automatic Rollover

At the conclusion of your term deposit, your term deposit provider can automatically roll over your matured deposit to a new term deposit of the same period as your original, at the new interest rate offered for that new term.

Compound Interest on Some Accounts

Some term deposit accounts offer monthly payments into the same account with the benefit of compound interest on that amount and the balance, rather

47

than a fixed interest amount. This is only available to accounts over at least one year in length as monthly interest payments are not available on terms shorter than one year.

What you must know fixed deposit

A good invesmant strategy requris choosing the fixed mix safe and risk right mix of safe and risky investments. Among safe investments, fixed deposits, Fixed deposit, are the most popular today. With Fixed deposit you deposit a lump sum of money for a fixed period ranging from a few weeks to a few years and earn a pre-determined rate of interest. Fixed Deposit are offered by both banks and companies though putting your money with the latter is generally considered riskier.

Advantage and disadvantage of fixed deposit

The main advantage is that Fixed Deposit from reputed banks are a very safe investment because such banks are carefully regulated by the Reserve Bank of India , RBI, the banking regulator in India. Note that company Fixed Deposit isn't as safe as bank Fixed Deposit because if the company goes bankrupt you may lose your money. Make sure you check the credit rating of a company before investing in its Fixed deposit. You should be especially wary of companies which offer interest rates significantly higher than the average to attract your money. The other advantage of Fixed Deposit is that you have the option of receiving regular income through the interest payments that are made every month or quarter. This option is especially useful for retirees.

48

On the flip side, a fixed deposit won't give you the same returns that you may get in the stock markets. For instance a stock-portfolio may rise 20-30 per cent in a good year whereas a fixed deposit typically earns only 7-10 per cent. A fixed deposit also doesn't offer protection against inflation. If inflation rises steeply during the maturity of the Fixed Deposits your inflation adjusted return will fall. Say, for example, the inflation when you deposited the money at a fixed return of 8 per cent per annum is 3 per cent. Now when your Fixed Deposit matures say after 2 years, the inflation increases to say 5 per cent.In this case, your inflation adjusted returns is only 3 per cent (8-5). Had inflation remained at 3 per cent by the time your deposit matured, your real rate of return would be 5 per cent (8-3).

Interest rates on Fixed Ddeposit

The rate of interest on Fixed Deposit varies according to the maturity with longer deposits generally earning a higher interest rate. Here are the interest rates offered by deogiri Bank on their Fixed Deposit. Note that Fixed Deposit vary quite a bit from bank to bank so you should search around before investing. Interest paid on a fixed deposit is paid either monthly or quarterly according to the investor's choice. So if you invest Rs 3 lakhs in a one year fixed deposit which pays 8 per cent you can earn Rs 2,000 of interest every month or Rs 6,000 of interest every quarter.

Effective Return

Before you invest in Fixed Deposit you need to understand the concept of effective return which is higher than the rate of interest on the Fixed Deposit. Effective return is relevant if you choose to reinvest your interest every year which means that you will be earning compound interest.

49

For example suppose you invest Rs 1,000 in a fixed deposit with 8 per cent interest which is paid quarterly.

Returns of fixed deposit

In the first quarter (after 3 months) you will earn an interest of Rs 20 which is re-invested and continues to earn interest in the remaining three quarters. Similarly the interest you earn in the second (after 6 months) and third quarter (after 9 months) is also reinvested and earns interest. At the end of the year because of compound interest you will receive Rs 1,082.4 meaning that your effective return is 8.24 per cent rather than 8 per cent.

break a fixed deposit?

Breaking a fixed deposit means withdrawing the money before the maturity expires. This may be necessary if you urgently require the funds or if there are better investment opportunities elsewhere. You will have to pay a cost; for instance you may receive an interest rate 1 per cent lower than the stated interest rate on the Fixed Deposit. For example if you invested in a 3 year Fixed Deposit with 9 per cent and you break it after two years you may receive only 8 per cent interest for those two year instead of 9 per cent. An alternative to breaking a fixed deposit is taking a loan against the FD. Such loans are quite easy to obtain with amounts ranging up to 90 per cent of the principal and accumulated interest.

50

alternatives to Fixed deposits

Obviously mutual funds and stocks can offer higher returns but the main issue is whether there are low risk investment products which offer a better return than Fixed Deposit. Many financial experts believe that fixed maturity plans (FMP) offer exactly such a superior alternative.

BENEFIT OF FIXED DEPOSIT

. The major benefit of fixed deposits is its higher interest rate when compared to interest rate in a regular savings account High Intere No deduction of Income Tax at source up to Rs 5,000 p.a. Short-term deposits. Lock-in period is only 6 months. No Income Tax is deducted at source if the interest income is up to Rs 5,000 in one financial year .Investment can be spread in more than one company, so that interest from one company does not exceed Rs. 5,000. Company Fixed Deposits are non transferable that means there is no fear of Fixed Deposit receipt being stolen. In case it falls into wrong hands ,it cannot be misused. The Fixed Deposit holder in such a case should write to the company which shall issue duplicate deposit receipt upon execution of an indemnity and cancel the previous one. Further, advantage of investing in company fixed deposits is that one can analyse the company before investing in it because companies accepting deposits are old-established reputed companies with proven track records. Recently, nomination facility has been introduced in company fixed deposits.

51

Types of Fixed Deposits

Fixed Deposits require a customer to place cash in a savings account held with a financial institution for a particular time frame at a given interest rate. Early withdrawals from Fixed Deposits tend to result in a significant penalty. A holiday account, also called a Christmas club account, is a type of fixed deposit account. A fixed deposit, as its name implies, is a fixed sum of money that is held in a savings account for a pre-decided period of time--earning a fixed rate of interest. The time period for a fixed deposit varies from 15 days to 1,095 days (three years) and its interest rate varies between 3 percent and 7.5 percent. A fixed deposit account typically yields a greater interest rate than a regular account, owing to its fixed time period. Fixed deposits are also called time or term deposits.

Certificate of Deposit

A certificate of deposit (CD) is a type of fixed deposit account that can be purchased in varying amounts from a credit union, traditional bank or other depository institution. A CD is a commercial paper that confirms the monetary value of the deposit made, its maturity date and the interest applicable on the amount loaned. Certificates of deposit mature in one month, three months, six months, 12 months (one year), 36 months (three years) and 60 months (five years). Interest rates accrued on certificates of deposit are quoted on a yearly (annual) basis.

Bank Term Deposit

52

A revolving term deposit renews itself automatically for another term of an equal length after its loan period expires. Depositors can put money in a revolving term account through a cashless transfer from an existing account or by direct transfer. The terms on revolving fixed deposits range between one week to 12 months

Unchanging term deposit

An unchanging term deposit, also called a single term deposit, does not renew automatically after its maturity date. An unchanging fixed term deposit can be opened from one month, three months, six months, 12 months, 24 months and 36 months.

Holiday Account

A holiday account, also called a Christmas Club account, is a special type of fixed term deposit that allows a depositor to put aside, and add, small denomination funds till the account matures. Cash cannot be withdrawn from the account till it reaches its expiration date. A holiday account can be thought of as a short-term savings account that secures a depositor during a holiday season. Some financial institutions and banks require a minimum initial deposit before they can open a holiday account. Christmas club accounts accrue monthly interest, the entire amount of which is paid when the account matures, typically right before Christmas.

Different types of fixed deposits

Consumers and companies throughout the world use Fixed Deposits to save money for future use from time frames varying between one month and several years. The term Fixed Deposit is especially popular in India for this retail financial product, but they are also called Term Deposits .

companies provide fixed deposits

Financial institutions like banks and savings and loan corporations provide Fixed Deposits and they are required to follow the applicable banking regulations in the countries in which they operate.

Fixed deposit in seving account

53

Although the terms of specific Fixed Deposits can vary significantly among financial institutions and countries, Fixed Deposits generally differ from checking and savings accounts because they cannot be used as money by allowing the account holder to make withdrawals without incurring a significant penalty. They also differ from such accounts by having a fixed maturity date after which funds are either returned or rolled over

Risk of fixed deposit

Substantial investment security is provided by Fixed Deposits held with reputable and insured financial institutions, but as a result of this perceived lack of risk, they usually only offer a rather low nominal rate of return or interest to the holder on deposits. Interest rates available on Fixed Deposits tends to be higher than with regular savings accounts since funds are not readily available until maturity, but returns are usually lower than those available with riskier investments like some corporate stocks and bonds.

54

Time deposit

A Time Deposit requires the placement of cash in a savings account at a fixed rate of interest for a certain term or time period. Funds generally cannot be withdrawn from a Time Deposit prior to the end of its term without incurring a penalty.

Type of time deposit

Time Deposits are used around the world by consumers and businesses to save money for use in the future. Although Time Deposit is the common term used for such accounts in the India , they are also known as Term Deposits in India , as Bonds in the Britain and as Fixed Deposits in countries like India. Financial institutions offering Time Deposits to retail clients are usually required to follow the applicable banking regulations in the country in which they operate.

provide time deposits

Time Deposits can be placed with a retail financial institution like a bank or credit union, and the risk involved in doing so is quite low if the funds are deposited with a member of a deposit insurance organization like the financial deposit in India

55

guarantees time deposits?

In the India , funds deposited in Time Deposits are protected up to a certain amount by the financial deposit in India when the Time Deposit is made with a financial institution that is also an F D I member.

risky are time deposits

A variety of Time Deposit maturity dates ranging from one month to several years are available from financial institutions. Also, because of the requirement to leave Time Deposit funds alone for a period of time or pay a penalty, Time Deposits tend to pay out a higher rate of interest than normal savings accounts. Nevertheless, this return is usually considerably less than can be obtained by investing in riskier products like corporation stocks or bonds

6 month deposit

A 6 month term deposit is often referred to as a short term investment due to the short time horizon of less than 1 year. For a period of fixed product 6 months, major banks can follow or anticipate central banks when determining the rates they publish for depositors. In countries such as India who offer 'term deposits' as savings products from banks, the Reserve Bank of India issues guidance from its meetings and rate decisions indicating reasons for increasing, lower or keeping the same interest rates. These decisions have a major impact on what rates India banks publish.

56

Advantage of fixed deposit

1 A Fixed Deposit Account is one in which the customer deposits a big sum of money (Usually a few thousands and upwards. There is actually no limit to the amount of money you can deposit in a FD) for a fixed 2 A Fixed Deposit is an agreement between a customer and bank wherein the customer agrees to deposit a fixed sum of money for a specific duration of time. The bank in return accepts the deposit and... 3 No. As long as it can be cashed in at any time, it is still liquid and therefore a current asset. If it cannot be cashed in before maturity, it would be classified as Other Non-Current Assets. 4 If deposited into Fixed deposit its more safe for you. Its interest % is high when compare with other deposits like SB (Saving Bank A/C) & Current A/C. If you're a senior

Disadvantages of fixed deposit

57

1 Well one disadvantage is being 'hooked' into spending inordinate amounts of time in front of a screen editing spelling and grammar mistakes that people make when asking questions here. (lol) Another 2 if the interest rate increases, they will not increase your. it will be based on the initial rate 3 The major disadvantage of a fixed deposit is that you cannot withdraw the amount instantly when the need for money suddenly arises. Another disadvantage of fixed deposits is that it is prone to 4 You can't withdraw the deposited money back until the terms of deposit completes. for example.: You deposit your money into the FD for 5 years upto Rs.50,00,000/-. After 2 years of deposit, U need the deposited money in FD, you can't withdraw back without completion of the deposit amount

Chapter 4

OBJECTIVE OF FIXED DEPOSIT

58

To know the fixed deposit position of R.B.I To identify the position of fixed deposit on total deposit

To comparing fixed deposit of R.B.I with total commercial bank and Indian Bank Ltd. to know its actual financial position and performance

To sketch the trend of fixed deposit of R.B.I To see how far the bank is able to utilize the collection deposit

To identify the problem in fixed deposit

59

To provide suggestion and possible guideline to improve the bank fixed deposit position based on the finding of the study

SCOPE OF FIXED DEPOSITS

60

In sense of profitability then invest less in fixed deposit try to invest in shares if you are a good player in share market.

I am a central govt servant, my monthly net salary is 17500, how can i save the tax by investing. and what kind OF benefits get from govt. pl help me

At present, there is no scope of short term investment in equity based mutual fund. Go for atleast two or three years please. Market is at it peak lev. I really appreciate tht you have taken an initiative 2 invest & grow......But at least take a look while choosing a category to post .

61

As crr is hiked money will be scarce with bank so who ever wants to take loan it will be dearer but without increasing fixed deposit rate so people

Chapter 5

METHODOLOGY OF THE STUDY FIXED DEPOSIT

62

Research Design:

The first step of the study is to collect necessary information and data concerning the study of R.B.B fixed deposit by contacting the concern staffs. The task will be fulfilling by the collection of secondary data and Primary data and various published information regarding this context. Then the collected data will be presented and analyzed systematically to fulfill the objective of the A deposit of money that pays higher interest than a savings account but imposes conditions on the amount, frequency, and/or period of withdrawals. Also called time deposit. Receipt issued by a depository institution (such as a bank, credit union, or a finance or insurance company) to a depositor who opens a certificate ac...

63

Fixed Deposit is the most common form of savings all over the world, specially in India. A Fixed Deposit involves locking a certain amount of money for a certain time period with a government approved institution, it can be a bank or a corporate offering fixed deposits to raise money for its business, etc

Prmaary data

1 Source of data

The various data require for the study is collected from concern authorities i.e. R.B.B. and Nepal Rastra Bank. Data required is collected through primary data and secondary data. Primary data is collected from concern authority by asking them question or by taking the interview. Secondary data is collected from the annual report, banking and financial statistics, quarterly economic bulletin, Papers and magazines, which were published, by R.B.I

2 Data Gathering and Processing Procedure:

64

All the necessary data were collected on various issues from R.B.I and N.R.B. This study is based on secondary data but interview techniques has also been used to collected information on the fixed deposit of the bank. The collected data are processed by tabulating and arranging in a required form for the sequential analysis of data.

3

Tools Used for Analysis:

Then an attempt has been made to analyze the tabulated data to review the financial aspect of R.B.I. For the analysis of data the various statistical tools like percentage change, bar diagrams, pie - chart, time series and correlation will be taken in to use. In this regard, the analysis will be mainly based on financial aspect.

Secondary data

1 Fixed deposits are money deposited by the customers for a fixed period, which range from 1 week to 5 years. Such as 1 week, 2 week, 3 months, 6 months, 9 months and 1 to 5 years. Fixed deposit is also known as time deposit or time liabilities. 2 Fixed deposit is the main source of funds. Bank uses this sum of money in its investment activities. Out of the total deposit higher percentage comes from fixed deposit account as it most stable of all deposit. As it is permanent sources of funds, bankers use this fund to long-term investments, which gives higher return to the bank. Bank does not need to maintain higher

65

cash balances to meet the demand of such account holders because banks have fixed the expiry of the account per head. 3 In Nepal, any fixed deposit can not be withdrawn before the maturity period. However, upto 90% deposit can be withdrawn as loan. The bank will charge 2% more than the interest paid to the depositors for granting loan against deposit. The bank pays a higher interest on such deposit. But interest provide by the bank depends upon its time duration. Bank repays the fixed deposit principal together with interest after maturity period. 4 The best fixed deposit interest rate can come from a different bank than the one you're currently using, so you might want to check into that also. Fixed deposits can be great for saving money when you don't think it's possible or simply are having a tough time saving period. It's definitely something to think about right now with the economy and the threat of no more Social Security - you should always have a back up plan.

Features of the fixed deposits

Fixed deposit was received by bank for certain period.

The bank is free to make use of this money for granting loans and advances

66

Any fixed deposit can not be withdrawn by issuing cheque.

Bank pays a higher interest on such deposit in comparison with other deposit.

Any additional amount can not be allowed to deposit in the fixed deposit account before the maturity period.

Fixed deposit account is automatically closed once the deposit matures.

Bank repays the fixed deposit to customer principal together with interest after maturity period.

5 Rules for Fixed Deposit

In this article I will be writing about the important points to consider while opening the fixed deposit account. I have already published many articles explaining the fixed deposit account and the tax savings involved with the fixed deposit schemes. This post is intend to list some of the key points which you must be aware before opening the fixed deposit account. I hope you will like the post and will be more informative. Please post your feedback and add if you have any points in your mind. If you like the post, subscribe to our future articles here. 1. Split

Your Fixed Deposit

67

You have to split the fixed deposit to avoid the TDS(Tax deduction at Source). If the total interest is more than Rs.10000 in a branch for the specific year, then TDS must be paid. To avoid that please split the fixed deposit and invest in the different banks. 2. Plan

the Tenure

It is important to plan the number of years you want to keep the deposit. Banks will charge as penalty if you are foreclosing the deposit account. Please ask the banker for penalty applicable for the foreclosing. 3. Appoint

a Nominee

Always appoint a nominee for your fixed deposit to avoid the hassle free release of amount after you. If you are not appointing any nominee, they will have to bring any of the heirs proof certificate to receive the money. 4. Check

the compound interest policies

This is one of the important consideration while opening a fixed deposit account. When you hear the rate of interest is 8.0% p.a., first thing you have to ask whether it is compounded quarterly, half-yearly or yearly. If the interest is compounded quarterly, then the return rate of interest will be potentially more than the actual one. 5. Learn

fixed deposit investment

If you are not aware that the fixed deposit savings can be used for tax benefits, please learn about the tax savings on fixed deposit. It has limitation of Rs.100000 under section 80c. Might be useful if you are looking for the same one.

68

Chapter 6

DATA ANALYSIS AND INTERPRETIAT CHART

69

Fixed deposit in deogiri bank 31/3/2010

70

currant deposit 5.37% fixed deposit 69.11%

seving deposit 25.52%

currant deposit seving deposit fixed deposit

Fixed deposit in deogirin bank

71

31/3/2011

currant deposit 6.63% fixed deposit 64.81% seving deposit 28.56%

currant deposit seving deposit fixed deposit

72

DEPOSIT SCHEM OF DEOGIRI BANK

DEPOSIT SCHEM INTERST RATE

2011 DEC 2012 Term Deposit 15 Days To 45 Days 46 Days To 90 Days 91 Days To 180 Days 181 Days To Less Than 13 Months Only for 13 Months Above 13 Months Special Scheme 555 Days Special Scheme 655 Days Unmarried Girls Below 25 Years Co-op Senior Public Societies and Widow Citizen banks 5.00 5.50 7.25 5.50 6.00 7.75 5.00 5.50 7.25 5.00 5.50 7.25 Handicapped/ Blind 5.00 5.50 7.25

7.75

8.25

7.75

7.75

7.75

11.50 9.25

12.00 9.75

12.00 9.75 10.25% 10.50% 11.00%

12.00 9.75

12.00 9.75

73

Chapter 7

LIMITATION OF STUDY

74

Taxation in case of debt funds is more investor friendly when compared with fixed deposits especially for the investors in higher tax bracket In the short term investment horizon, investor gets the benefit of lower dividend distribution tax in debt funds In the long term investment horizon, investor gets the benefit of indexation in debt funds Debt Funds are highly liquid as the amount invested can be redeemed indays unlike fixed deposits where money gets locked in for a fixed period of tim Though the pre tax returns are in the same range of 8-9%, but variation can be seen in post tax returns. Let us discuss two scenarios: Debt Funds are more liquid than Fixed Deposit Debt Funds deliver better post tax returns when compared with fixed deposits In the short term and long term investment horizon, investor earns better post tax returns by investing in debt funds.Fixed depositgives limited but assured returns.Stocks can give very high returns or even very high losse Debit card is a facility to withdraw your own deposi ed money in the bank. Credit card as the name denotes, you make advance arrangement with a bank

I think there is no certain limit but one loses the interest on such a big amount as the interest rate is very low in savings bank ac and hence he lo. Loan is a fixed amount and to be paid in a certain period OF time where as in cash credit a limit is fixed and u have to be in that limit always a...

75

Chapter 8

SUMMARY&CONCLUSION

76

Fixed deposits are loan arrangements where a specific amount of funds is placed on deposit under the name of the account holder. The money placed on deposit earns a fixed rate of interest, according to the terms and conditions that govern the account. The actual amount of the fixed rate can be influenced by such factors at the type of currency involved in the deposit, the duration set in place for the deposit, and the location where the deposit is made. The most unusual characteristic of a fixed deposit is that the funds cannot be withdrawn for a specified period of time. In most cases, fixed deposits carry a duration of five years. During that time, the money remains in the account and cannot be withdrawn for any reason. Individuals, corporate entities, and even non-profit organizations that wish to set aside funds and limit their access to the funds for a period of time often find that fixed deposits are a simple way to accomplish this goal. As an added benefit, the monies in the account will earn a fixed rate of interest regardless of any fluctuations in interest rates that apply to other types of accounts. However, both these benefits can also turn into disadvantages under certain circumstances. Because the money cannot be withdrawn until the duration is complete, the funds cannot be used even in emergency situations. Changes in the going interest rate may also rise to a point above and beyond the interest rate applied to existing deposits. This means account holders are actually earning less interest with fixed deposits than with other types of loans and accounts. where the While the interest rate on fixed deposits cannot be changed, there is sometimes a way to work around the issue of obtaining use of funds in an emergency situation. At times, the lending institution fixed deposit is placed may be willing to extend a separate loan to the account holder, using the fixed account as collateral. While not ideal, this can at least make it possible to deal with the current financial crunch. Fixed deposits are a credible way to make a return on investment that is somewhat higher than a standard savings account. The use of fixed deposits can also be helpful when working with various types of currency. By establishing what is known as a Foreign Currency Fixed Deposit or FCFD, it is possible to choose the type of currency involved in the deposit and lock in a rate of interest. If the choice of currency is a good one, this means the investor can enjoy a healthy fixed deposit currency rate for the duration of the

77

deposit and earn more than with a standard fixed deposit strategy. However, going with an FCFD does contain a slightly higher amount of risk, since the funds deposited must be converted to the currency of choice and then converted back when the deposit is fulfilled. If the currency did not fare well in the interim, there is some chance of obtaining a loss, due to the changes in the rate of exchange from the time the fixed deposit was activated until the time the deposit is considered complete.

78

Chapter 9

BIBLIOGRAPHY

www.yahoo.com www.google.com Referance book

deogiri nagari sahakari bank ltd aurangabad adderss: arth complex kesrsingpura, adalt rode aurangabad

You might also like

- SBI Mobile BankingDocument46 pagesSBI Mobile BankingAbhishek Tiwari100% (3)

- Sbi Project On DepositsDocument47 pagesSbi Project On DepositsSai Sekhar0% (1)

- Comparative Study of Private and Public Sector BankDocument21 pagesComparative Study of Private and Public Sector BankbuddysmbdNo ratings yet

- Internship Report BOMDocument27 pagesInternship Report BOMMAHIMA50% (2)

- Final Project Neft Rtgs PDFDocument82 pagesFinal Project Neft Rtgs PDFMehul Patel58% (12)

- Project of Internet Banking of SbiDocument41 pagesProject of Internet Banking of Sbiprakash100% (1)

- Review of LiteratureDocument7 pagesReview of LiteraturekomalpreetdhirNo ratings yet

- Loans and Advances at HDFC Bank PaperDocument7 pagesLoans and Advances at HDFC Bank PaperSarah FatimaNo ratings yet

- State Bank of India Home LoanDocument41 pagesState Bank of India Home LoanPratap ShivshetteNo ratings yet

- Theoretical Framework of Home LoanDocument8 pagesTheoretical Framework of Home LoanTulika GuhaNo ratings yet

- Deposit Schemes Project ReportDocument59 pagesDeposit Schemes Project ReportAnu Joseph92% (13)

- Indian Overseas Bank SIP Report: Loans and Advances ManagementDocument86 pagesIndian Overseas Bank SIP Report: Loans and Advances ManagementSONIYA SINHA85% (13)

- The Study of Customer Satisfaction in Private Sector and Public Sector Banks in Haldwani"Document43 pagesThe Study of Customer Satisfaction in Private Sector and Public Sector Banks in Haldwani"Ankit Tiwari50% (2)

- HDFCDocument61 pagesHDFCpatyal20100% (1)

- Cash Management ReportDocument122 pagesCash Management Reportarchita031257% (7)

- Sbi ProjectDocument60 pagesSbi Projectjithu100% (3)

- Comparative Study and Analysis of Home Loan Schemes Offered by Different BanksDocument109 pagesComparative Study and Analysis of Home Loan Schemes Offered by Different Banksshariq ameen100% (2)

- SBI Bank ProjectDocument150 pagesSBI Bank Projectee23258No ratings yet

- Comparative Study On Advance Products of Bank of MaharashtraDocument54 pagesComparative Study On Advance Products of Bank of MaharashtraSami Zama0% (1)

- Summer Project - Uco BNK MAHESHDocument60 pagesSummer Project - Uco BNK MAHESHSuraj Tiwari100% (1)

- Research Methodology HDFC BANK.... PODocument5 pagesResearch Methodology HDFC BANK.... POdivya100% (3)

- Questionnaire For Bank (PNB)Document13 pagesQuestionnaire For Bank (PNB)Abhishek PathakNo ratings yet

- ICICI - History - Objectives - Functions - Financial Assistance - RolesDocument10 pagesICICI - History - Objectives - Functions - Financial Assistance - RolesHebaNo ratings yet

- Questionnaire On Credit CardDocument2 pagesQuestionnaire On Credit CardVaibhav Goyal100% (6)

- Questionnaire Comparative Study On Public Bank and Private Bank.Document4 pagesQuestionnaire Comparative Study On Public Bank and Private Bank.Lavkush Tiwari100% (1)

- Customer Satisfaction QuestionnaireDocument6 pagesCustomer Satisfaction Questionnairesid1982No ratings yet

- Icici Loans and AdvancesDocument88 pagesIcici Loans and AdvancesSaraswati Pratik0% (1)

- Bank of MaharashtraDocument91 pagesBank of MaharashtraArun Savukar67% (3)

- Project On SBI BankDocument48 pagesProject On SBI BankArvind Mahandhwal80% (5)

- Project Report on"CASA" in HDFCDocument42 pagesProject Report on"CASA" in HDFCRoshan Friendsforever100% (5)

- Final Sip Mba Project PDFDocument87 pagesFinal Sip Mba Project PDFDisha JAINNo ratings yet