Professional Documents

Culture Documents

Loctite Corporation

Uploaded by

hanuman24Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loctite Corporation

Uploaded by

hanuman24Copyright:

Available Formats

EXECUTIVE SUMMARY I recommend a full launch of the Bond-A-Matic 2000 (BAM) to facilitate IPGs goals of increasing year-on-year sales

of SuperBonder adhesives by 30.81% (from sales of $3.44M to $4.5M) and attaining a 35% market share amongst core industry groups within the CA market. Within the market for instant adhesives, Loctites target customer for SuperBonder will increasingly be a varied group of small- to mid-sized industrial manufacturers interested in quality control, cost-effectiveness, ease of use and efficiency. With a strong reputation as a leader in the development and marketing of high-performance adhesives and sealants for industrial and consumer applications, Loctite is wellsituated to lead the growth in this new market by aggressively increasing efforts to educate a new group of endbuyers of the benefits of its products. Specifically, I propose that Loctite initiate production of BAM 2000 and concentrate on marketing it to small and mid-size firms within the SIC 35-39 industry groups who use between one and nine pounds of CAs annually. CUSTOMER ANALYSIS In FY 1978, SuperBonder adhesives captured a 34.64% share of the industrial market for CA and Quick Set 404 maintained a 5.36% share. While sales in CA were growing by more than 20% annually, the industrial segment grew even faster at 26.42%. Within the industrial segment, sales of SuperBonder adhesives grew by 47.47% from FY 1977 to FY 1978 indicating that SupeBonder was stealing share from competitors while attracting new users as well. If Loctite could sustain such growth, it would have no problem reaching its targeted goal of further increasing sales by 30.81% in FY 1979 to $4.5M. While the industrial segment within CA was highly fragmented and firm size was a poor predictor of CA demand, more than 50% of IPGs current SuperBonder adhesive sales came from distributors who sold to either small or medium OEMs. Small firms accounted for 55% of total industrial volume and, in 16 SIC groups, more than 10% of firms used instant adhesives. The Systems Division developed the BAM 2000 in response to difficulties among assembly line workers in dispensing CA from standard one-ounce and smaller bottles. The BAM 2000 would allow these end-users to precisely dispense dots, dashes, or lines of adhesive quickly and without mess. With only 16% of firms using instant adhesives, Loctite had an opportunity to create primary demand and expand the size of the market while also increasing its share within it. As a leader in a young and growing industry, Loctite should educate the market about SuperBonders many applications and uses. With regards to the BAM 2000 however, Loctite should not market it as standalone product but as complementary to SuperBonder adhesives. By

targeting based on benefits, usage and decision processes, Loctite should concentrate on plant and production engineers as well as company presidents at small to medium sized firms in SIC industry groups 35-39 that use between one and nine pounds of instant adhesives annually. This segment currently includes 8997 firms with a potential to grow to 14,763 firms based on the industry estimates provided in the case. Group # Current Users Establishments # New Potential User Establishments Total SIC 35-39 Moderate* Use 8997 5766 14763 SIC 35-39 Heavy Use 3413 2187 5600 SIC 35-39 31023 19883 50906

*Moderate Use: 29% of firms purchased between one and nine pounds annually; Heavy Use: 11% of firms purchased more than 10 pounds annually

Segmenting our market in this way allows Loctite to use BAM 2000 to introduce new users to instant adhesives and to react to the expressed interest of current SuperBond users with improved dispensing technology. The industries within the selected classification are characterized by small to medium usage with strong opportunity to convert additional nonusers in the future. Their products are subject to frequent design changes and their production processes are better suited for BAM 2000 than for anything else on the market including the cumbersome oneounce bottles that are prone to clogging and making a mess on the assembly line. BAM 2000 provides these users with greater precision, control, reliability and efficiency while they work. COMPANY ANALYSIS As a pioneer in the market for instant adhesives, Loctite is one of three companies that altogether account for about 75% of the industrial CA market in the US. Unlike other competitors, Loctite is unique in that it also manufactures automatic adhesive dispensing equipment to complement sales of CAs. Loctites Systems Division was responsible for more than 15% of IPGs FY 1978 sales. It precisely engineered and sold automatic adhesive dispensing equipment for large firms at up to a 33% premium over comparable equipment from competitors. The Systems Division developed the BAM 2000 and the Gluematic tip to address the needs of a different type of user the assembly line worker in a small to midsize plant who found it very burdensome to work with the one-ounce bottles that are prone to clogging. By increasing the precision and reliability of equipment available to such workers, the BAM 2000 played directly to the Systems Divisions unique competitive advantage purposeful, high-quality innovative designs and will drive IPGs growth into new markets that already comprise 70% of revenues. In FY 1978, sales of SuperBonder adhesives increased by 42% from FY 1977. Over 50% of SuperBonder adhesive sales were made through Loctites distributors who resold to medium and small OEMs. Since small firms accounted 1

for 55% of volume of the instant adhesive market, Loctite could continue to leverage its highly qualified salespeople to educate distributors and end-users about the benefits offered by BAM 2000 and provide BAM 2000-specific training programs. By doing so, it could convert more nonusers to users and encourage greater consumption by current users. Loctites strong relationships with its 285 distributors were highly valued because they allowed the company to command premium prices, expect distributors to carry a full line of Loctite adhesives and list Loctite products in their catalogs. Loctite should strengthen these relationships to protect and encourage sales and overcome distributors reluctance to stock equipment that required servicing. The company should incentivize salespeople and distributors with a matching commission percentage for equipment as for adhesives and offer distributors a matching 25% margin on sales of the BAM 2000. Additionally, as neither salespeople nor distributors have previously been pushed to sell equipment, Loctite should train both parties on using the BAM 2000 for various applications as well as on the benefits it offers to end-users. The Systems Divisions doubts about being able to manufacture large quantities of the BAM 2000 and about their ability to service a high volume of service requests from inexperienced users posed a serious limitation to the launch. As a market leader, Loctite cannot afford to jeopardize its reputation for quality and service with a new launch of a complementary product. The company should control its initial quantity of production to ensure that this does not happen or look for ways to outsource production of the BAM 2000. Financially, Loctite is well situated to launch BAM 2000 as an augmented product to complement and drive sales of SuperBonder adhesives. With 25% of Loctites sales in FY 1978 and a CAGR of 25%, IPGs sales should grow from $32M in FY 1978 to $40M in FY 1979 even without launching the BAM 2000. Additionally, the up-front R&D and investment costs of $48,000 represented 1.5% of SuperBonder sales from FY 1978. Without accounting for various marketing scenarios, at a price of $200 for distributors, Loctite would breakeven with 223 units of the low-pressure model or 310 units of the high-pressure model (a 3.6% market share: 553/14763). With the most aggressive promotion strategies including both direct mail and following the proposed media schedule, at a price to distributors of $200, Loctite would breakeven with 934 high-pressure models and 673 low-pressure models (a 10.8% market share of: 1607/14763). COMPETITOR ANALYSIS 2

The BAM 2000 would be entering the market at a price point far below the automatic dispensers made by competitors (which sell for $483) and by IPGs System Division ($725 and $1200). As a manual dispenser it will not likely steal share from competitors who manufacture automatic dispensers catered at larger firms. Since current competitors have limited resources and are highly fragmented in different regional markets or specific industries, there is little direct threat posed by them. However, if sales of BAM 2000 increase very quickly or the product is highly profitable, there are few barriers to entry prohibiting new competitors from entering the market for mechanical adhesive dispensers. Furthermore, a successful launch of BAM 2000 by Loctite may encourage 3M, Eastman, and Permabond to begin developing their own dispensers for their line of instant adhesives as well. As a first-mover, Loctite has established its competitive advantage in CA and has been growing among industrial groups by stealing share from competitors. While its marketing campaign in FY 1978 clearly paid off, it must continue marketing to educate potential users about its products and converting more users to BAM 2000 thereby raising switching costs for competitors. Cannibalization with IPGs Systems Decisions applicators is not a concern because they cater to very different usage levels. It would not be pragmatic for a large firm using more than nine-ten pounds of SuperBonder to switch to the BAM 2000. PRODUCT, PRICING AND PROMOTION STRATEGY BAM 2000 complements the SuperBonder line of instant adhesives. SICs 35-39 are very heterogeneous with regards to their uses and applications for instant adhesives. Sales of BAM 2000 should be accompanied with the Gluematic tip, the Vari drop needle and applicator. Though BAM 2000 and the Gluematic Pen use the same applicator, the vastly different size of adhesive that accompanies each negates the possibility of rivalry between them. As adoption of BAM 2000 increases, sales of one-ounce bottles will decline and may at some point need to be eliminated altogether pushing demand to either the one-pound containers or the three-gram Gluematic Pen. I recommend introducing both the high- and low-pressure models of the BAM 2000 at $200 for distributors and $250 for the end-user. Pricing the BAM 2000 this way eliminates the need to get sales cleared by the purchasing department and allows the majority of purchasing decisions to be made directly by production and plant engineers and owners of small firms. The $200 price for distributors incentivizes them to stock equipment by raising their margin on equipment sales to 25% (equivalent to their margin on adhesives) presenting a greater incentive to 3

market these products to their customers. Additionally, the suggested pricing scheme allows Loctite to pursue a price skimming strategy in line with the premium it charges for its other products. I am not certain about the target customers price sensitivity. Though the market survey indicated that price was not very important in instant adhesive purchase decisions, I wonder whether price will become more important as firms start spending a lot more money on such purchases, especially as their orders grow from one-ounce bottles to one-pound containers with a dispenser. At this early stage in the market, many potential users have little knowledge about instant adhesives and their capabilities. In order to continue growing, Loctite must employ a pull strategy and continue its highly successful advertising campaign to raise consumer awareness, change their perceptions and preferences, and educate nonusers about the SuperBond line of adhesives. To encourage sales and adoption of BAM 2000, Loctite should follow through with the proposed media schedule in conjunction with SuperBond advertising and incorporate the direct-mail program to reach the full list of 14,470 potential users of instant adhesives in SICs 35-39 with moderate use (between one and ten pounds). Loctite should insert brochures in all SuperBond packages and highlight anti-clogging features to target current users. When sending a package through the direct-mail program, I would suggest that the brochure describing BAM 2000 focus on benefits it provides with user testimonials. Finally, when following the proposed media schedule, Loctite should not highlight anti-clogging features as the goal here is to target new users as well as nonusers. DISTRIBUTION STRATEGY At this early stage, I would not recommend any changes to the current distribution strategy and would revisit in the future if competition increases or when BAM becomes a well-established product. Loctite has strong relationships with distributors and these distributors already manage over 50% of current sales of SuperBond adhesives. By incentivizing distributors to stock equipment, the goal is to have them sell BAM 2000 as a complement to all SuperBond adhesives.

Exhibit 1: Market Analysis by SIC Industry Group

SIC Code 20-24 26-27 25 28-29 33-35 36 38 30-31 32 37 39 40-49 70, 72, 73 75 76 78-80

Industry Food, Textile, wood products Paper and printing Furniture Chemicals, petroleum products Metal products, machinery Electrical and electronic equipment Scientific instruments, photo equipment, watches Rubber, platstic, leather products Stone, clay, glass products Transportation equipment Jewelry, toys, sporting goods Transportation, communications, utilities Personal, tourist, business services Motor vehicle services Appliance repair Entertainment and health services

Number of Establishments 92874 62872 13875 20167 102523 19610 10143 16332 19190 11771 23904 135657 282239 89257 85838 42001

Instant Adhesives Usage (lbs) 4700 9500 15850 48200 42000 10650 27350

% of User Establishments 5.00% 14.3% 12% 12.50% 14.70% 26.70% 27.60% 15.30% 15.10% 17.30% 24.60% 11.80% 8.30% 36.10% 30.80% 10.1%

16000 8450 58900 13500 9900

Additional % of Potential User Establishments 7.60% 6.40% 20.20% 6.00% 7.80% 18.30% 20.10% 9.70% 3.80% 15.20% 18.70% 7.10% 6.20% 10.10% 4.10% 5.60%

Usage per Establishment (lbs) 0.344716407 0.344716407 5.705705706 6.28749938 3.198220462 8.021589535 3.804294244 2.054343893 2.054343893 2.054343893 2.054343893 0.999529846 0.360712832 1.827956292 0.510626632 2.333749244

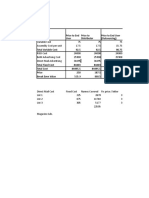

Exhibit 2: Breakeven Analysis for the Low-Pressure and High-Pressure BAM 2000*

Breakeven on Low Pressure BAM Variable Cost Assembly Cost per unit Total Variable Cost R&D Cost BAM Advertising Cost Direct Mail Advertising Total Fixed Cost Price BEV BEV Share Price to End User 75 17.5 92.5 24000 25908 22447.5 72355.5 250 459.4 3% Price to Distributor 75 17.5 92.5 24000 25908 22447.5 72355.5 200 673.07 5% Price to Distributor 75 17.5 92.5 24000 25908 22447.5 72355.5 187.5 761.64 5% Price to Distributor 75 17.5 92.5 24000 25908 22447.5 72355.5 175 877.04 6%

Breakeven on High Pressure BAM Variable Cost Assembly Cost per unit Total Variable Cost R&D Cost BAM Advertising Cost Direct Mail Advertising Total Fixed Cost Price BEV BEV Share

Price to End User 105 17.5 122.5 24000 25908 22447.5 72355.5 250 567.4941176 4%

Price to Distributor 105 17.5 122.5 24000 25908 22447.5 72355.5 200 933.6193548 6%

Price to Distributor 105 17.5 122.5 24000 25908 22447.5 72355.5 187.5 1113.161538 8%

Price to Distributor 105 17.5 122.5 24000 25908 22447.5 72355.5 175 1378.2 9%

*Assuming that direct mail and BAM advertising cost are split evenly between the high pressure and low pressure systems

Exhibit 3: Advertisement Bond-A-Matic

You might also like

- Loctite-Corporation Mid TermDocument16 pagesLoctite-Corporation Mid TermPreeti SoniNo ratings yet

- Loctite International Case Analysis - Group 1Document3 pagesLoctite International Case Analysis - Group 1Subhrodeep Das0% (1)

- Group4 LoctiteDocument2 pagesGroup4 LoctiteCaptn Pawan DeepNo ratings yet

- Dendrite InternationalDocument6 pagesDendrite InternationalRajan MishraNo ratings yet

- Case Analysis of Dendrite International: Industrial Marketing StrategyDocument3 pagesCase Analysis of Dendrite International: Industrial Marketing StrategyyodamNo ratings yet

- Loctite Case StatsDocument8 pagesLoctite Case StatsBharat SinghNo ratings yet

- Case Submission - Dell Computers (A)Document3 pagesCase Submission - Dell Computers (A)Anmol YadavNo ratings yet

- Dominion Motors and Controls Case AnalysisDocument3 pagesDominion Motors and Controls Case AnalysisAshish JaiswalNo ratings yet

- Solution - Pintura Corporation: The Lena Launch DecisionDocument3 pagesSolution - Pintura Corporation: The Lena Launch DecisionKOTHAPALLI VENKATA JAYA HARIKA PGP 2019-21 Batch100% (3)

- Case Summary of PSI Social MarketingDocument3 pagesCase Summary of PSI Social MarketingviyahooNo ratings yet

- Dendrite InternationalDocument9 pagesDendrite InternationalSaurabh Srivastava0% (1)

- WEC Assignment: Report - Ajanta PackagingDocument5 pagesWEC Assignment: Report - Ajanta PackagingSusmitha MNo ratings yet

- PV Technologies, Inc.: Were They Asleep at The Switch?Document12 pagesPV Technologies, Inc.: Were They Asleep at The Switch?Sumedh Bhagwat0% (1)

- 02 Kunst 3500Document9 pages02 Kunst 3500KuntalDekaBaruah0% (1)

- Dominion Motors AnalysisDocument4 pagesDominion Motors AnalysisUday Kiran100% (1)

- Loctite Case SolutionDocument5 pagesLoctite Case SolutionRonakkumar Patel50% (2)

- What Could Be The Reasons For The Unfavourable Evaluation of PV Technologies by Greg Morgan?Document2 pagesWhat Could Be The Reasons For The Unfavourable Evaluation of PV Technologies by Greg Morgan?Amit kaushal0% (1)

- Pintura CorporationDocument2 pagesPintura CorporationVidhun Gyasra67% (3)

- B2B - Pintura Case Analysis - Group9Document6 pagesB2B - Pintura Case Analysis - Group9BOLLAPRAGADA SAI SRAVANTHINo ratings yet

- Clinique Pens: The Writing Implements Division of U.S. HomeDocument3 pagesClinique Pens: The Writing Implements Division of U.S. HomeSakshi Shah100% (1)

- Cumberland Metal IndustriesDocument2 pagesCumberland Metal IndustrieskakriakartikNo ratings yet

- Making The Stickk StickDocument2 pagesMaking The Stickk StickRodriguez Henry50% (2)

- Tweeter Etc CaseDocument4 pagesTweeter Etc Casebinzidd007100% (4)

- Reinventing AdobeDocument1 pageReinventing AdobeRohanNo ratings yet

- Pintura CorporationDocument3 pagesPintura Corporationjyoti50% (2)

- Case Analysis Aniket Bothare MBM PVTDocument4 pagesCase Analysis Aniket Bothare MBM PVTAniket BothareNo ratings yet

- Cooper Pharmaceuticals IncDocument11 pagesCooper Pharmaceuticals IncRohit KumarNo ratings yet

- Eco7 AnalysisDocument11 pagesEco7 AnalysisDewang PalavNo ratings yet

- PGP10100 MobonikDocument1 pagePGP10100 MobonikSwarnajit SahaNo ratings yet

- Abb CatDocument9 pagesAbb CatMukesh Kumar MeenaNo ratings yet

- Stick KDocument2 pagesStick KPraveen Pamnani75% (4)

- Retail Marketing: Case Analysis Mukherjee, J., Bhardwaj, P (2016)Document5 pagesRetail Marketing: Case Analysis Mukherjee, J., Bhardwaj, P (2016)Sushma KumariNo ratings yet

- Metabical Demand, ForecastingDocument6 pagesMetabical Demand, ForecastingAnirban KarNo ratings yet

- Marketing 3 - Group 3 - Soren Chemicals - Case AnalysisDocument2 pagesMarketing 3 - Group 3 - Soren Chemicals - Case Analysispuneet100% (1)

- Dell Computers: Field Service For Corporate Clients (A) : Group Number: 7Document4 pagesDell Computers: Field Service For Corporate Clients (A) : Group Number: 7someone specialNo ratings yet

- Interface RaiseDocument17 pagesInterface RaiseAyush DharnidharkaNo ratings yet

- Grp5 SecB FormPrintDocument4 pagesGrp5 SecB FormPrintshubhamagrawal1994100% (3)

- Dominion Motor CaseDocument3 pagesDominion Motor Caseabhijeet pandeNo ratings yet

- SAP: Building A Leading Technology BrandDocument12 pagesSAP: Building A Leading Technology BrandNikita Runwal100% (2)

- Market Head's Conundrum: Case Analysis and RecommendationsDocument9 pagesMarket Head's Conundrum: Case Analysis and RecommendationsJoseph Thomas KurisunkalNo ratings yet

- Eureka Forbes Case StudyDocument3 pagesEureka Forbes Case Studysaikat sarkarNo ratings yet

- Section B-Group 6: Ingersoll - Rand (India) LTD.: The Air Compressors Business at The Crossroads (A) BackgroundDocument2 pagesSection B-Group 6: Ingersoll - Rand (India) LTD.: The Air Compressors Business at The Crossroads (A) BackgroundAnjali MaheshwariNo ratings yet

- Coca Cola On FacebookDocument5 pagesCoca Cola On FacebookNaseeba MubeenNo ratings yet

- CPI Case Study SolutionDocument5 pagesCPI Case Study SolutionKumar Sachin100% (2)

- Dendrite InternationalDocument9 pagesDendrite InternationalAbhishek VermaNo ratings yet

- Q1. What Is The Case Situation? Ans. The Key Issues As Highlighted in The Case Situation AreDocument6 pagesQ1. What Is The Case Situation? Ans. The Key Issues As Highlighted in The Case Situation AreVenkata Sai Pavan Jeerla100% (2)

- Indian Institute of Management - Kozikhode: Case Analysis NoteDocument4 pagesIndian Institute of Management - Kozikhode: Case Analysis NoteUmesh SonawaneNo ratings yet

- Pintura Corporation: The Lena Launch DecisionDocument6 pagesPintura Corporation: The Lena Launch Decisionsheersha kk67% (3)

- SAP Brand Analysis: Ensuring Consistency WorldwideDocument3 pagesSAP Brand Analysis: Ensuring Consistency WorldwideSachin SuryavanshiNo ratings yet

- Case Analysis - Wright Line, Inc. (A)Document8 pagesCase Analysis - Wright Line, Inc. (A)ayush singlaNo ratings yet

- Designs by Kate - The Power of Direct Sales Number AnalysisDocument2 pagesDesigns by Kate - The Power of Direct Sales Number AnalysiskananguptaNo ratings yet

- Cumberland Case Study SolutionDocument2 pagesCumberland Case Study SolutionPranay Singh RaghuvanshiNo ratings yet

- B2B - Group 3 - Jackson Case StudyDocument5 pagesB2B - Group 3 - Jackson Case Studyriya agrawallaNo ratings yet

- Group3 ABB&CaterpillarDocument3 pagesGroup3 ABB&CaterpillarmonikaNo ratings yet

- LoctiteDocument6 pagesLoctiteRisheek SaiNo ratings yet

- Case Analysis: "Loctite Corporation: Industrial Products Group"Document3 pagesCase Analysis: "Loctite Corporation: Industrial Products Group"Saurabh ChipadeNo ratings yet

- Pintura's Lena Powder Coating StrategyDocument9 pagesPintura's Lena Powder Coating StrategyRitika Sharma0% (1)

- Case 4 - Curled MetalDocument4 pagesCase 4 - Curled MetalSravya DoppaniNo ratings yet

- Master of Business Administration 2020-22: Group Assignment 2 XiameterDocument3 pagesMaster of Business Administration 2020-22: Group Assignment 2 Xiameterkusumit1011No ratings yet

- Operations Strategy at GalanzDocument7 pagesOperations Strategy at GalanzAshishAg91No ratings yet

- What Is Change Management and Why Is It Important (Discussion Board)Document2 pagesWhat Is Change Management and Why Is It Important (Discussion Board)Arun KumarNo ratings yet

- G17 Comprehensive Detailed Area Plan On Rs Mauza MapDocument1 pageG17 Comprehensive Detailed Area Plan On Rs Mauza MapMd Omor Faruk100% (1)

- Pipe Schedule MethodDocument4 pagesPipe Schedule MethodSanket PhatangareNo ratings yet

- Sri Chaitanya IIT Academy., India.: PhysicsDocument12 pagesSri Chaitanya IIT Academy., India.: PhysicsSridhar ReddyNo ratings yet

- Lattice SeminarDocument48 pagesLattice SeminarNaina JabbarNo ratings yet

- Last Service ReportDocument4 pagesLast Service ReportSandeep NikhilNo ratings yet

- 2016 MAEG 3040 SyllabusDocument2 pages2016 MAEG 3040 SyllabusJohnNo ratings yet

- Quarter 1 - Module 1 Nature Goals and Perspectives in Anthropology Sociology and Political ScienceDocument24 pagesQuarter 1 - Module 1 Nature Goals and Perspectives in Anthropology Sociology and Political Science완83% (12)

- New Microsoft Word DocumentDocument12 pagesNew Microsoft Word DocumentMuhammad BilalNo ratings yet

- International Journal of Project Management: Lavagnon A. Ika, Jonas Söderlund, Lauchlan T. Munro, Paolo LandoniDocument11 pagesInternational Journal of Project Management: Lavagnon A. Ika, Jonas Söderlund, Lauchlan T. Munro, Paolo LandoniWarda IshakNo ratings yet

- Sine and Cosine Functions WorksheetDocument6 pagesSine and Cosine Functions WorksheetManya MNo ratings yet

- Band III VHF Antennas 174 240 MHZDocument14 pagesBand III VHF Antennas 174 240 MHZragiNo ratings yet

- Wood You Beleaf It - Final Media Literacy Commercial Lesson PlanDocument5 pagesWood You Beleaf It - Final Media Literacy Commercial Lesson Planapi-528496792No ratings yet

- CASE 2901: Inquiry: Under What Requirements May External Loads (Forces and Bending Moments) Be Evaluated ForDocument2 pagesCASE 2901: Inquiry: Under What Requirements May External Loads (Forces and Bending Moments) Be Evaluated ForDijin MaroliNo ratings yet

- Iron and Steel ReviewDocument2 pagesIron and Steel ReviewSajal SinghNo ratings yet

- Checking Mixing Procedures for Compounds in Mixers 1 & 2Document1 pageChecking Mixing Procedures for Compounds in Mixers 1 & 2Dilnesa EjiguNo ratings yet

- Epigraphs - SubtitleDocument2 pagesEpigraphs - Subtitle17ariakornNo ratings yet

- CV - Nguyen Trung KienDocument1 pageCV - Nguyen Trung KienNguyễn Trung KiênNo ratings yet

- Grinding Process Within Vertical Roller Mills Experiment and SimulationDocument5 pagesGrinding Process Within Vertical Roller Mills Experiment and SimulationDirceu Nascimento100% (1)

- Lexmark™ X950de, X952dte and X954dhe (7558-xxx) - Service ManualDocument1,178 pagesLexmark™ X950de, X952dte and X954dhe (7558-xxx) - Service ManualNikkiSpencerNo ratings yet

- Ciara Mae G. Daguio Civil Engineer ResumeDocument1 pageCiara Mae G. Daguio Civil Engineer ResumeCiara Mae DaguioNo ratings yet

- Energy Landscapes: Applications To Clusters, Biomolecules and Glasses (Cambridge Molecular Science)Document6 pagesEnergy Landscapes: Applications To Clusters, Biomolecules and Glasses (Cambridge Molecular Science)darlyNo ratings yet

- WorkshopDocument4 pagesWorkshopAmit GuptaNo ratings yet

- Advanced View of Projects Raspberry Pi List - Raspberry PI ProjectsDocument186 pagesAdvanced View of Projects Raspberry Pi List - Raspberry PI ProjectsBilal AfzalNo ratings yet

- MATH 10 Test Questions SY 2022-2023 QIIIDocument4 pagesMATH 10 Test Questions SY 2022-2023 QIIIRYAN C. ENRIQUEZNo ratings yet

- Logistics RegressionDocument14 pagesLogistics RegressiondownloadarticleNo ratings yet

- Performance Task 1 - Attempt Review RSCH 122Document6 pagesPerformance Task 1 - Attempt Review RSCH 122John Dexter LanotNo ratings yet

- Literature Review of Job Satisfaction of TeachersDocument7 pagesLiterature Review of Job Satisfaction of Teachersfeiaozukg100% (1)

- Afs General - Adjustment-TestDocument4 pagesAfs General - Adjustment-Testphuong leNo ratings yet

- PGT Lesson Plan#1Document1 pagePGT Lesson Plan#1Bart T Sata'oNo ratings yet