Professional Documents

Culture Documents

Commercial Tax

Uploaded by

Sivakumar VedachalamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commercial Tax

Uploaded by

Sivakumar VedachalamCopyright:

Available Formats

251

20. COMMERCIAL TAX

20.1Important Indicators for Tamil Nadu

20.2Revenue Realised under all the Acts Administered by Commercial Taxes Department

20.3Registered Dealers in Tamil Nadu

20.4Division-wise Distribution of TNGST Assessees by Tax Slabs

20.5Distribution of Assessees by Turnover Slabs and Tax Slabs

20.6Division-wise No. of Assessees and Tax Revenue

20.7Tax Slab-wise Assessees and Tax Revenue under VAT

CHART

Chart-1. Revenue Derived from Taxes under all the Commercial Taxes Act

Chart-2. Division wise VAT Tax Revenue

Chart-3. Division wise CST Tax Revenue

COMMERCIAL TAXES

252

20. COMMERCIAL TAXES

20.1 IMPORTANT INDICATORS FOR TAMIL NADU

2009-10

VAT

CST

1) Registered dealers (No. in lakhs)

5.43

3.38

2) Assessees (No. in lakhs)

2.24

0.46

41

14

3) % of Assessees to registered dealers

4) Tax Revenue (Rs. in Crores)

Value Added Tax (VAT)

21335.52

General Sales Tax (GST)

217.67

Central Sales Tax (CST)

1772.65

Entertainment Tax

Betting Tax

Entry Tax

Luxury Tax

TDS ( Tax Deducted at Source )

Total

5) Total Own Tax Revenue of the State (in Crores)

6) Percentage of Sales Tax to States Own Tax Revenue

7) Assessments finalised (No. in lakhs)

13.18

6.87

1162.48

168.47

142.00

24818.84

35396

70.12%

-

8) % of Assessees by Turnover Range in 2009-10

(VAT Act Only)

Rs. 0 - 3 lakhs

17.78%

Rs. 3 - 4 lakhs

3.42%

Rs. 4 - 5 lakhs

2.98%

Rs. 5 - 10 lakhs

11.55%

Rs.10 -25 lakhs

20.19%

Rs.25 -50 lakhs

14.52%

Rs.50 -75 lakhs

6.38%

Rs.75-100 lakhs

Rs.

1 - 10 crores

4.01%

16.48%

Rs. 10 - 50 crores

2.12%

Rs. 50- 100 crores

0.29%

Rs. 100- 200 crores

0.14%

Rs. 200- 300 crores

0.04%

Rs. 300- 400 crores

0.02%

Rs. 400- 500 crores

0.01%

Rs. 500 Crore & above

0.07%

Source: Commercial Taxes Department, Chennai-5

COMMERCIAL TAXES

253

20.2 REVENUE REALISED UNDER ALL THE ACTS ADMINISTERED BY

COMMERCIAL TAXES DEPARTMENT

(Rs. in Crores)

GROSS RECEIPTS UNDER

Year

VAT Tax

2001-02

2002-03

2003-04

2004-05

2005-06

2006-07

2007-08

2008-09

2009-10

2290.00

16473.00

19305.00

21335.52

TNGST Act

1959

TN

Entertainment

Tax Act 1939

Central Sales Tax

Act 1956

7541.00

8499.00

9767.00

11421.00

13597.00

13347.00

329.00

292.00

217.67

904.00

982.00

1186.00

1495.00

1799.00

2033.00

1744.00

1653.00

1772.65

68.00

71.00

75.00

59.00

44.00

25.00

16.00

12.00

13.18

(Rs. in Crores)

Year

TN Betting

Tax Act

1935

6

2001-02

2002-03

2003-04

2004-05

2005-06

2006-07

2007-08

2008-09

2009-10

GROSS RECEIPTS UNDER

TN Tax on Entry

TN Tax on

of Motor Vehicles

Luxuries

and Goods in to

in Hotels

Local Areas Act

Act 1981

1990

7

6.00

5.00

5.00

5.00

6.00

6.00

6.00

6.00

6.12

TDS

Collection

89.00

82.00

63.00

78.00

92.00

129.00

160.00

170.00

168.47

Gross

Revenue

297.00

553.00

638.00

808.00

1016.00

1318.00

1125.00

996.00

1162.48

10

8.00

23.00

41.00

61.00

69.00

100.00

135.00

142.00

8905.00

10200.00

11757.00

13907.00

16615.00

19217.00

19953.00

22570.00

24818.84

Source: Commercial Taxes Department, Chennai - 5

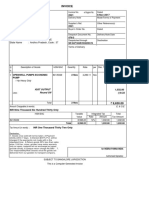

Chart-1

REVENUE DERIVED FROM TAXES UNDER ALL THE

COMMERCIAL TAXES ACTS 2001-02 TO 2009-10

25000

20000

15000

24819

22570

16615

19217 19953

13907

8905 10200

11757

10000

5000

0

2001- 2002- 2003- 2004- 2005- 2006- 2007- 2008- 200902

03

04

05

06

07

08

09

10

Period

COMMERCIAL TAXES

254

20.3 REGISTERED DEALERS IN TAMIL NADU

Category of

Dealers

2004-05

No.

%

2005-06

No.

%

4

2006-07

No.

%

6

TNGST

Assessees

136030

35

142601

37

151818

38

Non-Assessees

248463

65

244926

63

247285

62

Total (Registered

Dealers)

384493

100

387527

100

399103

100

% increase over

previous year

1.2

1.4

3.0

CST

Assessees

37917

21

39669

23

Non-Assessees

141978

79

136387

77

Total (Registered

Dealers)

179895

100

176056

100

% increase over

previous year

Category of

Dealers

1

13.3

46393

26

130161

74

176554

100

-2.13

3.46

2007-08 (VAT)

2008-09 (VAT)

2009-10 (VAT)

No.

No.

No.

10

11

12

13

TNGST

Assessees

179714

40

205319

41

224168

41

Non-Assessees

266537

60

291396

59

319035

59

Total (Registered

Dealers)

446251

100

496715

100

543203

100

% increase over

previous year

11.81

11.30

9.36

CST

Assessees

44360

17

39733

13

45991

14

Non-Assessees

212512

83

267783

87

292405

86

Total (Registered

Dealers)

256872

100

307516

100

338396

100

% increase over

previous year

45.49

19.7

Source: Special Commissioner and Commissioner of Commercial Taxes, Chennai-5

10.04

COMMERCIAL TAXES

255

20.4 DIVISION-WISE DISTRIBUTION OF VAT ASSESSEES BY

TAX SLABS 2009-10

(Assessees in Nos.)

Tax Slabs

(Tax Rs. in Crores)

Assessees/

Tax (VAT)

Chennai

(N)

Chennai

(S)

Chennai

(E)

Chennai

(C)

Below Rs.1000

Rs.1000-5000

Rs.5000-10000

Rs.10000-50000

Rs.50000-l Lakh

Rs.1 5 Lakhs

Assessees

2330

8568

3383

3786

Tax

0.02

0.11

0.03

0.04

Assessees

1080

4098

1426

1867

Tax

0.33

1.74

0.52

630.29

Assessees

944

3559

1200

1637

Tax

0.75

3.86

1.14

1.42

Assessees

2944

8833

3235

4452

Tax

8.03

31.12

10.18

12.93

Assessees

1249

3146

1216

1752

Tax

9.57

33.27

11.29

14.89

Assessees

Tax

Rs.5 10 Lakhs

Assessees

Tax

Rs.10 50 Lakhs

Assessees

Tax

Rs.50 - 100 Lakhs

Assessees

Tax

Rs.1 10 Crores

Assessees

Tax

Rs.10 20 Crores

Assessees

Tax

Rs.20 30 Crores

Assessees

Tax

Rs.30 40 Crores

Assessees

Tax

Rs.40 50 Crores

Assessees

Tax

Rs.50 Crores &

above

Assessees

Tax

Total

Assessees

Tax

1904

4649

1880

2980

46.87

154.38

56.00

82.23

436

999

510

727

33.29

103.61

46.74

61.47

428

1117

599

887

97.63

347.77

168.77

219.41

53

164

103

175

38.30

171.81

92.81

145.52

53

201

130

183

176.29

918.63

440.08

601.62

15

59.24

298.13

139.75

146.09

0.00

68.92

230.78

71.98

34.87

55.42

91.58

145.79

0.00

137.44

457.51

99.72

10

2804.85

4646.56

0.00

3784.74

11430

35360

13704

18474

3310.05

6972.77

1747.19

5388.47

COMMERCIAL TAXES

256

20.4 DIVISION-WISE DISTRIBUTION OF VAT ASSESSEES BY

TAX SLABS 2009-10 (Contd.)

(Assessees in Nos.)

Tax Slabs

(Tax Rs. in Crores)

Assessees/

Tax (VAT)

Below Rs.1000

Rs.1000-5000

Rs.5000-10000

Rs.10000-50000

Assessees

0.05

0.08

0.06

3934

2842

Tax

1.03

0.80

1.31

0.91

Assessees

2403

1569

2685

2024

Tax

2.03

1.71

0.08

2.29

Assessees

4715

2817

4985

4511

12.43

9.31

13.26

11.64

1191

565

1318

1177

10.05

5.98

0.61

11.09

Assessees

Assessees

Assessees

Assessees

Assessees

Tax

Rs.1 10 Crores

Assessees

Tax

Rs.10 20 Crores

Assessees

Tax

Rs.20 30 Crores

Assessees

Tax

Rs.30 40 Crores

Assessees

Tax

Rs.40 50 Crores

Assessees

Tax

Rs.50 Crores &

above

Assessees

Tax

Total

5798

1849

Tax

Rs.50 - 100 Lakhs

10

7082

0.06

Tax

Rs.10 50 Lakhs

4126

Tirunelveli

3110

Tax

Rs.5 10 Lakhs

4877

Madurai

Assessees

Tax

Rs.1 5 Lakhs

Vellore

Tax

Tax

Rs.50000-l Lakh

Trichy

Assessees

Tax

1409

711

1833

1569

35.28

22.80

47.49

37.72

255

115

302

280

20.89

12.14

25.10

22.55

241

134

291

310

60.63

38.62

71.76

75.09

35

17

44

67

29.64

16.88

35.68

52.38

30

16

32

28

88.26

66.64

79.31

64.48

0.00

15.55

32.79

0.00

25.38

31.93

0.00

0.00

0.00

0.00

0.00

0.00

284.02

260.40

0.00

0.00

0.00

0.00

0.00

178.15

18271

11923

22507

18607

569.71

482.81

320.17

454.01

COMMERCIAL TAXES

257

20.4 DIVISION-WISE DISTRIBUTION OF VAT ASSESSEES BY

TAX SLABS 2009-10 (Concld.)

(Assessees in Nos.)

Tax Slabs

(Tax Rs. in Crores)

Assessees/

Tax

Coimbatore

11

Below Rs.1000

Rs.1000-5000

Rs.5000-10000

Assessees

Rs.50000-l Lakh

Rs.1 5 Lakhs

0.09

0.58

0.00

3592

29654

13.21

Tax

0.51

1.22

9.01

0.00

Assessees

4384

2635

23040

10.27

1.65

0.99

2.27

18.13

10837

6094

53423

23.84

Tax

8.06

17.23

134.18

0.01

Assessees

3547

1991

17152

7.65

Assessees

Tax

9.37

7.86

16.63

129.98

Assessees

5235

2551

24721

11.06

35.42

67.73

585.92

0.03

995

530

5149

2.30

21.75

36.89

384.43

0.02

992

397

5396

2.41

64.69

119.15

1263.52

0.06

135

55

848

0.38

29.49

60.00

672.51

0.03

85

39

797

0.36

55.03

188.62

2678.96

0.13

47

0.02

19.36

36.22

747.13

0.04

16

0.01

7.43

31.68

468.10

0.02

0.00

0.00

0.00

365.94

0.02

11

0.00

13.80

1252.88

0.06

27

0.01

1209.91

0.00

12624.23

0.59

142.00

0.01

46527

27364

224168

100.00

1474.34

616.00

21335.52

Assessees

Assessees

Assessees

Tax

Rs.1 10 Crores

Assessees

Tax

Rs.10 20 Crores

Assessees

Tax

Rs.20 30 Crores

Assessees

Tax

Rs.30 40 Crores

Assessees

Tax

Rs.40 50 Crores

Assessees

Tax

Rs.50 Crores &

above

Assessees

Tax

TDS Collection

Total

28.43

0.04

Tax

Rs.50 - 100 Lakhs

14

63879

5856

Tax

Rs.10 50 Lakhs

13

9476

% to

Total

Assessees

Tax

Rs.5 10 Lakhs

12

14453

State

Tax

Tax

Rs.10000-50000

Salem

Assessees

Tax

TDS : Tax deducted at source

Source: Commercial Taxes Department, Chennai 5

COMMERCIAL TAXES

258

20.5 DISTRIBUTION OF ASSESSEES BY TURNOVER SLABS AND

TAX SLABS 2009-10

Turn over slabs

Tax Slabs

Rs.0 - 3

lakhs

Below Rs.1000

Rs.1000-5000

Rs.5000-10000

Rs.10000-50000

Rs.50000-1 Lakh

Rs.1 Lakh 5 Lakhs

Rs.5 Lakhs 10 Lakhs

Rs.10 Lakhs 50 Lakhs

Rs.50 Lakhs 100 Lakhs

Rs. 1 Crore 10 Crores

Rs. 10 Crores 20 Crores

Rs. 20 Crores 30 Crores

Rs. 30 Crores 40 Crores

Rs. 40 Crores 50 Crores

Rs. 50 Crores & above

Total

Percentage to Total

Rs. 3 -4

lakhs

Rs.4 - 5

lakhs

Rs.5 - 10

lakhs

Rs.10

25 lakhs

23591

9388

3640

2799

181

188

45

27

3

0

0

0

0

0

0

2443

2142

1071

1930

49

20

4

3

1

0

0

0

0

0

0

1983

1791

897

1811

167

28

8

4

1

0

0

0

0

0

0

6706

6532

2994

8195

1168

265

11

13

0

0

0

0

0

0

0

9132

4253

9631

15077

4849

2251

25

39

2

0

0

0

0

0

1

39863

7663

6689

25884

45260

17.78

3.42

2.98

11.55

20.19

20.5 DISTRIBUTION OF ASSESSEES BY TURNOVER SLABS AND

TAX SLABS 2009-10 (Contd.)

Turn over slabs

Tax Slabs

Rs. 25

50 lakhs

Below Rs.1000

Rs.1000-5000

Rs.5000-10000

Rs.10000-50000

Rs.50000-1 Lakh

Rs.1 Lakh 5 Lakhs

Rs.5 Lakhs 10 Lakhs

Rs.10 Lakhs - 50 Lakhs

Rs.50 Lakhs 100 Lakhs

Rs. 1 Crore 10 Crores

Rs. 10 Crores 20 Crores

Rs. 20 Crores 30 Crores

Rs. 30 Crores 40 Crores

Rs. 40 Crores 50 Crores

Rs. 50 Crores & above

Total

Percentage to Total

Rs. 50

75 lakhs

Rs. 75

100 lakhs

Rs.

1 - 10

Crores

Rs.

10 50

Crores

11

10

6236

2341

1969

12358

4191

5303

116

27

3

0

0

0

0

0

0

3013

970

857

3353

1867

3777

441

13

1

0

0

0

0

0

0

1850

545

496

1800

1012

2811

377

101

0

0

0

0

0

0

0

7944

1567

1345

5625

3324

9350

3667

3870

228

27

0

0

0

0

0

819

106

120

398

305

631

413

1149

481

333

0

1

0

0

0

32543

14293

8992

36946

4755

14.52

6.38

4.01

16.48

2.12

COMMERCIAL TAXES

259

20.5 DISTRIBUTION OF ASSESSEES BY TURNOVER SLABS AND

TAX SLABS 2009-10 ( VAT Act Only ) (Contd.)

Turn over slabs

Tax Slabs

Rs.50 - 100

Crores

Rs. 100 200

Crores

Rs. 200 300

Crores

Rs. 300 400

Crores

12

13

14

15

Below Rs.1000

Rs.1000-5000

Rs.5000-10000

Rs.10000-50000

Rs.50000-1 Lakh

Rs.1 Lakh 5 Lakhs

Rs.5 Lakhs 10 Lakhs

Rs.10 Lakhs - 50 Lakhs

Rs.50 Lakhs 100 Lakhs

Rs. 1 Crore 10 Crores

Rs. 10 Crores 20 Crores

Rs. 20 Crores 30 Crores

Rs. 30 Crores 40 Crores

Rs. 40 Crores 50 Crores

Rs. 50 Crores & above

Total

Percentage to Total

88

13

8

31

19

52

25

98

89

219

3

0

0

1

0

42

3

6

15

12

25

9

25

21

134

17

3

0

0

0

9

1

1

2

3

2

3

12

6

41

4

7

4

0

0

5

0

1

4

1

4

2

10

5

14

2

1

3

0

1

645

310

95

53

0.29

0.14

0.04

0.02

20.5 DISTRIBUTION OF ASSESSEES BY TURNOVER SLABS AND

TAX SLABS 2009-10 ( VAT Act Only ) (Concld.)

Turn over slabs

Tax Slabs

Rs.400 500

Crores

Rs. 500

Crores &

above

16

17

Below Rs.1000

2

Rs.1000-5000

0

Rs.5000-10000

1

Rs.10000-50000

0

Rs.50000-1 Lakh

2

Rs.1 Lakh 5 Lakhs

2

Rs.5 Lakhs 10 Lakhs

0

Rs.10 Lakhs - 50 Lakhs

3

Rs.50 Lakhs 100 Lakhs

3

Rs. 1 Crore 10 Crores

11

Rs. 10 Crores 20 Crores

4

Rs. 20 Crores 30 Crores

0

Rs. 30 Crores 40 Crores

1

Rs. 40 Crores 50 Crores

1

Rs. 50 Crores & above

1

Total

31

Percentage to Total

0.01

Source: Commercial Taxes Department, Chennai 5

Total

% Contribution

18

19

15

1

2

27

4

12

4

2

5

19

17

4

1

9

24

63878

29654

23040

53423

17152

24720

5149

5396

848

797

47

16

9

11

27

28.43

13.21

10.27

23.84

7.66

11.06

2.31

2.42

0.38

0.36

0.02

0.01

0.00

0.00

0.01

146

224168

100.00

0.07

100.00

COMMERCIAL TAXES

260

20.6 DIVISION-WISE NUMBER OF ASSESSEES AND TAX REVENUE

2009-10

VALUE ADDED TAX

CT Divisions

No. of

Assessees

% to

State

Tax Revenue

(Rs.in crores)

% to

State

Chennai (N) *

11430

5.10

3310.05

15.41

Chennai (S) *

35360

15.77

6972.77

32.47

Chennai (E) *

13704

6.11

1747.19

8.13

Chennai (C) *

19840

8.85

5388.47

25.09

Tiruchirappalli

18271

8.15

569.71

2.65

Vellore

11923

5.32

482.81

2.25

Madurai

22508

10.04

320.17

1.49

Tirunelveli

18607

8.30

454.01

2.11

Coimbatore

45161

20.15

1474.34

6.86

Salem

27364

12.21

616

2.87

TDS Collection

STATE

142

0.66

224168

100.00

21477.52

100.00

* N : North ; S : South ; E : East ; C : Central

TDS: Tax deducted at source

Chart-2

DIVISION WISE VAT TAX REVENUE 2009-10

( Percentage to State )

2.11

6.86

2.87

0.66

15.41

1.49

2.25

2.65

25.09

32.47

8.13

Chennai ( N )

T iruchirapalli

Coimbatore

Chennai ( S )

Vellore

Salem

Chennai ( E )

Madurai

T DS Collection

Chennai ( C )

T irunelveli

COMMERCIAL TAXES

261

20.6 DIVISION-WISE NUMBER OF ASSESSEES AND TAX REVENUE

2009-10 (Concld.)

CST

CT Divisions

No. of

Assessees

% to

State

Tax Revenue

(Rs.in crores)

% to

State

Chennai (N) *

5030

10.94

97.84

5.52

Chennai (S) *

10630

23.11

712.03

40.17

Chennai (E) *

3961

8.61

162.32

9.16

Chennai (C) *

4902

10.66

225.01

12.69

Tiruchirappalli

1061

2.31

213.15

12.02

803

1.75

14.3

0.81

Madurai

2409

5.24

31.52

1.78

Tirunelveli

3737

8.13

61.11

3.45

Coimbatore

9841

21.40

152.02

8.58

Salem

3617

7.86

103.35

5.83

45991

100.00

1772.65

100.00

Vellore

STATE

* N : North ; S : South ; E : East ; C : Central

Source: Special Commissioner and Commissioner of Commercial Taxes Department, Chennai 5

Chart-3

DIVISION WISE CST TAX REVENUE 2009-10

( Percentage to State )

5.83

5.52

8.58

3.45

1.78

0.81

12.02

40.17

12.69

Chennai ( N )

Vellore

Chennai ( S )

Madurai

9.16

Chennai ( E )

T irunelveli

Chennai ( C )

Coimbatore

T iruchirapalli

Salem

COMMERCIAL TAXES

262

20.7 TAX SLAB-WISE ASSESSEES AND

TAX REVENUE UNDER VAT 2009-10

Tax Slabs

Number of

Assessees

% to Total

Cumulative

%

Below Rs.1000

Rs.1000-5000

Rs.5000-10000

Rs.10000-50000

Rs.50000-1 Lakh

Rs.1 Lakh 5 Lakhs

Rs.5 Lakhs -10 Lakhs

Rs.10 Lakhs -50 Lakhs

Rs.50 Lakhs -100 Lakhs

Rs. 1 Crore 10 Crores

Rs. 10 Crores 20 Crores

Rs. 20 Crores 30 Crores

Rs. 30 Crores 40 Crores

Rs. 40 Crores 50 Crores

Rs. 50 Crores & above

TDS Collection

Total

63878

29654

23040

53423

17152

24720

5149

5396

848

797

47

16

9

11

27

-

28.50

13.23

10.28

23.83

7.65

11.03

2.30

2.41

0.38

0.36

0.02

0.01

0.00

0.00

0.01

-

28.50

41.72

52.00

75.83

83.49

94.51

96.81

99.22

99.60

99.95

99.97

99.98

99.98

99.99

100.00

-

224168

100.00

Tax Slabs

Tax Revenue

(Rs.in

Crores)

% to Total

Cumulative

%

Below Rs.1000

Rs.1000-5000

Rs.5000-10000

Rs.10000-50000

Rs.50000-1 Lakh

Rs.1 Lakh 5 Lakhs

Rs.5 Lakhs 10 Lakhs

Rs.10 Lakhs 50 Lakhs

Rs.50 Lakhs 100 Lakhs

Rs. 1 Crore 10 Crores

Rs. 10 Crores 20 Crores

Rs. 20 Crores 30 Crores

Rs. 30 Crores 40 Crores

Rs. 40 Crores 50 Crores

Rs. 50 Crores & above

TDS Collection

Total

0.58

9.01

18.13

134.18

129.98

585.92

384.42

1263.53

672.51

2678.97

747.15

468.10

365.94

1252.88

12624.23

142.00

0.00

0.04

0.08

0.62

0.61

2.73

1.79

5.88

3.13

12.47

3.48

2.18

1.70

5.83

58.78

0.66

21477.52

100.00

TDS: Tax deducted at source

Source: Commercial Taxes Department, Chennai 5

0.00

0.04

0.13

0.75

1.36

4.09

5.88

11.76

14.89

27.36

30.84

33.02

34.73

40.56

99.34

100.00

-

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Sneha Ram KumarDocument4 pagesSneha Ram KumarSivakumar VedachalamNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Format Voice ProcessDocument1 pageFormat Voice ProcessSivakumar VedachalamNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Manikandan ActivityDocument32 pagesManikandan ActivitySivakumar VedachalamNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Bhagavath GeethaDocument20 pagesBhagavath GeethaVenu Gopal92% (12)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Candidate Information SheetDocument5 pagesCandidate Information SheetSivakumar VedachalamNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Designation / Position: Job Posting FormDocument6 pagesDesignation / Position: Job Posting FormSivakumar VedachalamNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Computer Science Engineering, 9677767045: No.87, Mosque Street, Chitthathur, Walajah tk-632501, Vellore DistDocument2 pagesComputer Science Engineering, 9677767045: No.87, Mosque Street, Chitthathur, Walajah tk-632501, Vellore DistSivakumar VedachalamNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Sindhu-AR 1 To 500 13 08 2013Document40 pagesSindhu-AR 1 To 500 13 08 2013Sivakumar VedachalamNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Unit 2 Environmental EthicsDocument11 pagesUnit 2 Environmental EthicsSivakumar VedachalamNo ratings yet

- State Consumer Help Line: A Message To PublicDocument2 pagesState Consumer Help Line: A Message To PublicSivakumar VedachalamNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Work Content of Production Team LeaderDocument18 pagesWork Content of Production Team LeaderSivakumar VedachalamNo ratings yet

- Unit 1 LessonsDocument24 pagesUnit 1 LessonsSivakumar VedachalamNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Environmental EthicsDocument22 pagesEnvironmental EthicsSivakumar VedachalamNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- FactoriesDocument3 pagesFactoriesSivakumar VedachalamNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Unit III EthicsDocument8 pagesUnit III EthicsSivakumar VedachalamNo ratings yet

- Space ManufacturingDocument19 pagesSpace ManufacturingSivakumar VedachalamNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Family WelfareDocument3 pagesFamily WelfareSivakumar VedachalamNo ratings yet

- Emp Statistics 300611Document3 pagesEmp Statistics 300611Sivakumar VedachalamNo ratings yet

- EthicsDocument5 pagesEthicsSivakumar VedachalamNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Qs Global200 Business Schools Report 2013Document47 pagesQs Global200 Business Schools Report 2013Sivakumar VedachalamNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- EnvironmentDocument8 pagesEnvironmentSivakumar VedachalamNo ratings yet

- Family WelfareDocument3 pagesFamily WelfareSivakumar VedachalamNo ratings yet

- EmploymentDocument16 pagesEmploymentSivakumar VedachalamNo ratings yet

- VitalstatisticsDocument7 pagesVitalstatisticsSivakumar VedachalamNo ratings yet

- Co OperationDocument7 pagesCo OperationSivakumar VedachalamNo ratings yet

- Education StatisticsDocument33 pagesEducation StatisticsVinothNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- ElectricityDocument11 pagesElectricitySivakumar VedachalamNo ratings yet

- CooperativeDocument3 pagesCooperativeSivakumar VedachalamNo ratings yet

- Companies Limited by SharesDocument3 pagesCompanies Limited by SharesSivakumar VedachalamNo ratings yet

- Accountstatementfrom01-10-2023To22-01-2024: AccountdetailsDocument38 pagesAccountstatementfrom01-10-2023To22-01-2024: Accountdetailsr6540073No ratings yet

- Banking Enquiry: Payment Cards and Interchange Fee HearingsDocument18 pagesBanking Enquiry: Payment Cards and Interchange Fee HearingssanjayjogsNo ratings yet

- Print PageDocument1 pagePrint PageSAGAR KHATUANo ratings yet

- Adobe Scan Jul 12, 2022Document6 pagesAdobe Scan Jul 12, 2022Ritis GamingNo ratings yet

- Customer Inquiry ReportDocument3 pagesCustomer Inquiry ReportPerdana Sukma WibowoNo ratings yet

- E-Way Bill: Government of IndiaDocument1 pageE-Way Bill: Government of IndiaYash MittalNo ratings yet

- Supply Chain ManagementDocument209 pagesSupply Chain ManagementMădălina Ioana PetreaNo ratings yet

- Logistics NotesDocument33 pagesLogistics NotesMustafa SoniNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Technological Innovations in Indian Banking Sector: Aruna R. ShetDocument4 pagesTechnological Innovations in Indian Banking Sector: Aruna R. ShetNikhil patilNo ratings yet

- The IncotermsDocument3 pagesThe IncotermsVrinda GuptaNo ratings yet

- Revenue Regulations No 12-99Document3 pagesRevenue Regulations No 12-99Zoe Dela CruzNo ratings yet

- BIR Form 2551Q: Under Sections 116 To 126 of The Tax Code, As AmendedDocument9 pagesBIR Form 2551Q: Under Sections 116 To 126 of The Tax Code, As AmendedJAYAR MENDZNo ratings yet

- Tugas Rutin Makro WawaDocument5 pagesTugas Rutin Makro WawaSuhairo Nasuha Sitorus100% (1)

- Chapter 4 - Business ServicesDocument15 pagesChapter 4 - Business ServicesAkashdeep MukherjeeNo ratings yet

- Expanded Withholding Taxes On Government Income PaymentsDocument172 pagesExpanded Withholding Taxes On Government Income PaymentsBien Bowie A. CortezNo ratings yet

- Amazon Shopping FAQ'sDocument6 pagesAmazon Shopping FAQ'sElla ServantesNo ratings yet

- MBBsavings - 158118 107625 - 2016 12 31Document7 pagesMBBsavings - 158118 107625 - 2016 12 31Zahar ZekNo ratings yet

- SafeKey ACS MPIs On Amex Enabled July 2018Document1 pageSafeKey ACS MPIs On Amex Enabled July 2018Talent BeaNo ratings yet

- No Due CertificateDocument27 pagesNo Due CertificateRUPAM BAPARYNo ratings yet

- Export ProcedureDocument24 pagesExport Proceduresd_logeshNo ratings yet

- Sanction LetterDocument1 pageSanction LetterJayanta Kumar GaraiNo ratings yet

- Invoice: #25/1, BDG Lane, Jolli Mohalla Bangalore - 560053 GSTIN/UIN: 29AAIFH5508A1ZM State Name: Karnataka, Code: 29Document1 pageInvoice: #25/1, BDG Lane, Jolli Mohalla Bangalore - 560053 GSTIN/UIN: 29AAIFH5508A1ZM State Name: Karnataka, Code: 29AnamikaNo ratings yet

- Tally Acc TermsDocument22 pagesTally Acc TermsShekhar Chandra SahuNo ratings yet

- Lowongan Kerja Tauzia HotelsDocument3 pagesLowongan Kerja Tauzia HotelsLowongan KerjaNo ratings yet

- Global Distribution SystemDocument21 pagesGlobal Distribution Systemelenaanwar100% (2)

- Pengaruh Muatan Truk Berlebih Terhadap Biaya Pemeliharaan JalanDocument11 pagesPengaruh Muatan Truk Berlebih Terhadap Biaya Pemeliharaan JalanWiwik Adetya SaruddinNo ratings yet

- Taxation in India Vs AfghanistanDocument11 pagesTaxation in India Vs AfghanistanKomal AgrawalNo ratings yet

- EWM BrochureDocument4 pagesEWM BrochureMrconfusionSapNo ratings yet

- Deposit Slip 3Document11 pagesDeposit Slip 3AlfazzastoreNo ratings yet

- Сommonwealth AU UnsecDocument3 pagesСommonwealth AU Unsecbefix80880No ratings yet