Professional Documents

Culture Documents

MPBF - Tandon Committee

Uploaded by

neeteesh_nautiyalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MPBF - Tandon Committee

Uploaded by

neeteesh_nautiyalCopyright:

Available Formats

MPBF or Maximum Possible Bank Finance - Tandon Committee

Example :

Let total Current Assets of a company is Rs. 560 lakhs and total Current

Liability is also Rs. 560 lakh. The current liability includes short term bank borrowings of Rs. 360 lakhs. 1) Calculate MPBF using Tandon Committee recommendations Method-I 2) Calculate MPBF using Tandon Committee recommendations Method-II Solution: Current assets, CA = 560 Current Liability, CL = 560 Current Liability excluding bank finance = 560 360 = 200 So Working capital Gap (WCG) = 560 - 200 = 360 .. (a) (1) Method I Margin = 25 % of WCG = 25% of 360 = 90 MPBF = WCG Margin = 360 90 = 270 Existing bank borrowing = 360 Hence excess bank finance = 360 270 =90 (2) Method-II Margin = 25% CA = 25% of 560 = 140 Working capital Gap(WCG) = 360 MPBF = WCG Margin = 360 140 = 220 Existing bank borrowing = 360 Hence excess finance = 360 220 = 140 If bank borrowing is reduced from 360 to 220, current liability will be reduced from 560 to 560-140 = 420 (CL) Current ratio after this change = CA/CL = 560/420 = 4/3 = 1.33:1

You might also like

- Wyckoff e BookDocument43 pagesWyckoff e BookIan Moncrieffe95% (22)

- Embedded CoderDocument8 pagesEmbedded Coderجمال طيبيNo ratings yet

- MPBF Tandon CommitteeDocument3 pagesMPBF Tandon CommitteeAnkit Gupta0% (1)

- Role of Central Bank in Pakistan's Economic DevelopmentDocument61 pagesRole of Central Bank in Pakistan's Economic DevelopmentMuhammad WasifNo ratings yet

- International LiquidityDocument19 pagesInternational LiquidityAnu Narayanankutty100% (2)

- CFP - Module 1 - IIFP - StudentsDocument269 pagesCFP - Module 1 - IIFP - StudentsmodisahebNo ratings yet

- MCQ on Operating Leverage, Interest Rate Derivatives and Financial MarketsDocument19 pagesMCQ on Operating Leverage, Interest Rate Derivatives and Financial MarketsParvesh AghiNo ratings yet

- Project Appraisal FinanceDocument20 pagesProject Appraisal Financecpsandeepgowda6828No ratings yet

- Cryptography Seminar - Types, Algorithms & AttacksDocument18 pagesCryptography Seminar - Types, Algorithms & AttacksHari HaranNo ratings yet

- Working Capital Control and Banking PolicyDocument3 pagesWorking Capital Control and Banking Policyrahulravi4u0% (1)

- Understanding the Security Market Line (SML) /TITLEDocument9 pagesUnderstanding the Security Market Line (SML) /TITLEnasir abdulNo ratings yet

- Model Paper-I BFM Basel Framework Multiple Choice QuestionsDocument9 pagesModel Paper-I BFM Basel Framework Multiple Choice QuestionsHimanshuGururaniNo ratings yet

- Tandon Committe & Tarapore Committee SuggestionDocument6 pagesTandon Committe & Tarapore Committee SuggestionAmar SinhaNo ratings yet

- 1Document10 pages1Sai Krishna DhulipallaNo ratings yet

- Working Capital Financing Methods for Maximum Bank FinanceDocument9 pagesWorking Capital Financing Methods for Maximum Bank FinanceArakanshu SinghNo ratings yet

- Problems On Hire Purchase and LeasingDocument5 pagesProblems On Hire Purchase and Leasingprashanth mvNo ratings yet

- Sharpe Index Model - Prof. S S PatilDocument36 pagesSharpe Index Model - Prof. S S Patilraj rajyadav100% (1)

- Financial Management Question PaperDocument24 pagesFinancial Management Question PaperDhatri Srivatsa100% (1)

- Senior citizen retirement investment planDocument19 pagesSenior citizen retirement investment planPrasanth TalluriNo ratings yet

- MCQDocument6 pagesMCQArup Kumar DasNo ratings yet

- Tarapore Committee ReportDocument14 pagesTarapore Committee ReportChintakunta PreethiNo ratings yet

- Working Capital Assessment of Eicher Motors LTDDocument8 pagesWorking Capital Assessment of Eicher Motors LTDAkhilesh Shukla GMPE 2018 BatchNo ratings yet

- SFM May 2015Document25 pagesSFM May 2015Prasanna SharmaNo ratings yet

- Fa IiiDocument76 pagesFa Iiirishav agarwalNo ratings yet

- Asset and LiabilityDocument30 pagesAsset and LiabilitymailsubratapaulNo ratings yet

- FINANCIAL MANAGEMENT Assignment 2Document14 pagesFINANCIAL MANAGEMENT Assignment 2dangerous saifNo ratings yet

- CCA Current Cost Accounting Theory 2021Document4 pagesCCA Current Cost Accounting Theory 2021PradeepNo ratings yet

- Topic: Markowitz Theory (With Assumptions) IntroductionDocument3 pagesTopic: Markowitz Theory (With Assumptions) Introductiondeepti sharmaNo ratings yet

- MCQ On Home Loans (A K Marandi, SBLC-Siliguri)Document4 pagesMCQ On Home Loans (A K Marandi, SBLC-Siliguri)Raghu Nayak100% (1)

- Portfolio Construction Models Risk ReturnDocument40 pagesPortfolio Construction Models Risk ReturnjitendraNo ratings yet

- SFM - Forex - QuestionsDocument23 pagesSFM - Forex - QuestionsVishal SutarNo ratings yet

- Receivables ManagementDocument4 pagesReceivables ManagementVaibhav MoondraNo ratings yet

- Internship Report Final PDFDocument88 pagesInternship Report Final PDFSumaiya islamNo ratings yet

- Continuous ProbDocument10 pagesContinuous Probtushar jainNo ratings yet

- Fund Flow StatementDocument7 pagesFund Flow StatementvipulNo ratings yet

- Bond Valuation ExplainedDocument20 pagesBond Valuation Explainedsona25% (4)

- Corporate Finance Exam GuideDocument8 pagesCorporate Finance Exam Guideneilpatrel31No ratings yet

- Chapter 16 MGT of Equity CapitalDocument29 pagesChapter 16 MGT of Equity CapitalRafiur Rahman100% (1)

- Solved Examples Based On Ebit-Eps Analysis - Part 1 Example Help For Leverage, Management, Homework Help - Transtutors - ComDocument3 pagesSolved Examples Based On Ebit-Eps Analysis - Part 1 Example Help For Leverage, Management, Homework Help - Transtutors - Communish12345650% (2)

- FM - 30 MCQDocument8 pagesFM - 30 MCQsiva sankarNo ratings yet

- Model PAPER-Analysis of Financial Statement - MBA-BBADocument5 pagesModel PAPER-Analysis of Financial Statement - MBA-BBAvelas4100% (1)

- Balance of Payments: International FinanceDocument42 pagesBalance of Payments: International FinanceSoniya Rht0% (1)

- Capital Structure Problems AssignmentDocument3 pagesCapital Structure Problems AssignmentRamya Gowda100% (2)

- Numericals On Capital Budgeting TechniquesDocument5 pagesNumericals On Capital Budgeting TechniquesKritikaNo ratings yet

- Forex Pages 42 90Document49 pagesForex Pages 42 90RITZ BROWN100% (1)

- Strengths in The SWOT Analysis of ICICI BankDocument2 pagesStrengths in The SWOT Analysis of ICICI BankSudipa RouthNo ratings yet

- Unit 2 Capital StructureDocument27 pagesUnit 2 Capital StructureNeha RastogiNo ratings yet

- Dividend Concepts & Theories: Year EPS (X LTD.) DPS (X LTD.) Eps (Y LTD.) Dps (Y LTD.) Mps (X LTD.)Document23 pagesDividend Concepts & Theories: Year EPS (X LTD.) DPS (X LTD.) Eps (Y LTD.) Dps (Y LTD.) Mps (X LTD.)amiNo ratings yet

- 1164914469ls 1Document112 pages1164914469ls 1krishnan bhuvaneswariNo ratings yet

- NPTEL Assign 2 Jan23 Behavioral and Personal FinanceDocument7 pagesNPTEL Assign 2 Jan23 Behavioral and Personal FinanceNitin Mehta - 18-BEC-030No ratings yet

- FM Recollected QuestionsDocument8 pagesFM Recollected Questionsmevrick_guyNo ratings yet

- What Is A CMA Report PDFDocument2 pagesWhat Is A CMA Report PDFभगवा समर्थकNo ratings yet

- Credit Risk ManagementDocument13 pagesCredit Risk ManagementVallabh UtpatNo ratings yet

- SLIDE PPT Pearson Working CapitalDocument58 pagesSLIDE PPT Pearson Working Capitaldheo pratamaNo ratings yet

- Assignment - 1 Time Value of MoneyDocument1 pageAssignment - 1 Time Value of MoneyPradnya WadiaNo ratings yet

- Financial Derivatives and Risk Management ExplainedDocument1 pageFinancial Derivatives and Risk Management Explainedmm1979No ratings yet

- IFM Notes Full Rudramurthy SirDocument96 pagesIFM Notes Full Rudramurthy Sirsagar_us100% (1)

- NPTEL Assign 4 Jan23 Behavioral and Personal FinanceDocument6 pagesNPTEL Assign 4 Jan23 Behavioral and Personal FinanceNitin Mehta - 18-BEC-030No ratings yet

- Rajkot District Co Operative LTD BankDocument133 pagesRajkot District Co Operative LTD BankNicholas CraigNo ratings yet

- Weightage Meaning & Factors, Calculation & Techniques For Distribution of Profit Under Mudaraba SystemDocument5 pagesWeightage Meaning & Factors, Calculation & Techniques For Distribution of Profit Under Mudaraba SystemMD. ANWAR UL HAQUENo ratings yet

- Seminar 12.2 Outline - Auditing of Group Financial Statements IIDocument6 pagesSeminar 12.2 Outline - Auditing of Group Financial Statements IIJasmine TayNo ratings yet

- Corporate Finance 22vaCRTlVYrpDocument8 pagesCorporate Finance 22vaCRTlVYrpAdityaSinghNo ratings yet

- Dataware Computer LTD.: Case StudyDocument16 pagesDataware Computer LTD.: Case StudyGaurang singhNo ratings yet

- Sensors: A Smartphone-Based Driver Safety Monitoring System Using Data FusionDocument17 pagesSensors: A Smartphone-Based Driver Safety Monitoring System Using Data FusionpravinNo ratings yet

- Consumer Protection ActDocument3 pagesConsumer Protection Actneeteesh_nautiyalNo ratings yet

- Neural NetworksDocument109 pagesNeural NetworksDerrick mac GavinNo ratings yet

- Sensors: A Smartphone-Based Driver Safety Monitoring System Using Data FusionDocument17 pagesSensors: A Smartphone-Based Driver Safety Monitoring System Using Data FusionpravinNo ratings yet

- Interview Questions For BMDocument15 pagesInterview Questions For BMSaurabh SumanNo ratings yet

- Banking QuestionareDocument3 pagesBanking Questionareneeteesh_nautiyalNo ratings yet

- Resume Financial AnalystDocument2 pagesResume Financial AnalystIshaq KhanNo ratings yet

- Refunds and Netting in R12Document5 pagesRefunds and Netting in R12Bernadette MulkeenNo ratings yet

- Shale Gas Market USA - Sample ReportDocument3 pagesShale Gas Market USA - Sample Reportneeteesh_nautiyalNo ratings yet

- The Banking Ombudsman Scheme 2006Document4 pagesThe Banking Ombudsman Scheme 2006neeteesh_nautiyalNo ratings yet

- Risk and Capital Budgeting DecisionsDocument21 pagesRisk and Capital Budgeting DecisionsSushma RajneeshNo ratings yet

- RBI MasterCircular Wilful DefaultersDocument17 pagesRBI MasterCircular Wilful Defaultersneeteesh_nautiyalNo ratings yet

- Final Banking ProjectDocument39 pagesFinal Banking Projectneeteesh_nautiyalNo ratings yet

- Supervision of The Indian Financial SystemDocument8 pagesSupervision of The Indian Financial Systemneeteesh_nautiyalNo ratings yet

- Para-Banking ActivitiesDocument14 pagesPara-Banking Activitiesneeteesh_nautiyalNo ratings yet

- Recommendations of The Goiporia CommitteeDocument7 pagesRecommendations of The Goiporia Committeeneeteesh_nautiyalNo ratings yet

- CGTMSEDocument1 pageCGTMSEneeteesh_nautiyalNo ratings yet

- Balance of Payment ComparisonDocument24 pagesBalance of Payment Comparisonneeteesh_nautiyalNo ratings yet

- Capital Account ConvertibilityDocument213 pagesCapital Account ConvertibilityPrashant SahniNo ratings yet

- SMEDocument36 pagesSMEneeteesh_nautiyalNo ratings yet

- RBI MasterCircular IRACDocument101 pagesRBI MasterCircular IRACneeteesh_nautiyalNo ratings yet

- Master Circular On Kyc AmlDocument70 pagesMaster Circular On Kyc AmlMeghendra MalviNo ratings yet

- MRP OverviewDocument6 pagesMRP OverviewRao KakaralaNo ratings yet

- Aptitude Paper Ion - Gate2010Document2 pagesAptitude Paper Ion - Gate2010hornlongliveNo ratings yet

- Resume FormatDocument5 pagesResume Formatneeteesh_nautiyalNo ratings yet

- Ec 2010Document16 pagesEc 2010Shubham KaushikNo ratings yet

- Flex VPNDocument3 pagesFlex VPNAnonymous nFOywQZNo ratings yet

- Rodriguez, Joseph Lorenz Ceit-08-402ADocument7 pagesRodriguez, Joseph Lorenz Ceit-08-402AJOSEPH LORENZ RODRIGUEZNo ratings yet

- Feedback Mechanism InstrumentDocument2 pagesFeedback Mechanism InstrumentKing RickNo ratings yet

- University of Texas at Arlington Fall 2011 Diagnostic Exam Text and Topic Reference Guide For Electrical Engineering DepartmentDocument3 pagesUniversity of Texas at Arlington Fall 2011 Diagnostic Exam Text and Topic Reference Guide For Electrical Engineering Departmentnuzhat_mansurNo ratings yet

- Virtual Content SOPDocument11 pagesVirtual Content SOPAnezwa MpetaNo ratings yet

- PNB V. Se, Et Al.: 18 April 1996 G.R. No. 119231 Hermosisima, JR., J.: Special Laws - Warehouse Receipts LawDocument3 pagesPNB V. Se, Et Al.: 18 April 1996 G.R. No. 119231 Hermosisima, JR., J.: Special Laws - Warehouse Receipts LawKelvin ZabatNo ratings yet

- Lessee Information StatementDocument1 pageLessee Information Statementmja.carilloNo ratings yet

- List of Registered Architects and Engineers As On 30-08-2010 PDFDocument10 pagesList of Registered Architects and Engineers As On 30-08-2010 PDFSaidhu MuhammedNo ratings yet

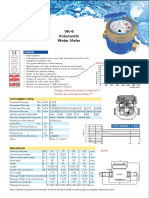

- Baylan: VK-6 Volumetric Water MeterDocument1 pageBaylan: VK-6 Volumetric Water MeterSanjeewa ChathurangaNo ratings yet

- Midterm Exam SolutionsDocument11 pagesMidterm Exam SolutionsPatrick Browne100% (1)

- Panameterics GF 868 Flare Gas Meter PDFDocument8 pagesPanameterics GF 868 Flare Gas Meter PDFDaniel DamboNo ratings yet

- Railway Reservation System Er DiagramDocument4 pagesRailway Reservation System Er DiagramPenki Sarath67% (3)

- Cambridge IGCSE: GEOGRAPHY 0460/13Document32 pagesCambridge IGCSE: GEOGRAPHY 0460/13Desire KandawasvikaNo ratings yet

- Chapter 2 FlywheelDocument24 pagesChapter 2 Flywheelshazwani zamriNo ratings yet

- Matching a Vendor's HRSG in THERMOFLEXDocument30 pagesMatching a Vendor's HRSG in THERMOFLEXRafraf EzdineNo ratings yet

- Crypto Is New CurrencyDocument1 pageCrypto Is New CurrencyCM-A-12-Aditya BhopalbadeNo ratings yet

- Desarmado y Armado de Transmision 950BDocument26 pagesDesarmado y Armado de Transmision 950Bedilberto chableNo ratings yet

- Opening A New Company in Bangladesh (FAQ)Document12 pagesOpening A New Company in Bangladesh (FAQ)nomanpur100% (1)

- A Survey of The Advancing Use and Development of Machine Learning in Smart ManufacturingDocument32 pagesA Survey of The Advancing Use and Development of Machine Learning in Smart Manufacturingbeben_19No ratings yet

- Chrysler Corporation: Service Manual Supplement 1998 Grand CherokeeDocument4 pagesChrysler Corporation: Service Manual Supplement 1998 Grand CherokeeDalton WiseNo ratings yet

- MEETING OF THE BOARD OF GOVERNORS Committee on University Governance April 17, 2024Document8 pagesMEETING OF THE BOARD OF GOVERNORS Committee on University Governance April 17, 2024Jamie BouletNo ratings yet

- Machine Problem 6 Securing Cloud Services in The IoTDocument4 pagesMachine Problem 6 Securing Cloud Services in The IoTJohn Karlo KinkitoNo ratings yet

- Group Assignment: Consumer Buying Behaviour Towards ChipsDocument3 pagesGroup Assignment: Consumer Buying Behaviour Towards ChipsvikasNo ratings yet

- ESA 7.6 Configuration GuideDocument460 pagesESA 7.6 Configuration GuideaitelNo ratings yet

- 22 Caltex Philippines, Inc. vs. Commission On Audit, 208 SCRA 726, May 08, 1992Document36 pages22 Caltex Philippines, Inc. vs. Commission On Audit, 208 SCRA 726, May 08, 1992milkteaNo ratings yet

- Detect Single-Phase Issues with Negative Sequence RelayDocument7 pagesDetect Single-Phase Issues with Negative Sequence RelayluhusapaNo ratings yet

- Kinds of ObligationDocument50 pagesKinds of ObligationKIM GABRIEL PAMITTANNo ratings yet