Professional Documents

Culture Documents

Microeconomics Homework

Uploaded by

Taylor TownsendOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Microeconomics Homework

Uploaded by

Taylor TownsendCopyright:

Available Formats

ECON 102.

1001 - Principles of Microeconomics Fall 2012

Mehmet S. Tosun

ECON 102 Homework 2 (Due by Thursday, November 1, 2012) (Answer All Questions on the Class Webcampus Page) 1. A local restaurant has estimated that the price elasticity of demand for meals is equal to 2. If the restaurant increases menu prices by 5%, they can expect the number of customers to decrease by ________and total revenue to ________. A) 10%; fall B) 10%; increase C) 2.5%; fall D) 5%; stay constant

2. On a linear demand curve: A) elasticity is the same at all points on the demand curve. B) demand is elastic at high prices. C) demand is elastic at low prices. D) demand is inelastic at high prices.

3. If the quantity demanded of agricultural output is very unresponsive to a fall in price, the demand for agricultural output is: A) horizontal. B) positively sloped. C) price-elastic. D) price-inelastic.

4. An important determinant of the price elasticity of demand is the: A) level of technology. B) availability of substitutes. C) quantity of the good supplied. D) price of related goods.

5. A newspaper typically consumes a smaller fraction of a consumer's budget than a home entertainment system. Therefore, you would expect the demand for: A) both to be equally price-elastic. B) newspapers to be more price-elastic. C) a home entertainment system to be more price-elastic. D) a home entertainment system to be more price-inelastic.

Page 1

ECON 102.003 - Principles of Microeconomics

Mehmet S. Tosun

6. To say that two goods are complements, their cross-price elasticities of demand should be: A) greater than 0. B) positive, yet almost equal to 0. C) less than 0. D) equal to 0.

7. Suppose the cross-price elasticity between demand for Burger King burgers and the price of McDonald's burgers is 0.8. If McDonald's increases the price of its burgers by 10%, then: A) Burger King will sell 8% more burgers. B) We cannot tell what will happen to Burger King, but McDonald's will sell 8% fewer burgers. C) Burger King will sell 10% more burgers. D) Burger King will sell 8% fewer burgers.

8. If your income increases and your consumption of bagels increases, other things equal, bagels are considered a(n): A) positive good. B) normal good. C) negative good. D) inferior good.

9. The price elasticity of supply is computed as the percentage change in: A) price divided by the percentage change in quantity supplied. B) quantity supplied divided by the percentage change in quantity demanded. C) quantity supplied divided by the percentage change in consumer income. D) quantity supplied divided by the percentage change in price.

10. Which of the following is true? A) If the price elasticity of supply is greater than 1, then supply is price-inelastic. B) If the price elasticity of supply is zero, then supply is price unit-elastic. C) If the price elasticity of supply is greater than 1, then quantity supplied is relatively unresponsive to price changes. D) If the price elasticity of supply is greater than 1, then supply is price-elastic.

Page 2

ECON 102.003 - Principles of Microeconomics

Mehmet S. Tosun

11. The long-run price elasticity of supply of crude oil is ________ the short-run price elasticity of supply of crude oil. A) equal to B) not comparable to C) greater than D) less than

12. A price floor will cause a larger surplus when demand is ________ and supply is ________. A) elastic; elastic B) elastic; inelastic C) perfectly inelastic; elastic D) inelastic; inelastic

13. Assume the supply curve shifts to the right by a given amount at each price. Price in the market will decline the most if demand is more: A) price-elastic and supply is more price-inelastic. B) price-elastic and supply is more price-elastic. C) price-inelastic and supply is more price-inelastic. D) price-inelastic and supply is more price-elastic.

14. Which of the following is an example of an excise tax? A) a one-time local government tax of $50 B) a tax on the value of your property C) a tax of $0.41 per gallon of gas D) a tax of 12.4% of your wages

15. State governments place excise taxes on cigarettes because: A) they want to reduce deadweight loss. B) it is an easy way to raise tax revenue while discouraging smoking. C) they want to subsidize tobacco farming. D) they want to discourage cigarette smuggling.

16. The incidence of a tax: A) is a measure of the deadweight loss from the tax. B) is a measure of the revenue the government receives from the tax. C) refers to who writes the check to the government. D) refers to who in reality pays the tax to the government.

Page 3

ECON 102.003 - Principles of Microeconomics

Mehmet S. Tosun

17. By law, FICA (the Federal Insurance Contributions Act), a payroll tax, is collected equally from the employers and the employees. In reality: A) it's impossible to determine who bears the burden of the tax. B) the law worksboth the employers and the employees bear half the burden of the tax. C) the employees bear almost all the burden of the tax. D) the employers bear almost all the burden of the tax.

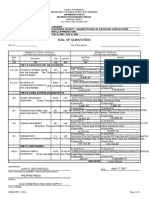

Use the following to answer questions 18-19:

18. (Table: Market for Fried Twinkies) The government decides to tax fried Twinkies at a rate of $0.30 per Twinkie and collect that tax from the producers. Using the table, the consumers will pay ________ per Twinkie and buy ________ Twinkies after the tax. A) $1.30; 7,000 B) $1.40; 6,000 C) $1.50; 5,000 D) $1.20; 8,000

19. (Table: Market for Fried Twinkies) From the table, of the $0.30 tax per fried Twinkie, consumers actually pay ________, while producers actually pay ________. A) $0.20; $0.10 B) $0.00; $0.30 C) $0.15; $0.15 D) $0.30; $0.00

Page 4

ECON 102.003 - Principles of Microeconomics

Mehmet S. Tosun

20. Suppose the price elasticity of demand for yachts equals 4.04, while the price elasticity of supply for yachts equals 0.22. If Congress reinstates a luxury tax on yachts, who will pay more of the tax? A) It's impossible to tell without additional information. B) Yacht builders and buyers will pay equally. C) Yacht builders will pay more. D) Yacht buyers will pay more.

Use the following to answer question 21: Figure: Market for Lattes

21. (Figure: Market for Lattes) If, in the market for lattes shown in the figure, the government assesses a tax of $0.75 on each latte, the price the consumer pays for a latte after the tax will: A) change, but we cannot determine by how much. B) increase from $2 to $2.25. C) increase from $2 to $2.75. D) increase from $2 to $2.50.

22. If demand is perfectly inelastic and the supply curve is upward-sloping, then the burden of an excise tax is: A) shared by consumers and producers, with the burden falling mainly on consumers. B) shared by consumers and producers, with the burden falling mainly on producers. C) borne entirely by producers. D) borne entirely by consumers.

Page 5

ECON 102.003 - Principles of Microeconomics

Mehmet S. Tosun

23. The governor wants to impose a $1 excise tax on some goodhe doesn't care which but he does want to minimize the deadweight loss. The deadweight loss will be least when: A) the demand is inelastic and supply is elastic. B) both demand and supply curves are elastic. C) both demand and supply are inelastic. D) the demand is elastic and supply is inelastic.

Use the following to answer question 24: Figure: The Gas Market

24. (Figure: The Gas Market) The figure represents the market for gasoline. An excise tax has been levied on each gallon of gasoline supplied by producers. Based on the graph, the incidence of the tax on suppliers is: A) $1. B) $0.50. C) $15,000. D) $1.50.

25. Criteria that economists use in selecting a tax system include: A) low revenue yield. B) only ability to pay. C) ability to pay and benefits received. D) only benefits received.

Page 6

ECON 102.003 - Principles of Microeconomics

Mehmet S. Tosun

26. A tax that takes a larger share of the income of high-income taxpayers than of lowincome taxpayers is called a: A) flat tax. B) sales tax. C) regressive tax. D) progressive tax.

27. Suppose Governor Meridias initiates a payroll tax of 10% on all income up to $50,000. Any income above $50,000 is not taxed. This payroll tax will be: A) regressive. B) structural. C) proportional. D) progressive.

28. Accounting profit differs from economic profit because: A) economic costs include depreciation, while accounting costs do not. B) accounting costs are generally higher than economic costs because accounting costs include explicit and implicit costs, while economic costs include only explicit costs. C) economic costs are generally higher than accounting costs because economic costs include all opportunity costs, while accounting costs include explicit costs only. D) of differences in the manner in which revenue is calculated.

29. For most firms, economic profit is: A) equal to accounting profit. B) greater than accounting profit. C) negative. D) less than accounting profit.

30. You own a small deli that sells sandwiches, salads, and soup to the community. Which of the following is an implicit cost of the business? A) the job offer you did not accept at a local catering service B) your monthly utility bill C) wages paid to part-time employees D) bread, meat, and vegetables used to produce the items on your menu

Page 7

ECON 102.003 - Principles of Microeconomics

Mehmet S. Tosun

31. Until recently Rosemarie worked as an accountant, earning $30,000 annually. Then she inherited a piece of commercial real estate that had been renting for $12,000 annually. Rosemarie decided to leave her job and operate a Peruvian restaurant in the space she inherited. At the end of the first year, her books showed total revenues of $260,000 and total costs of $230,000 for food, utilities, cooks, and other supplies. Her economic profit at the end of one year is: A) $0. B) $230,000. C) $12,000. D) $30,000.

32. The implicit cost of capital is: A) the opportunity cost of the capital used by a business. B) the cost of human capital. C) depreciation. D) the explicit cost of capital that the firm might have used but didn't need to.

33. Suppose the Chicago Cubs could rent out Wrigley Field (the field the players play on) to local youth leagues for $11,000 per month. The $11,000 per month reflects the ________ of capital. A) total cost B) implicit cost C) explicit cost D) direct cost 34. In economics a marginal value refers to: A) a value entered as an explanatory item in the margin of a balance sheet or other accounts. B) the value associated with one more unit of an activity. C) a value that is most appropriately identified in a footnote. D) the value associated with an unimportant, or marginal, activity.

35. The amount by which an additional unit of an activity increases total benefit is: A) marginal benefit. B) utility. C) net benefit. D) marginal cost.

Page 8

ECON 102.003 - Principles of Microeconomics

Mehmet S. Tosun

36. Whenever MB > MC, the decision maker should do ________ of the activity. A) none B) more C) less D) the same amount

37. To maximize her grade in economics, Stacey should study until: A) her marginal benefit of studying begins to decrease. B) her marginal cost of studying reaches zero. C) her marginal cost of studying begins to increase. D) her marginal benefit of studying equals her marginal cost of studying.

38. William installs custom sound systems in cars. If he installs seven systems per day, his total costs are $300. If he installs eight systems per day, his total costs are $400. William will install only eight sound systems per day if the eighth customer is willing to pay at least: A) $50. B) $100. C) $300. D) $400.

39. According to the optimal output rule, if marginal benefit: A) is less than marginal cost, an activity should be reduced. B) is equal to marginal cost, an activity should be reduced. C) exceeds marginal cost, net benefit is maximized. D) exceeds marginal cost, an activity should be reduced.

Page 9

ECON 102.003 - Principles of Microeconomics

Mehmet S. Tosun

Use the following to answer question 40: Figure: Marginal Analysis of Good X

40. (Figure: Marginal Analysis of Good X) You are considering consuming units of Good X. The graph represents your marginal benefit and marginal cost curves. How many units of Good X will you consume? A) 2 B) 3 C) 4 D) 1

41. You have won the lottery and have been given the choice of receiving $5 million today or $10 million after 10 years. Assume that the interest rate remains fixed at 10% per year for the entire 10-year period. You should choose: A) $10 million after 10 years, since that is a larger amount than the present value of $5 million paid after 10 years. B) $5 million today, since it would be worth more than $10 million after 10 years, if the $5 million earned interest at the rate of 10% per year. C) $10 million after 10 years, since it is the larger amount. D) $10 million after 10 years, since this is more than you would get if you invested $5 million for 10 years at an annual rate of interest of 10%.

Page 10

ECON 102.003 - Principles of Microeconomics

Mehmet S. Tosun

Use the following to answer question 42:

42. (Table: Present Value of Projects A, B, C, and D) Given the information in the accompanying table, if the interest rate were 2%, which project would you choose? A) B B) C C) D D) A

43. The marginal utility of coffee consumption for Steve is the change in ________ generated by consuming an additional unit of coffee. A) total demand B) total utility C) price D) total consumption

44. The principle of diminishing marginal utility states that as an individual consumes more of a good: A) the total utility obtained will eventually become negative. B) the addition to total utility obtained from the nth unit of the good will be less than that obtained from the (n 1) unit of the good. C) the marginal utility will eventually become negative. D) the total utility obtained will eventually fall.

Use the following to answer questions 45-46:

Page 11

ECON 102.003 - Principles of Microeconomics

Mehmet S. Tosun

45. (Table: Utility) The marginal utility for the second unit is: A) 15. B) 10. C) 5. D) 35.

46. (Table: Utility) Total utility is maximized at the ________ unit. A) sixth B) fourth C) first D) second

47. When total utility is at a maximum, marginal utility is: A) zero. B) at a maximum. C) rising. D) at its average value.

48. Utility is the: A) satisfaction consumers derive from their consumption of goods and services. B) lowest price that buyers are willing to pay for a given quantity of a good. C) good not adequately provided by a free market and usually provided by the government. D) difference between a firm's total revenue and its total economic cost.

49. Chuck spends all his income on two goods: tacos and milkshakes. His income is $100, the price of tacos is $10, and the price of milkshakes is $2. If Chuck purchases 10 milkshakes, he can purchase ________ tacos. A) 8 B) 10 C) 18 D) 50

50. For Darryl, the optimum consumption bundle is the one that ________ his ________, given his budget constraint. A) minimizes; opportunity cost B) maximizes; opportunity cost C) minimizes; utility D) maximizes; utility

Page 12

ECON 102.003 - Principles of Microeconomics

Mehmet S. Tosun

Answer Key

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. A B D B C C A B D D C A C C B D C C A C B D C B C D A C D A C A B B A B D B A C B D B B

Page 13

ECON 102.003 - Principles of Microeconomics

Mehmet S. Tosun

45. 46. 47. 48. 49. 50.

A B A A A D

Page 14

You might also like

- AP Macroeconomics Review Sheet 2013Document7 pagesAP Macroeconomics Review Sheet 2013Crystal Farmer100% (4)

- Micro Formula PacketDocument2 pagesMicro Formula Packetlhv48No ratings yet

- The Everything Economics Book: From theory to practice, your complete guide to understanding economics todayFrom EverandThe Everything Economics Book: From theory to practice, your complete guide to understanding economics todayRating: 3 out of 5 stars3/5 (2)

- Microeconomics Test Bank and Solutions ManualDocument7 pagesMicroeconomics Test Bank and Solutions ManualTestBank0% (13)

- Economics Cheat SheetDocument5 pagesEconomics Cheat Sheetcaitobyrne341275% (4)

- AP Macroeconomics TestDocument10 pagesAP Macroeconomics TestTomMusic100% (1)

- MicroeconomicsDocument10 pagesMicroeconomicsVishal Gattani100% (5)

- Macroeconomics National Income Accounting PDFDocument15 pagesMacroeconomics National Income Accounting PDFmayur2510.20088662No ratings yet

- Macroeconomics Key GraphsDocument5 pagesMacroeconomics Key Graphsapi-243723152No ratings yet

- Drilling Workover ManualDocument187 pagesDrilling Workover Manualmohammed100% (1)

- Microeconomics Summary NotesDocument14 pagesMicroeconomics Summary NotesNg Chai SheanNo ratings yet

- Economics Practice ExamDocument33 pagesEconomics Practice ExamMelissa Douglas100% (1)

- MicroEconomics Study NotesDocument12 pagesMicroEconomics Study Notesthiotakis100% (4)

- IBA Sindh Foundation Economics NotesDocument31 pagesIBA Sindh Foundation Economics Notessalmanahmed_hyd100% (3)

- Comparing economic progress using per capita income growth ratesDocument11 pagesComparing economic progress using per capita income growth ratesIAs100% (1)

- Microeconomics Notes (Advanced)Document98 pagesMicroeconomics Notes (Advanced)rafay010100% (1)

- 90,95,2000 Macro Multiple ChoiceDocument37 pages90,95,2000 Macro Multiple ChoiceAaron TagueNo ratings yet

- Microeconomics HomeworkDocument16 pagesMicroeconomics HomeworkTaylor Townsend100% (1)

- Intermediate Microeconomics Exam 1Document6 pagesIntermediate Microeconomics Exam 1Chet GemaehlichNo ratings yet

- Solutions For MicroeconomicsDocument4 pagesSolutions For MicroeconomicsagsanghaniNo ratings yet

- Chapter 5-Elasticity Multiple ChoiceDocument33 pagesChapter 5-Elasticity Multiple ChoiceBriceHong100% (4)

- Microeconomics - ECO402 Final Term QuizDocument28 pagesMicroeconomics - ECO402 Final Term QuizSuleyman KhanNo ratings yet

- Study Questions for Exam 1 Chapter 1-2Document33 pagesStudy Questions for Exam 1 Chapter 1-2Ahmed MahmoudNo ratings yet

- Micro vs Macro: Intro to Macroeconomics ConceptsDocument8 pagesMicro vs Macro: Intro to Macroeconomics Conceptsmurtaza mannan50% (2)

- Business CycleDocument14 pagesBusiness CycleThiện Thảo67% (3)

- Price Cielings and Price FloorDocument54 pagesPrice Cielings and Price FloorKrish KumarNo ratings yet

- Answer DashDocument6 pagesAnswer DashJeffrey AmitNo ratings yet

- Microeconomics SummaryDocument22 pagesMicroeconomics SummaryChristie Osarenren100% (1)

- MCQ. Production Possibility FrontierDocument2 pagesMCQ. Production Possibility FrontierNikoleta Trudov40% (5)

- Principles of Macroeconomics Final Exam Practice: Part One: Multiple Choices: Circle The Most Appropriate AnswerDocument8 pagesPrinciples of Macroeconomics Final Exam Practice: Part One: Multiple Choices: Circle The Most Appropriate AnswerKhalid Al Ali100% (2)

- Microeconomics Chapter 2 Multiple Choice Test BankDocument32 pagesMicroeconomics Chapter 2 Multiple Choice Test BankAyesha KanwalNo ratings yet

- Test Bank for Introductory Economics: And Introductory Macroeconomics and Introductory MicroeconomicsFrom EverandTest Bank for Introductory Economics: And Introductory Macroeconomics and Introductory MicroeconomicsRating: 5 out of 5 stars5/5 (1)

- Chapter 6 MULTIPLE-CHOICE QUESTIONSDocument6 pagesChapter 6 MULTIPLE-CHOICE QUESTIONSHabiba MohamedNo ratings yet

- Microeconomics Sample Practice Multiple Choice QuestionsDocument10 pagesMicroeconomics Sample Practice Multiple Choice QuestionsManohar Reddy86% (59)

- Quiz 1 - Microeconomics Pindyck and Rubinfeld MCQ QuestionsDocument3 pagesQuiz 1 - Microeconomics Pindyck and Rubinfeld MCQ Questionsanusha500100% (3)

- Basic Economic Ideas: Opportunity Cost.Document37 pagesBasic Economic Ideas: Opportunity Cost.huzaifathe007100% (2)

- MR MOYO'S ECONOMICS REVISION NOTESDocument30 pagesMR MOYO'S ECONOMICS REVISION NOTESFaryalNo ratings yet

- Private Equity Real Estate FirmsDocument13 pagesPrivate Equity Real Estate FirmsgokoliNo ratings yet

- Introduction To Microeconomics NotesDocument26 pagesIntroduction To Microeconomics NotesChristine Keh100% (2)

- AP Macroeconomics Study SheetDocument3 pagesAP Macroeconomics Study SheetepiphanyyNo ratings yet

- Revision QuestionDocument19 pagesRevision QuestionSharina DailamyNo ratings yet

- Tesda Perpetual and Periodic Inventory SystemsDocument6 pagesTesda Perpetual and Periodic Inventory Systemsnelia d. onteNo ratings yet

- Microeconomics Econ 101Document164 pagesMicroeconomics Econ 101Alphá Kídd100% (1)

- Principles of EconomicsDocument27 pagesPrinciples of EconomicsAqil Siddiqui100% (2)

- Exam1 Practice Exam SolutionsDocument37 pagesExam1 Practice Exam SolutionsSheehan T Khan100% (3)

- Introduction To MicroeconomicsDocument107 pagesIntroduction To Microeconomicsmoza100% (1)

- Mama's AssignmentDocument34 pagesMama's AssignmentUche Aquilina OzegbeNo ratings yet

- Elasticity GuideDocument4 pagesElasticity Guidenreid2701100% (2)

- Macroeconomics Canadian 8th Edition by Sayre and Morris Solution ManualDocument67 pagesMacroeconomics Canadian 8th Edition by Sayre and Morris Solution Manualkevaxt100% (1)

- Principles of Microeconomics - SyllabusDocument10 pagesPrinciples of Microeconomics - SyllabusKatherine Sauer0% (1)

- Microeconomics: (S A M (P 1) )Document3 pagesMicroeconomics: (S A M (P 1) )Niaz MahmudNo ratings yet

- IB Economics Revision Guide: Macroeconomics EssentialsDocument19 pagesIB Economics Revision Guide: Macroeconomics EssentialsPaola Fernanda Montenegro100% (3)

- FLYFokker Fokker 70 Leaflet - 1Document4 pagesFLYFokker Fokker 70 Leaflet - 1FredyBrizuelaNo ratings yet

- Roadmap Highlight of Sdgs Indonesia - FinalDocument124 pagesRoadmap Highlight of Sdgs Indonesia - Finalthedvx389100% (1)

- 6 - Supply Change ManagementDocument19 pages6 - Supply Change ManagementWall JohnNo ratings yet

- Chapters 5-8 Microeconomics Test Review QuestionsDocument157 pagesChapters 5-8 Microeconomics Test Review Questionscfesel4557% (7)

- Mock Test Questions Micro e ConsDocument10 pagesMock Test Questions Micro e Conscalz..100% (1)

- More Multiple Choice Questions With AnswersDocument14 pagesMore Multiple Choice Questions With AnswersJudz Sawadjaan100% (2)

- Microeconomics Practice Multiple Choice Questions PDFDocument48 pagesMicroeconomics Practice Multiple Choice Questions PDFJoseph King100% (1)

- Macroeconomics Midterm 2013Document19 pagesMacroeconomics Midterm 2013Daniel Welch100% (1)

- Principles of Micro Economics MCQsDocument7 pagesPrinciples of Micro Economics MCQsnatrix029100% (3)

- Business Economics 2015 Quiz 3 AnswersDocument3 pagesBusiness Economics 2015 Quiz 3 Answersanusha50067% (3)

- Intermediate Microeconomics Quiz 2Document5 pagesIntermediate Microeconomics Quiz 2paterneNo ratings yet

- Principles of Macroeconomics Practice AssignmentDocument4 pagesPrinciples of Macroeconomics Practice AssignmentAnonymous xUb9GnoFNo ratings yet

- Visa Cashless Cities ReportDocument68 pagesVisa Cashless Cities ReportmikeNo ratings yet

- BELENDocument22 pagesBELENLuzbe BelenNo ratings yet

- Kotler On Marketing How To Create Win and DominateDocument8 pagesKotler On Marketing How To Create Win and DominateDhimas Angga AryadinataNo ratings yet

- International Market SegmentationDocument9 pagesInternational Market SegmentationYashodara Ranawaka ArachchigeNo ratings yet

- Bylaws Gulf Shores Association IncDocument9 pagesBylaws Gulf Shores Association IncTeena Post/LaughtonNo ratings yet

- By: John Paul Diaz Adonis Abapo Alvin Mantilla James PleñosDocument9 pagesBy: John Paul Diaz Adonis Abapo Alvin Mantilla James PleñosRhea Antonette DiazNo ratings yet

- Botswana Review 2010Document176 pagesBotswana Review 2010BrabysNo ratings yet

- Global Trends AssignmentDocument9 pagesGlobal Trends Assignmentjan yeabuki100% (2)

- Kunal Uniforms CNB TxnsDocument2 pagesKunal Uniforms CNB TxnsJanu JanuNo ratings yet

- RubricsDocument2 pagesRubricsScarlette Beauty EnriquezNo ratings yet

- 17FG0045 BoqDocument2 pages17FG0045 BoqrrpenolioNo ratings yet

- International-Organisation List NotesDocument62 pagesInternational-Organisation List NotesVINOD KUMARNo ratings yet

- Project Report SSIDocument140 pagesProject Report SSIharsh358No ratings yet

- Tony Tan Caktiong – Jollibee founderDocument6 pagesTony Tan Caktiong – Jollibee founderRose Ann0% (1)

- Lavanya Industries Tool Manufacturing Facility ProfileDocument11 pagesLavanya Industries Tool Manufacturing Facility ProfilepmlmkpNo ratings yet

- The New Progressive Agenda: Peter MandelsonDocument8 pagesThe New Progressive Agenda: Peter MandelsonLoriGirlNo ratings yet

- Product Highlight Sheet-Retire SmartDocument3 pagesProduct Highlight Sheet-Retire SmartLU HERRERANo ratings yet

- English Essay On 2007/2008 Financial CrisisDocument6 pagesEnglish Essay On 2007/2008 Financial CrisisMahmudul HasanNo ratings yet

- Stock DividendsDocument7 pagesStock DividendsShaan HashmiNo ratings yet

- Cleared OTC Interest Rate Swaps: Security. Neutrality. TransparencyDocument22 pagesCleared OTC Interest Rate Swaps: Security. Neutrality. TransparencyAbhijit SenapatiNo ratings yet

- Sisig HoorayDocument3 pagesSisig HoorayMaria Freyja Darlene CruzNo ratings yet

- Quan Tri TCQTDocument44 pagesQuan Tri TCQTHồ NgânNo ratings yet