Professional Documents

Culture Documents

PorterSM05final FinAcc

Uploaded by

Gemini_0804Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PorterSM05final FinAcc

Uploaded by

Gemini_0804Copyright:

Available Formats

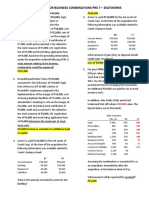

CHAPTER 5 Inventories and Cost of Goods Sold

OVERVIEW OF EXERCISES, PROBLEMS, AND CASES

Learning Outcomes Exercises Estimated Time in Minutes Level

1. Identify the forms of inventory held by different types of businesses and the types of costs incurred. 2. Show that you understand how wholesalers and retailers account for sales of merchandise.

1 2 3 4 20* 21* 5 6 7 8 9 20* 21*

10 10 25 10 25 15 15 20 25 20 15 25 15

Easy Mod Mod Easy Mod Mod Easy Mod Mod Mod Mod Mod Mod

3. Show that you understand how wholesalers and retailers account for cost of goods sold.

4. Use the gross profit ratio to analyze a companys ability to cover its operating expenses and earn a profit. 5. Explain the relationship between the valuation of inventory and the measurement of income. 6. Apply the inventory costing methods of specific identification, weighted average, FIFO, and LIFO using a periodic system. 7. Analyze the effects of the different costing methods on inventory, net income, income taxes, and cash flow. 8. Analyze the effects of an inventory error on various financial statement items. 9. Apply the lower-of-cost-or-market rule to the valuation of inventory. 10. Explain why and how the cost of inventory is estimated in certain situations. 10 23* 11 22* 12 22* 24* 13 14 23* 15 15 20 20 25 15 25 40 25 20 20 20 Mod Mod Easy Mod Mod Mod Mod Mod Mod Mod Mod

5-1

5-2

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

Learning Outcomes (Continued)

Exercises

Estimated Time in Minutes

Level

11. Analyze the management of inventory. 12. Explain the effects that inventory transactions have on the statement of cash flows. 13. Explain the differences in the accounting for periodic and perpetual inventory systems and apply the inventory costing methods using a perpetual system. (Appendix) *Exercise, problem, or case covers two or more learning outcomes Level = Difficulty levels: Easy; Moderate (Mod); Difficult (Diff)

16 17 18 19 24*

20 10 15 15 40

Mod Easy Mod Mod Mod

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-3

Learning Outcomes

Problems and Alternates

Estimated Time in Minutes

Level

1. Identify the forms of inventory held by different types of businesses and the types of costs incurred. 2. Show that you understand how wholesalers and retailers account for sales of merchandise. 3. Show that you understand how wholesalers and retailers account for cost of goods sold. 4. Use the gross profit ratio to analyze a companys ability to cover its operating expenses and earn a profit. 5. Explain the relationship between the valuation of inventory and the measurement of income.

1 15* 8* 9* 10* 8* 9* 10* 2 9* 11* 12* 13* 14* 11* 13* 14* 3 11* 12* 13* 14* 15* 16* 4 15* 16* 5 6 7 8* 12*

25 20 45 40 40 45 40 40 25 40 45 60 30 30 45 30 30 20 45 60 30 30 20 20 45 20 20 20 30 25 45 60

Mod Mod Mod Mod Mod Mod Mod Mod Mod Mod Mod Diff Mod Mod Mod Mod Mod Mod Mod Diff Mod Mod Mod Mod Diff Mod Mod Mod Mod Mod Mod Diff

6. Apply the inventory costing methods of specific identification, weighted average, FIFO, and LIFO using a periodic system. 7. Analyze the effects of the different costing methods on inventory, net income, income taxes, and cash flow.

8. Analyze the effects of an inventory error on various financial statement items. 9. Apply the lower-of-cost-or-market rule to the valuation of inventory. 10. Explain why and how the cost of inventory is estimated in certain situations. 11. Analyze the management of inventory. 12. Explain the effects that inventory transactions have on the statement of cash flows. 13. Explain the differences in the accounting for periodic and perpetual inventory systems and apply the inventory costing methods using a perpetual system. (Appendix) *Exercise, problem, or case covers two or more learning outcomes Level = Difficulty levels: Easy; Moderate (Mod); Difficult (Diff)

5-4

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

Learning Outcomes

Cases

Estimated Time in Minutes

Level

1. Identify the forms of inventory held by different types of businesses and the types of costs incurred. 2. Show that you understand how wholesalers and retailers account for sales of merchandise.

1* 3* 1* 4* 5* 9 1* 4* 5* 6 4* 5*

25 25 25 20 20 30 25 20 20 25 20 20

Mod Mod Mod Mod Mod Mod Mod Mod Mod Mod Mod Mod

3. Show that you understand how wholesalers and retailers account for cost of goods sold.

4. Use the gross profit ratio to analyze a companys ability to cover its operating expenses and earn a profit. 5. Explain the relationship between the valuation of inventory and the measurement of income. 6. Apply the inventory costing methods of specific identification, weighted average, FIFO, and LIFO using a periodic system. 7. Analyze the effects of the different costing methods on inventory, net income, income taxes, and cash flow. 8. Analyze the effects of an inventory error on various financial statement items. 9. Apply the lower-of-cost-or-market rule to the valuation of inventory. 10. Explain why and how the cost of inventory is estimated in certain situations. 11. Analyze the management of inventory. 12. Explain the effects that inventory transactions have on the statement of cash flows. 13. Explain the differences in the accounting for periodic and perpetual inventory systems and apply the inventory costing methods using a perpetual system. (Appendix) *Exercise, problem, or case covers two or more learning outcomes Level = Difficulty levels: Easy; Moderate (Mod); Difficult (Diff)

3* 7* 2 7* 10 8 3* 11

25 40 25 40 30 30 25 30

Mod Mod Mod Mod Mod Mod Mod Mod

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-5

QUESTIONS 1. The three distinct types of costs incurred by a manufacturer are direct materials, direct labor, and manufacturing overhead. Direct, or raw, materials are the ingredients used in making a product. Direct labor consists of the amounts paid to factory workers to manufacture the product. Manufacturing overhead includes all the other costs that are related to the manufacturing process but cannot be directly matched to specific units of output. 2. The use of a contra revenue account to record cash refunds and other types of allowances allows a company to monitor the size and frequency of these occurrences. For example, a relatively large amount of returns in any one period may be an indication that the quality of the product has slipped. The information provided by the use of these contra revenue accounts would be lost if all returns and allowances were recorded as reductions of the Sales Revenue account. Also, if this practice were followed, the actual amount of sales would be understated for the period to the extent of any returns and allowances. 3. Terms of 3/20, net 60, mean that the customer may deduct 3% from the selling price if the bill is paid within twenty days. Otherwise, the full amount is due within 60 days of the date of the invoice. Assuming a sale for $1,000, a 3% discount would save the customer $30, resulting in a net amount due of $970. The amount saved is the result of paying 40 days earlier than is required by the 60-day term. Assuming 360 days in a year, there are 360/40, or 9 periods of 40 days each, in a year. Thus, a savings of $30 for 40 days is equivalent to a savings of $30 9, or $270 for the year. This is equivalent to an annual return of $270/$970, or 27.8%. 4. The two inventory systems differ with respect to how often the inventory account is updated. Under the perpetual system, the account is updated each time a sale or purchase is made. With the periodic system, the inventory account is updated only at the end of the period. A temporary account, called Purchases, is used to keep track of the acquisitions of inventory during the period. The periodic method relies on a count of the inventory on hand at the end of the period to determine the amount to assign to ending inventory on the balance sheet and to cost of goods sold expense on the income statement. 5. A point-of-sale terminal gives the merchandiser the ability to update the inventory records each time a sale is made. As an item is run over the sensing glass, a bar code on the product is read by the computer. In this way, the unit can be removed from the inventory at the point of sale. In some instances, however, merchandisers use the terminals only to update the quantity of units on hand, not necessarily the dollar amount. 6. The Purchases account is neither an asset nor an expense account. It is simply a temporary holding account for the purchases of merchandise, which is closed at the end of the period. The effect of purchases made during the period is to increase the cost of goods sold expense.

5-6

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

7. For inventory in transit at the end of the year, the terms of shipment dictate whether the buyer should record the purchase of the inventory. FOB shipping point means that the goods belong to the buyer as soon as they are shipped, and the purchases should be recorded at this point in time. Alternatively, FOB destination point means that the goods do not belong to the buyer until they are received and therefore should not be recorded if they are in transit at year end. 8. Transportation-in represents the freight costs incurred on purchases of merchandise and is therefore added to the purchases of the period in determining cost of goods sold expense. Alternatively, transportation-out indicates the freight costs incurred in selling merchandise and is therefore reported as a selling expense on the income statement in the period of sale. 9. Gross profit is computed by deducting cost of goods sold from net sales. The gross profit ratio indicates how well the company controlled its product costs during the year. For example, a 30% gross profit ratio indicates that for every dollar of sales the company has a gross profit of 30 cents. That is, after deducting 70 cents on every dollar for the cost of the inventory that is sold, the company has 30 cents to cover its operating costs and earn a profit. 10. According to the cost of goods sold model, beginning inventory plus purchases minus ending inventory equals cost of goods sold. Therefore, the amount assigned to inventory on the balance sheet has a direct effect on the measurement of cost of goods sold on the income statement. Any errors in valuing inventory will flow through to cost of goods sold and thus have an impact on the measurement of net income. 11. The justification for treating freight costs on incoming inventory as a cost incurred in acquiring the asset, rather than as an expense of the period, is the matching principle. Freight costs are necessary to put the inventory into a position to be sold and should therefore be included in the cost of the asset. This is a significant decision, since the cost will become an expense only at the time the inventory is sold. If freight costs are not included in the cost of the inventory, they are expensed immediately as they are incurred. Thus, if the inventory is not sold at the end of the period, the decision to treat freight costs as a cost of the inventory will result in higher net income than if the costs had been included as an expense of the period. 12. The specific identification method is appropriate only for certain types of inventory. It is normally used for situations in which the inventory is relatively high-priced and subject to a low amount of turnover. Although it is not a necessary condition, each unit of inventory is often unique. For example, an automobile dealer uses the specific identification method, as would a jewelry company.

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-7

13. When used on an inventory of identical units, the specific identification can lead to the manipulation of income. Because all units are identical, management can select which units to sell based on the relative high or low cost of the units on hand. For example, in a bad year a company might be tempted to select for sale all units that had a relatively low unit cost, regardless of when they were acquired. The use of a cost flow assumption, such as weighted average, FIFO, or LIFO, eliminates the ability of management to select units for sale based solely on the effect this decision will have on the income of the period. 14. The weighted average cost method does not rely on a simple arithmetic average of the unit cost for the various purchases of the period. Instead, more weight is assigned to unit costs for which more units were purchased. For example, assume that beginning inventory consists of 100 units with a unit cost of $10 per unit. Assume that during the period, 100 units were purchased at $15 per unit, and 200 units were purchased at $20 per unit. The arithmetic average unit cost for the period would be ($10 + $15 + $20)/3 = $15. However, the weighted average unit cost would be [100($10) + 100 ($15) + 200($20)]/400 units, or $16.25. The acquisition of twice as many units at $20 as opposed to those purchased at $10 and $15 drives the weighted average up to $16.25. 15. The FIFO method more nearly approximates the physical flow of products in most businesses. This is particularly true for perishable products, such as fresh fruits and vegetables. Most businesses prefer as a matter of good customer relations to sell their goods on a first-in, first-out basis. This minimizes the likelihood that units of inventory will become obsolete and spoiled. 16. The use of LIFO will have the effect of maximizing net income if a company is experiencing a decline in the unit cost of inventory. Last-in, first-out charges the most recent purchases to cost of goods sold. If prices are declining, the amounts charged to cost of goods sold will be less than if either the weighted average method or FIFO was used. Because less is charged to cost of goods sold, net income will be higher. 17. In a period of rising prices, the use of LIFO will result in a lower tax bill. Because the most recent purchases are charged to cost of goods sold under LIFO, in a period of rising prices, these units will be higher-priced, and thus the result will be lower gross margin as well as lower net income before tax. Lower net income will result in a lower amount of tax to pay. If prices are declining during the period, FIFO will result in a lower tax bill. 18. No, the president should not be enthralled with the new controller. The controller is suggesting something that is not allowed under the tax law. The Internal Revenue Services LIFO conformity rule requires that a company that wants to use LIFO for tax purposes must also use it in preparing its income statement.

5-8

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

19. A LIFO liquidation occurs when a company using the LIFO inventory method sells more units during the period than it purchases. A liquidation of some or all of the older, relatively lower priced units (assuming rising prices) will result in a low cost of goods sold amount and a correspondingly higher gross margin. This may present a dilemma to a company. If the company sells the lower-priced units, its net income will improve, but higher taxes will have to be paid. To avoid facing this situation, a company might buy inventory at the end of the year to avoid these consequences of a liquidation. Unfortunately, the somewhat forced purchase of inventory to avoid the liquidation may not be in the best interests of the company. 20. In a period of rising prices, FIFO can result in significant inventory profits. In comparison with LIFO, the use of FIFO charges less to cost of goods sold because it is the older, lower-priced units that are assumed to be sold. However, in a period of significant inflation, there may be a large difference between the gross margin that results from using FIFO and the much smaller amount that would result from using the current cost of the inventory (replacement cost). This difference, called inventory profit, is simply the result of holding the units during a period of inflation. 21. No, it is not acceptable for a company to indicate to its stockholders that it is switching to LIFO to save on taxes. While the ability to save taxes may be an important result of the change, the company must be able to demonstrate that LIFO does a better job of matching costs with revenues. This is normally the justification offered in the annual report for a companys change to LIFO. 22. Because a certain section of the warehouse is double-counted, ending inventory will be overstated. According to the cost of goods sold model, ending inventory is subtracted from cost of goods available to sell to arrive at cost of goods sold expense. Therefore, an overstatement of ending inventory will lead to an understatement of cost of goods sold expense. An understatement of an expense results in an overstatement of net income for the period. 23. The lower-of-cost-or-market rule is invoked when the utility of inventory is less than its cost to the company. It is a departure from the historical cost principle and is justified on the basis of conservatism. The rule is a reaction to uncertainty by anticipating a decline in the value of inventory and writing down the asset currently before it is sold. 24. Application of the lower-of-cost-or-market rule on a total basis, compared with an item-by-item basis, will usually yield a different result. The reason is that with the total approach, increases in market value above cost are allowed to offset decreases in value. Alternatively, when the item-by-item approach is used, any increases in value are essentially ignored, and it is the declines in value for each item that are recognized. 25. A company using the periodic inventory system could undoubtedly save money by estimating its year-end inventory and thus avoiding the expense of counting it. However, the inventory must be based on actual cost, not an estimate, for purposes of the annual report.

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-9

26. A retailer can save time and money at the end of the year by simply counting the number of units of each item of inventory and multiplying each of these counts by the price marked on the units (that is, the retail price). This process gives the company an amount that represents the value of the inventory at retail. The retail method is then used to convert this amount to cost. It would be prohibitive for many retailers, particularly mass merchandisers, to trace the unit cost of each item of inventory to purchase invoices. 27. Inventory turnover equals cost of goods sold (cost of sales) divided by average inventory. If the cost of sales remains constant while the denominator (average inventory) increases, inventory turnover will decrease. This indicates that inventory is staying on the shelf for a longer time. The company should probably evaluate the salability of its inventory. 28. When a perpetual inventory system is used, the dollar amount of inventory is calculated after each sale. Thus, when it is used in conjunction with the weighted average costing method, a new average cost is calculated after each sale. The weighted average changes each time a sale is made, and therefore the unit cost is called a moving average.

EXERCISES LO 1

EXERCISE 5-1 CLASSIFICATION OF INVENTORY COSTS

Inventory Item Fabric Lumber Unvarnished tables Chairs on the showroom floor Cushions Decorative knobs Drawers Sofa frames Chairs in the plant warehouse Chairs in the retail storeroom

Raw Material X X X X

Work in Process

Finished Merchandise Goods Inventory

X X X* X X X X

*Cushions produced by the company would be work in process, but if purchased from a supplier, they would be raw materials.

5-10

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

LO 1

EXERCISE 5-2 INVENTORIABLE COSTS

List price: $100 200 units Less: 10% volume discount Freight costs Insurance for goods in transit Total cost

$20,000 (2,000) 56 32 $18,088

Under the cost principle, all of these costs are necessary to put the inventory into a position where it can be sold. Other classifications: The phone charges and purchasing department salary would both be difficult to match directly with the sale of any particular product and therefore should be treated as operating expenses of the period. The labeling supplies are immaterial in amount and should also be reported as operating expenses. The interest paid to suppliers is a financing cost and would be reported as interest expense on the income statement.

LO 2

EXERCISE 5-3 PERPETUAL AND PERIODIC INVENTORY SYSTEMS

1. Company A is using a perpetual inventory system because it has the account Cost of Goods Sold. Company B is using the periodic inventory system because it uses the accounts Purchases, Purchase Discounts, and Purchase Returns and Allowances. 2. Company As end of the year inventory is the balance in its merchandise inventory account, $12,000. Its cost of goods sold is $38,000, the balance in that account. 3. Cost of goods sold in a periodic system is computed as: Beginning inventory + net purchases ending inventory. Company Bs merchandise inventory account represents beginning inventory. Ending inventory is obtained by conducting a physical count. Because you are not given the ending inventory figure, you cannot compute cost of goods sold.

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-11

LO 2

EXERCISE 5-4 PERPETUAL AND PERIODIC INVENTORY SYSTEMS

PerpetualAppliance store PerpetualCar dealership PeriodicDrugstore PerpetualFurniture store PeriodicGrocery store PeriodicHardware store PerpetualJewelry store Changes in technology may lessen the costs of maintaining perpetual inventory systems. Merchandisers will convert to perpetual inventory systems when the benefits of maintaining such systems exceed the costs.

LO 3 Case 1:

EXERCISE 5-5 MISSING AMOUNTS IN COST OF GOODS SOLD MODEL

(a) Beginning inventory: cost of goods available for sale cost of goods purchased = $7,110 ($6,230 $470 $200 + $150) = $7,110 $5,710 = $1,400 (b) Ending inventory: cost of goods available for sale cost of goods sold = $7,110 $5,220 = $1,890 Case 2: (must first solve d, then c) (d) Cost of goods available for sale: cost of goods sold + ending inventory = $5,570 + $1,750 = $7,320 (c) Purchase discounts: 1. Cost of goods available for sale beginning inventory = cost of goods purchased = $7,320 $2,350 = $4,970 2. Gross purchases purchase returns and allowances purchase discounts + transportation-in = cost of goods purchased; $5,720 $800 purchase discounts + $500 = $4,970; purchase discounts = $5,420 $4,970 = $450

5-12

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

Case 3: (e) Gross purchases: 1. Cost of goods purchased = cost of goods available for sale beginning inventory = $8,790 $1,890 = $6,900 2. Gross purchases purchase returns and allowances purchase discounts + transportation-in = cost of goods purchased; gross purchases $550 $310 + $420 = $6,900; gross purchases = $6,900 + $550 + $310 $420 = $7,340 (f) Cost of goods sold = cost of goods available for sale ending inventory = $8,790 $1,200 = $7,590

LO 3 July 3

EXERCISE 5-6 PURCHASE DISCOUNTS

Purchases Accounts Payable To record purchases of merchandise on credit. Assets = Liabilities +3,500 +

3,500 3,500 Owners Equity 3,500 7,000 7,000 + Owners Equity 7,000 3,500 3,465 35

July 6

Purchases Accounts Payable To record purchases of merchandise on credit. Assets = Liabilities +7,000

July 12

Accounts Payable Cash Purchase Discounts To record payment on account: $3,500 0.01($3,500) = $3,465. Assets 3,465 = Liabilities 3,500 +

Owners Equity +35 7,000 7,000

August 5 Accounts Payable Cash To record payment on account. Assets 7,000 = Liabilities 7,000 +

Owners Equity

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-13

LO 3 March 3

EXERCISE 5-7 PURCHASESPERIODIC SYSTEM

Purchases Accounts Payable To record purchases on credit. Assets = Liabilities +2,500 +

2,500 2,500 Owners Equity 2,500 250 250 + Owners Equity 250 1,400 1,400 + Owners Equity 1,400 2,500 2,450 50

March 3

Transportation-in Cash To record payment of freight costs. Assets 250 = Liabilities

March 7

Purchases Accounts Payable To record purchases on credit. Assets = Liabilities +1,400

March 12

Accounts Payable Cash Purchase Discount To record payment for purchases on credit: $2,500 0.02($2,500) = $2,450. Assets 2,450 = Liabilities 2,500 +

Owners Equity +50 500 500

March 15

Accounts Payable Purchase Returns and Allowances To record credit on defective merchandise. Assets = Liabilities 500 +

Owners Equity +500 1,600 1,600

March 18

Purchases Accounts Payable To record purchases on credit. Assets = Liabilities +1,600 +

Owners Equity 1,600

5-14

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

March 22

Accounts Payable Purchase Returns and Allowances To record credit on returned merchandise. Assets = Liabilities 400 +

400 400 Owners Equity +400 900 900

April 6

Accounts Payable Cash To record payment for purchases on credit: $1,400 $500. Assets 900 = Liabilities 900 +

Owners Equity 1,200 1,200

April 18

Accounts Payable Cash To record payment for purchases on credit: $1,600 $400. Assets 1,200 = Liabilities 1,200 +

Owners Equity

LO 3

EXERCISE 5-8 SHIPPING TERMS AND TRANSFER OF TITLE

1. The seller pays shipping costs when merchandise is shipped FOB destination point. Miller Wholesalers pays the freight bill and is responsible for the merchandise until it gets to Michaels warehouse. 2. The inventory should not be included as an asset on Michaels December 31, 2007, balance sheet because the terms of shipment indicate that the merchandise does not legally belong to Michael until it arrives, and this is after the end of the year. Likewise, Miller should not include the sale on its 2007 income statement, since the goods are not considered sold until they reach the buyers business. 3. If the terms of shipment were FOB shipping point, the answers to both questions in 2. above would change. Under these terms, the inventory belongs to Michael as soon as it is shipped, and because this is on December 23, 2007, the asset should be recognized on the year-end balance sheet. Similarly, Miller would record a sale in 2007.

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-15

LO 3

EXERCISE 5-9 TRANSFER OF TITLE TO INVENTORY

Purchases of merchandise that are in transit from vendors to Cameron Companies on December 31, 2007: Record during December 2007Shipped FOB shipping point Record during January 2008Shipped FOB destination point Sales of merchandise that are in transit to customers of Cameron Companies on December 31, 2007: Record during December 2007Shipped FOB shipping point Record during January 2008Shipped FOB destination point

LO 4

EXERCISE 5-10 INVENTORY AND INCOME MANIPULATION

By ignoring the large order at year-end, and thus including the inventory in the year-end count, the company will overstate ending inventory. This in turn will lead to an understatement of cost of goods sold and an overstatement of net income. The effects on next years income are the opposite. Because beginning inventory will be overstated, cost of goods sold will also be overstated, and net income understated. The accountant has an obligation to the financial statement users to convince the president to make the necessary adjustments to reduce the inventory balance.

LO 6

EXERCISE 5-11 INVENTORY COSTING METHODS

1. Ending inventory: (65 55) (50 35) (60 45) (45 5) 80 units

$20 $22 $23 $24

= $ 200 = 330 = 345 = 960 $1,835

Cost of goods sold: 55 $20 35 $22 45 $23 5 $24 140 units

= $1,100 = 770 = 1,035 = 120 $3,025

5-16

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

2. Ending inventory: 45 $24 35 $23 80 units

= $1,080 = 805 $1,885

Cost of goods sold: 65 $20 = $1,300 50 $22 = 1,100 25 $23 = 575 140 units $2,975 3. Ending inventory: 65 $20 15 $22 80 units = $1,300 = 330 $1,630

Cost of goods sold: 45 $24 = $1,080 60 $23 = 1,380 35 $22 = 770 140 units $3,230 4. Cost of goods available for sale and units available: 65 $20 = $1,300 50 $22 = 1,100 60 $23 = 1,380 45 $24 = 1,080 220 units $4,860 Weighted average cost = $4,860/220 = $22.09/unit Ending inventory: 80 $22.09 = $1,767.20 Cost of goods sold: 140 $22.09 = $3,092.60 Note: Does not total $4,860 because of rounding of average cost.

LO 7 1. a 2. d 3. c 4. c

EXERCISE 5-12 EVALUATION OF INVENTORY COSTING METHODS

5. b 6. a 7. b 8. c

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-17

LO 8

EXERCISE 5-13 INVENTORY ERRORS

1. 2. 3.

Inventory U O U

Retained Earnings U O U

Cost of Goods Sold O U O

Net Income U O U

LO 8

EXERCISE 5-14 TRANSFER OF TITLE TO INVENTORY

1. Michelson should include the costs in its inventory, since the merchandise had not arrived at its destination, PJs, by the end of the year. 2. Filbrandt should include the costs of the merchandise in its inventory, since it has received the shipment by the end of the year. 3. Randall would include the merchandise in its inventory, since the shipment left James Bros. before the end of the year. 4. Barner should include the merchandise in its inventory. It is both shipped by Hinz and received by Barner before the end of the year.

LO 10 (1) (2) (3)

EXERCISE 5-15 GROSS PROFIT METHOD

Net sales estimated gross profit ratio Estimated gross profit Net sales estimated gross profit Estimated cost of goods sold Beginning inventory Add: Purchases Cost of goods available for sale Estimated cost of goods sold Estimate of inventory destroyed Liabilities +

$105,300 0.25 $ 26,325 $105,300 26,325 $ 78,975 $ 15,400 84,230 $ 99,630 78,975 $ 20,655 Owners Equity Loss on insurance settlement

Assets = Cash +10,000 10,655 Inventory 20,655

5-18

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

LO 11

EXERCISE 5-16 INVENTORY TURNOVER FOR BEST BUY

1. Inventory turnover = cost of goods sold/average inventory $20,938/[($2,851 + $2,607)/2] = $20,938/$2,729 = 7.67 times. 2. The average length of time it takes to sell an item of inventory can be estimated by dividing the number of times inventory turns over in a year into the number of days in a year: (assuming 360 days in a year): 360/7.67 times = 46.9, or approximately 47 days. 3. It is difficult to determine from the information given whether 47 days is reasonable as the average length of time it takes to sell inventory. Other information needed to make this determination includes:

The historical average number of days. The industry norms for large, national retailers. Any recent changes in types of inventory, customer base, markets for the products, and other relevant factors.

EXERCISE 5-17 IMPACT OF TRANSACTIONS INVOLVING INVENTORIES ON STATEMENT OF CASH FLOWS

LO 12

Increase in accounts payable: Added to net income Decrease in accounts payable: Deducted from net income Increase in inventories: Deducted from net income Decrease in inventories: Added to net income LO 12

EXERCISE 5-18 EFFECTS OF TRANSACTIONS INVOLVING INVENTORIES ON THE STATEMENT OF CASH FLOWSDIRECT METHOD

Cash payments for inventory to be reported in the operating activities of Mastheads 2007 statement of cash flows (direct method): Inventory, December 31, 2006 Plus: Purchases during 2007 Less: Cost of goods sold during 2007 Inventory, December 31, 2007 $180,400 + X $1,200,000 = $241,200 X = $1,260,800 Accounts payable, December 31, 2006 Plus: Purchases during 2007 (from above) Less: Cash payments during 2007 Accounts payable, December 31, 2007 $85,400 + $1,260,800 X = $78,400 X = $1,267,800 $ 180,400 X (1,200,000) $ 241,200

85,400 1,260,800 (X) $ 78,400

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-19

LO 12

EXERCISE 5-19 EFFECTS OF TRANSACTIONS INVOLVING INVENTORIES ON THE STATEMENT OF CASH FLOWSINDIRECT METHOD

Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Increase in inventory ($241,200 $180,400) Decrease in accounts payable ($78,400 $85,400) Cash flows from operating activities MULTI-CONCEPT EXERCISES LO 2,3

EXERCISE 5-20 INCOME STATEMENT FOR A MERCHANDISER

$ xx,xxx $(60,800) (7,000)

(67,800) $ xx,xxx

a. Sales Net sales = Sales returns and allowances $125,600 $122,040 = $3,560 b. Do c. first. Net purchases + Purchase discounts = Purchases $74,600 + $1,300 = $75,900 c. Cost of goods purchased Transportation-in = Net purchases $81,150 $6,550 = $74,600 d. Net sales Gross margin = Cost of goods sold $122,040 $38,600 = $83,440 e. Cost of goods available for sale Cost of goods sold = Ending inventory $104,550 $83,440 = $21,110 f. Gross margin Income before tax = Operating expenses $38,600 $26,300 = $12,300 g. Income before tax Income tax expense = Net income $26,300 $10,300 = $16,000

5-20

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

LO 2,3

EXERCISE 5-21 PARTIAL INCOME STATEMENTPERIODIC SYSTEM

LAPINE COMPANY INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2007 Sales Less: Sales returns and allowances Sales discounts Net sales Less cost of goods sold: Beginning inventory Purchases Less: Purchase returns and allowances Purchase discounts Net purchases Add: Transportation-in Cost of goods purchased Cost of goods available for sale Less: Ending inventory Cost of goods sold Gross margin The gross profit ratio is 61.7%. ($48,300/$78,300) $80,000 $ 500 1,200 1,700 $78,300

$ 4,000 $30,000 400 800 $28,800 1,000 29,800 $33,800 3,800 30,000 $48,300

LO 6,7

EXERCISE 5-22 INVENTORY COSTING METHODSPERIODIC SYSTEM

1. a. Weighted average method: Cost of goods available for sale and units available: 200 300 400 250 150 1,300 $10 $11 $12 $13 $15 = = = = = $ 2,000 3,300 4,800 3,250 2,250 $15,600 1,300 1,000 300

Weighted average cost = $15,600/1,300 = $12 per unit Units available Units sold Units in ending inventory

Cost of ending inventory = 300($12) = $3,600 Cost of goods sold = 1,000($12) = $12,000

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-21

b. FIFO method: Ending inventory cost: 150 $15 = $2,250 150 $13 = 1,950 300 $4,200 Cost of goods sold: 200 $10 = $ 2,000 300 $11 = 3,300 400 $12 = 4,800 100 $13 = 1,300 1,000 $11,400 (OR: $15,600 $4,200 = $11,400) c. LIFO method: Ending inventory cost: 200 $10 = $2,000 100 $11 = 1,100 300 $3,100 Cost of goods sold: 150 $15 = $ 2,250 250 $13 = 3,250 400 $12 = 4,800 200 $11 = 2,200 1,000 $12,500 (OR: $15,600 $3,100 = $12,500) 2. LIFO cost of goods sold FIFO cost of goods sold Difference in expenses tax rate Difference in taxes $12,500 11,400 $ 1,100 0.30 $ 330

Conclusion: Because FIFO results in less cost of goods sold, a higher income and thus more taxes, $330, will be reported with this method than if LIFO were used.

LO 5,9

EXERCISE 5-23 LOWER-OF-COST-OR-MARKET RULE

Conservatism is the rationale for carrying inventory on the balance sheet at an amount less than its cost. It is a departure from the historical cost principle and is used when the utility of the inventory, as measured by the cost to replace it, is less than original cost. Two accounts are affected by the application of the lower of cost or market rule. An income statement account, such as Loss on Decline in Value of Inventory, is debited, and the Inventory account on the balance sheet is credited or reduced.

5-22

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

The effect of writing down inventory is to reduce the income of the current year by the amount debited to the loss account. In future years, however, income will be higher because of the write-down. This occurs because cost of goods sold will be lower in the future when the inventory that was written down to a lower amount is eventually sold.

LO 7,13

EXERCISE 5-24 INVENTORY COSTING METHODSPERPETUAL SYSTEM (Appendix)

1. a. Moving average:

Purchases Unit Total Units Cost Cost Sales Unit Cost Total Cost $1,500 2,171 2,338 3,670 1,974 $11,653 Balance Unit Cost Balance $10 $2,000 10 500 10.8571 $3,800 10.857 1,629 11.6892 6,429 11.689 4,091 3 12.235 7,341 12.235 3,671 13.1584 5,921 13.158 $3,947

Date 1/1 2/12 3/5 4/30 6/12 7/7 8/23 9/6 10/2 12/3

Units

150 $10 300 400 250 150 $11 12 13 15 $3,300 200 4,800 200 3,250 300 2,250 150 13.158 Cost of goods sold All amounts rounded to agree with total cost.

1.

10.857 11.689 12.235

Units 200 50 350 150 550 350 600 300 450 300

Ending inventory

50 300 350 150 400 550 350 250 600 300 150 450

$10 11

= $ 500 = 3,300 $3,800;

$3,800/350 = $10.857

2.

$10.857 = $1,629 12 = 4,800 $6,429; $11.689 = $4,091 13 = 3,250 $7,341; $12.235 = $3,671 15 = 2,250 $5,921;

$6,429/550 = $11.689

3.

$7,341/600 = $12.235

4.

$5,921/450 = $13.158

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-23

1. b. FIFO:

Purchases Unit Total Units Cost Cost Sales Unit Cost $10 10 11 11 12 12 Total Cost $1,500 500 1,650 1,650 600 3,600 Balance Unit Cost Balance $10 $2,000 10 500 10 11 3,800 11 11 12 12 12 13 12 13 12 13 15 13 15 1,650 6,450 4,200 7,450 3,850 6,100 $4,200

Date 1/1 2/12 3/5 4/30 6/12 7/7 8/23 9/6 10/2 12/3

Units 150

300

$11

$3,300 50 150

Units 200 50 50 300 150 150 400 350 350 250 50 250 50 250 150 150 150

400

12

4,800 150 50

250

13

3,250 300

150

15

2,250 50 100 Cost of goods sold 12 13 600 1,300 $11,400

Ending inventory

5-24

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

1. c. LIFO:

Purchases Unit Total Units Cost Cost Sales Unit Total Cost Cost $10 11 $1,500 2,200 Balance Unit Cost Balance $10 $2,000 10 500 10 11 3,800 10 11 1,600 10 11 12 6,400 10 11 12 4,000 10 11 12 13 7,250 10 11 12 3,400 10 11 12 15 5,650 10 11 12 $3,400

Date 1/1 2/12 3/5 4/30 6/12 7/7 8/23

Units 150

300

$11

$3,300 200

400

12

4,800 200 12 2,400

250

13

3,250

9/6 10/2 150 15 2,250

250 50

13 12

3,250 600

12/3

150

15

2,250

Units $200 50 50 300 50 100 50 100 400 50 100 200 50 100 200 250 50 100 150 50 100 150 150 50 100 150

Cost of goods sold

$12,200

Ending inventory

2. Average cost FIFO LIFO

EXERCISE 5-22: E/I C/G/S $3,600 $12,000 4,200 11,400 3,100 12,500

EXERCISE 5-24: E/I C/G/S $3,947 $11,653 Different 4,200 11,400 Same 3,400 12,200 Different

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-25

3. Cost of goods sold: LIFO FIFO Difference in expense tax rate Difference in taxes

$12,200 11,400 $ 800 0.30 $ 240

Conclusion: LIFO results in a higher cost of goods sold and therefore a lower taxable income and lower income tax by $240.

PROBLEMS LO 1

PROBLEM 5-1 INVENTORY COSTS IN VARIOUS BUSINESSES

Business Retail shoe store Grocery store

Frame shop Print shop Restaurant

Types of Costs Shoes for sale Shoe boxes Advertising signs Canned goods Produce Cleaning supplies Cash registers Wooden frame supplies Nails Glass Paper Copy machines Toner cartridges Frozen food China and silverware Prepared food Spices

Accounting Treatment Expense of Inventory Other the Period Cost Treatment X X X X X X* X** X X X X X** X* X X** X X

*Record as an asset and charge to expense as used. **Record as an asset and depreciate over estimated useful life.

5-26

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

LO 4

PROBLEM 5-2 CALCULATION OF GROSS PROFIT FOR WAL-MART AND TARGET

1. Gross profit ratios (dollar amounts in millions): Wal-Mart: 2004: ($285,222 $219,793)/$285,222 = $65,429/$285,222 = 22.9% 2003: ($256,329 $198,747)/$256,329 = $57,582/$256,329 = 22.5% Target: 2004: ($45,682 $31,445)/$45,682 = $14,237/$45,682 = 31.2% 2003: ($40,928 $28,389)/$40,928 = $12,539/$40,928 = 30.6%

2. In terms of the gross profit ratio, Target appears to be performing better, given a significantly higher ratio in each year. The mix of products sold by the two companies and the normal markups on the various products could certainly affect the ratios. A comparison with prior years and industry averages would also be important to consider.

LO 7

PROBLEM 5-3 EVALUATION OF INVENTORY COSTING METHODS

1. Company B will have the newest costs in inventory because it uses first-in, first-out. Because costs are rising, it will have the lowest costs of goods sold and thus the highest net income. 2. Company C will have the oldest costs in inventory because it uses last-in, first-out. Because costs are rising, it will have the highest cost of goods sold and thus the lowest income before taxes. Company C will pay the least in taxes. 3. This question does not lend itself to an easy answer. LIFO matches the most recent costs with the most recent revenue and thus may be a better indicator of future potential to investors. Inventory profits are not a major concern with LIFO as they are with FIFO, because the newer (most recent) costs are assigned to cost of sales. 4. Company C would have the oldest costs in inventory because it uses LIFO. Because costs are falling, it will have the lowest cost of goods sold and the highest net income. Company B will have the newest costs in inventory because it uses FIFO. Because costs are falling, it will have the highest cost of goods sold and the lowest income before taxes. Company B will pay the least in taxes. The answer to Question 3. is still not easy. There are advantages and disadvantages in all methods. The important point is to choose one method and stay with it for consistency.

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-27

LO 8

PROBLEM 5-4 INVENTORY ERROR

1. Revised income statements: Revenues Cost of goods sold* Gross profit Operating expenses Net income

2007 $20,000 13,600 $ 6,400 3,000 $ 3,400

2006 $15,000 9,400 $ 5,600 2,000 $ 3,600

*Because ending inventory in 2006 was understated, cost of goods sold was overstated. Because beginning inventory in 2007 was understated, cost of goods sold was understated. Revised balance sheets: Cash Inventory Other current assets Long-term assets Total assets Liabilities Capital stock Retained earnings Total liabilities and owners equity 12/31/07 $ 1,700 4,200 2,500 15,000 $23,400 $ 8,500 5,000 9,900 $23,400 12/31/06 $ 1,500 4,100 2,000 14,000 $21,600 $ 7,000 5,000 9,600 $21,600

2. Net income for two years, before revision: $3,000 + $4,000 = $7,000 Net income for two years, after revision: $3,600 + $3,400 = $7,000 Thus, there is no net over- or understatement. Retained earnings at December 31, 2007, before the revision: $9,900 Retained earnings at December 31, 2007, after the revision: $9,900 Thus, there is no over- or understatement. 3. Even though the error counterbalances over the two-year period, it is still important to restate the statements for the two years. It is important for comparative purposes that the correct amount of net income be known for each of the two years. The company needs to restate the income statements for each of the two years and restate the balance sheets at the end of each year.

5-28

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

LO 10

PROBLEM 5-5 GROSS PROFIT METHOD OF ESTIMATING INVENTORY LOSSES

1. (1) Net sales estimated gross profit ratio Estimated gross profit (2) Net sales estimated gross profit Estimated cost of goods sold (3) Beginning inventory Add: Purchases Cost of goods available for sale Estimated cost of goods sold Estimate of inventory at time of explosion Inventory saved Estimate of inventory destroyed 2. Journal entry: August 1 Loss on Insurance Settlement Cash* Inventory To record insurance settlement from explosion.

$113,500 0.40 $ 45,400 $113,500 45,400 $ 68,100 $ 3,200 164,000 $167,200 68,100 $ 99,100 4,500 $ 94,600

29,600 65,000 94,600

*Debit should be to a Receivable from Insurance Company if cash has not yet been received. Assets +65,000 94,600 = Liabilities + Owners Equity 29,600

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-29

LO 11

PROBLEM 5-6 INVENTORY TURNOVER FOR APPLE COMPUTER AND DELL COMPUTER

1. Gross profit ratios: Apple Computer (in millions) 2004 2003 Sales/Product revenue $ 8,279 $ 6,207 Less: Cost of sales/revenue 6,020 4,499 Gross profit $ 2,259 $ 1,708 Divided by sales 8,279 6,207 Gross profit ratio 27.3% 27.5% 2. Inventory turnover ratios: Apple Computer: $6,020/[($101 + $56)/2] = $6,020/78.5 = 76.69 times Dell Computer $40,190/[($459 + $327)/2] = $40,190/$393 = 102.26 times 3. Both companies gross profit ratios have remained about the same in the two years. The two companies turnover ratios are very different. Another factor to consider is the number of days sales in inventory. Apple Computer: 360/76.69 = 4.7days Dell Computer: 360/102.26 = 3.5 days It takes Apple an average of less than five days to sell an item of inventory, and Dell requires only three and a half days. On the basis of the gross profit, Apple appears to be performing better, although Dell does have a better inventory turnover and days sales in inventory. It would be helpful to measure all of these statisticsgross profit ratio, inventory turnover, and days sales in inventorywith the same measures for prior years. It would also be helpful to compare these measures with the industry averages. Dell Computer (in millions) 2005 2004 $ 49,205 $ 41,444 40,190 33,892 $ 9,015 $ 7,552 49,205 41,444 18.3% 18.2%

5-30

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

LO 12

PROBLEM 5-7 EFFECTS OF CHANGES IN INVENTORY AND ACCOUNTS PAYABLE BALANCES ON STATEMENT OF CASH FLOWS

1. Statement of cash flows: COPELAND ANTIQUES STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2007 Net loss Adjustments to reconcile net loss to net cash provided by operating activities: Decrease in inventory ($192,600 $214,800) Increase in accounts payable ($123,900 $93,700) Cash flows from operating activities Cash, December 31, 2006 Cash, December 31, 2007 2. Memorandum to the president: TO: FROM: DATE: President of Copeland Antiques Students name January 20, 2008 $(33,200) 22,200 30,200 $ 19,200 46,100 $ 65,300

SUBJECT: Cash Flows You recently questioned the increase in the companys cash balance in light of this years net loss. My thoughts and a copy of the companys 2007 statement of cash flows follow. Copeland Antiques was able to generate a significant amount of cash from operations even though the company incurred an accrual basis net loss of $33,200 during 2007. First, the amount of inventory on hand decreased by $22,200 during the year from $214,800 to $192,600; this reduction in inventory generated cash for the company. Second, the amount owed to the companys suppliers increased by $30,200 during the year from $93,700 to $123,900; the related bills have not yet been paid. Operating expenses need to be decreased relative to gross profit if we are to improve the companys bottom line. I look forward to discussing our plans to turn things around.

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-31

MULTI-CONCEPT PROBLEMS LO 2,3,12

PROBLEM 5-8 PURCHASES AND SALES OF MERCHANDISE, CASH FLOWS

1. Journal entries: April 1 Purchases Accounts Payable To record purchase of merchandise on account. Assets April 10 = Liabilities +500 + 500 500

Owners Equity 500 500 485 15

Accounts Payable Cash Purchase Discounts To record payment on account: $500 (1 0.03) = $485. Assets 485 = Liabilities 500 +

Owners Equity +15 200 200

April 15

Cash Sales Revenue To record cash sale. Assets +200 = Liabilities +

Owners Equity +200 900 900

April 18

Purchases Accounts Payable To record purchase of merchandise on account. Assets = Liabilities +900 +

Owners Equity 900 600 600

April 25

Cash Sales Revenue To record cash sales: 3 $200. Assets +600 = Liabilities +

Owners Equity +600

5-32

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

April 28

Accounts Payable Cash Purchase Discount (900 3%) To record payment on account: $900 (1 0.03) = $873. Assets 873 = Liabilities 900 +

900 873 27

Owners Equity +27 $ 800 $ 0

2. Net income for April: Sales revenue: $200 + $600 Cost of goods sold: Beginning inventory Purchases: $500 + $900 Less: Purchase discounts $15 + $27 Net purchases Cost of goods available for sale Less: Ending inventory Cost of goods sold Gross margin Operating expenses: Rent expense Miscellaneous expense Total operating expenses Net income 3. Net cash flow from operating activities for April: Cash collected from sales: $200 + $600 Cash paid for: Inventory: $485 + $873 Rent Miscellaneous Net cash flow from operating activities OR: Net income Deduct: Increase in inventory balance Net cash flow from operating activities

$1,400 42 1,358 $1,358 967 391 $ 409 $ 100 50 150 $ 259 $ 800 $1,358 100 50

1,508 $ (708) $ 259 (967) $ (708)

4. Net income is $259. Net cash flow from operating activities is a negative $708. The difference of $967 is attributable to inventory that has not been sold. That is, the company has paid for $1,358 of inventory (a cash outlay) but has only recognized cost of goods sold expense of $391. The difference is $967.

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-33

LO 2,3,4

PROBLEM 5-9 GAP INC.S SALES, COST OF GOODS SOLD, AND GROSS PROFIT

1. Apparently, Gap Inc. does not sell its merchandise on account. If customers want to pay on credit for their purchases they would use one of the various credit cards that Gap accepts. 2. Summary journal entry for sales during the year ended 1/29/05 (millions of dollars): Cash Sales Assets +16,267 = Liabilities + 16,267 16,267 Owners Equity +16,267

3. Gap Inc. would deduct sales returns and allowances from sales to arrive at the amount of net sales reported on its income statement. Since Gap Inc. does not have any accounts receivable on its balance sheet, it is unlikely that it offers sales discounts to its customers. Either because they do not feel the amounts are material enough or they would rather not divulge information about returns and allowances to competitors, some companies choose not to separately report them. 4. Cost of goods sold section of 2004 income statement (millions of dollars): Merchandise inventory, 1/31/04 Cost of goods purchased* Cost of goods available for sale Less merchandise inventory, 1/29/05 Cost of goods sold** *Including occupancy expenses. **Described as cost of goods sold and occupancy expenses. (1) $9,886 + $1,814 = $11,700. (2) $11,700 $1,704 = $9,996. 5. Gross profit ratios: (millions of dollars) Sales Less cost of sales Gross profit Divided by sales Gross margin ratio 2004 $ 16,267 9,886 $ 6,381 $16,267 39.2% 2003 $ 15,854 9,885 $ 5,969 $15,854 37.6% $ 1,704 9,996 (2) $11,700 (1) (1,814) $ 9,886

Gap Inc.s gross profit ratio increased by 1.6% from 2003 to 2004. Factors affecting Gap Inc.s gross profit ratio might include changes in the selling prices of merchandise, changes in the costs of goods purchased, and/or changes in the mix of merchandise sold (that is, a slight shift between selling products that have higher gross profit ratios and selling those with lower gross profit ratios).

5-34

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

LO 2,3

PROBLEM 5-10 FINANCIAL STATEMENTS

1. Cost of goods sold for 2007: Beginning inventory Purchases Less: Purchase discounts Net purchases Add: Transportation-in Cost of goods purchased Cost of goods available for sale Less: Ending inventory Cost of goods sold 2. Net income for 2007: Sales Less: Sales returns Net sales Cost of goods sold (from Part 1) Gross profit Operating expenses: Salaries Advertising Utilities Depreciation Total operating expenses Income before tax Income tax expense Net income

$ 6,400 $40,200 800 $39,400 375 39,775 $46,175 7,500 $38,675 $84,364 780 $83,584 38,675 $44,909 $25,600 4,510 3,600 2,300 36,010 $ 8,899 3,200 $ 5,699

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-35

3.

MAPLE INC. BALANCE SHEET AT DECEMBER 31, 2007 Assets Current assets: Cash Accounts receivable Inventory Interest receivable Total current assets Property, plant, and equipment: Land Building and equipment, net Total property, plant, and equipment Total assets Liabilities Current liabilities: Salaries payable Income tax payable Total liabilities Stockholders Equity Capital stock Retained earnings Total liabilities and stockholders equity *Beginning retained earnings + Net income Dividends $32,550 + $5,699 $6,000

590 2,359 7,500 100 $10,549

$20,000 55,550 75,550 $86,099

650 3,200 $ 3,850

$50,000 32,249*

82,249 $86,099

5-36

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

LO 5,6,7 1.

PROBLEM 5-11 COMPARISON OF INVENTORY COSTING METHODSPERIODIC SYSTEM

a. Weighted average b. FIFO c. LIFO a. Beginning inventory Oct. 8 Oct. 18 Oct. 29 600 800 700 800 2,900

Cost of Goods Sold $11,084 10,776 11,452 $5.00 = $ 3,000 5.40 = 4,320 5.76 = 4,032 5.90 = 4,720 $16,072

Ending Inventory $4,988 5,296 4,620

Total $16,072 16,072 16,072

Weighted average cost = $16,072/2,900 = $5.542 Units sold: 500 + 700 + 800 = 2,000 units Units available units sold = ending inventory 2,900 2,000 = 900 units Ending inventory = 900 $5.542 = $4,988 Cost of goods sold = 2,000 $5.542 = $11,084 b. Ending inventoryFIFO: 800 $5.90 = $4,720 100 5.76 = 576 900 $5,296 Cost of goods soldFIFO: 600 $5.76 = $ 3,456 800 5.40 = 4,320 600 5.00 = 3,000 2,000 $10,776 c. Ending inventoryLIFO: 600 $5.00 = $3,000 300 5.40 = 1,620 900 $4,620 Cost of goods soldLIFO: 500 $5.40 = $ 2,700 700 5.76 = 4,032 800 5.90 = 4,720 2,000 $11,452

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-37

2. The Total column represents the pool of costs (beginning inventory plus purchases) to be distributed between an asset, ending inventory on the balance sheet, and an expense, cost of goods sold on the income statement. In accounting, this pool of costs is called cost of goods available for sale. 3. Income statements for the month of October: Weighted Average $20,800 11,084 $ 9,716 3,000 $ 6,716 2,015 $ 4,701 FIFO $20,800 10,776 $10,024 3,000 $ 7,024 2,107 $ 4,917 LIFO $20,800 11,452 $ 9,348 3,000 $ 6,348 1,904 $ 4,444

Sales* Cost of goods sold Gross margin Operating expenses Income before taxes Income tax expense (30%) Net income

*Sales = 500($10) + 700($10) + 800($11) = $20,800 4. The company will pay $203 more in taxes if it uses FIFO: FIFO tax LIFO tax Difference $2,107 1,904 $ 203

LO 5,7,13 1.

PROBLEM 5-12 COMPARISON OF INVENTORY COSTING METHODSPERPETUAL SYSTEM (Appendix)

a. Moving average b. FIFO c. LIFO

Cost of Goods Sold $10,785 10,776 10,852

Ending Inventory $5,287 5,296 5,220

Total $16,072 16,072 16,072

5-38

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

a. Moving average:

Purchases Unit Total Units Cost Cost Sales Unit Total Cost Cost $5 5.356 5.67 $2,500 3,749 4,536 $10,785 Balance Unit Cost Balance $5 $3,000 5 500 1 5.356 4,820 5.356 1,071 5.672 5,103 5.67 567 3 5.874 $5,287

Date 10/1 10/4 10/8 10/9 10/18 10/20 10/29

Units 500

800 $5.40 700 800 5.76 5.90

$4,320 700 4,032 800 4,720 Cost of goods sold = $ 500 = 4,320 $4,820;

Units 600 100 900 200 900 100 900

Ending inventory

1.

100 800 900 200 700 900 100 800 900

$5.00 5.40

$4,820/900 = $5.356

2.

$5.356 = $1,071 5.76 = 4,032 $5,103; $5.67 5.90 = $ 567 = 4,720 $5,287;

$5,103/900 = $5.67

3.

$5,287/900 = $5.874

b. FIFO:

Purchases Unit Total Units Cost Cost Sales Unit Total Cost Cost $5 5 5.40 5.40 5.76 $2,500 500 3,240 1,080 3,456 Balance Unit Cost Balance $5 $3,000 5 500 5 5.40 4,820 5.40 5.40 5.76 5.76 5.76 5.90 1,080 5,112 576 $5,296

Date 10/1 10/4 10/8 10/9 10/18 10/20 10/29

Units 500

800 $5.40

$4,320 100 600

Units 600 100 100 800 200 200 700 100 100 800

700

5.76

4,032 200 600

800

5.90

4,720 Cost of goods sold $10,776

Ending inventory

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-39

c. LIFO:

Purchases Unit Total Units Cost Cost Sales Unit Total Cost Cost $5 5.40 $2,500 3,780 Balance Unit Cost Balance $5 $3,000 5 500 5 5.40 4,820 5 5.40 1,040 5 5.40 5.76 5,072 5 5 5.90 500 $5,220

Date 10/1 10/4 10/8 10/9 10/18 10/20 10/29

Units 500

800 $5.40

$4,320 700

700

5.76

4,032 700 100 5.76 5.40 4,032 540

Units 600 100 100 800 100 100 100 100 700 100 100 800

800

5.90

4,720 Cost of goods sold $10,852

Ending inventory

2. The Total column represents the pool of costs (beginning inventory plus purchases) to be distributed between an asset, ending inventory on the balance sheet, and an expense, cost of goods sold, on the income statement. In accounting, this pool of costs is called cost of goods available for sale. 3. Income statements for the month of October: Moving Average $20,800 10,785 $10,015 3,000 $ 7,015 2,105 $ 4,910 FIFO $20,800 10,776 $10,024 3,000 $ 7,024 2,107 $ 4,917 LIFO $20,800 10,852 $ 9,948 3,000 $ 6,948 2,084 $ 4,864

Sales* Cost of goods sold Gross margin Operating expenses Income before taxes Income tax expense (30%) Net income

*Sales = 500($10) + 700($10) + 800($11) = $20,800 4. The company will pay $23 more in taxes if it uses FIFO: FIFO tax LIFO tax Difference $2,107 2,084 $ 23

5-40

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

LO 5,6,7

PROBLEM 5-13 INVENTORY COSTING METHODSPERIODIC SYSTEM

1. Units in beginning inventory Add: units purchased (250 + 220 + 150 + 200) Units available Less: units sold (300 + 380 + 110) Units in ending inventory Ending Inventory $4,410 4,155 4,301 Cost of Goods Sold $14,663 14,918 14,772

200 820 1,020 790 230 Total $19,073 19,073 19,073

a. FIFO b. LIFO c. Weighted average a. Ending inventoryFIFO: 200 $19.20 = $3,840 30 19.00 = 570 230 $4,410 Cost of goods soldFIFO: 200 $18.00 = $ 3,600 250 18.50 = 4,625 220 18.90 = 4,158 120 19.00 = 2,280 790 $14,663 b. Ending inventoryLIFO: 200 $18.00 = $3,600 30 18.50 = 555 230 $4,155 Cost of goods soldLIFO: 220 $18.50 = $ 4,070 220 18.90 = 4,158 150 19.00 = 2,850 200 19.20 = 3,840 790 $14,918 c. Beginning inventory Nov. 4 Nov. 13 Nov. 18 Nov. 24 200 250 220 150 200 1,020

$18.00 = $ 3,600 18.50 = 4,625 18.90 = 4,158 19.00 = 2,850 19.20 = 3,840 $19,073

Weighted average cost = $19,073/1,020 = $18.699 Ending inventory = 230 $18.699 = $4,301 Cost of goods sold = 790 $18.699 = $14,772

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-41

2. Sales* Cost of goods sold Gross profit Operating expenses: Selling and administrative expenses Depreciation Income before taxes Income tax expense (35%) Net income FIFO $33,480 14,663 $18,817 10,800 4,000 $ 4,017 1,406 $ 2,611 LIFO $33,480 14,918 $18,562 10,800 4,000 $ 3,762 1,317 $ 2,445

Weighted Average $33,480 14,772 $18,708 10,800 4,000 $ 3,908 1,368 $ 2,540

*Sales = (300 $42) + (380 $42.50) + (110 $43) = $33,480 3. Oxendine pays the least taxes under the last-in, first-out method, since it has the highest cost of goods sold.

LO 5,6,7

PROBLEM 5-14 INVENTORY COSTING METHODSPERIODIC SYSTEM

1. a. Weighted average: Beginning inventory Feb. 4 April 12 Sept. 10 Dec. 5

5,000 3,000 4,000 2,000 1,000 15,000

$10 = 9 = 8 = 7 = 6 =

$ 50,000 27,000 32,000 14,000 6,000 $129,000

Weighted average cost = $129,000/15,000 = $8.60 Units available for sale Units sold Ending inventory Cost of goods sold b. FIFO: Ending inventory 1,000 $ 6 = 1,500 7 = 2,500 500 4,000 3,000 5,000 12,500 $7 = 8 = 9 = 10 = $ 6,000 10,500 $ 16,500 $ 3,500 32,000 27,000 50,000 $112,500 15,000 12,500 2,500 8.60 = 12,500 8.60 =

$1,500 $107,500

Cost of goods sold

5-42

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

c. LIFO: Ending inventory Cost of goods sold 2,500 $10 = 2,500 3,000 4,000 2,000 1,000 12,500 $10 = 9 = 8 = 7 = 6 = $ 25,000 $ 25,000 27,000 32,000 14,000 6,000 $104,000

2. Income statements for the year ended December 31, 2007: Weighted Average $150,000 107,500 $ 42,500 20,000 $ 22,500 6,750 $ 15,750 FIFO $150,000 112,500 $ 37,500 20,000 $ 17,500 5,250 $ 12,250 LIFO $150,000 104,000 $ 46,000 20,000 $ 26,000 7,800 $ 18,200

Sales* Cost of goods sold Gross margin Operating expenses Income before taxes Income tax expense (30%) Net income *Sales = 12,500 $12 = $150,000

3. Weaver can minimize its tax bill by using FIFO. In a period of declining prices, FIFO results in the highest amount of cost of goods sold, the least amount of income before taxes, and thus the least amount of income tax expense. 4. A company is not free to change inventory methods from year to year to take advantage of changing patterns in the level of prices. It must be able to justify any change in the method used on some basis other than saving taxes, such as a better matching of costs with revenues. LO 1,7,9

PROBLEM 5-15 INTERPRETING TRIBUNE COMPANYS INVENTORY ACCOUNTING POLICY

1. Newsprint costs are comparable to raw materials in a manufacturing company. A newspaper company, however, does not keep an inventory of finished goods. Its newspapers either are sold within hours after being printed or become worthless if not sold. 2. Some companies use more than one method to value different types of inventory. The methods should be chosen because they provide the most accurate matching of costs with the revenues generated. Apparently, LIFO provides the most accurate matching of costs with revenue for Tribune Companys newsprint.

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-43

LO 7,9

PROBLEM 5-16 INTERPRETING SEARS INVENTORY ACCOUNTING POLICY

1. No, the use of the last-in, first-out method for its domestic merchandise inventories does not mean that Sears always sells its newest merchandise first in the U.S. Actually, the physical flow of merchandise in most stores like Sears is normally on a firstin, first-out basis. However, the use of a cost flow assumption such as LIFO or FIFO for accounting purposes is independent of the actual physical flow of products. 2. No, Sears uses the retail method to account for inventories in its stores. This is a method that allows the company to convert its inventory from a retail value to a cost basis for financial statement purposes.

ALTERNATE PROBLEMS LO 1

PROBLEM 5-1A INVENTORY COSTS IN VARIOUS BUSINESSES

1. Classification of an item as inventory depends on the companys intent. DVDs offered by the company for resale should be classified as part of inventory and charged to cost of goods sold at the time they are sold. Alternatively, rental DVDs are income-producing assets and should not be classified as inventory. They should be classified as current assets because it is unlikely that any DVDs will be kept as rentals for more than one year. 2. When DVDs are transferred because they will be offered for resale, the asset account DVD Rentals would be credited, and the asset account DVD Inventory would be debited. LO 4

PROBLEM 5-2A CALCULATION OF GROSS PROFIT FOR BEST BUY AND CIRCUIT CITY

1. Gross profit ratios (dollar amounts in millions): Best Buy: 2005: ($27,433 $20,938)/$27,433 = $6,495/$27,433 = 23.7% 2004: ($24,548 $18,677)/$24,548 = $5,871/$24,548 = 23.9%

Circuit City: 2005: ($10,472 $7,904)/$10,472 = $2,568/$10,472 = 24.5% 2004: ($9,857 $7,573)/$9,857 = $2,284/$9,857 = 23.2% 2. In terms of the gross profit ratios, the two companies appear to be very similar. The mix of products sold by the two companies and the normal markups on the various products could certainly affect the ratios. A comparison with prior years and industry averages would also be important to consider.

5-44

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

LO 7

PROBLEM 5-3A EVALUATION OF INVENTORY COSTING METHODS

1. No, the three companies will not be equally pleased with the decline in prices. If the decline continues, Company Y (FIFO) will begin to show lower gross profit than Company Z (LIFO). Because gross profit will be lower, Company Y will report lower income before tax and thus have less tax to pay. 2. It should be noted that it is not acceptable for a company to change inventory valuation methods to save taxes. An acceptable explanation of the justification for the change is this: During the year recently completed, the company changed its method of valuing inventory on the balance sheet and recognizing cost of sales on the income statement. The company changed from the LIFO to FIFO method because it believes that the latter results in a better matching of cost of sales with the revenues of the period. LO 8

PROBLEM 5-4A INVENTORY ERROR

1. Revised income statements: Revenues Cost of goods sold* Gross profit Operating expenses Net income

2007 $35,982 12,094 $23,888 13,488 $10,400

2006 $26,890 10,412 $16,478 10,578 $ 5,900

*Because ending inventory in 2006 was overstated, cost of goods sold was understated. Because beginning inventory in 2007 was overstated, cost of goods sold was overstated. Revised balance sheets: Cash Inventory Other current assets Long-term assets, net Total assets Current liabilities Capital stock Retained earnings Total liabilities and owners equity 12/31/07 $ 9,400 4,500 1,600 24,500 $40,000 $ 9,380 18,000 12,620 $40,000 12/31/06 $ 4,100 4,900 1,250 24,600 $34,850 $10,600 18,000 6,250 $34,850

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-45

2. Current ratio: Before revision: Cash + Inventory + Other current assets Current liabilitie s $4,100 + $5,400 + 1,250 $10,750 = = 1.01 to 1 $10,600 $10,600 After revision: $4,100 + $4,900 + 1,250 $10,250 = = 0.97 to 1 $10,600 $10,600

If the lender required a current ratio of at least 1 to 1, Planter would not be eligible for the loan. However, the bank might not consider a current ratio of 0.97 to 1 to be materially different from a current ratio of 1 to 1 and might be willing to grant the loan. 3. Net income for two years, before revision: $6,400 + $9,900 = $16,300. Net income for two years, after revision: $5,900 + $10,400 = $16,300. Thus, there is no net over- or understatement of net income for the two-year period. Retained earnings at December 31, 2007, before the revision: $12,620. Retained earnings at December 31, 2007, after the revision: $12,620. Thus, there is no over- or understatement of retained earnings at December 31, 2007. 4. Even though the error counterbalances over the two-year period, it is still important to restate the statements for the two years. It is important for comparative purposes that the correct amount of net income be known for each of the two years. The company needs to restate the income statements for each of the two years and restate the balance sheets at the end of each year.

5-46

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

LO 10

PROBLEM 5-5A GROSS PROFIT METHOD OF ESTIMATING INVENTORY LOSSES

1. (1) Net sales estimated gross profit ratio Estimated gross profit (2) Net sales estimated gross profit Estimated cost of goods sold (3) Beginning inventory Add: Purchases Cost of goods available for sale Estimated cost of goods sold Estimate of inventory at time of explosion Inventory saved Estimate of inventory destroyed 2. Journal entry: July 1 Loss on Insurance Settlement Cash* Inventory To record insurance settlement from explosion. Assets +50,000 58,650 = Liabilities +

$93,500 0.70 $65,450 $93,500 65,450 $28,050 $14,200 77,000 $91,200 28,050 $63,150 4,500 $58,650

8,650 50,000 58,650

Owners Equity 8,650

*Debit should be to a Receivable from Insurance Company if cash has not yet been received.

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-47

LO 11

PROBLEM 5-6A INVENTORY TURNOVER FOR WAL-MART AND TARGET

1. Inventory turnover ratios: Wal-Mart: $219,793/[($29,447 + $26,612)/2] = $219,793/$28,029.5 = 7.84 times Target: $31,445/[($5,384 + $4,531)/2] = $31,445/$4,957.5 = 6.34 times 2. Wal-Marts inventory turnover is higher than Targets during the most recent fiscal year, 7.84 versus 6.34. Another factor to consider is the number of days sales in inventory: Wal-Mart: 360/7.84 = 45.9 days Target: 360/6.34 = 56.8 days It takes Wal-Mart an average of 46 days to sell an item of inventory; Target requires an average of 57 days. On the basis of inventory turnover and days sales in inventory, Wal-Mart appears to be performing slightly better. It would be helpful to measure these statisticsinventory turnover and days sales in inventory, along with the companies gross profit ratioswith the same measures for prior years. It would also be helpful to compare these measures with the industry averages.

5-48

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

LO 12

PROBLEM 5-7A EFFECTS OF CHANGES IN INVENTORY AND ACCOUNTS PAYABLE BALANCES ON STATEMENT OF CASH FLOWS

1. Statement of cash flows: CARPETLAND CITY STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2007 Net income Adjustments to reconcile net income to net cash provided by operating activities: Increase in inventory ($105,500 $84,900) Decrease in accounts payable ($23,900 $93,700) Cash flows from operating activities Cash, December 31, 2006 Cash, December 31, 2007 2. Memorandum to the president: TO: FROM: DATE: SUBJECT: President of Carpetland City Students name January 20, 2008 Cash Flows $ 78,500 $(20,600) (69,800) (90,400) $(11,900) 26,300 $ 14,400

You recently expressed concern about the decrease in the companys cash balance in spite of the profitable year that was reported on this years income statement. My thoughts and a copy of the companys 2007 statement of cash flows follow. Although net income on an accrual basis was $78,500, the companys cash balance declined by $11,900 during the year for two reasons. Most importantly, the amount owed to the companys suppliers decreased by $69,800 during the year from $93,700 to $23,900; this decrease in accounts payable drained our cash balance. In addition, the amount of inventory on hand increased by $20,600 during the year from $84,900 to $105,500; this increase in inventory required an additional outflow of cash. We can better manage our cash flow by carefully timing the payment of bills to coincide with the due dates on invoices. In addition, we can improve cash flow by closely monitoring our inventory levels and only adding to inventory levels when increases in sales warrant an addition.

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-49

ALTERNATE MULTI-CONCEPT PROBLEMS LO 2,3,12

PROBLEM 5-8A PURCHASES AND SALES OF MERCHANDISE, CASH FLOWS

1. Journal entries: Oct. 1 Purchases Accounts Payable To record purchase of merchandise on account. Assets Oct. 10 = Liabilities +249 + 249 249

Owners Equity 249 249 244 5

Accounts Payable Cash Purchase Discounts To record payment on account: $249 (1 0.02) = $244. Assets 244 = Liabilities 249 +

Owners Equity +5 200 200

Oct. 15

Cash Sales Revenue To record cash sale. Assets +200 = Liabilities +

Owners Equity +200 800 800

Oct. 18

Purchases Accounts Payable To record purchase of merchandise on account. Assets = Liabilities +800 +

Owners Equity 800 600 600

Oct. 25

Cash Sales Revenue To record cash sales: 3 $200. Assets +600 = Liabilities +

Owners Equity +600 800 800

Oct. 30

Accounts Payable Cash To record payment on account. Assets 800 = Liabilities 800 +

Owners Equity

5-50

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

2. Units on hand on October 31: October 1 purchase October 15 sale October 18 purchase October 25 sale Ending inventory 3. Cash balance at end of month: Beginning cash balance October 10 payment October 15 sale October 25 sale October 30 payment Cash balance at end of month

3 units (1) 10 (3) 9 units $2,000 (244) 200 600 (800) $1,756

The cash balance decreased during the month even though the company reported a profit because cash outflows exceeded expenses. This was the case because the entire inventory purchased (and paid for) was not yet sold (expensed).

LO 2,3,4

PROBLEM 5-9A WALGREENS SALES, COST OF GOODS SOLD, AND GROSS PROFIT

1. Summary journal entries for the year ended 8/31/04: (in millions) Cash Accounts Receivable To record collection of beginning accounts receivable. Assets +1,017.8 1,017.8 Accounts Receivable Sales To record sales on account. Assets +37,508.2 = Liabilities + = Liabilities + 1,017.8 1,017.8 Owners Equity

37,508.2 37,508.2 Owners Equity +37,508.2 36,339.1 36,339.1 + Owners Equity +36,339.1

Cash Sales To record cash collections: $37,508.2 $1,169.1. Assets +36,339.1 = Liabilities

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-51

2. Walgreens would deduct sales returns and allowances, and the amount of any sales discounts taken by its customers from sales, to arrive at the amount of net sales reported on its income statement. Either because they do not feel the amounts are material enough or they would rather not divulge information about returns and allowances to competitors, some companies choose not to separately report them. 3. Cost of goods sold section of 2004 income statement: (in millions) Merchandise inventory, August 31, 2003 Cost of goods purchased Cost of goods available for sale Less merchandise inventory, August 31, 2004 Cost of goods sold (1) $27,310.4 + $4,738.6 = $32,049.0. (2) $32,049.0 $4,202.7 = $27,846.3. 4. Gross profit ratios: (In millions) Net sales Cost of sales Gross profit Divided by net sales Gross profit ratio 2004 $ 37,508.2 27,310.4 $ 10,197.8 37,508.2 27.2% 2003 $ 32,505.4 23,706.2 $ 8,799.2 32,505.4 27.1% $ 4,202.7 27,846.3 (2) $32,049.0 (1) (4,738.6) $27,310.4

Walgreens gross profit ratio was virtually unchanged from 2003 to 2004. Factors affecting Walgreens gross profit ratio include changes in the selling prices of merchandise, changes in the costs of goods purchased, and/or changes in the mix of merchandise sold (that is, a slight shift from selling products that have higher gross profit ratios to selling those with lower gross profit ratios).

LO 2,4

PROBLEM 5-10A FINANCIAL STATEMENTS

1. Cost of goods sold for 2007: Beginning inventory Purchases Less: Purchase discounts Net purchases Add: Transportation-in Cost of goods purchased Cost of goods available for sale Less: Ending inventory Cost of goods sold

$ 6,400 $62,845 1,237 $61,608 375 61,983 $68,383 5,900 $62,483

5-52

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

2. Net income for 2007: Sales Less: Sales returns Net sales Cost of goods sold (from Part 1) Gross profit Operating expenses: Wages and salaries expense Advertising expense Utilities expense Total operating expenses Income before tax Income tax expense Net income 3. LLOYD INC. BALANCE SHEET AT DECEMBER 31, 2007 Assets Cash Accounts receivable Inventory Total assets Liabilities Salaries payable Wages payable Income tax payable Total liabilities Stockholders Equity Capital stock Retained earnings Total stockholders equity Total liabilities and stockholders equity

$112,768 1,008 $111,760 62,483 $ 49,277 $ 23,000 12,900 1,800 37,700 $ 11,577 1,450 $ 10,127

$22,340 56,359 5,900 $84,599 $ 650 120 1,450 $ 2,220 $50,000 32,379* 82,379 $84,599

*Beginning retained earnings + Net income Dividends $28,252 + $10,127 $6,000

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-53

LO 5,6,7 1.

PROBLEM 5-11A COMPARISON OF INVENTORY COSTING METHODSPERIODIC SYSTEM

a. Weighted average b. FIFO c. LIFO a. Beginning inventory Nov. 8 Nov. 18 Nov. 29

Cost of Goods Sold $5,120 4,875 5,375 300 500 700 600 2,100

Ending Inventory $4,655 4,900 4,400

Total $9,775 9,775 9,775

$4.00 = $1,200 4.50 = 2,250 4.75 = 3,325 5.00 = 3,000 $9,775

Weighted average cost = $9,775/2,100 = $4.655 Units sold: 200 + 500 + 400 = 1,100 units Units available units sold = ending inventory 2,100 1,100 = 1,000 units Ending inventory = 1,000 4.655 = $4,655 Cost of goods sold = 1,100 4.655 = $5,120* *Rounded to agree with total cost. b. Ending inventoryFIFO: 600 $5.00 = $3,000 400 4.75 = 1,900 1,000 $4,900 Cost of goods soldFIFO: 300 $4.00 = $1,200 500 4.50 = 2,250 300 4.75 = 1,425 1,100 $4,875 c. Ending inventoryLIFO: 300 $4.00 = $1,200 500 4.50 = 2,250 200 4.75 = 950 1,000 $4,400 Cost of goods soldLIFO: 600 $5.00 = $3,000 500 4.75 = 2,375 1,100 $5,375

5-54

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

2. The Total column represents the pool of costs (beginning inventory plus purchases) to be distributed between an asset, ending inventory on the balance sheet, and an expense, cost of goods sold on the income statement. In accounting, the pool of costs is called cost of goods available for sale. 3. Income statements for the month of November: Weighted Average $10,100 5,120 $ 4,980 2,000 $ 2,980 745 $ 2,235 FIFO $10,100 4,875 $ 5,225 2,000 $ 3,225 806 $ 2,419 LIFO $10,100 5,375 $ 4,725 2,000 $ 2,725 681 $ 2,044

Sales* Cost of goods sold Gross margin Operating expenses Income before taxes Income tax expense (25%) Net income

*Sales = 200($9) + 500($9) + 400($9.50) = $10,100 4. The company will pay $125 more in taxes if it uses FIFO: FIFO tax LIFO tax Difference $806 681 $125

LO 5,7,13 1.

PROBLEM 5-12A COMPARISON OF INVENTORY COSTING METHODSPERPETUAL SYSTEM (Appendix)

a. Moving average b. FIFO c. LIFO

Cost of Goods Sold $4,892 4,875 4,950

Ending Inventory $4,883 4,900 4,825

Total $9,775 9,775 9,775

CHAPTER 5 INVENTORIES AND COST OF GOODS SOLD

5-55

a. Moving average:

Purchases Unit Total Units Cost Cost Sales Unit Cost $4 4.417 4.708 Total Cost $ 800 2,209 1,883 $4,892 Balance Unit Cost Balance $4 $1,200 4 400 1 4.417 2,650 4.417 441 4.7082 3,766 4.708 1,883 3 4.883 $4,883

Date 11/1 11/4 11/8 11/9 11/18 11/20 11/29

Units 200

500 $4.50 700 600 4.75 5.00

$2,250 500 3,325 400 3,000 Cost of goods sold

Units 300 100 600 100 800 400 1,000

Ending inventory

All amounts rounded to agree with total cost.

1.

100 500 600 100 700 800

$4.00 4.50

= $ 400 = 2,250 $2,650;

$2,650/600 = $4.417

2.