Professional Documents

Culture Documents

Moss Co. bonds and warrants analysis

Uploaded by

Joy Montalla SangilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Moss Co. bonds and warrants analysis

Uploaded by

Joy Montalla SangilCopyright:

Available Formats

P1 1. On December 31, 2010, Moss Co.

issued P1,000 bonds was issued with fifty detachable stock warrants, each of which entitled the bondholder to purchase one share of P5 par common stock for P25. Immediately after issuance, the market value of each warrant was P4. On December 31, 2010, what amount should Moss record as discount or premium on issuance of bonds? a. P40,000 premium b. P90,000 premium c. P110,000 discount d. P200,000 discount 2. The following balances were reported by Mall Co. at December 31, 2010 and 2009: 12/31/2010 12/31/2009 Inventory P260,000 P290,000 Accounts Payable P75,000 P50,000 Mall paid suppliers P490,000 during the year ended December 31, 2010. What amount should Mall report for cost of goods sold in 2010? a. P545,000 b. P495,000 c. P485,000 d. P435,000 3. On January 2, 2008, Lava, Inc. purchased a patent for a new consumer product for P90,000. At the time of purchase, the patent was valid for fifteen years; however, the patents useful life was estimated to be ten years due to the competitive nature of the product. On December 31,2011, the product was permanently withdrawn from sale under governmental order because of a potential hazard in the product. What amount should Lava charge against income during 2011, assuming amortization is recorded at the end of each year? a. P9,000 b. P54,000 c. P63,000 d. P72,000 4. Cap Corp. reported accrued investment interest receivable of P38,000 and P46,500 at January 1 and December 31, 2010 respectively. During 2010, cash collections from the investments included the following: Capital gain distributions P145,000 Interest P152,000 What amount should Cap report as interest revenue from investment for 2010? 5. In 2007, Chain Inc. purchased a P1,000,000 life insurance policy on its president, of which Chain is the beneficiary. Information regarding the policy for the year ended December 31, 2010, follows: Cash surrender value, 1/1/10 P87,000 Cash surrender value, 12/31/10 P108,800 Annual advance premium paid 1/1/10 P140,000 During 2010, dividends of P6,000 were applied to increase the cash surrender value of the policy. What amount should Chain report as life insurance expense for 2010? a. P40,000 b. P25,000 c. P19,000 d. P13,000 e. P8,000 f. P3,000

6. The following information pertains to a sale and leaseback of equipment of Mega Co. on December 31, 2011: Sales price P400,000 Carrying amount P300,000 Monthly lease payment P3,250 Present value of lease payments P36,000 Estimated remaining life 25 years Lease term 1 year Implicit rate 12% What amount of deferred gain on the sale should Mega report at December 31, 2010? 7. Nome Co. sponsors a defined benefit plan covering all employees. Benefits are based on years of service and compensation levels at the time of requirement. Nome determined that, as of September 30, 2011, its accumulated benefit obligation was P380,000, and its plan assets had a P290,000 fair value. The projected benefit obligation on September 30, 2011, was P400,000. In its September 30, 2011 balance sheet, what amount should Nome report as pension liability? 8. Black Co. requires advanced payments with special orders for machinery constructed to customer specifications. These advances are non-refundable. Information for 2011 is as follows: Customer advances- balance 12/31/2010 P118,000 Advances received with orders in 2011 P184,000 Advances applied to orders shipped in 2011 P164,000 Advances applicable to orders cancelled in 2011 P50,000 In Blacks December 31, 2011 balance sheet, what amount should be reported as a current liability for advances from customer? a. P0 b. P88,000 c. P138,000 d. P148,000 e. P164,000 9. Dean Co. acquired 1005 of Morey Corp. prior to 2010. During 2010, the individual companies included in their financial statements the following Dean Morey Officers salaries P75,000 P50,000 Officers expenses 20,000 10,000 Loans to officers 125,000 --What amount should be reported as related-party disclosures in the notes to Deans 2010 consolidated financial statements? a. P150,000 b. P155,000 c. P175,000 d. P330,000

10. Marr Co. sells its products in reusable containers. The customer is charged a deposit for each container delivered and receives a refund for each container returned within two years after the year of delivery. Mar accounts for the containers not returned within the time limit as being retired by sale at the deposit amount. Information for 2011 is as follows: Container deposits at Dec 31, 2010, from deliveries in 2009 P150,000 2010 P430,000 P580,000 Deposits for containers delivered in 2011 Deposits for containers returned in 2011 from deliveries in 2009 P90,000 2010 P250,000 2011 P286,000 In Marrs Dec 31, 2010 balance sheet, the liability for deposits on returnable containers should be a. P494,000 b. P584,000 c. P674,000 d. P734,000 e. P894,000 11. The following pertains to Eagle Co.s 2010 salesCash sales Gross P80,000 Returns and Allowance 4,000 Credit sales Gross 120,000 Discount 6,000 On Jan 1, 2010 customers owed Eagles P40,000. On Dec 31, 2010, customers owed Eagle P30,000. Eagle uses the direct writeoff method for bad debts. No bad debts were recorded in 2010. Under the cash basis of accounting, what amount of net revenue should Eagle report for 2010? a. P76,000 b. P170,000 c. P190,000 d. P200,000 E1. Statement 1: The columns in the special journals depend on the financial data needed by the business. Statement 2: The chart of accounts shows the ledger accounts that will be used in journalizing/recording transactions a. True, True b. True, False c. False, True d. False, False E2. Crazy Company has recognized a provision for lawsuit at P400,000 in its statement of financial position at Dec 31, 2011. At Dec 31, 2012, the risk adjusted present value of the best estimate of the amount acquired to settle the lawsuit is P900,000 but portion of the increase during 2012 included 7% that is attributed to the unwinding of the discount and the remainder of the increase is attributed to better information becoming available on which to base the estimates. In the statement of comprehensive income for the year ended Dec 31, 2012, what amount of loss from the lawsuit Crazy Company must be disclosed?

E3.

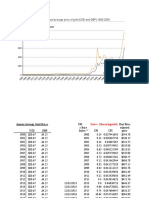

Masa Histas Spa and Massage Trial Balance Jan 31, 2011 Account Title Cash Accounts receivable Massage supplies Furniture and Fixtures Building Accounts Payable Capital Massage Income Salaries expense Utilities expense Supplies expense TOTAL Debit 185,000 165,000 40,000 220,000 300,000 Credit

130,000 500,000 410,000 50,000 70,000 10,000 1,040,000

1,040,000

How much is the total noncurrent assets? E4. A credit entry decreases the balance of a. Owners equity b. Liabilities c. Income d. Assets E5. An example of a cash flow from an investing activity is a. Receipt of cash from an owner upon issuance of stock b. Receipt of cash from the issuance of bonds payable c. Payment of cash to purchase bonds of another corporation d. Payment of cash to an owner to repurchase common stock D5. The following information is made available on Dec 31 of the current year: Balance per bank 110,820 Balance per book 113,240 Outstanding check 13,650 Deposit in transit 10,920 Bank collection 1,200 Bank service charge 1,850 A deposit of 2,000 was erroneously recorded as P200 by the bank. A check issued for 3,000 was erroneously recorded as P300 in the books. How much is the adjusted balance per book on Dec 31? a. 109,890 c. 108,090 b. 108,990 d. 110,090 D2. The following data are made available to you by the management of CORVEAU Trading: Credit sales P500,000 Inventory turnover 7x Current Liabilities 80,000 Current ratio 2 to 1 Quick ratio 1.25 to 1 Average collection ratio 36 days Number of working days 360 Compute: Cash________________

A3. Hudson, Inc. is a calendar-year corporation. Its financial statements for the years 2011 and 2010 contained errors as follows: 2009 2010 Ending Inventory 30,000 overstated 80,000 overstated Depreciation expense 20,000 understated 60,000 overstated Assume that the proper correcting entries were made at Dec 31, 2009. By how much will 2010 income before taxes be overstated or understated? A4. Fleming Company provided the following information on selected transaction during 2011: Dividends paid to preferred stockholders P150,000 Loans made to affiliated corporations 750,000 Proceeds from issuing bonds 900,000 Proceeds from issuing preferred stock 1,050,000 Proceeds from sale of equipment 450,000 Purchases of inventories 1,200,000 Purchases of land by issuing bonds 300,000 Purchases of treasury stock 600,000 The net cash provided (used) by investing activities during 2011 is a. (P600,000) c. P150,000 b. (P300,000) d. P450,000 D1. The results of operation of Yummy Convenient Store, not VAT registered sole proprietorship, owns by Lovely Chua, for the first three quarters of 2010 as follows Gross Income Deductions First Quarter 300,000 150,000 Second Quarter 350,000 200,000 Third Quarter 250,000 150,000 How much is the taxable income for the third quarter assuming Mrs. Chua is married and has three qualified dependent children? a. 100,000 c. 400,000 b. 250,000 d. 425,000 A2. The following statements are based on PAS 16 (Property, Plant & Equipment): Statement I: After recognition of an asset, an item of property, plant and equipment shall be carried at its cost less accumulated depreciation and any accumulated impairment losses. Statement II: After recognition of an asset, an item of property, plant and equipment whose fair value can be measured reliability shall be carried at a revalued amount, being its fair value at the date of revaluation, less any subsequent accumulated depreciation and subsequent accumulated impairment losses. Statement III: Revaluations shall be made with sufficient regularity to ensure that the carrying amount does not differ materially from that which would be determined using fair value at the end of the reporting period. a. All of the statements are true. b. Only statement I is true. c. Only statement II is false. d. Only statement III is false. A1. The buyer paid the shipper freight charges and later asked the reimbursement from the seller. The term agreed must have been a. FOB destination point, freight prepaid b. FOB destination point, freight collect c. FOB shipping point, freight prepaid

d. FOB shipping point, freight collect D10. The following information was provided by the bookkeeper of Maya Inc., - Sales for the month of June totalled 286, 000 units - The following purchases were made in June: Date Quantity Unit Cost June 4 50,000 13 8 62,500 12.5 11 75,000 12 24 70,000 12.4 - There were 108,500 units on hand on June 1 with a total cost of 1,450,000. Maya Inc., uses a periodic FIFO costing system. The companys gross profit for June was 2,058,750. How many units were on hand on June 30? a. 80,000 b. 177,500 c. 28,500 d. 149,000 D9. (Refer to D8) What is Eds diluted earnings per share for 2010? a. 31.42 b. 17.14 c. 23.56 d. None of the above D8.The following information was obtained from the audited financial statements of Eds Inc. for the year ended Dec 31, 2010: Operating Income 3500000 Selling, administrative and other 1800000 Operating expenses Finance Cost 250000 10% Non-convertible Bonds 2500000 Income tax rate 35% Additional data: a. There were 35000 ordinary shares outstanding throughout the year. b. On January 1, 2010, there were options outstanding to purchase 20000 ordinary shares at P30 per share. The average market price during the year was P40 per share. What is Eds basic earnings per share for 2010? a. 31.42 b. 23.56 c. 31.57 d. None of the above Sunflower Company sells a variety of imported goods. By selling on credit, Sunflower cannot expect to collect 100% of its accounts receivable. At Dec 31, 2009, Sunflower reported the following on its statement of financial position: Accounts receivable 2,197,500 Less: Allowance for Bad debts (133,500) Net Accounts receivable 2,064,000 During the year ended Dec 31, 2010, Sunflower earned sales revenue of P537,702,500 and collected cash of P528,070,500 from customers. Assume bad debts expense for the year was 1% of sales revenue and that Sunflower wrote off uncollectible accounts receivable totalling P5,439,500.

What is the accounts receivable balance at Dec 31, 2010? a. 5,439,500 b. 6,000,000 c. 6,390,000 d. 6,500,000 D6. Amount of share premium a. 276,180 b. 267,480 c. 254,180 d. 226,180 D5. Number of Ordinary shares a. 100,000 b. 108,000 c. 108,700 d. 120,880 MECCA Corp. reported the following amounts in the shareholders equity section of its Dec 31, 2010, balance sheet: Preference shares, P10 par (100,000 shres authorized, 40,000 shares issued) P400,000 Ordinary shares, P5 par (50,000 shares authorized, 20,000 shares issued) P100,000 Share Premium 192,000 Accumulated profits 1,200,000 The following transactions occurred during 2010: a. Paid the annual 2010 P1 per share dividend on preference shares and P0.50 per share dividend on ordinary shares. These dividends had been declared on Dec 31, 2009. b. Purchase 4,000 shares of its own outstanding ordinary shares for P80,000. c. Reissued 1,400 treasury shares for equipment with a fair value at P50,000. d. Issued 10,000 shares of preference shares at P15 per share. e. Declared a 10% stock dividend on the outstanding ordinary shares when the stock is selling for P12 per share. f. Issued the share dividend. g. Declared the annual 2010 P1 dividend on preference shares and the 0.50 per share dividend on ordinary shares. These dividends are payable in 2011. h. Appropriated accumulated profits for BOD-approved planned plant expansion, P600,000. i. Registered a net income for 2010 at P940,000. D4. Number of preference shares a. 400,000 b. 500,000 c. 550,000 d. 750,000

Sales Cost of goods sold Gross Income Operating expenses Interest expense Income before tax Income tax expense Net Income

Mercury Inc. INCOME STATEMENT For the year ending December 31, 2010 1,690,750 875,000 815,750 620,000 47,000 667,000 148,750 52,062 P96,688

Additional Information: a. Dividends in the amount of P30,000 were declared and paid during 2010. b. Depreciation expense is included in operating expense. c. No unrealized gains or losses have incurred on the available-for0sale security during the year. Compute the cash paid for operating expenses. a. 550,000 b. 555,000 c. 600,000 d. 605,000 The following information was obtained from the audited financial statement of Red, Inc. for the year ended Dec 31, 2010: Operating income 4,500,000 Selling, administrative and other 2,300,000 Operating expenses Finance Cost 650,000 10% Non-convertible bonds 2,500,000 Income tax rate 35% Additional data: - There were 25,000 ordinary shares outstanding throughout the year. - On Jan 1, 2010, there were options outstanding to purchase 40,000 ordinary shares at P30 per share. The average market price during the year was P50 per share. What is Red basic earning per share for 2010? a. 40.00 b. 40.30 c. 41.40 d. 42.00 D1. The following are Philippines Companys equity accounts at Dec 31, 2009: Ordinary share capital, par value P10; Authorized 200,000 shares; issued and Outstanding 120,000 shares 1,200,000 Share premium 180,000 Retained Earnings 720,000 Philippines Company uses the cost method of accounting for treasury shares. The following transactions occurred in 2010: - Acquired 8,000 ordinary shares for P144,000

- Sold 6,500 treasury shares at P20 per share - Retired the remaining treasury shares What is the share premium balance on Dec 31, 2010? a. 181,000 b. 200,000 c. 205,000 d. 211,000 A2. Erap Company uses the retail inventory method to value its merchandise inventory. The following information is available for the current year: Cost Retail Beginning Inventory 900,000 1,500,000 Purchases 12,700,000 16,700,000 Freight in 300,000 --Purchases allowance 50,000 Purchases returns 350,000 600,000 Net markups --400,000 Net markdowns --800,000 Employee discount --300,000 Theft and other losses --500,000 Sales --15,000,000 Sales allowance --100,000 Sales returns --400,000 If the ending inventory is to be measured using lower of cost or average market, what is the estimated cost of sales of Erap Company? a. 12,150,000 b. 12,075,000 c. 11,550,000 d. 11,925,000 D8. A corporation accounting records provided the following information: 12/31/2008 12/31/2009 Current assets 240,000 ? Non-current assets 1,600,000 1,500,000 Current Liabilities ? 130,000 Non-current liabilities 580,000 ? All assets and liabilities of the company are reported in the schedule above. Working capital of 92,000 remained unchanged from 2008 to 2009. Net income in 2009 was P88,000. No dividends were declared during 2009 and there were no other changes in equity, total non-current liabilities at Dec 31, 2009 would be a. 616,000 b. 392,000 c. 568,000 d. 480,000 D6. The following information was taken from Basilan Co. accounting records for the year ended Dec 31, 2009. Sales 10,000,000 Decrease in goods in process inventory 200,000 Decrease in raw material inventory 350,000

Increase in finished goods inventory Raw materials purchased Direct labour payroll Factory overhead Selling expenses Freight out General and administrative expense Basilans profit before tax is a. 3,550,000 b. 4,250,000 c. 3,250,000 d. 4,150,000

500,000 2,100,000 1,000,000 800,000 300,000 900,000 1,600,000

D5. In 2008, Fred Company had the following financial data Cash Revenue P8,000,000 Cash expense 4,000,000 Depreciation expense 2,000,000 Income before tax 2,000,000 Income tax expense 500,000 Net income 1,500,000 At the beginning of 2009, the company purchased additional assets at a cost of P5,000,000 on cash basis. Each year, these assets provide additional cash revenue of P5,000,000 and incur cash expenses of P2,000,000. The assets have a 10-year life and the company uses the straight line depreciation for all assets. The existing assets produced the same cash revenue and incur the same expenses as in 2008. Assume income tax is paid every April 15 for each year. The net cash inflows from the operating activities in 2009 should be a. 13,000,000 b. 12,500,000 c. 7,000,000 d. 6,500,000 D4. August 1, 2008, Blue Corporations P6,000,000 one-year, non-interest bearing note due July 31, 2009, was discounted at red Bank at 10.17%. Blue uses the straight line method of amortizing discount. What should Red report for note payable in its Dec 31, 2006 balance sheet? a. 6,000,000 b. 5,949,150 c. 5,389,800 d. None D1. On Nov 1, 2008, Blaine Company discounted with recourse at 12% a one-year, noninterest bearing, and P2,150,000 note receivable maturing on Jan 31, 2008. What amount of contingent liability for this note must Blaine discloses in its financial statements for the year ended 2008? a. 2,150,000 b. 1,892,000 c. 2,000,000 d. None of the above D2. Benjamin Company failed to recognize accruals and prepayments since the inception of its business three years ago. The earnings before tax of 35%, accruals and prepayments at the end of 2009 are; Earnings before tax P1,400,000 Prepaid insurance 20,000

Accrued wages Rent revenue collected in advance Interest receivable The corrected earnings after tax should be a. 1,415,000 b. 1,400,000 c. 1,275,000 d. 919,750

25,000 30,000 50,000

D3. Mira Inc. sells products to department stores in Cagayan de Oro. The beginning and ending balances of the companys inventory and accounts payable during 2008 follow: Jan 1, 2008 Dec 31, 2008 Inventory 231,460 155,980 Accounts payable 102,970 76,470 Miras cost of goods sold was reported at P1,380,500 on its income statement and uses the indirect method in preparing the statement of cash flows. How much was the cash payments made to its suppliers? a. 1,380,500 b. 1,331,520 c. 1,407,000 d. 1,240,480 D7. The following errors were made in preparing a trial balance: P1,350 balance of inventory was omitted; the P450 balance of prepaid insurance was listed as a credit; and the P300 balance of salaries expense was listed as utilities expense. The debit and credit totals of the trial balance would differ by a. 1,350 b. 2,100 c. 1,800 d. 2,250 D9. Rainbow Company has the following information pertaining to its biological assets: A herd of 100, 2-years old animals was held at Jan 1, 2010. Ten animals aged 2.5 years were purchased on July 1, 2010 for 5,400 and ten animals were born on July 1, 2010. No animals were sold or disposed of during the period. Per unit fair value less estimated point-of-sale costs were as follows: 2.0-year old animal at Jan 1, 2010: P5,000 Newborn animal at July 1, 2010: P3,500 2.5-year old animal at July 1, 2010:P5400 Newborn animal at Dec 31, 2010: P3,600 0.5-year old animal at Dec 31, 2010: P4,000 2.0-year old animal at Dec 31, 2010: P5,250 2.5-year old animal at Dec 31, 2010: P5,550 3,0-year old animal at Dec 31, 2010: P6,000 How much of the increase in the fair value of the biological assets due to physical change? a. 75,000 c. 110,000 b. 79,500 d. 118,500 D10. The stockholders equity section of Ella Company appears below as of Dec 31, 2008: 10% cumulative preference shares, P52 per value 100,000 shares, outstanding 95,000 shares 4,940,000

50,000,000 20,500,000 132,600,000 168,140,000 P243,580,000 Net income for 2008 reflects an income tax rate of 35%. Included in the net income figure is an expropriation loss of P8,000,000 before tax. The basic earnings per share should be a. 3.50 b. 3.554 c. 4.20 d. 4.46 The following information pertains to Pylon Company for 2009: a. the company had net monetary items of P1,600,000 on Jan 1. b. Sales of P6,000,000 and purchases of P2,400,000 were made evenly throughout the year. c. Operating expenses of P1,800,000 and income tax expense of P1,200,000 were made evenly throughout the year. d. Cash dividends of P400,000 were declared on Nov 30 and paid on Dec 31. Selected values of the CPI-U during 2009 appear below: Jan 1 110.0 Average for year 121.0 Nov 30 131.0 Dec 31 133.1 The purchasing power loss of 2009 expressed in constant year-end pesos is?________

Ordinary shares, P5 par, authorized and issued 10,000,000 shares Share premium RE, Dec 31, 2005 Net income 35,540,000

On Jan 1, 2010, Dayag Company has a receivable balance of P1,000,000. During 2010, it generated sales amounting to P20,000,000, of which 60% is made on credit. 2010 receivable collections totalled P9,000,000. What is the accounts receivable return? a. 12x c. 4.8x b. 6x d. 2x

On Jan 1, 2009, Sahara Company granted some of its executives options to purchase 45,000 share of the entitys P50 par ordinary share capital at an option price of P60 per share. The Black-Scholes option pricing model determines total compensation expense to be P3,300,000. The options are exercisable immediately over a three-year period beginning Jan 1, 2009. No share options were exercised in 2009. What is the impact on Saharas total shareholders equity for the year ended Dec 31, 2009, as a result of the share options under the fair value method?

D4. On Jan 1, 2005, Nuggets Company entered into a lease contract with Denver Company for a new equipment that had a selling price of P2,120,000. The lease contract provides that annual payments of P420,000 will be made for a six year. Nuggets made the first payment on Jan 1, 2005, subsequent payments are made on Jan 1, of each year. Nuggets guarantees a residual value of P367,122 at the end of the lease term. After considering the guaranteed residual value, the rate implicit in the lease is determined to be 12%. Nuggets has an incremental borrowing rate of 15%. The economic life of the equipment is 9 years. Nuggets depreciates its equipment using straight line method. Based on the aove and the result of your audit, compute for the following: Cost of the leased equipment to be recognized by Nuggets Company

a. 1,912,772

b. 2,013,908

c. 2,120,000

d. 0

On July 1, 2011, CLARK COMPANY sold a machine to Subic Inc. and simultaneously leased it back for one year. Details of the transaction are summarized below: Sales price 2,160,000 Carrying value on June 30, 2011 1,890,000 Estimated remaining life at June 30, 2011 6 years Monthly rental under leaseback 20,000 Present value at lease rentals on July 1, 2011 114,120 How much profit should CLARK COMPANY recognize on July 1, 2011 on the sale of the machine? a. 136,945 c. 172, 945 b. 72,000 d. 270,000

Roxanne Nierras Company had the following capital during 2008 and 2009: Preference share capital, P100 par, 10% cumulative, 100,000 shares P10,000,000 Ordinary share capital, P100 par, 400,000 shares 40,000,000 Roxanne Nierras reported profit of P8,000,000 for the year ended during Dec 31, 2009. Roxanne Nierras paid no preference share dividends during 2008 and paid P1,500,000 preference share dividends during 2009. On January 31, 2010, prior to the date the financial statements are authorized for issue, Roxanne Nierras distributed 10% ordinary share dividend. In its 2009 income statement, what amount should Roxanne Nierras report as basic earnings per share? A2. On July 1,2010, Julibabes Corporation acquired a held to maturity security in Clamor Companys 10 year 12% bonds, with face value of P5,000,000 for P5,386,300. Interest is payable semi-annually on Jan 1 and July 1. The bonds mature on July 1, 2015. Bonds effective rate is 10%. On Dec 31,2011, Juliebabes Corporation sold its debt instrument for P5,500,000. What amount of gain should Juliebabes Corporation recognize as a result of disposal?

Mr. Borja obtained one year loan from METRO BANK in the amount of P3,000,000 with interest of 15% per annum. The loan was granted to Mr. Borja on Dec 1, 2007 with interest for 1 year of P450,000 deducted in advance. In 2008, how much interest can be deducted if Mr. Borja will liquidate the loan on March 1, of the said year? a. 420,000 b. 350,000 c. 112,500 d. Answer is not given

In your examination of the books and accounts of PLUM Company for the year 2009, you have noted that the entire past due accounts of the company amounting to P200,000 should be set as Allowance for Doubtful Accounts. On these past due accounts, management with proper recommendation from the companys legal counsel, has decided to write off accounts with balance totalling P40,000. As of Dec 31, 2009, the balance of Allowance for Doubtful Accounts was P125,000. The addition provision required for the companys doubtful account is:________

The Winnie Company determined that the amortization rate on its patents is unacceptably low due to current advances in technology. The company decided at the beginning of 2008 to decrease the estimated useful life on all existing patents from 10 years to 8 years. Patents were purchased on Jan 1, 2003 for P3,000,000. The estimated residual value is zero. The winnie Company decided on Jan 1, 2008 to change its depreciation method for manufacturing equipment from an accelerated method to the straight-line method. The straight-line method is to be used for new acquisitions as well as for previously acquired equipment. As of Jan 1, 2008, the total historical cost of depreciable assets is P8,000,000 and the accumulated depreciation on those assets as of Jan 1, 2008 is 5 years and the expected residual value is P300,000. What is the total charge against 2008 income as a result of accounting changes? a. 1,047,500 b. 1,107,500 c. 1,360,000 d. 1,420,000 At the close of its fiscal year on March 31, 2008, Barbie Industries, Inc., which uses the periodic inventory system, was in process of relocating its plant. This resulted in some confusion relating to the inventory cut-off as indicated by the following: a. Merchandise on hand costing 17,940 was included in the inventory although the purchase invoice was not recorded until April 12, 2008. b. merchandise shipped on April 1, 2008 was included in the inventory. The cost of this merchandise was 22,190 and the sales was recorded as 31,380on March 31, 2008. c. Merchandise costing 12,250 was included in the inventory although it was shipped to a customer onn March 31, 2008, FOB shipping point; the company recorded the sale of 19,246 on that date. d. Merchandise costing 18, 200 was not counted. e. Merchandise in transit (shipped to the company, FOB destination) was recorded as a purchase as of April 2, 2008 and its cost of 17,287 was not included in the March 31,2008 inventory. As a result of the above error, by how much was the purchases account of Barbie industries, Inc. for the year ended March 31, 2008, overstated or understated? a. 17,940 understated b. 17,287 understated c. 35,227 understated d. not affected

On Jan 1, 2008, Bill Company purchased investment securities for P1,500,000. The securities are classified as trading. By Dec 31, 2008, the securities had a fair value of P2,100,000 but had not yet been sold. The company also recognized a P400,000 restructuring charge during the year. The restructuring charge is composed of an impairment write down on a manufacturing facility. Tax rules do not allow a deduction for the write down unless the facility is actually sold. The facility was not sold at the end of the year. Including the unrealized gain on the trading securities and the restructuring charge, the accounting income before tax for the year was P5,000,000. The income tax rate for the current year and future years is 35%. What is Bills current tax expense? a. 1,680,000 b. 1,750,000 c. 1,820,000 d. 1,920,000

The skyline Company provides the following data at Dec 31, 2008: Operating revenue 5,600,000 Operating expenses 3,000,000

Income tax rate 35% Ordinary share capital outstanding during 200,000 shares The year On Jan 1, 2008, there were options outstanding to purchase 40,000 ordinary shares at P40 per share. The average market price during the year was P20 per share. The balance sheet reports 2,000,000 at 10% nonconvertible bonds at Dec 31, 2008. The interest expense is included in the operating expense. What is the amount of earnings per share? a. 7.58 b. 8.45 c. 8.89 d. 9.58 Dix Companys equity at Dec 31, 2009 consisted of the following; 8% cumulative preference share capital , P50 par Liquidating value P55 per share; Authorized, issued and outstanding 20,000 shares Ordinary share capital, P25 PAR, 200,000 shares authorized; 100,000 shares issued and outstanding Retained earnings

1,000,000 2,500,000 400,000

Dividends on preference share have been paid through 2007 but have not been declared for 2008 and 2009. At Dec 31, 2009, Dixs book value per ordinary share was a. 25.00 b. 27.20 c. 26.40 d. 29.00

E1. Taylor has just acquire the net assets of Jack for P100,000. In acquiring Jack, the owners of Taylor felt that Jack had unrecorded goodwill. They decided to capitalize the estimated annual superior earnings of Jack at 20% to determine the amount of goodwill. The computation resulted in an estimated goodwill of 10,000. A rate of 10% on net assets before recognition of goodwill was used to determine normal annual earnings of Jack, because it is the rate that is earned on net assets in the industry in which Jack operates. All other assets of Jack were properly recorded. The estimated annual earnings of Jack were a. 10,000 b. 9,000 c. 2,000 d. 11,000

E2.On Jan 1, 2006, Cherry Company issued its 10%, 5-year convertible debt instrument with a face amount of P5,000,000 for P5,217,344. Interest is payable every Dec 31 of each year. The debt instrument is convertible into 50,000 ordinary shares with a par value of P100. When the debt instrument were issued, the prevailing market rate of interest for similar debt without conversion option is 11%. The Company incurred transaction cost of P70,000 related to the issue of the compound instrument. (Carry PV factors up to 3 decimal places) How much of the net proceeds represent the equity component?

6. The stock investment account showed the following details: Stock Investment in PAL Jan 1 Audited balance 2,000 shares 40,000 March 1 Bought shares 4,500 Feb 28 Cash dividend 1,000 Apr 1 Sales of right 3,000 June 30 Sale of shares 5,000 The following transaction occurred:

A cash dividend of P0.50 per share was received on Feb 28 The adjusting entry is: Debit a. Stock investment 1,000 b. Retained earnings 1,000 c. Dividend income 1,000 d. None of the above

Credit Dividend income 1,000 Dividend income 1,000 Stock investment 1,000

7. The Melaren Company is going through some financial problems in 2008. A group of creditors holding P1,000,000 of 14% of Debenture bonds issued by Melaren agreed to accept 80,000 share of P10 per common stock in full payment of the obligation. Interest equivalent to one year period is still outstanding. Melaren stock has a market value of P12 per share in 2008. An unamortized premium of P15,000 for the P1,000,000 onds outstanding. What amount of gain in restructuring of debt should be reported by Melaren in 2008? a. 0 b. 55,000 c. 195,000 d. 255,000

On November 1, 2010, Yes Co., sold some limited edition art prints to Yakitate Co. for Y47,850,000 to be paid on January 1,2011. The current exchange rate on November 1,2010 was Y110=$1,so that payment at the current exchange rate would be equal to $435,000. Yes enters into a forward contract with a large bank to guarantee the number of dollars to be received. According to the terms of the contract, if Y47,850,000 is worth less than $435,000, the bank will pay Yes difference in cash. Likewise, if Y47,850,000 is worth more than $435,000, Yes must pay the bank the difference in cash. The exchange rate on December 31,2012 is Y120=$1 What amount in US$ will Yes report as derivative asset or liability on December 31,2012?(indicate whether it is an asset or liability)

The following data are taken from the shareholders equity section of the balance sheet of FLOOD CORP. Dec 31,2006 625,000 312,500 625,000 Dec.31,2007 637,500 362,500 653,750

Ordinary shares(100 per value) Share premium in excess of par Retained earnings

During 2008, the company declared and paid cash dividends of 93,750 and also declared and issued a stock dividend. There were no other changes in stock issued and outstanding during 2008. Net income for 2006 is:

Oaf Corporation has determined that its fine china division is a cash-generating unit. The carrying amount of the assets at December 31,2009 are as follows: Factory Land Equipment Inventory 210,000 150,000 120,000 60,000

Oaf Corporation calculated the value in use of the division to be 510,000. assuming that the fair value less costs to sell of the land is 145,00, how much is the carrying amount of equipment after allocating impairment loss?

Santos Ltd. Cash-generating unit has been assessed for impairment and it has been determined that the unit has incurred an impairment loss of 480,00. the carrying amounts of the assets were as follows: Building Equipment Land Fittings 6,000,000 2,000,000 3,500,000 2,500,000

The cash-generating unit has not recorded any amount if goodwill. If the fair value less cost to sell the building is 5,860,000,what amount of impairment loss should be allocated to the equipment? A.68,572 C.85,714 B.85,000 D.148,750

The following information was extracted from the records of Obduracy Corporation as at December 31,2009: Assets(liability) carrying amount Account receivable 150,000 Motor vehicles 165,000 Provision for warranty (12,000) Deposits received in advance (15,000) Tax base 175,000 125,000 0 0

The depreciation rates for accounting and taxation are 15% and 25% respectively. Deposits are taxable when received and warranty costs are deductible when paid. An allowance for doubtful debts of 25,000 has been raised against accounts receivable for accounting purposes, but such debts are deductible only when written off as uncollectible. The net journal entry to record deferred tax for the year ended December 31,2009 assuming no deferred items had been raised in prior years, will increase(decrease profit by

Victoria Inc. needs 2,000,000 to finance its expansion program. Victoria is negotiating a loan with Metropolis Bank which requires the company to maintain a compensating balance of 10% of the loan in a loan principal on deposit in a current account in a bank. Victoria Inc. currently maintains a balance of 20,000in its current account. The current account earns interest of 2% per annum; the interest on the loan is 12% per annum(Hint: compute first the principal amount of the loan) What is the effective interest rate on the loan? A.13.2% C.13% B.11.8% D.12%

Your audit of the debt securities held for trading purposes of DAP CORP. disclosed the following entries during the fiscal year ended June 30,2009: Date Particulars Nov 1 Acquired 10 shares of 10,000 face value bonds At 102 plus accrued interest Jan 1 Interest received Mar31 Proceeds from sale of 30,000 par value bonds Including accrued interest Debit 108,000 9,000 Credit

Required: How much is gain or loss on sale of investment on March 31, 2009? A.400 gain C.1,850 loss B.275 loss D.950 loss

On January 1, 2004, The Pokemon Company granted 10,000 share options to each of its ten executives. The share options will vest immediately if and when the entitys share price increases from 50 to 70 provided the executive remains in service when the share price target is achieved. The Pokemon Company applied a binomial option pricing model and estimated that the fair value of the share options grant date is 25 per option. From this option pricing model, the entity has determined that the most likely outcome of the condition is that the share price target will be achieved at the end of 5 years, on December 31,2008. Hence, the expected vesting period is 5 years. Pokemon Company also estimates that two executives will have left by December 31,2008. During the years 2004,2005,2006,2007, the entity continues to estimate that two executives will leave by December 31,2008. However, a total of three executives left, one each in 2006,2007,2008. The share price target is achieved on December 31,2009 and another executive left during 2009 before the price target is achieved. What is the compensation expense for 2008? A.400,000 C.150,000 B.200,000 D.0

On July 1,2008, Tom Company acquired a 25% interest in the outstanding shares of Jerry Company at a total cost 1,750,000. The underlying equity of the shares acquired by Tom was 1,500,000. The difference was due to the following: a. Land with current fair value of 750,000 more than its carrying amount. b. Depreciable plant assets with current fair value of 150,000 more than carrying amount c. Inventories which are undervalued by 20,000 All other identifiable assets of Jerry Company have fair values equivalent to their book values. The depreciable plant assets have remaining useful lives of 10 years from the date of acquisition of the investment. All of the inventories have been sold as of December 31,2008. Tom received 100,000 dividends form Jerry in 2008. Jerry reported a 1,350,000 net income during the year. Interim reports from Jerry revealed that it earned 650,000 during the first two quarter of 2008. There are no differences in accounting policies between the two companies, nor do differences in accounting policies between the two companies, nor do differences in reporting dates exist. Assume that there is no indication of impairment in the shares as of December 31,2008. How much was the income from associate reported in Toms income statement for the year ended December 31,2008? A.161,875 C.168,125 B.166,250 D.175,000

At the beginning of year 1, Opaque Corp. grants share options to each of its 100 employees working in the sales department. The share options will vest at the end of year 3, provided that the employees remain in the entitys employ and provided that the volume of sales of a particular product increases by at least an average of 5 per cent per year. If the volume of sales of the product increases by an average of between 5 per cent and 10 per cent per year, each employee will receive 100 share options. If the volume of sales increases by an average of between 10 per cent and 15 per cent each year, each employee will receive 200 share options. If

the volume of sales increases by an average of 15 per cent or more, each employee will receive 300 share options. On grant date, Opaque Corp. estimates that the share options have a fair value of 20 per option. By the end of year 1, seven employees have left and the entity expects that a total of 20 employees will leave by the end of year 3. product sales have increased by 12 per cent and the entity expects this rate of increase to continue over the next 2 years. By the end of year 2, a further five employees have left. The entity now expects only three more employees will leave during year 3. product sales have increased by 19 per cent. The entity now expects that sales will average 15 per cent or more over the three-year period. By the end of year 3, further two employees have left. The entitys sales have increased by 17 per cent. Compute for the amount to be recognized as compensation expense in year 3. In 2005, Dochi Company purchased a 5,000,000 life insurance policy on its president, of which Dochi is the beneficiary. Information regarding the policy for the year ended December 31,2009 follows: Cash surrender value, Jan.1,2009 Annual advance premium paid Jan.1,2009 Life insurance expense recognized 435,000 200,000 95,000

During 2009, dividends of 300,000 were applied to increase the cash surrender value of the policy. The cash surrender value of December 31,2009 is A.570,000 C.540,000 B.510,000 D.465,000

VJ Chemical Company spent 200,000 on researches and development cost for an invention during 2003. On January 1,2004, the invention was patented at a nominal cost that was expensed in 2004. The legal wife of the patent was 15 years and the estimated useful life was 9 years. In January,2008 VJ paid 25,000 for legal fees in a successful defense of the patent. What should be the amortization expense for 2008? A.-0C.2,778 B.2,273 D.5,000

Bubble Company determined that due to obsolescence, equipment with an original cost of 9,000,000 and accumulated depreciation at January 1,2010, of 4,200,000 had suffered permanent impairment, and as a result should have a carrying value of only 3,000,000 as of the beginning of the year. In addition, the remaining useful life of the equipment was reduced form 8 years to 3. In its December 31,2010 statement of financial position, what amount should Bubble report as accumulated depreciation? A.1,000,000 C.6,000,000 B.5,200,000 D.7,000,000 Benjo Corp.s trademark was licensed to Aries Co. for royalties of 15% of sales of the trademarked items. Royalties are payable semi-annually on March 15 for sales in July through December of the prior year, and on September 15 for sales in January through June of the same year. Benjo received the following royalties form Aries: March 15 2006 5,000 2007 6,000 September 15 7,500 8,500

Aries estimated that sales of the trademarked would total 80,000 for july through December 2007. In Benjos 2007 income statement, the royalty revenue should be A.20,500 C.22,000 B.26,500 D.28,000

In preparing its bank reconciliation for the month of February, Shone Company has available the following information: Balance per bank statement, February 28 Deposit in transit, February 28, Outstanding checks, February 28 18,025 3,125 2,875

Check erroneously deducted by bank from Shones Account, February 10 125 Bank service charges for February 25 What is the corrected cash balance at February 28? A.18,125 C.18,275 B.18,150 D.18,400 Still Trading made investments in available for sale securities. The unrealized gain or loss account has a debit balance of 38,700 at December 31,2006 showed the following: No.of shares 600 shares 225 shares 2,000 shares Cost Market 922,500 810,000 229,500 270,000 808,500 841,800

A. common B. common C. common

On July 1, 2008, the shares of B common were sold for 210,000. On December 31,2008, A shares were quoted at 1,320 per share and C common shares were quoted at 414 per share. How much is the required increased in the Unrealize gain or loss account at the end of 2008? A.130,500 C.91,800 B.111,000 D.31,800

National Bank began business in February of 2007. During the year, National Bank purchased the three trading securities listed below. In its December 31,2007 balance sheet, National Bank appropriately reported a 40,000 debit balance in its Fair value Adjustment-Trading Securities account. There was no change during 2008 in the composition of National Banks portfolio of trading securities. Pertinent data are as follows: Security A B C Total Cost 1,200,000 900,000 1,600,000 3,700,000 December31,2008 Market value 1,260,000 950,000 1,620,000 3,830,000

What amount of gain on these securities should be included in Nationals bank income statement for the year ended December 31,2008? A. None C.90,000 B.40,000 D.130,000

CONCORD CO. purchased real property for 3,225,000 which included 67,500 for realty tax arrears for prior years. A mortgage of 1,500,000 was assumed by CONCORD CO. on the purchase. Twenty percent of the purchased price should be allocated to the land and the balance to the building. In order to make the building suitable for the use of CONCORD CO., remodeling costs had to be incurred in the amount of 337,500. this however necessitated the demolition of a portion of the building, which resulted in recovery of salvage material sold for 11,250 cash. Landscaping and parking lot cost the company a total of 120,000 while repairs in the main hall were 16,875. The cost of the land was:

Valenciano Company provides the following data December 31, 2006: Operating revenue Operating expenses Income tax rate Ordinary share outstanding during the entire year 1,120,000 600,000 32% 26,000 shares

On January 1,2006, there were options outstanding to purchase 15,000 ordinary share at 25 per share. The average market price during the year was 35 per share. The balance sheet reports 240,000 of 7% nonconvertible bonds at December 31,2006. (interest expense is included in operating expenses. How much is the diluted EPS for 2006?

Alpha Company has granted 250 share appreciation rights to each of its 500 employees on January 1,2006. The rights are due to vest on December 31,2009 with payment being made on December 31,2010. Only 80% of the awards vest. Share prices are January 1,2006 predetermined price December 31,2006 December 31,2009 December 31, 2010 150 180 210 190

How should the settlement of the share appreciation rights be accounted for on December 31,2010? A. B. C. D. payment of 4,000,000 and no gain is recorded payment of 6,000,000 and no gain is recorded payment of 2,000,000 and gain of 4,000,000 recorded payment of 4,000,000 and gain of 2,000,000 recorded

The Allowance for Doubtful Accounts has a credit balance of 150,000 at December 31,2009. During 2010, uncollectible accounts of 35,000 had been written off. The company estimates its bad debt expense to be 2% of net sales. The balance of the companys net sales for 2010 amounted to A.12,600,000 C.21,850,000 B.16,100,000 D.14,350,000

PRIME Co. received from a customer a one year, 500,000 note bearing annual interest of 8%. After holding the note for six months, PRIME discounted the note at Asian Bank at an effective interest rate of 10%. At the date of discounting, PRIME should recognize A.40,000 interest revenue B.23,810 interest revenue C.13,000 interest revenue D.4,762 interest expense

In analyzing the shareholders equity section of the PEARSON CORP. the following information was abstracted from the accounts at December 31,2008: Total income since incorporation Total cash Dividends paid Proceeds from sale of donated stock Total value of stock dividends distributed Excess of proceeds over cost of treasury stock sold 7,875,000 2,437,500 834,750 562,500 131,250 P

What should be the balance of the retained earnings account as of December 31,2008? A.4,875,000 B. 6,218,750 C.7,031,250 D.10,031,250

On October 1,2010, Rodel Corporation, a real estate developer, sold land to Gerry Company for 5,000,000. Gerry paid cash of 600,000 and signed a ten-year 4,400,000 note bearing interest at 12%. The carrying amount of the land was 4,000,000 on the date of sale. The note was payable in forty quarterly principal installments of 110,000 beginning January 2,2011. Rodel appropriately accounts for the sale under the cost recovery method. On January 2,2011, Gerry paid the first principal installment of 110,000 and interest of 132,000. For the yea ended December 31,2011, what total amount of income should Rodel recognize from the land sale and the financing? A.0 B. 208,000 C.508,200 D.309,640

On January 1,2006, Zaft Company enters into a forward contract that requires the entity to repurchase 2,000 shares for 240,000 on December 31,2007. No consideration is paid or received at inception of the contract. The market rate of interest is 10% of the same type of transaction. What amount of financial liability should Zaft Company recognize on January 1,2006?

On January 1,2010, Blocked Company leased a building to Hide Company for a ten-year term at an annual rental of 500,000. At inception of the lease, Blocked received 2,000,000 covering the first two years rent of 1,000,000 and a security deposit of 1,000,000. This deposit was not to be returned to Hide upon expiration of the least but will applied to payment of rent for the last two years of the lease. What portion of 2,000,000 should be shown as a current and non-current liability in Blockeds December 31,2010 statement of financial position?

Charge Co. has three financial statement element for which the December 31,2010 carrying amount is different from the tax basis. Carrying Amount Equipment 310,000 Prepaid officers insurance policy 76,000 Warranty liability 52,000 Tax Basis Difference 215,000 95,000 -076,000 -052,000

What is the total amount of future taxable differences?

The following accounts appear on the adjusted trial balance of Grand Company on December 31,2009 Petty cash fund Payroll fund 10,000 100,000

Sinking fund cash 500,000 Sinking fund securities 1,000,000 Accrued interest receivable-sinking fund securities 50,000 Plant expansion fund 600,000 Cash surrender value 150,000 Investment property 3,000,000 Advances to subsidiary 200,000 Investment in joint venture 2,000,000 How much should be reported as non current investment on December 31,2009? On December 31,2009, Bart Company purchased a machine in exchange for a non-interest bearing note requiring eight payments of 200,000. the first payment was made on December 31,2009 and the others are due annually on December 31. At date of issuance, the prevailing rate of interest for this type of note was 11%. Present value factors are as follows: Present value of an ordinary of 1 at 11% for 8 periods Present value of annuity of 1 in advance at 11% for 8 periods On December 31,2009, the machine should be recorded at A.1,600,000 C.1,400,000 B.1,029,200 D.1,142,200 On December 31, 2009, Sadanga Company finished consultation services and accepted in exchange a promissory note with a face value of 300,000 a due date of December 31,2012, and a stated rate of 5%, with interest receivable at the end of each year. The fair value of the services is not readily determinable and the note is not readily marketable. Under the circumstances, the note is considered to have an appropriate imputed rate of 10%. The carrying amount of the note receivable as of December 31,2010 is A.300,000 C.262,694 B.273,963 D.247,920 A2. Thea received 12,000 from a tenant on Dec 1 for four months rent of an office. This rent was for Dec, Jan, Feb, March. If lane debited Cash and credited Unearned Rental Income for P12,000 on Dec 1, the necessary adjustment Dec 31 would include a. a debit to Rental Income of 3,000 b. a credit to Rental Income of 3,000 c. a debit to Unearned Rental Income of P9,000 d. a credit to Unearned Rental Income of P9,000 5,146 5,712

A3. Athena Bottling purchased for P800,000 a trademark for a very successful softdrink it markets under the name OK!. The trademark was determined to have an indefinite life. A competitor recently introduced a product that is in direct competition with the OK! product, thus suggesting the need for an impairment test. Data gathered by Athena suggest that the useful life of the trademark is still indefinite, but the cash flows expected to be generated by the trademark have reduced either to P30,000 per year (with a probability of 80%) or to the P60,000 per year (with 20% probability). The appropriate risk-free interest is 5%. The appropriate risk adjusted interest rate is 10%. The loss of impairment of trademark is a. 440,000 b. 320,000 c. 200,000 d.80,000

A1. The net income of Nick Co. was 5,465,000 for the current year. Presented are the changes in Nicks Statement of Financial Position during the year. Deferred Tex Liability 54,000 decrease Accumulated Depreciation due to major repair to equipment 63,000 decrease Long term investment at equity 136,500 decrease Unearned Interest Income 40,350 decrease What amount should be reported as net cash provided by operating activities in the statement of cash flows for the current year?________

A1. Sub Company had net assets according to its books of P1,000,000 on Jan 1, 2010. On the same date, Parr Company owned 9,000 of the 12,000 outstanding shares of Subs only class of stock, and its investment in Sub Company account had a balance of P795,000. If, on Jan 1, 2010, Sub repurchased 2,000 shares from Parr for 200,000, the gain on the sale of the stock recognized by Parr was a. 3,000 b. 7,000 c. 10,000 d. 23,333

MMDS Company is engaged in the operation of public highways and skyways in Metro Manila. On Nov 2, 2009, a catastrophe devastated some of the companys operated highways and skyways. The company suffered P5.6 million loss due to catastrophe. On Jan 1, 2010, the Philippine government decided to compensate the company for the incurred loss. The government loaned P5 billion at 5% per annum with maturity period of 5 years. The current market rate for similar type of loan after considering credit ricks attached was 10%. The conditions stipulated on the loan agreement provide that the proceeds will be used for reconstruction of the skyways and highways. On Jan 1, 2010, how much should the company recognize as government grant (round off to the nearest million)? A6. During 2008, CUTE COMPANY purchased trading equity securities as a short-term investment. The cost and market values at Dec 31, 2008 were as follows: Securities Cost Market Value A-1,000 shares 200,000 300,000 B-10,000 shares 1,700,000 1,600,000 C-20,000 shares 3,100,000 2,900,000 Cute sold 10,000 shares of Company B stock on Jan 15, 2009 for P130 per share, incurring P50,000 in brokerage commission and taxes. On this sale, Cute should report a loss of ___________________

A7. SWEET COMPANY, a public company, issued 5,000 ordinary shares with 1,000 par values for a building. The following information relates to the exchange: Net book value of the building 17,500,000 Insurance amount for the building 25,000,000 Current quoted price of stock 4,400/share The building should be recorded at a. 5,000,000 b. 17,000,000 c. 22,000,000 d. 25, ,000,000

The inventory on hand on Dec 31, 2006 of LEISA CORP, is valued at a cost of P300,000. The following items were not included in the inventory:

a. Purchased goods in transit shipped FOB Destination, with price of 30,000 which included freight charge of P5,000. b. Goods held on consignment by LEISA CORP at a sales price of 10,000, excluding a 20% commission on the sales price. Freight paid by LEISA CORP was P1,000. c. Goods sold in transit shipped FOB Destination, with invoice price of 49,000 which included freight charges of 4,000 to deliver the goods. d. Purchased goods in transit shipped FOB Shipping Point with invoice price of 60,000. Freight costs amount to 6,000. Goods out on consignment with sales price of P30,000. Shipping costs amount to P3,000. What is the correct inventory on Dec 31, 2006 assuming LEISAs selling price is 150% of costs? a. 419,000 b. 416,000 c. 410,000 d. 17,500

Jet Company had the following ordinary share transaction during the current year: 1/1 Ordinary Shares outstanding 300,000 2/1 Issued a 10% stock dividend 30,000 3/1 Issued Ordinary Shares in a purchase combination 90,000 7/1 Issued Ordinary Shares for cash 80,000 12/31 Ordinary Shares outstanding 500,000 What was the weighted average number of shares outstanding? a. 400,000 b.442,500 c. 445,000 d. 460,000

15. During 2009, Congruent Company introduced a new product carrying a two-year warranty against defects. The estimated warranty cost related to pesos sales are 2% within 12 months following sales and 4% in the 2nd twelve months following sales. Sales and actual warranty expenditures foe years ended Dec 31, 2009 and 2010 were as follows: Sales Actual Warranty Expenditures 2009 6,000,000 90,000 2010 10,000,000 300,000 16,000,000 390,000 At Dec 31, 2010, Congruent should report an estimated warranty liability of ? 10. Kangaroo Company has a defined benefit pension plan. Kangaroos policy is to fund net periodic pension cost annually, payment to an independent trustee being made two months after the end of each year. Data relating to the pension plan for 2008 are as follows: Net pension cost for 2008 190,000 Present value of benefit obligation, Dec 31, 2008 480,000 Fair value of plan assets, Dec 31, 2008 310,000 Unrecognized net gain, Dec 31, 2008 20,000 What amount should Kangaroo Company report in its balance sheet as of Dec 31, 2008? a. none b. 190,000 assets c. 190,000 liability d. 330,000 liability

6. On Dec 31, 2007, Over Corporation borrowed from Whelm Bank, signing a 5-year non-interest earing note for P100,000. The note was issued to yield 10% interest. Unfortunately, during 2009, Over began to experience financial difficulty. As a result, at Dec 31, 2009, Whelm Bank determined that it was probable that it would receive back only 75,000 at maturity. The market loss of interest on loans of this nature is now 11%. How much should be recognized as loan impairment loss in 2009? a. 11,952 b. 18,782 c. 20,292 d. 5,743

A2. On Jan 1, 2009, Dyer Company acquired as a long-term investment of 20% ordinary share interest in Eason Company. Dyer paid P7,000,000 for this investment when the fair value of Easons net asset was P35,000,000. Dyer can exercise significant influence over Easons operating and financial policies. For the year ended Dec 31, 2009, Eason reported net income of 4,000,000 and declared and paid cash dividends of 1,600,000. How much revenue from this investment should Dyer report for 2009? a. 320,000 b. 480,000 c. 800,000 d. 1,120,000 5. Eton Company reports the following information at Dec 31, 2008: Cash (in the form of coins, currencies, savings accounts and checking accounts) for a total of P3,400,000 Investment in equity securities of P1,000,000. These are ordinary share investments in several companies whose shares are traded actively in the Makati Stock Exchange. Investment in government treasury bills of P2,000,000. These T-bills have a 2 year term and were purchased during Dec, at which time the remaining term to maturity is two months. Commercial papers (short-term receivables from other companies) amounting to P1,500,000 with a term of nine months. They were purchased in late Nov, at which time the remaining term to maturity to four months. How much should be reported as cash and cash equivalents at Dec 31, 2008? a. 3,400,000 b. 5,400,000 c. 6,400,000 d. 6,900,000

2. Henri Company purchased for cash on Jan 1, 2003, three machines which cost a P1,800,000. Estimated selling prices of the machines were: Machine 1 600,000 Machine 2 750,000 Machine 3 900,000 The machines were believed to have a useful life of 10 years without residual value. The company records depreciation annually on a monthly basis. On Jan 1, 2006, Machine 1 was sold for 375,000 cash. The proceeds were credited to the Machinery account. On July 1, 2008, Machine 3 was traded in for a new machine (No.4) which had a cash price of 750,000, Henri paying 300,000 for the difference with the trade in value of the old machine. What should be the balance of Accumulated depreciation-Machinery on Dec 31, 2008 after adjusting the books? 9. The following information was obtained from the statement of financial position of Paris, Inc. on Dec 31, 2010: 6% convertible 10-year bonds at par 2,000,000 Ordinary share capital, P20 par, 2,200,000 110,000 shares issued and outstanding Retained Earnings 950,000 Each P1,000 bond can be converted into 40 ordinary shares. On Sept 30, 2010 the bonds were all converted into ordinary shares. Norway reported net income of P600,000 in 2010. The income tax rate is 35%. What is Paris diluted earnings per share 2010?

7. On July 1, 2008, the Obnoxious Corporation was registered with the SEC. its authorized share capital consists of 100,000 ordinary shares with par value P20.00 per share. On July 15, 2008, it issued 10,000 shares at P23 per share. On Oct 15, 2008, the Obnoxious Corporation paid to the majority shareholders the sum of 80,000 for a certain parcel of land; and

issued 5,000 ordinary shares for the building on the land. The land was appraised at P130,000. The building has a cost of P150,000 and its depreciated value is P90,000. It was appraised at P120,000. On April 15, 2009, the corporation purchased 5,000 of its own ordinary shares for P100,000. On June 15, 2009, 2,000 of treasury shares were sold at P24 per share. How much is the total share premium of Obnoxious Corporation on June 30, 2009?

6. On January 1, 2008, Calcium Inc. signed a long-term lease for an office building. The term the lease required Calcium to pay 100,000 annually, beginning Dec 31, 2008 and continuing each for 30 years. The lease qualifies as financial lease. On Jan 1, 2008, the present value of the lease payments is 1,125,000 at 8% interest rate implicit in the lease. In Calciums Dec 31, 2008 balance sheet, how much should be the finance lease liability? a. 1,025,000 b. 1,115,000 c. 1,125,000 d. 2,900,000

E3. Foster Co. adjusted its allowance for uncollectible accounts at Year-end. The general ledger balances for the accounts receivable and the related allowance account were 1,000,000 and 40,000, respectively. Foster uses the percentage of receivables method to estimates its allowance for uncollectible accounts. Accounts receivable were estimated to be 5% uncollectible. What amount should Foster record as an adjustment to its allowance for uncollectible accounts at year-end? a. 10,000 decrease b. 10,000 increase c. 50,000 decrease d. 50,000 increase 3. During 2005, Patrick Company experienced financial difficulty and is likely to default on a 1,000,000, 15%, 3 year note dated Jan 2, 2004, payable to Landbank. On Dec 31, 2005, the bank agreed to settle the note and unpaid interest of P150,000 for 2005 for P100,000 cash and available for sale securities having a current market value of 750,000. Patricks acquisition cost of the securities is 770,000. Ignoring income taxes, what amount should Patrick report as a gain as a result of the debt restructuring in its 2005 income statement? E1. The current liability of an entity include fines and penalties for environmental damage. The fines and penalties are stated at 10 million. The fines and penalties are not deductible for tax purposes. What is the tax base of fines and penalties? a. 10 million b. 3 million c. 13 million d. 0 5. IMORTAL Company acquired a machine on Jan 1, 2008, at a cost of 120,000. It was expected to have a economic useful life of 10 years. Imortal uses the straight line method in depreciating its machinery and equipment and reports on a calendar year basis. On Dec 31, 2010, the machine was appraised as having a gross replacement cost of 150,000. Imortal applies the revaluation model in valuing this class of property, plant and equipment after its initial recognition. How much should be credited to revaluation surplus on Dec 31, 2010? a. 30,000 b. 105,000 c. 21,000 d. 9,000 DIFFICULT ROUND (Choices may be omitted to increase level of difficulty.) 1. On June 30, 2010, Orient Company had outstanding 8%, P 3,000,000 face amount, 15-year bonds maturing on June 30, 2017. Interest is payable on June 30 and December 31. The unamortized balances on June 30, 2010 bond discount and deferred bond issue costs accounts were P 105,000 and P 30,000, respectively. Orient reacquired all of these bonds at 94 on June 30, 2010, and retired them. Ignoring income taxes, how much gain should Orient report on this early debt? extinguishments of

a. b.

P 45,000 P 75,000

c. d.

P 105,000 P 180,000

3. The shareholders equity of Diskette Corporations December 31, 2009 balance sheet consisted of the following account balances: Ordinary shares, P50 par, 100,000 shares authorized and outstanding Share premium Accumulated profits and losses (deficit) P 5,000,000 3,000,000 (2,000,000)

On January 2, 2010, the company put into effect a shareholder-approved quasireorganization by reducing the par value of the stock to P25 and eliminating the deficit against share premium. Immediately after the quasi-reorganization, what amount should the company report as share premium in its balance sheet? a. b. None P 3,000,000 c. d. P 3,500,000 P 5,500,000

4. On January 2, 2009, Cinderella Company enters into a forward contract to purchase on January 2, 2011, a specified number of barrels of oil at a fixed price. Cinderella Company is speculating that the price of oil will increase and plans to net settle the contract if the price increases. Cinderella Company does not pay anything to enter into the forward contract on January 2, 2009. Cinderella Company does not designate the forward contract as a hedging instrument. At the end of 2009, the fair value of the forward contract has increased to P 400,000 and at the end of 2010 its fair value has declined to P 350,000. What amount of forward loss should Cinderella Company recognize at the end of year 2010? the

5. The net income for the year ended December 31, 2010 for Dwarf Company was P 1,800,000. Additional information follows: Depreciation on plant assets Depreciation of leasehold improvements Provision for doubtful account on short-term receivables Provision for doubtful account on long-term receivables Interest paid on short-term borrowings Interest paid on long-term borrowings P 900,000 510,000 180,000 150,000 120,000 90,000

Based on the information given, what should be the net cash provided by operating activities in the statement of cash flows for the year ended December 31, 2010? a. b. P 3,390,000 P 3,510,000 c. d. P 3,540,000 P 3,750,000

7. Impressed company, a division of Philippine Realty Corporation maintains escrow accounts and pays real estate taxes for Philippines mortgage customers. Escrow funds are kept in interest-

bearing accounts. Interest, less a 10% service fee, is credited to the mortgagees account and used to reduce future escrow payments. Additional information follows: Escrow accounts liability, January 1, 2010 Escrow payments received during 2010 Real estate taxes paid during 2010 Interest on escrow funds during 2010 P 900,000 1,500,000 1,900,000 90,000 its December

What amount should Impressed Company report as escrow accounts liability in 31, 2010 balance sheet? a. b. P 491,000 P 500,000 c. d. P 581,000 P 590,000

9. Man Company purchased 10% of Kind Corporations 200,000 outstanding shares of ordinary shares on January 2, 2010 for P 2,500,000. On October 31, 2010, Man Company purchased another 40,000 shares of kind for P 6,000,000. There was no goodwill as a result of either acquisition and Kind had not issued any stock dividends during 2010. Kind reported earnings of P 6,000,000 for the year ended December 31, 2010. What amount should Man Company report in its December 31, 2010 balance Investment in Kind? a. P 8,500,000 c. P 9,400,000 b. P 9,300,000 d. P 10,300,000 EASY ROUND sheet as

1. Marketable available-for-sale securities were acquired at January 1, 2010 for P 18,000. The fair value at December 31, 2010 amounted to P 22,500. How should the fair value adjustment be recognized in the companys financial statements? a. b. P 4,500 through profit or loss P 4,500 as contra equity c. d. P 4,500 as adjunct-equity P 4,500 as note disclosure

8. On January 2, 2010, Cream Company received a consolidated grant of P 240,000,000. Threefourths of the grant is to be utilized to purchase a college building for students for underdeveloped or developing countries. The balance of the grant is for subsidizing the tuition costs of those students for four years from the date of the grant. The expected college life of the building is 10 years and the company uses the straight-line method of depreciation. What amount of the grant is recognized as income for the year ended December 31, 2010? a. b. P 15,000,000 P 18,000,000 c. d. P 33,000,000 P 60,000,000

2. A depreciable assets carrying value is determined to be P 45,000 at year-end. On the same date, net selling price is determined to be P 36,000 while the allocated value in use is P 39,000. How much should be recognized as impairment loss? a. b. P0 P 3,000 c. d. P 6,000 P 9,000

3. Seven Seas Company had share capital of two million shares P 1 each fully paid up. On January 2, 2008, Seven Seas Company issued one million P 1 ordinary shares. The full price of the new shares was P 1.50 and they were 50% paid up on issue. The dividend participation is to be 50% until fully paid up. The shares remained 50% paid at December 31, 2008. During the year 2008, the average fair value of one ordinary share was P 2.00. Net income for the year was P 8,000,000. What should be reported as basic earnings per share? a. b. P 2.67 P 3.05 c. d. P 3.20 P 4.00

AVERAGE A7. On July 1, 2009, ECV Corporation exchanged 20,000 shares of its P200 par value stock for land. A few months ago, the land is appraised by an independent appraiser at P 5,000,000. ECV is currently trading at the stock exchange at P 300. The earnings per share is P 40. How much should be debited to land account? D8. Jabar Corp. holds 10,000 ordinary shares, par value P 10, as treasury shares, which was purchased in year 2007 at a cost of P 120,000. On December 8, 2008, Jabar sold all the 10,000 shares for 210,000. The sale would result in a credit to Paid-in capital from sale of treasury shares in the amount of? D6. Silverio, Domingo, Reyes, and Pastor are partners, sharing earnings in the ratio of 3/21, 4/21, 6/21 and 8/21, respectively. The balances of their capital accounts on December 31, 2008 are as follows: Silverio Domingo Reyes Pastor P 1,000 25,000 25,000 9,000

The partners decide to liquidate and they accordingly convert the non-cash assets into P 23,200 of cash. After paying the liabilities amounting to P 3,000, they have P22,200 to divide. Assume a debit balance of any partners capital is uncollectible. After P22,200 was divided, the capital balance of Domingo was: A4. A pre-tax accounting income of P3,000,000 is subject to the following adjustments: Non-deductible expense as permanent difference: P 270,000. Future taxable amount as temporary difference: P 330,000. If tax rate is set to 34%, what is the amount of income tax payable for the period? 10. Rainbow Company has the following information pertaining to its biological assets: A herd of 100, 2-year old animals was held at January 1, 2010. Ten animals aged 2.5 years were purchased on July 1, 2010 for P 5,400 and ten animals were born on July 1, 2010. No animals were

sold or disposed of during the period. Per unit fair values less estimated point-of-sale costs were as follows: 2.0-year old animal at January 1, 2010: P 5,000 Newborn animal at July 1, 2010: P 3,500 2.5-year old animal at July 1, 2010: P 5,400 Newborn animal at December 31, 2010: P 3,600 0.5-year old animal at December 31, 2010: P 4,000 2.0-year old animal at December 31, 2010: P 5,250 2.5-year old animal at December 31, 2010: P 5,550 3.0-year old animal at December 31, 2010: P 6,000 How much of the increase in the fair value of biological assets due to physical a. P 75,000 c. P 110,000 b. P 79,500 d. P 118,500 6. The following facts relate to Sydney Company for the year 2010: P 400,000 0 1,600,000 1,750,000 2,400,000 350,000 32% change?

Deferred tax liability , January 1, 2010 Deferred tax asset, January 1, 2010 Taxable income for 2010 Pre-tax financial income Cumulative temporary difference at 12/31/10 Giving use to future taxable amount Cumulative temporary difference at 12/31/10 Giving use to future deductible amount Income tax rate for all years

What is the amount of deferred tax expense (net) for 2010? a. P 112,000 c. P 368,000 b. P 256,000 d. P 400,000 2. The following information relates to the defined benefit pension plan for the Citywide Company for the year ending December 31, 2010: PV of benefit obligation, January 1 PV of benefit obligation, December 31 Fair value of plan assets, January 1 Fair value of plan assets, December 31 Expected return on plan assets Amortization of deferred gain Employer contribution Benefits paid to retirees Settlement rate P 6,700,000 7,200,000 7,500,000 7,900,000 675,000 48,750 300,000 600,000 10%

How much would be the current service cost for the year? a. P 88,500 c. P 193,500 b. P 141,000 d. P 430,000 A4. Dream Company, a lessor of office machines, purchased a new machine for P 500,000 on January 1, 2010, which was leased the same day to Girl Company. The machine is expected to have a ten-year life and will be depreciated P 50,000 per year. The lease is for a three-

year period expiring January 1, 2013 and provides for annual rental payments of P 100,000 beginning January 1, 2010. In addition, Girl paid P 60,000 as a lease bonus to obtain a three-year lease. In its 2010 income statement, what amount should Dream report as operating leased asset? Difficult Question #1: Goren Corporation had the following amounts, all at retail: Beginning Inventory Purchase returns Abnormal shortage Sales Employee discounts P 36,000 60,000 40,000 720,000 16,000 Purchases Net Mark-ups Net Markdowns Sales returns Normal shortage 1,000,000 180,000 28,000 18,000 26,000 profit on this

What is Gorens ending inventory at retail? D2. David and Goliath began the year with capital balances of P 40,800 and P 112,000, respectively. On April 1, David invested an additional P 15,000 into the partnership and on August 1, Goliath invested an additional P 20,000. David and Goliath have agreed to distribute partnership net income of P 80,000 according to the following plan: David Interest on average capital balances Bonus on net income before the bonus but after the interest on average capital balances Salaries Residual (If Positive) Residual (If Negative) 6% Goliath 6%

10% P 25,000 70% 50% P 30,000 30% 50%

The share of David and Goliath on the net income is: ________________

E1. On December 1, 2010, Nam Company leased office space for five years at a monthly rental of P600,000. On the same date Nam paid the lessor the following amounts: Bonus to obtain lease 300,000 First months rent 600,000 Last months rent 600,000 Security deposit (refundable at lease expiration) 800,000 Installation of new walls and offices 3,600,000 Nams 2010 expense relating to utilization of the office space should be a. 1,400,000 b. 1,200,000 c. 665,000 d. 600,000 D1. On December 31, 2010, Qatar Company had 500,000 shares of common stock outstanding. On October 1, 2011, an additional 100,000 shares of common stock were issued. In addition, Qatar had

P10, 000,000 of 6% convertible bonds outstanding at December 31, 2010, which are convertible into 225,000 shares of common stock. No bonds were converted into common stock in 2011. The net income for the year ended December 31, 2011 was P3,000,000. Assuming the income tax rate was 30%, the diluted earnings per share for the year ended December 31, 2011, which will be presented in the audited financial statements, will be: Hint: Round off to the nearest centavo. E2. Bernal Construction bought machinery with a useful life of 5 years at a cost of P200,000 estimated salvage value was P50,000. The company uses the sum of years digit method of de[recitation. The annual depreciation expense for the fifth year applicable to the machinery is: a. P10,000 b. P30, 000 c. P40,000 d. P50,000 E3. Out Company accepted a P10,000, 2% interest-bearing note from Look Company on December 31, 2008, in exchange for a machine with a list price of P8,000 and a cash price of P7,500. The note is payable on December 31, 2010. In its 2008 income statement, Out should report the sale at: a. P 7,500 c. P8,000 b. P10,000 d. P10,400 E4. Mai Company had 200,000 ordinary shares of P20 per value and 20,000 share of P100 par.6 % cumulative, convertible preference share capital outstanding for the entire year ended December 31, 2010. Each preference share is convertible into 5 ordinary shares. Mais net income for 2009* was P840,000. For the year ended December 31, 2010, the diluted earnings per share should be: E5. Kenya Enterprises developed a new machine that reduces the time required to mix the chemicals used in one of its leading products. Because the process is considered very valuable to the company, Kenya patented the machine. Kenya incurred the following expenses in developing and patenting the machine: Research and development laboratory expenses P750,000 Materials used in the construction of the machine 240,000 Blueprints used to design the machine 96,000 Legal expenses to obtain patent 360,000 Wages paid for the employees work on the research, Development, building of the machine (60% of the Time was spent in actually building the machine) 900,000 Expense of drawing required by the Bureau of Patents To be submitted with the patent application 51,000 Fees paid to Bureau of Patents to process application 75,000 One year late, Kenya Enterprises paid P525,000 in legal fees to successfully defend a patent against an infringement suit by Gaya-gaya Company. What is the total cost of the new machine? a. P1,362,000 b. P0 c. P780,000 d. P876,000 E6. Gong Company started construction of its administration building at and estimated cost of P50,000,000 on January 1, 2012. The construction Is expected to be completed by December 31, 2013. Gong has the following debt obligations outstanding during 2012: Construction loan 12% interest, payable Semiannually, issued December 31, 2009 P20,000,000

Short-term loan 10% interest, payable monthly, And principal payable by maturity on May 31, 2011 Long-term plan 11% interest, payable on January 1 of each year, principal payable on January 1, 2014

P14,000,000

P10,000,000